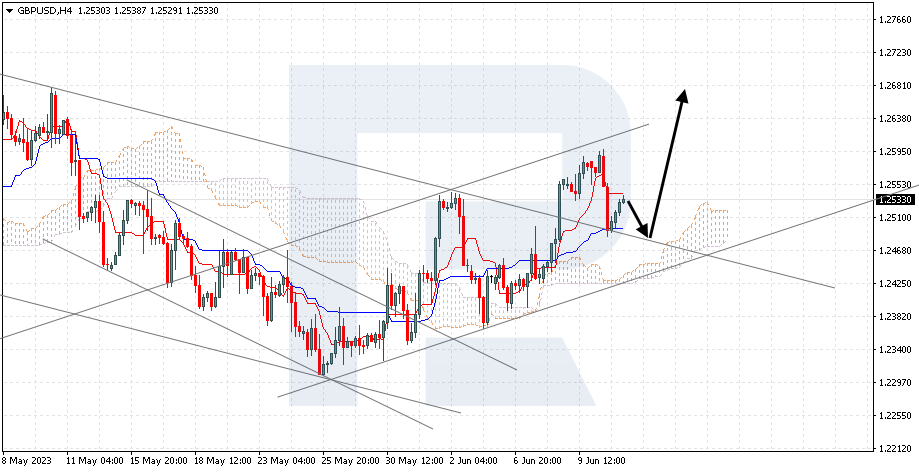

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is pushing off the signal lines of the indicator. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 1.2475 is expected, followed by a rise to 1.2685. An additional signal confirming the rise will be a rebound from the upper border of the bearish channel. The scenario can be cancelled by a breakout of the lower border of the Cloud, securing under 1.2405, which will indicate a further decline to 1.2310.

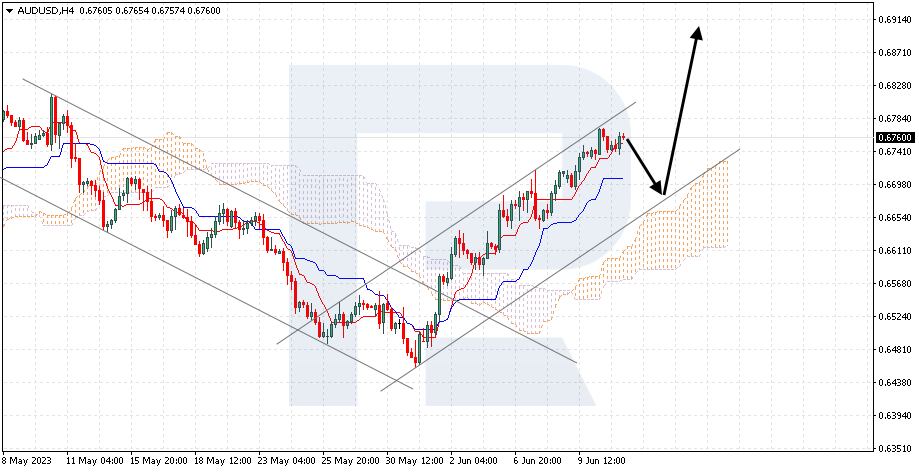

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has secured above the Tenkan-Sen line. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 0.6695 is expected, followed by a rise to 0.6955. An additional signal confirming the rise will be a rebound from the lower border of the bullish channel. The scenario can be cancelled by a breakout of the lower border of the Cloud, securing under 0.6565, which will indicate a further decline to 0.6475.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

BRENT

Brent is testing the support area. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Tenkan-Sen line at 74.35 is expected, followed by a decline to 67.75. An additional signal confirming the decline will be a rebound from the upper border of the bearish channel. The scenario can be cancelled by a breakout of the upper border of the Cloud, securing above 77.25, which will indicate a further rise to 81.65.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Silver Apr 5, 2025

- COT Bonds Charts: Speculator Bets led by SOFR 1-Month & US Treasury Bonds Apr 5, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil, Cotton & Soybeans Apr 5, 2025

- COT Stock Market Charts: Speculator Bets led by S&P500 & Nasdaq Apr 5, 2025

- Today, investors focus on the Non-Farm Payrolls labor market report Apr 4, 2025

- USD/JPY collapses to a 6-month low: safe-haven assets in demand Apr 4, 2025

- GBP/USD Hits 21-Week High: The Pound Outperforms Its Peers Apr 3, 2025

- Most of the tariffs imposed by the Trump administration take effect today Apr 2, 2025

- EUR/USD Declines as Markets Await Signals of a Renewed Trade War Apr 2, 2025

- “Liberation Day”: How markets might react to Trump’s April 2nd tariff announcement? Apr 2, 2025