By Orbex

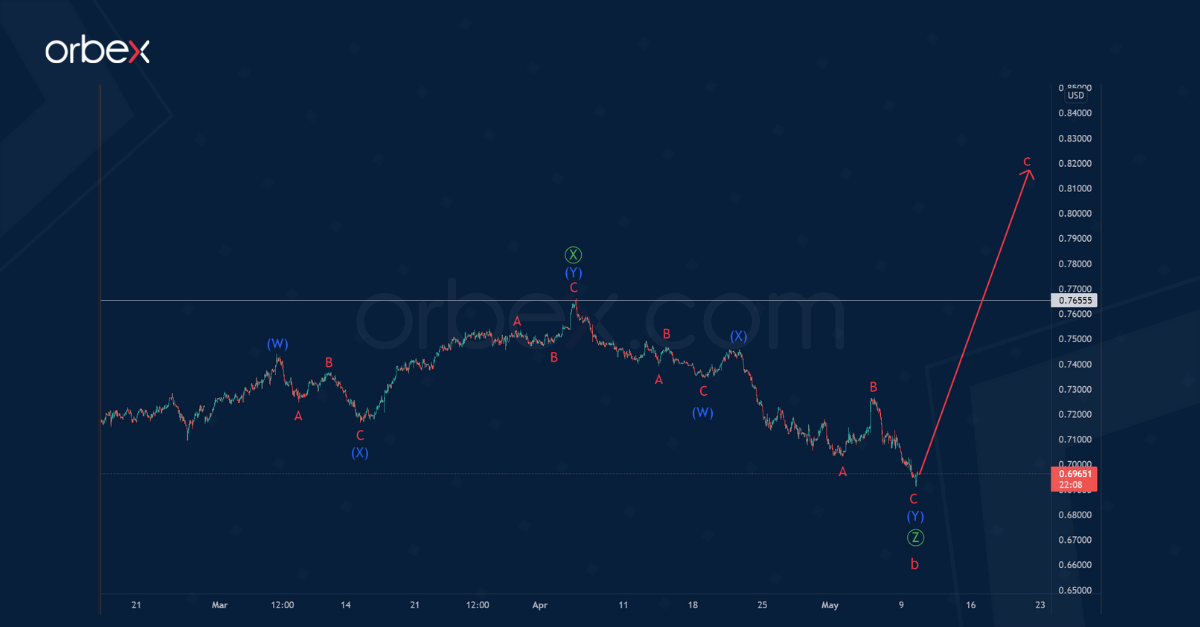

The current AUDUSD structure indicates that the market is forming a cycle zigzag a-b-c. This currently includes a bearish correction wave b and consists of primary sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ.

The final section of the chart shows the structure of the last primary wave Ⓩ. It seems to be an intermediate triple zigzag (W)-(X)-(Y)-(X)-(Z). The final wave (Z) will take the form of a minor zigzag A-B-C and will end near 0.646.

At that level, cycle correction b will be at 61.8% of cycle impulse wave a.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

According to the alternative, the bearish wave Ⓩ of the primary degree has already ended.

Therefore, the primary wave Ⓩ will be a double zigzag (W)-(X)-(Y) of the intermediate degree, and not a triple zigzag, as we assumed in the main version.

According to this view, in the next coming trading weeks, the currency pair could move higher within the new cycle wave c. This would be in the direction of the previous maximum of 0.765, which was marked by the intervening wave Ⓧ.

Test your strategy on how the AUD will fare with Orbex – Open Your Account Now.

Article by Orbex

Article by Orbex

Orbex is a fully licensed broker that was established in 2011. Founded with a mission to serve its traders responsibly and provides traders with access to the world’s largest and most liquid financial markets. www.orbex.com

- Trump announces exemption of key tech goods from imposed tariffs Apr 14, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil & Wheat Apr 13, 2025

- COT Stock Market Charts: Speculator Bets led higher by Nasdaq, Russell & DowJones Apr 13, 2025

- The US stocks are back to selling off. The US raised tariffs on China to 145% Apr 11, 2025

- EUR/USD Hits Three-Year High as the US Dollar Suffers Heavy Losses Apr 11, 2025

- Markets rallied sharply on the back of a 90-day tariff postponement. China became an exception with tariffs of 125% Apr 10, 2025

- Pound Rallies Sharply Weak Dollar Boosts GBP, but BoE Rate Outlook May Complicate Future Gains Apr 10, 2025

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025