By RoboForex Analytical Department

Gold prices are on a consecutive three-day rise, reaching $1930.00 per Troy ounce as of Monday. The upward trend seems to be fueled by investors seeking a hedge against uncertainties ahead of key events this week.

Investors are keenly awaiting the U.S. Federal Reserve’s decision, which is widely expected to maintain the interest rate at 5.5% per annum. The primary focus will likely be on the Fed’s outlook on the economy and inflation, which should provide valuable insights into the regulator’s future course of action.

Additionally, the Bank of England and the Bank of Japan are set to hold their meetings this week, while the Reserve Bank of Australia (RBA) will release the minutes from its previous meeting.

Another contributing factor to gold’s demand is the sudden depreciation in the yuan exchange rate, making the precious metal more attractive as a safe-haven asset.

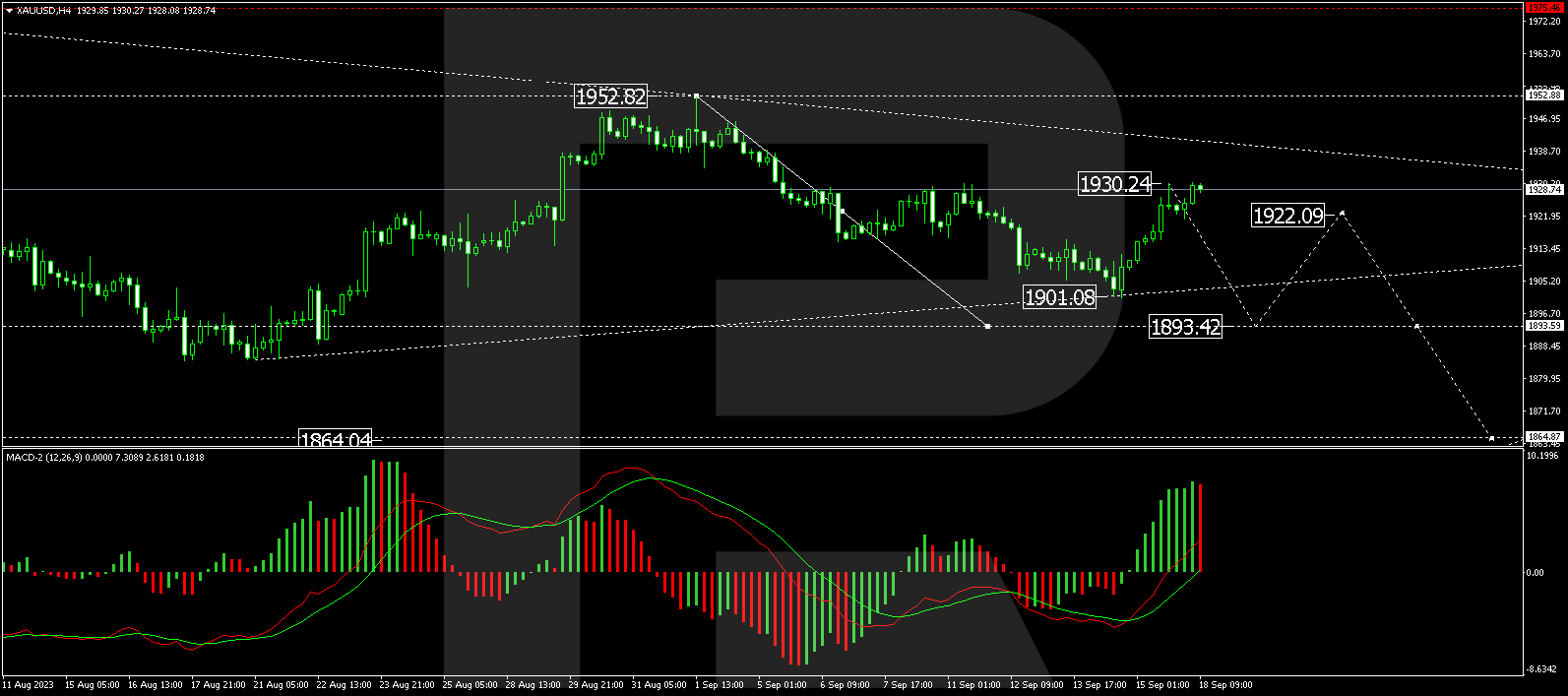

Technical Analysis of XAU/USD price chart

On the 4-hour XAU/USD chart, a downward wave has concluded at $1901.00, followed by a corrective rally to $1930.00. A consolidation phase is anticipated below this level. Should the price break below the consolidation range, there’s potential for an extension of the downward wave to $1893.40. The Moving Average Convergence Divergence (MACD) confirms this scenario, with its signal line positioned above zero but appearing to gear up for a downward movement.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

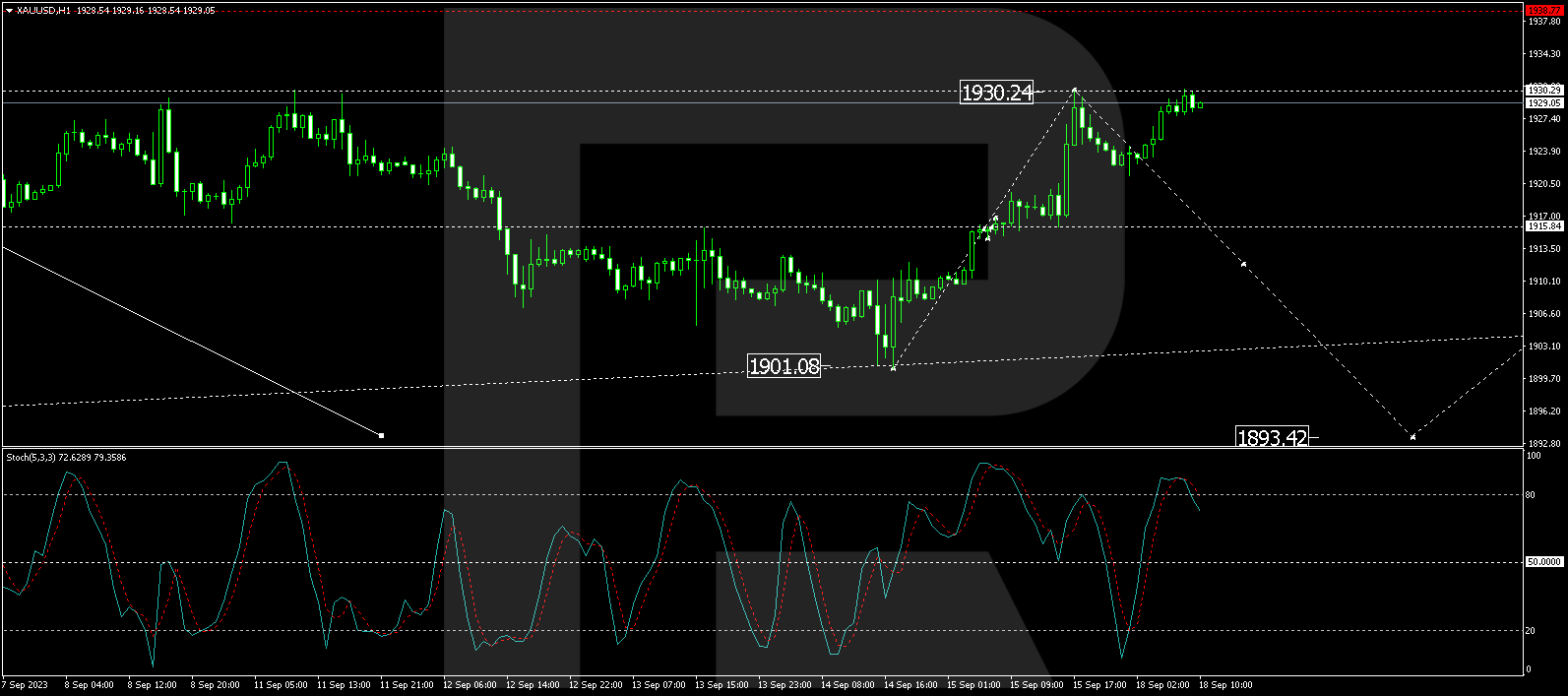

On the 1-hour chart, the price has formed a consolidation zone around $1915.85. Breaking out of this range to the upside, it has corrected to $1930.25. A retracement to $1915.00 is anticipated today. If this level is decisively breached, the door may open for a more significant drop to $1893.40. The Stochastic oscillator supports this outlook, showing its signal line above the 80 mark but trending strictly downward.

In summary, gold is experiencing a bullish streak, propelled by market uncertainties and key economic events on the horizon. Technical indicators point towards a possible short-term decline, but overall sentiment appears cautiously optimistic. Investors should closely monitor upcoming central bank meetings and currency fluctuations for further clues on the metal’s future trajectory.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Copper & Palladium Mar 30, 2025

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds, Fed Funds & 2-Year Bonds Mar 30, 2025

- COT Soft Commodities Charts: Speculator Bets led by Sugar & Live Cattle Mar 30, 2025

- COT Stock Market Charts: Weekly Speculator Bets led this week by Nikkei 225 Mar 30, 2025

- It Looks Like Its a Good Time To Buy This Gold Stock Mar 28, 2025

- Copper Co. Should Be Up Way Higher Mar 28, 2025

- Banxico cut the rate by 0.5%. The global auto market is under pressure from the introduction of tariffs. Mar 28, 2025

- The Pound Stands Strong Amid Global Trade Tensions Mar 28, 2025

- Uncertainty over the scope and impact of tariffs increased market volatility Mar 27, 2025

- EUR/USD Faces Further Decline Amid Market Jitters and Trump’s Tariff Threat Mar 27, 2025