By RoboForex Analytical Department

The EUR/USD pair has experienced a notable decline, currently stabilising around 1.0648. Last week, the pair recorded its most significant weekly gain since 2022, fuelled by the anticipation of persistently high interest rates in the US and escalated conflicts in the Middle East.

The US dollar appreciated by 1.6% over the week against a basket of six major currencies, reaching another 34-year high against the Japanese yen and experiencing its most substantial weekly increase against the British pound since July 2023.

Recent US inflation data and the Federal Reserve’s cautious stance have tempered expectations for substantial interest rate cuts this year. Initially, six cuts were anticipated at the start of the year, reduced to three in early April, and now just two cuts are forecasted. In contrast, European monetary authorities have hinted at potential rate cuts within the coming months.

Market expectations for the first Fed rate cut have shifted from June to September, reflecting ongoing concerns about inflation and uncertainty about whether the economic environment will support easing monetary policies soon. Additionally, the disputes in the Middle East have bolstered the safe-haven appeal of the US dollar, further supporting its strength.

EUR/USD technical analysis

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

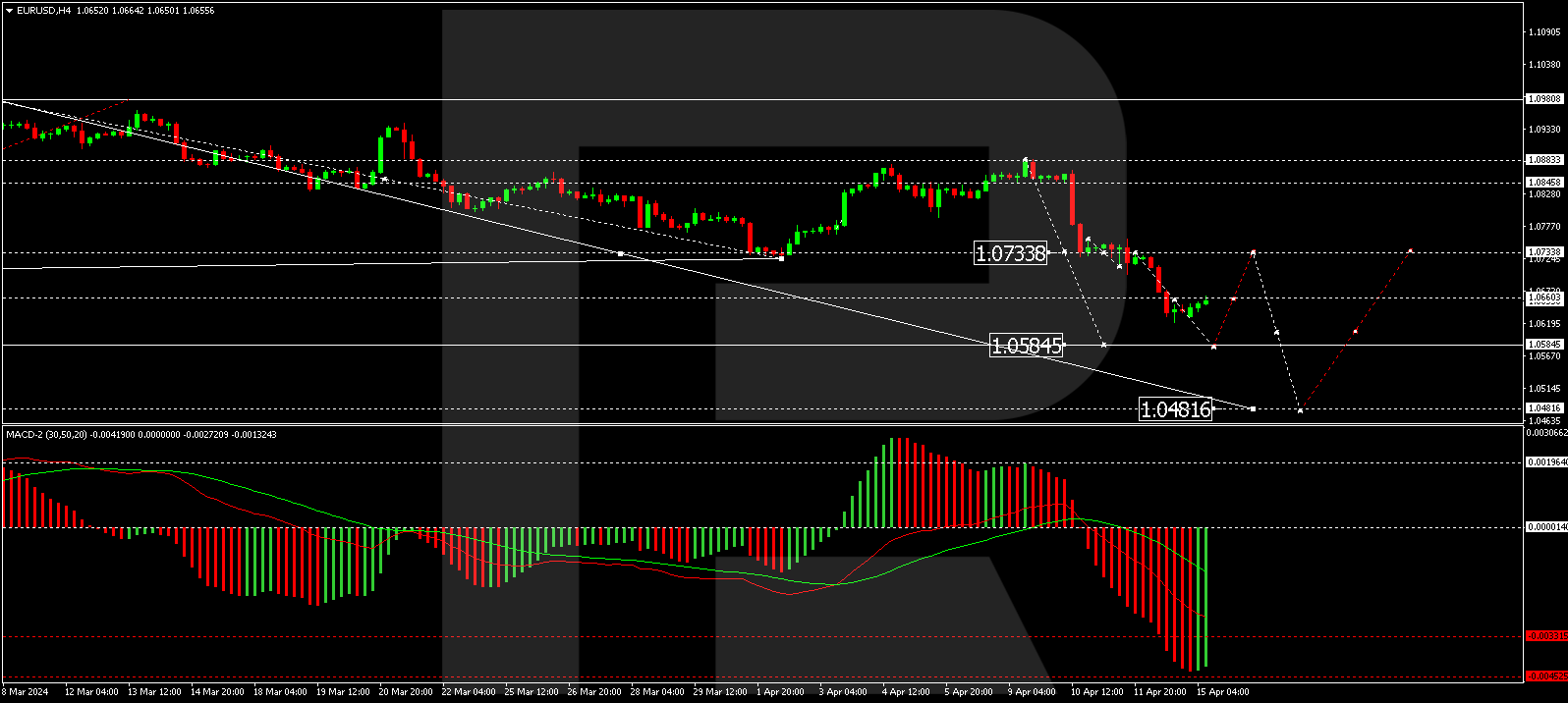

On the H4 chart of EUR/USD, the pair formed a consolidation range around 1.0733 before beginning a downward wave to 1.0622. A new consolidation range is currently forming above this level. An upward exit from this range could lead to a corrective move towards 1.0733. Conversely, a downward exit might signal a continuation of the decline to 1.0585. The MACD indicator, with its signal line below zero and directed downwards, supports this bearish scenario.

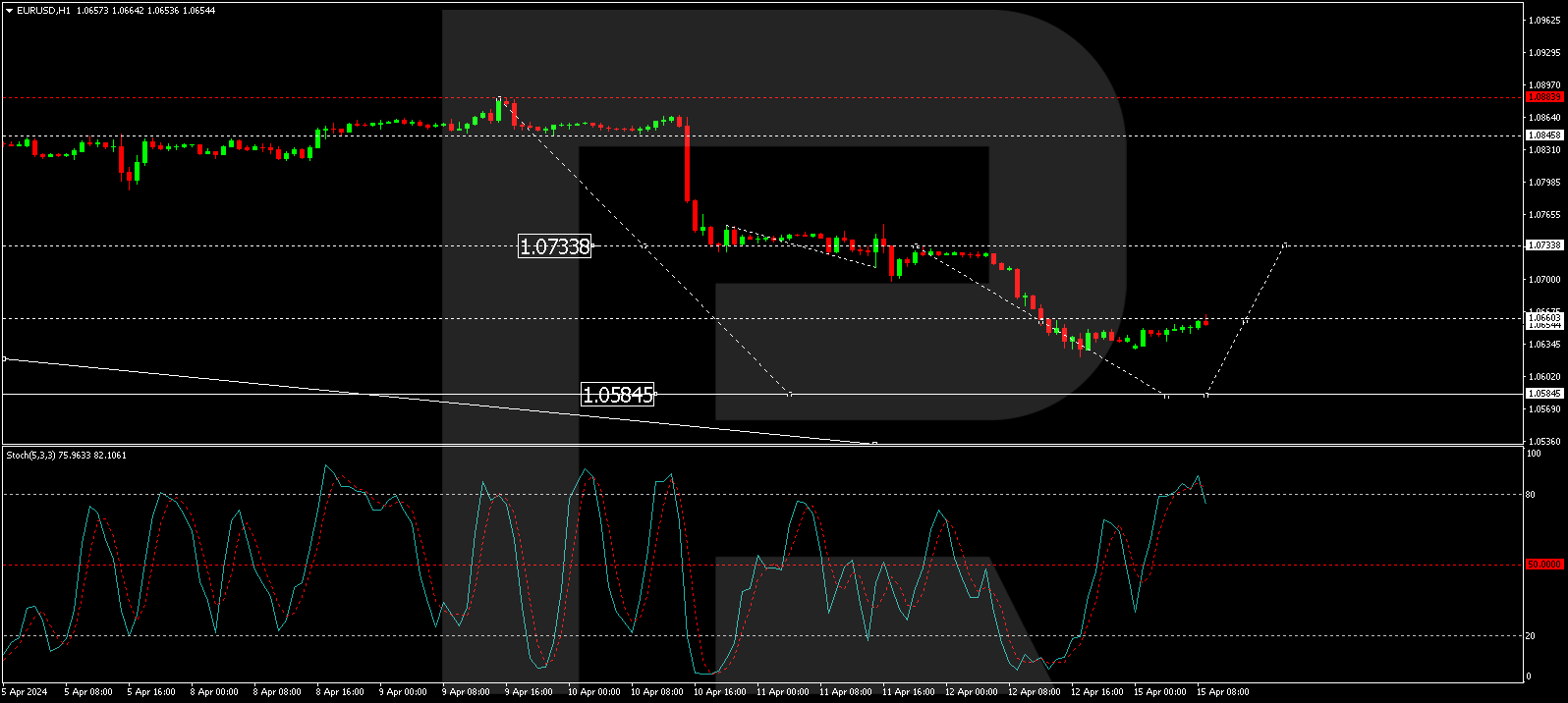

The H1 chart shows ongoing development in the downward wave towards 1.0585. After completing a rise to 1.0622, the market is currently correcting to 1.0660. Following this correction, a further decline to 1.0585 is anticipated. This bearish outlook is confirmed by the Stochastic oscillator, currently above 80, with an expected fall to the 20 mark, indicating potential for further declines.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Today, investors focus on the Non-Farm Payrolls labor market report Apr 4, 2025

- USD/JPY collapses to a 6-month low: safe-haven assets in demand Apr 4, 2025

- GBP/USD Hits 21-Week High: The Pound Outperforms Its Peers Apr 3, 2025

- Most of the tariffs imposed by the Trump administration take effect today Apr 2, 2025

- EUR/USD Declines as Markets Await Signals of a Renewed Trade War Apr 2, 2025

- “Liberation Day”: How markets might react to Trump’s April 2nd tariff announcement? Apr 2, 2025

- The RBA expectedly kept interest rates unchanged. Oil rose to a one-month high Apr 1, 2025

- World stock indices sell off under the weight of new tariffs Mar 31, 2025

- COT Metals Charts: Speculator Bets led by Copper & Palladium Mar 30, 2025

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds, Fed Funds & 2-Year Bonds Mar 30, 2025