By InvestMacro.com | #stocks #XLU #utilities

Utilities Select Sector SPDR Fund End of Day Update: October 06 2022

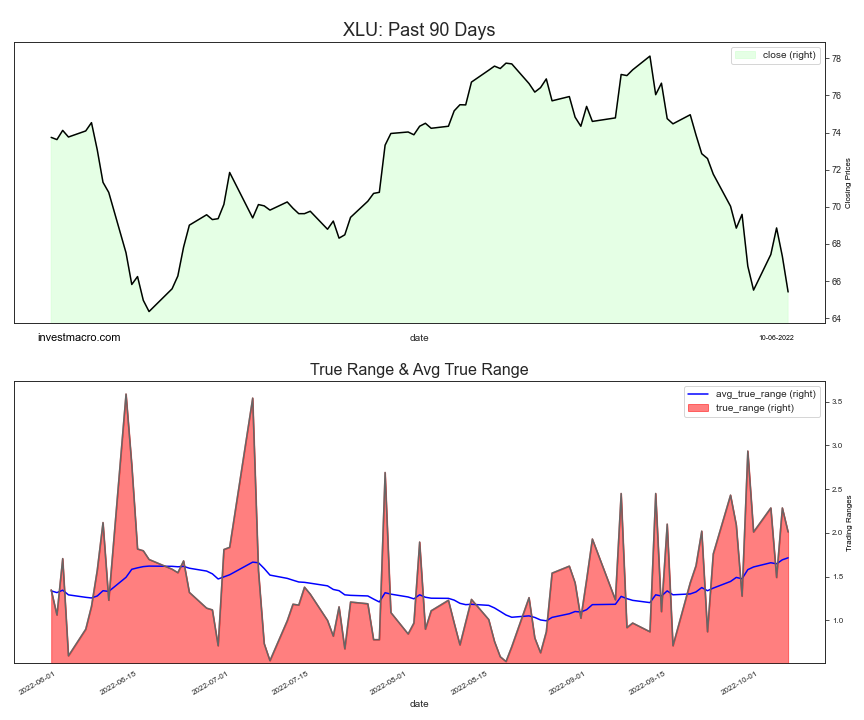

The Utilities Select Sector SPDR Fund (XLU) ETF finished the day with a fall of -2.85 percent and closed the day not too far off the lows of the day near the 65.41 price level, according to unofficial data at the New York close.

The XLU, an ETF that tracks the SP500 Utilities Select Sector Index, opened the day trading at 67.04 with the high of the day being 67.15 and the low of the day at 65.32.

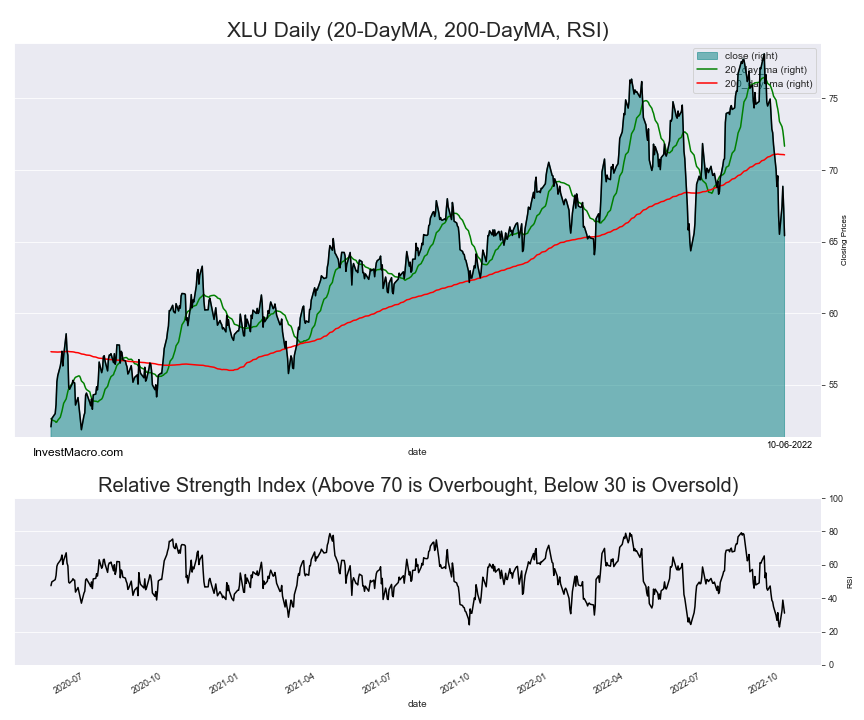

XLU has recently fallen below the 200-day moving average and has seen a deep descend after hitting a recent high over $78.00 in the middle of September.

The XLU RSI level is Bearish

The Relative Strength Index, an indicator that can indicate overbought (above 70) and oversold levels (below 30), shows that the current RSI score is at 31.0 for a Bearish reading on the daily time-frame.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

XLU Price Trends

The XLU has fallen by -9.90 percent over the past 10 days while seeing a decrease by -14.41 over the past 30 days. The 90-day change is -12.52 while the 180-day return and the 365-day return are -3.64 and 3.40, respectively.

By investmacro.com

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025

- Volatility in financial markets is insane. Oil fell to $60.7 per barrel Apr 8, 2025

- Japanese Yen Recovers Some Losses as Investors Seek Safe-Haven Assets Apr 8, 2025

- The sell-off in risk assets intensified as tariffs took effect Apr 7, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Silver Apr 5, 2025

- COT Bonds Charts: Speculator Bets led by SOFR 1-Month & US Treasury Bonds Apr 5, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil, Cotton & Soybeans Apr 5, 2025

- COT Stock Market Charts: Speculator Bets led by S&P500 & Nasdaq Apr 5, 2025

- Today, investors focus on the Non-Farm Payrolls labor market report Apr 4, 2025

- USD/JPY collapses to a 6-month low: safe-haven assets in demand Apr 4, 2025