By RoboForex Analytical Department

The commodity market efficiently reflected the improvement of the general situation. A Brent barrel on Monday is stabilising near 97.60 USD.

The main trigger for buying became an unexpected improvement in the forecasts on the global recession, which is a positive factor for the crude oil sector; also, there is a possibility that China will give up the zero tolerance regime in fighting with the coronavirus.

If these forecasts come true somehow, the commodity market will get serious support.

However, there are too few real reasons for softening the quarantine measures in China, and this understanding make commodity markets correct on Monday.

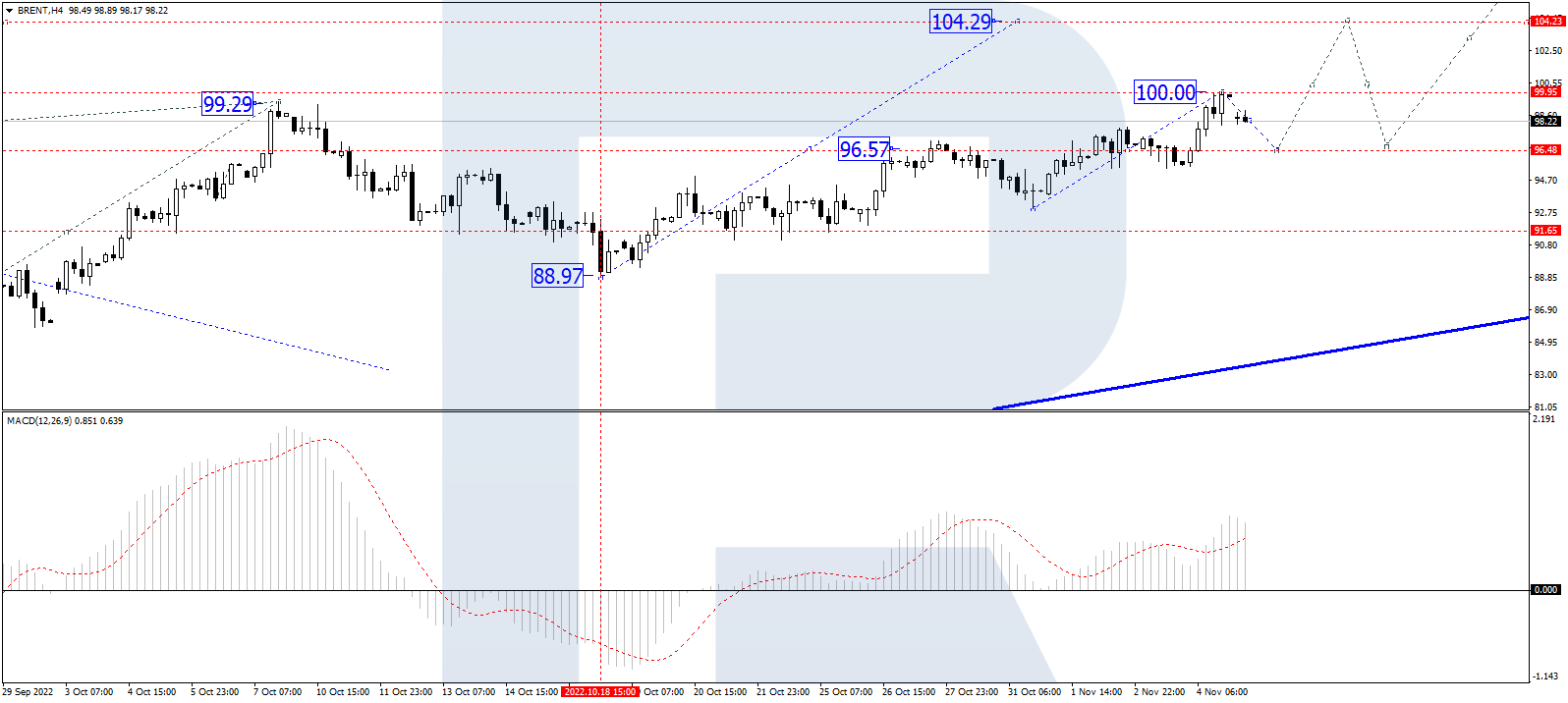

On H4, Brent has completed a wave of growth to 100.00. Today the market is forming a consolidation range under this level. Next, we expect a link of correction to 96.00. After it is over, a new wave of growth to 104.30 should start. The goal is local. Technically, this scenario is confirmed by the MACD. Its signal line is above zero in the histogram area, aimed strictly upwards.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

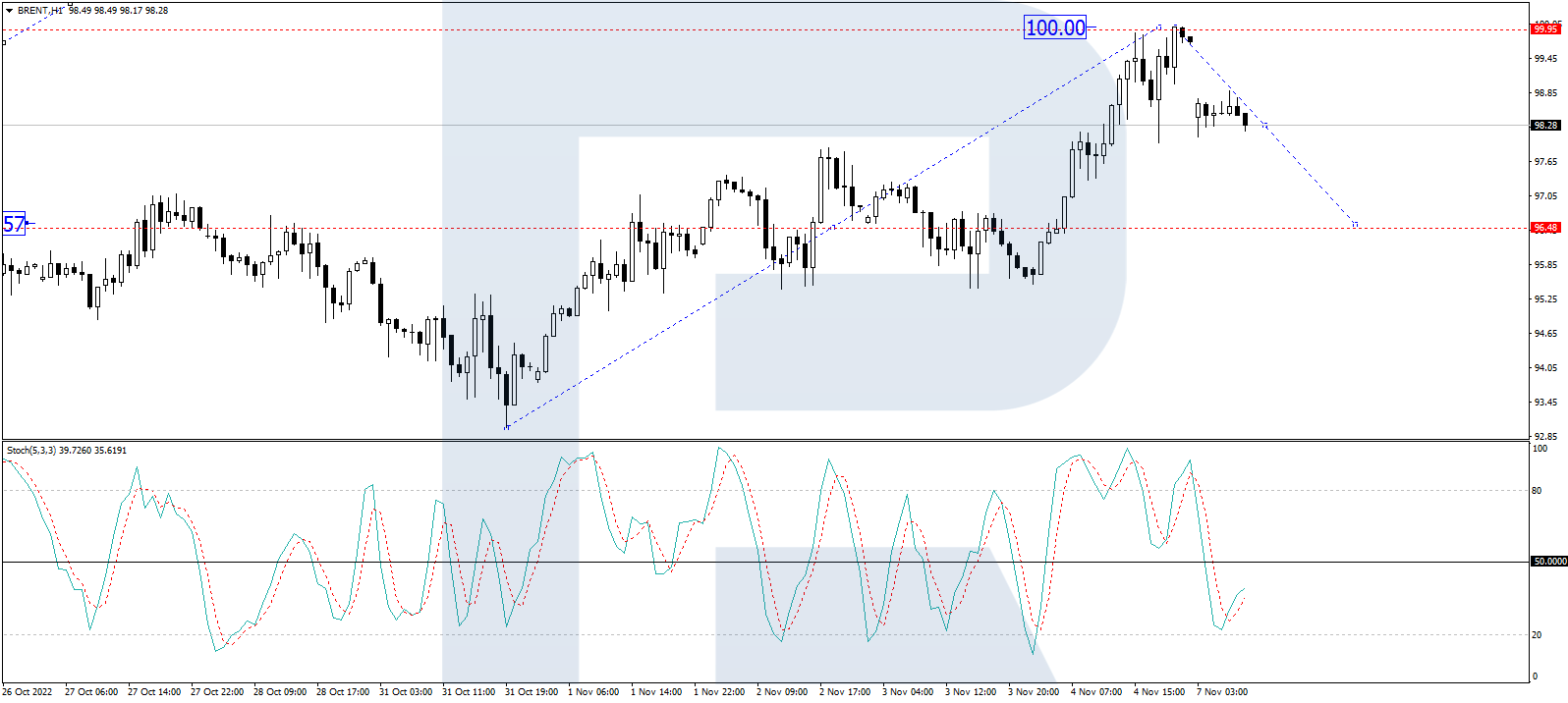

On H1, Brent has formed a consolidation range around 96.50. With an escape upwards, the market has reached the goal of 100.00. This whole wave of growth is interpreted as the third one by the trend. Then we expect a link of correcting decline to 96.50. When this correction is over, another wave of growth to 100.00 should start. And when this level is broken away, a pathway for growth to 104.30 will open. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 50. Further decline to 20 is expected.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Canadian dollar declines after weak GDP data. Qatar threatens EU to halt natural gas exports Dec 24, 2024

- Goldman Sachs has updated its economic projections for 2025. EU countries are looking for alternative sources of natural gas Dec 23, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & 10-Year Bonds Dec 21, 2024

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Palladium Dec 21, 2024

- COT Soft Commodities Charts: Speculator Bets led by Live Cattle, Lean Hogs & Coffee Dec 21, 2024

- COT Stock Market Charts: Speculator Bets led by S&P500 & Russell-2000 Dec 21, 2024

- Riksbank and Banxico cut interest rates by 0.25%. BoE, Norges Bank, and PBoC left rates unchanged Dec 20, 2024

- Brent Oil Under Pressure Again: USD and China in Focus Dec 20, 2024

- Market round-up: BoE & BoJ hold, Fed delivers ‘hawkish’ cut Dec 19, 2024

- NZD/USD at a New Low: The Problem is the US Dollar and Local GDP Dec 19, 2024