By RoboForex Analytical Department

The currency major has tested six-month highs and remains at 1.0610.

By now, investors have got maximum information from December. The US Fed has increased the interest rate to 4.50% and promised further increases in accordance with inflation. The European Central Bank has lifted the rate to 2.50% as expected but the comments turned out to be even more carnivorous than expected.

The final inflation report in the Euro zone in November demonstrated growth to 10.1% y/y against the forecast 10.0%. Meanwhile, the base CPI remained at 5.0% y/y.

Until Christmas, the markets will continue analysing the information to become active again after winter holidays.

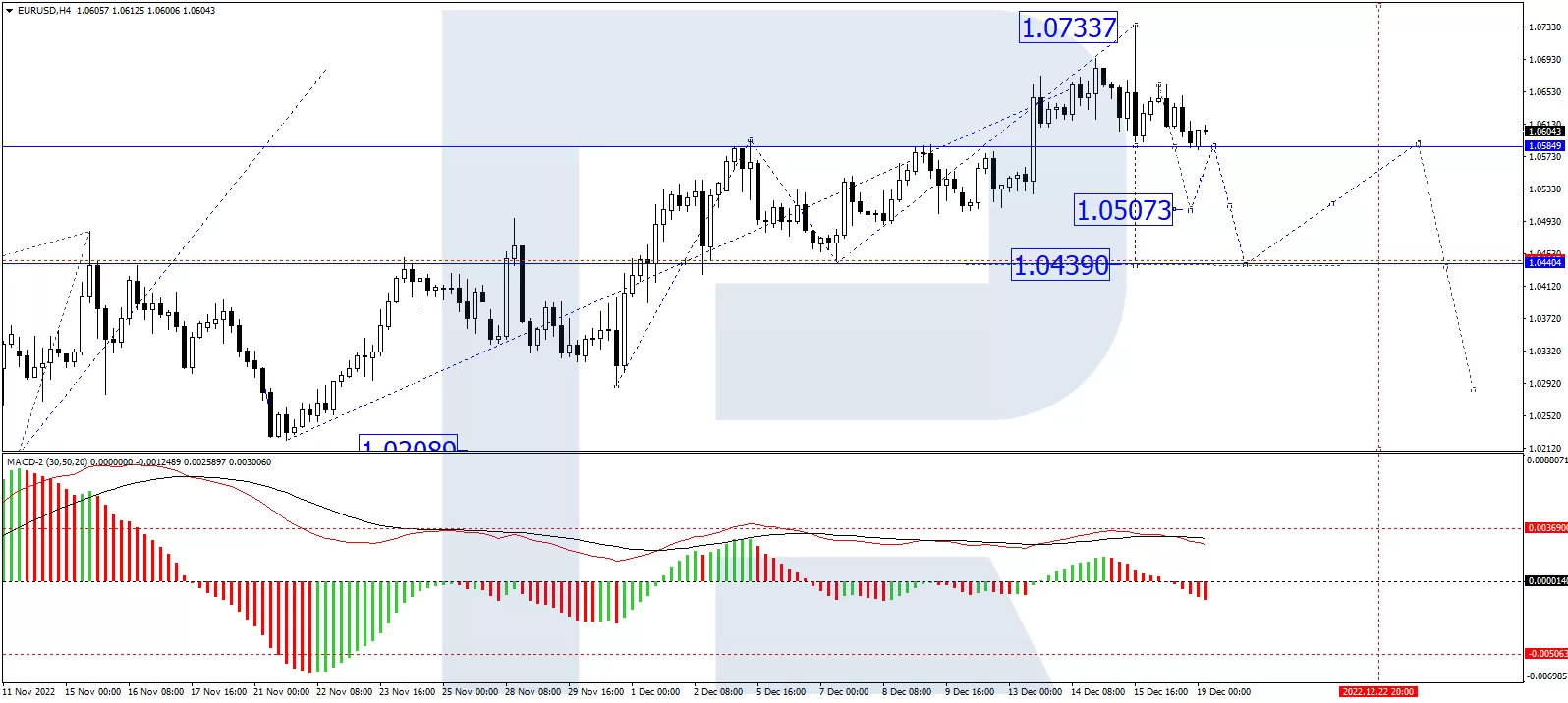

On H4, the pair has completed an impulse of decline to 1.0586. Today a consolidation range is expected to form above it. With an escape downwards, a wave of decline to 1.0507 might become possible. The goal is local. Then growth to 1.0585 and a decline to 1.0440 will become possible. Technically, the scenario is confirmed by the MACD: its signal line is headed strictly down, suggesting further development of the wave of decline.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

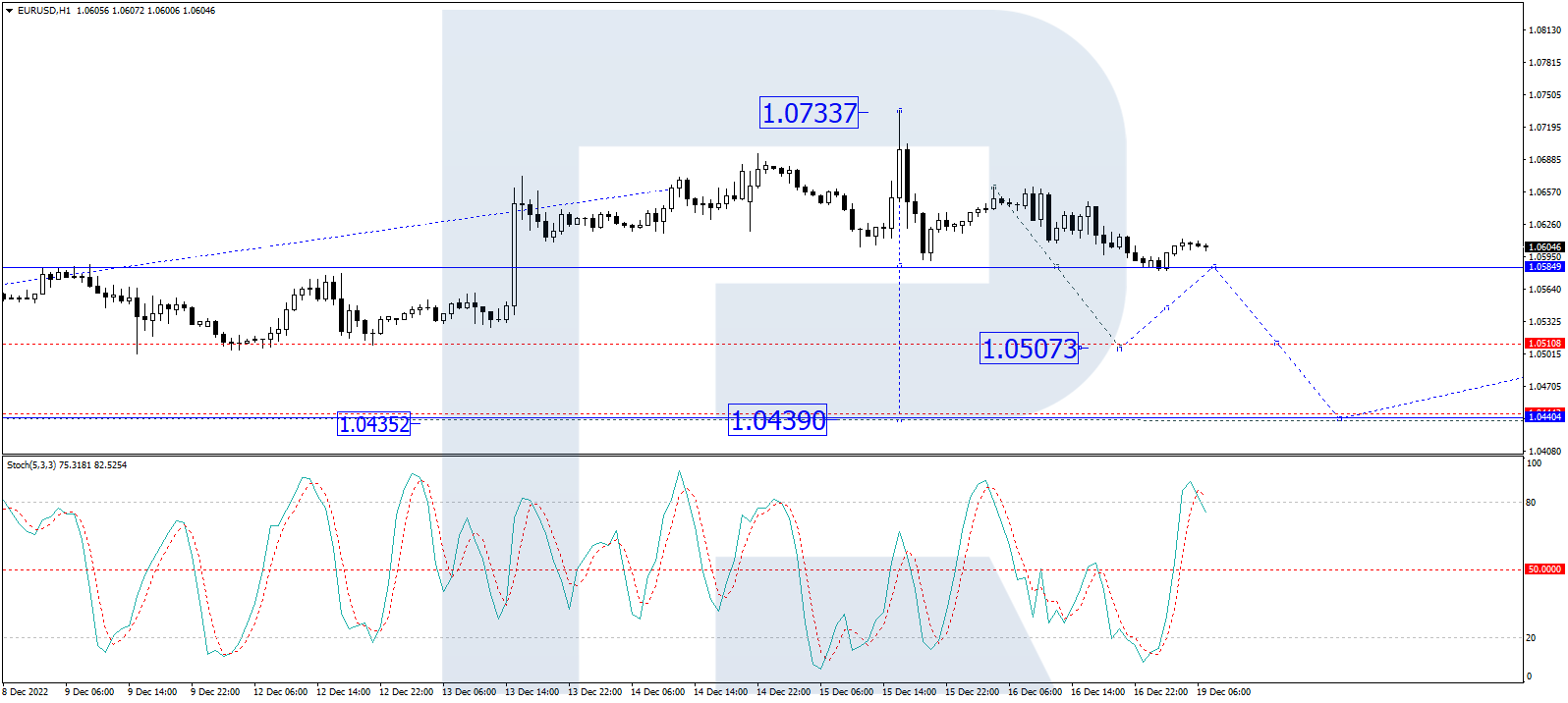

On H1, the pair has formed a structure of decline to 1.0585. A link of correction to 1.0640 is not excluded, followed by falling to 1.0555, from where the wave might continue to 1.0510. The goal is local. Technically, the scenario is confirmed by the Stochastic: its signal line is above 80 and is preparing to develop a new impulse of decline to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Trump announces exemption of key tech goods from imposed tariffs Apr 14, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil & Wheat Apr 13, 2025

- COT Stock Market Charts: Speculator Bets led higher by Nasdaq, Russell & DowJones Apr 13, 2025

- The US stocks are back to selling off. The US raised tariffs on China to 145% Apr 11, 2025

- EUR/USD Hits Three-Year High as the US Dollar Suffers Heavy Losses Apr 11, 2025

- Markets rallied sharply on the back of a 90-day tariff postponement. China became an exception with tariffs of 125% Apr 10, 2025

- Pound Rallies Sharply Weak Dollar Boosts GBP, but BoE Rate Outlook May Complicate Future Gains Apr 10, 2025

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025