By RoboForex Analytical Department

The Pound Sterling continues plummeting against the USD; by now, it has already dropped to 1.1660.

Apart from the strong USD factor, the Pound is being significantly pressured by domestic news. Britain’s energy regulator announced Friday that energy bills for households in the UK would rise by 80% in October. In response to that, the HM Treasury said that it was thoroughly working on developing new options to support households and defuse cost loading from energy price surges. However, all these words didn’t help the Pound at all.

The bearish pressure on the Pound is currently too strong to expect a quick and miraculous recovery.

Systematic issues inside the British economy might seriously escalate in the near future due to the energy crisis, making the national currency much cheaper.

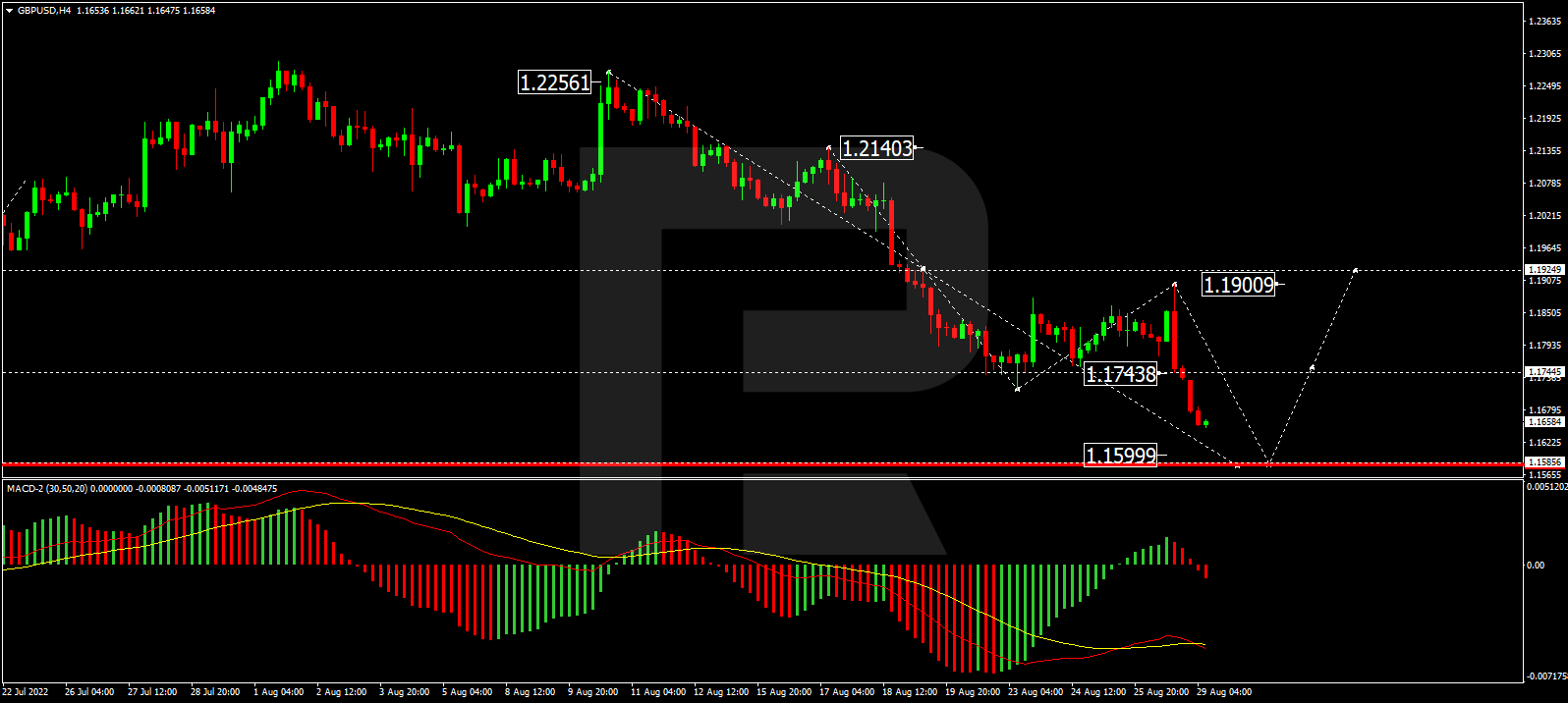

As we can see in the H4 chart, having finished the correctional structure at 1.1900 and rebounded from this level, GBP/USD is forming a new descending structure towards 1.1600. Later, the market may start another correction to reach 1.1750 and then resume trading downwards with the target at 1.1550. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving below 0 and may continue falling to reach new lows soon.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

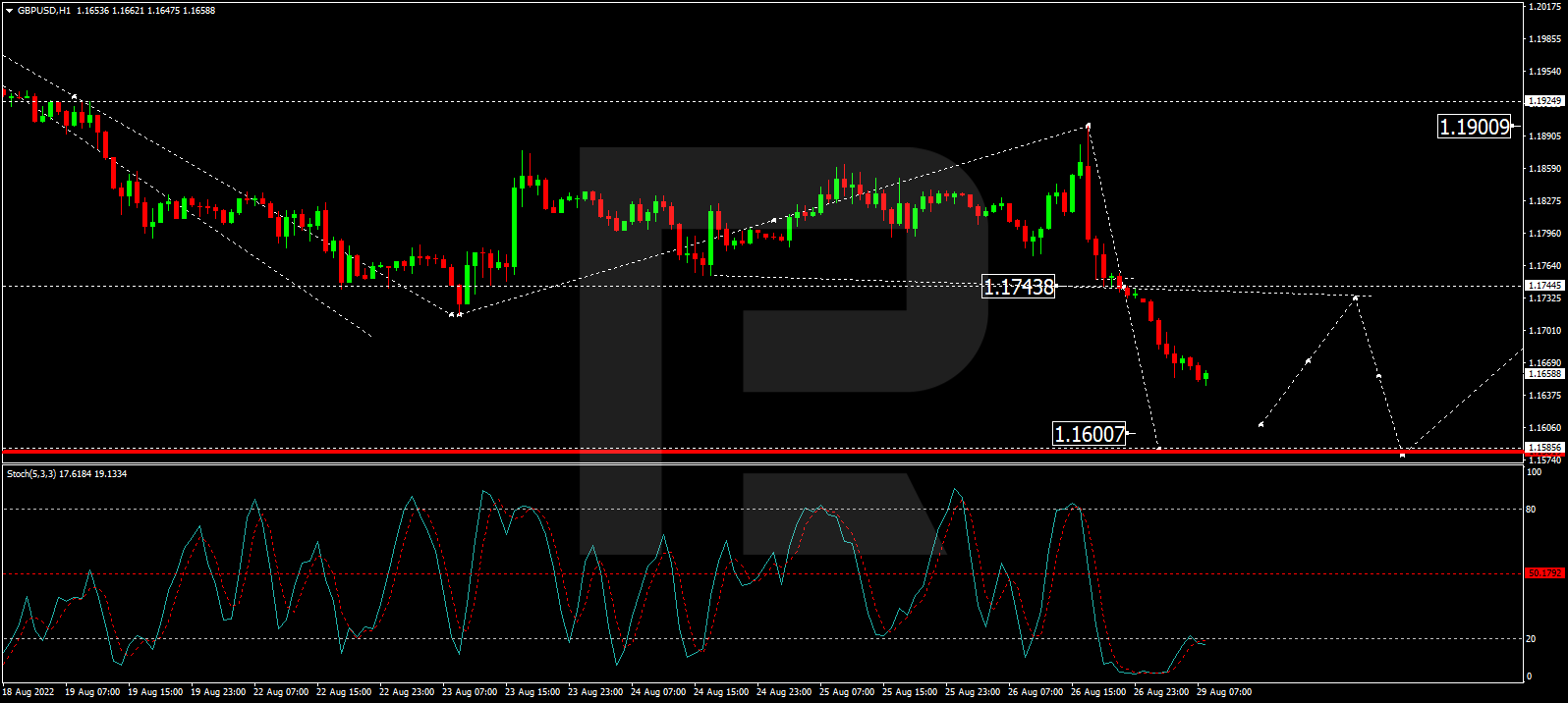

In the H1 chart, after completing the correction at 1.1900, breaking the correctional channel at 1.1744, and then forming a new consolidating range there, GBP/USD has broken it downwards and may continue falling towards 1.1600. Later, the market may correct to test 1.1744 from below and then resume trading downwards with the target at 1.1550. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is moving below 20. In the future, it may grow to rebound from 50 and resume falling to return to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024