Article By RoboForex.com

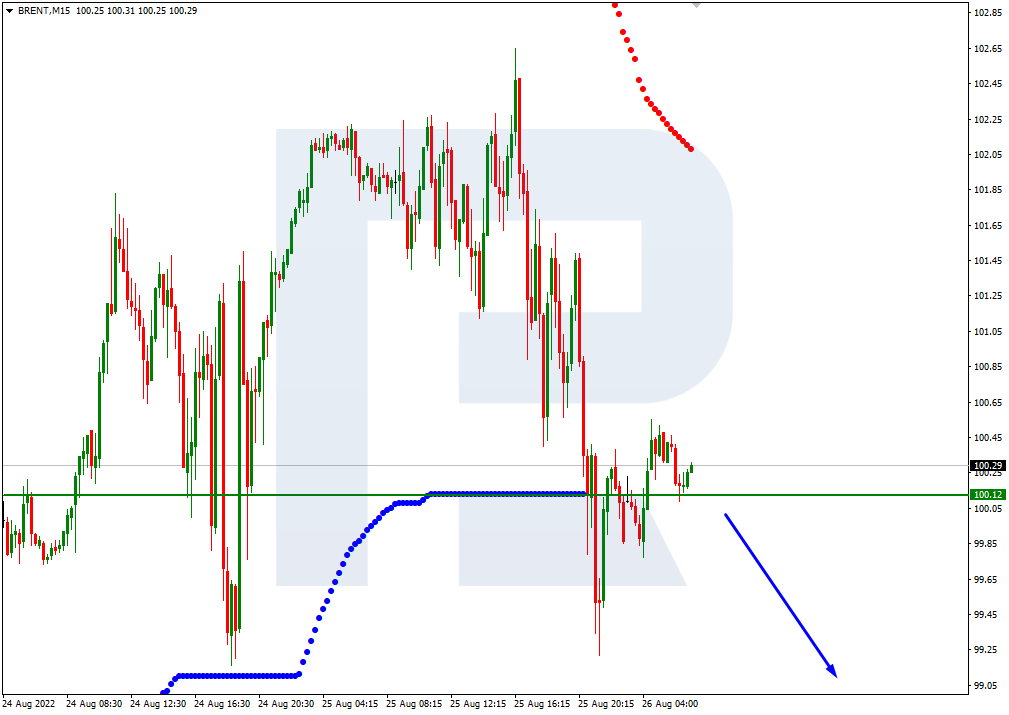

Brent

As we can see in the H4 chart, Brent is trading below the 200-day Moving Average, thus indicating a descending tendency. In this case, the price is expected to break 4/8 and continue moving downwards to reach the support at 3/8. However, this scenario may no longer be valid if the asset breaks 5/8 to the upside. After that, the instrument may reverse and grow to return to the resistance at 6/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue its decline.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

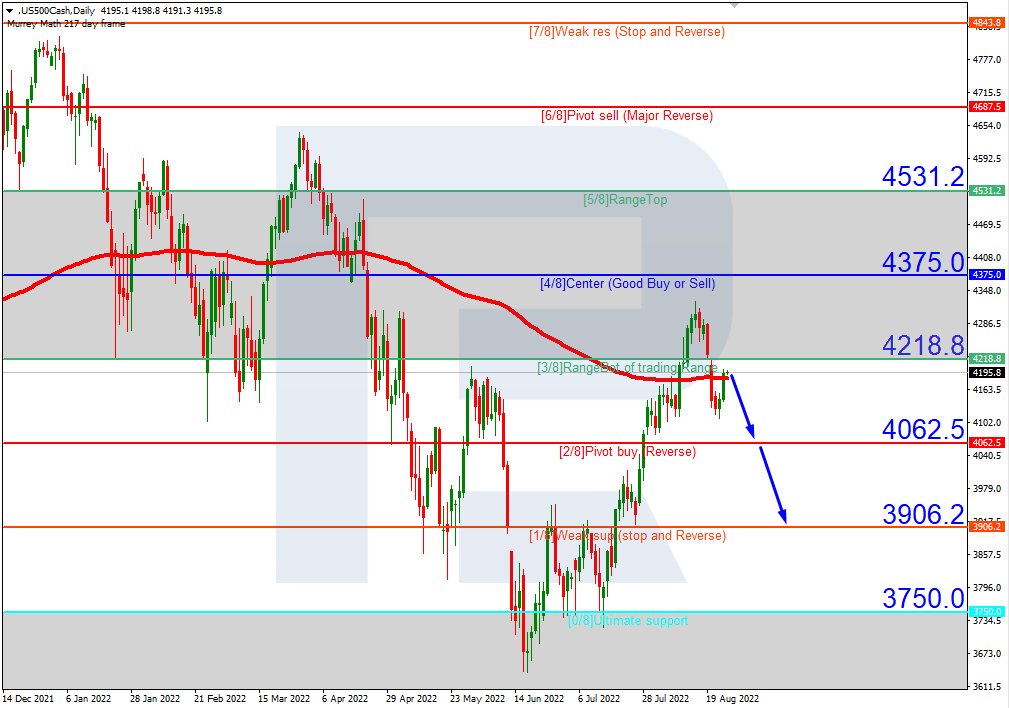

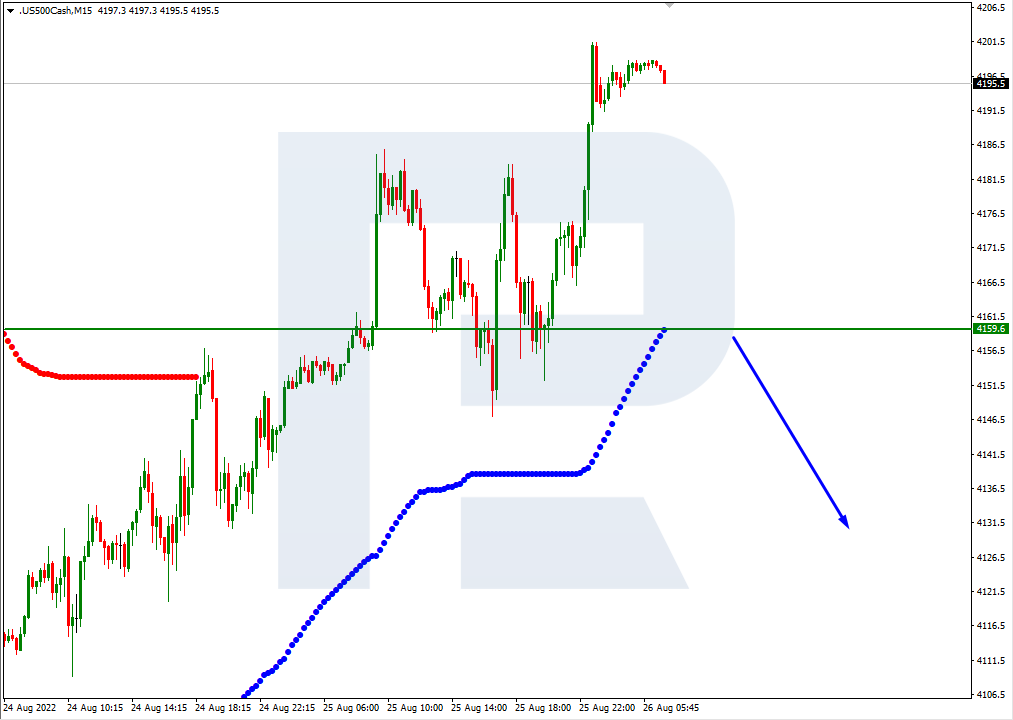

S&P 500

As we can see in the H4 chart, after breaking the consolidation range, the S&P Index is trading below 3/8. In this case, the price is expected to test 2/8, break it, and then continue falling towards the support at 1/8. However, this scenario may no longer be valid if the asset breaks the resistance at 3/8 to the upside. After that, the instrument may reverse and grow to reach 4/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue trading downwards to reach 1/8 from the H4 chart.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- The Bank of Canada kept the interest rate unchanged. In New Zealand, there is an increase in inflation Apr 17, 2025

- Pound Among the Winners Boosted by US Dollar Weakness and Rate Cut Prospects Apr 17, 2025

- China data beat expectations. Inflationary pressures in Canada continue to ease Apr 16, 2025

- Japanese Yen Surges as Weak US Dollar Fuels Momentum Apr 16, 2025

- Investors welcome tariff reliefs. Demand for safe assets is decreasing Apr 15, 2025

- CN50 waits on key China data Apr 15, 2025

- Gold Prices Remain Elevated Amid Concerns Over Trump’s Tariffs Apr 15, 2025

- Trump announces exemption of key tech goods from imposed tariffs Apr 14, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025