By RoboForex Analytical Department

The commodity market was adjusted moderately on Tuesday morning after the price of Brent crude oil rose by 2% the day before. A barrel of the North Sea variety is at about 84 USD.

The main support factor currently is the improving prospects for global demand. Additionally, there are expectations that global oil producers will restrain supply.

The latest oil market reports from OPEC+, the International Energy Agency and the US Department of Energy suggest a steady increase in energy demand in the second half of 2024.

Yesterday’s surge in Brent’s price was also supported by an increase in the value of the entire range of risky assets. This is due to reduced inflationary pressures in the world’s largest economies. Such signals strengthen the bet on lowering the cost of lending in the coming months.

The proposal is underpinned by the collaborative efforts of key OPEC+ member countries, including Russia and Iraq, which have confirmed their intentions to adhere to the agreed production quotas. Saudi Arabia has also expressed its readiness to adjust production volumes to fully account for market conditions.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Technical analysis of Brent

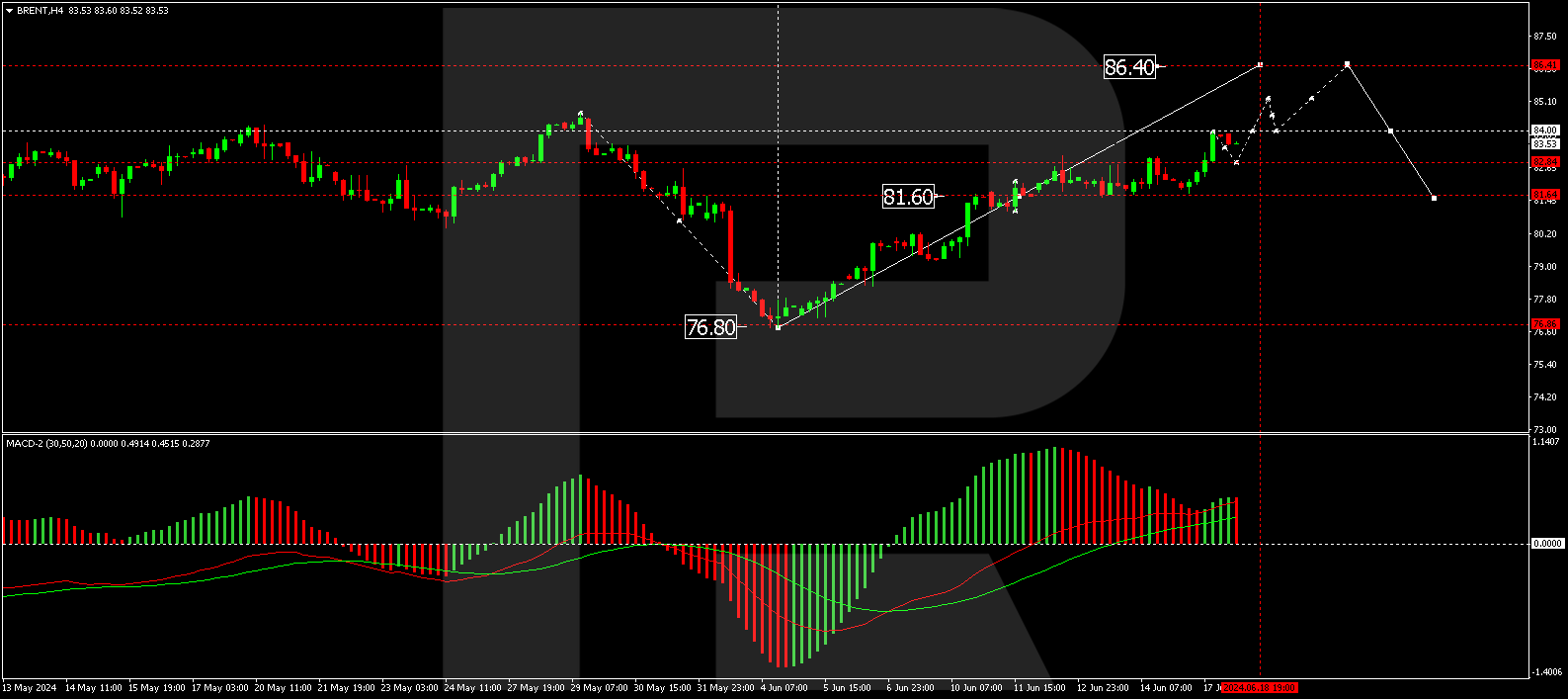

On the H4 Brent chart, the market has formed a consolidation range above the 81.60 level. Today, the price has moved up from this range, continuing to develop a wave of growth to the level of 86.40. After achieving this level, we anticipate a correction to 81.60. Next, we expect the trend to continue to the level of 89.00. This scenario is technically confirmed by the MACD indicator, with its signal line above the zero mark and directed strictly upwards.

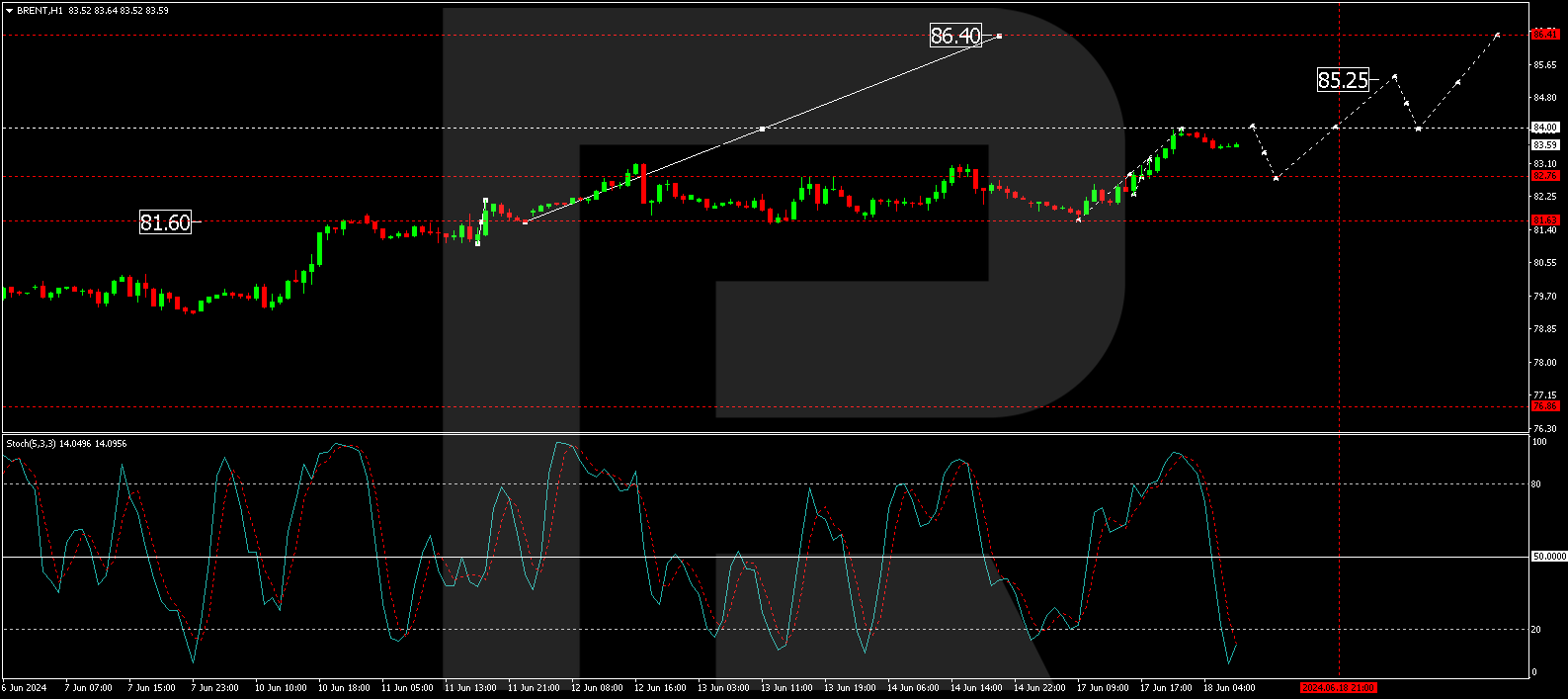

On the H1 Brent chart, the market received support at 81.56 and began the development of the second half of the growth wave. At the moment, the local target at the level of 83.98 is fulfilled. Today, a link of growth to 84.00 is possible. Next, we expect a correction link to the level of 82.76 (test from above), followed by an increase to the level of 86.40. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is below the level of 20 and is preparing for the start of growth.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Dec 21, 2024

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Palladium Dec 21, 2024

- COT Soft Commodities Charts: Speculator Bets led by Live Cattle, Lean Hogs & Coffee Dec 21, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell-2000 Dec 21, 2024

- Riksbank and Banxico cut interest rates by 0.25%. BoE, Norges Bank, and PBoC left rates unchanged Dec 20, 2024

- Brent Oil Under Pressure Again: USD and China in Focus Dec 20, 2024

- Market round-up: BoE & BoJ hold, Fed delivers ‘hawkish’ cut Dec 19, 2024

- NZD/USD at a New Low: The Problem is the US Dollar and Local GDP Dec 19, 2024

- The Dow Jones has fallen for 9 consecutive trading sessions. Inflationary pressures are easing in Canada. Dec 18, 2024

- Gold Holds Steady as Investors Await Federal Reserve’s Rate Decision Dec 18, 2024