Article By RoboForex.com

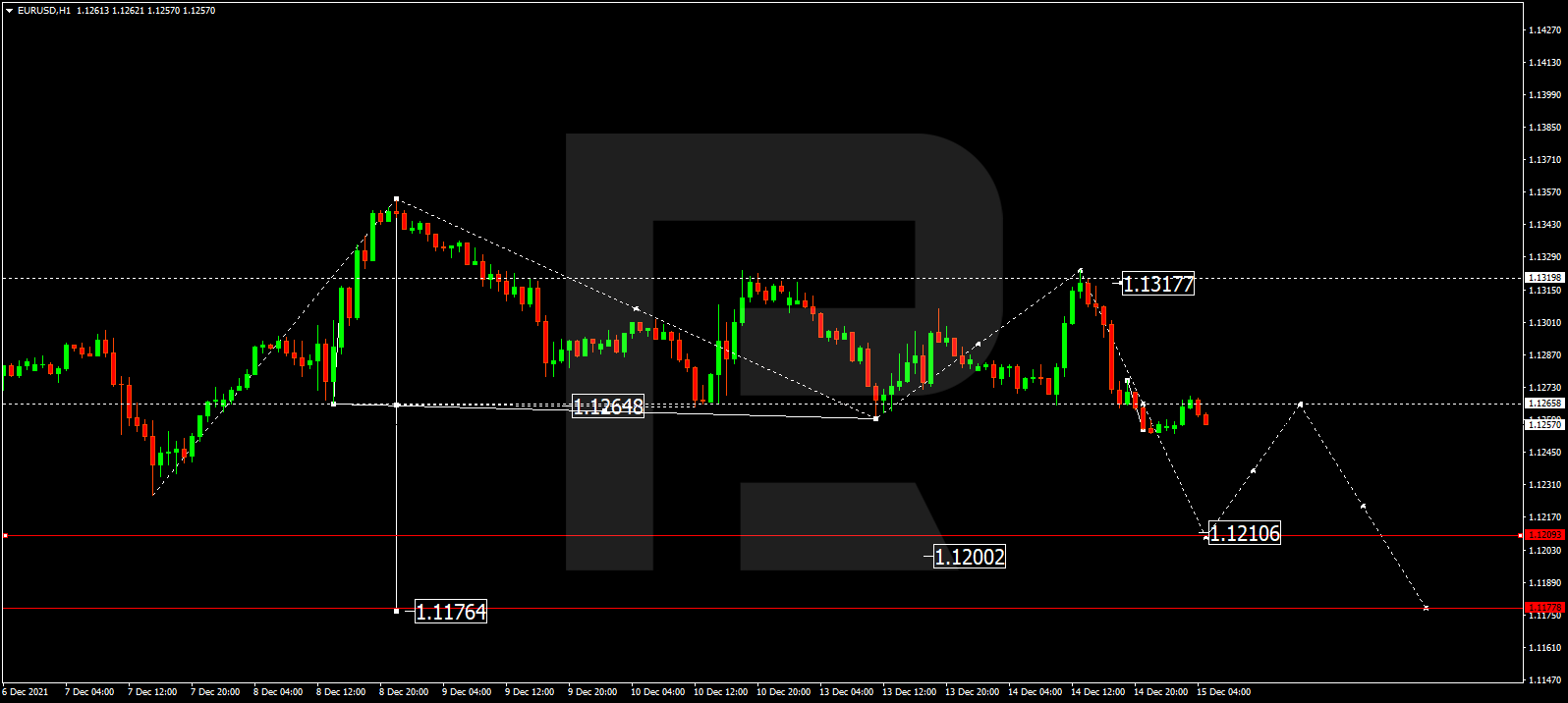

EURUSD, “Euro vs US Dollar”

EURUSD has completed another descending wave at 1.1260; right now, it is consolidating around this level. Possibly, the pair may break the range to the downside and reach 1.1210. Later, the market may start a new correction towards 1.1270 and then resume trading downwards with the target at 1.1180.

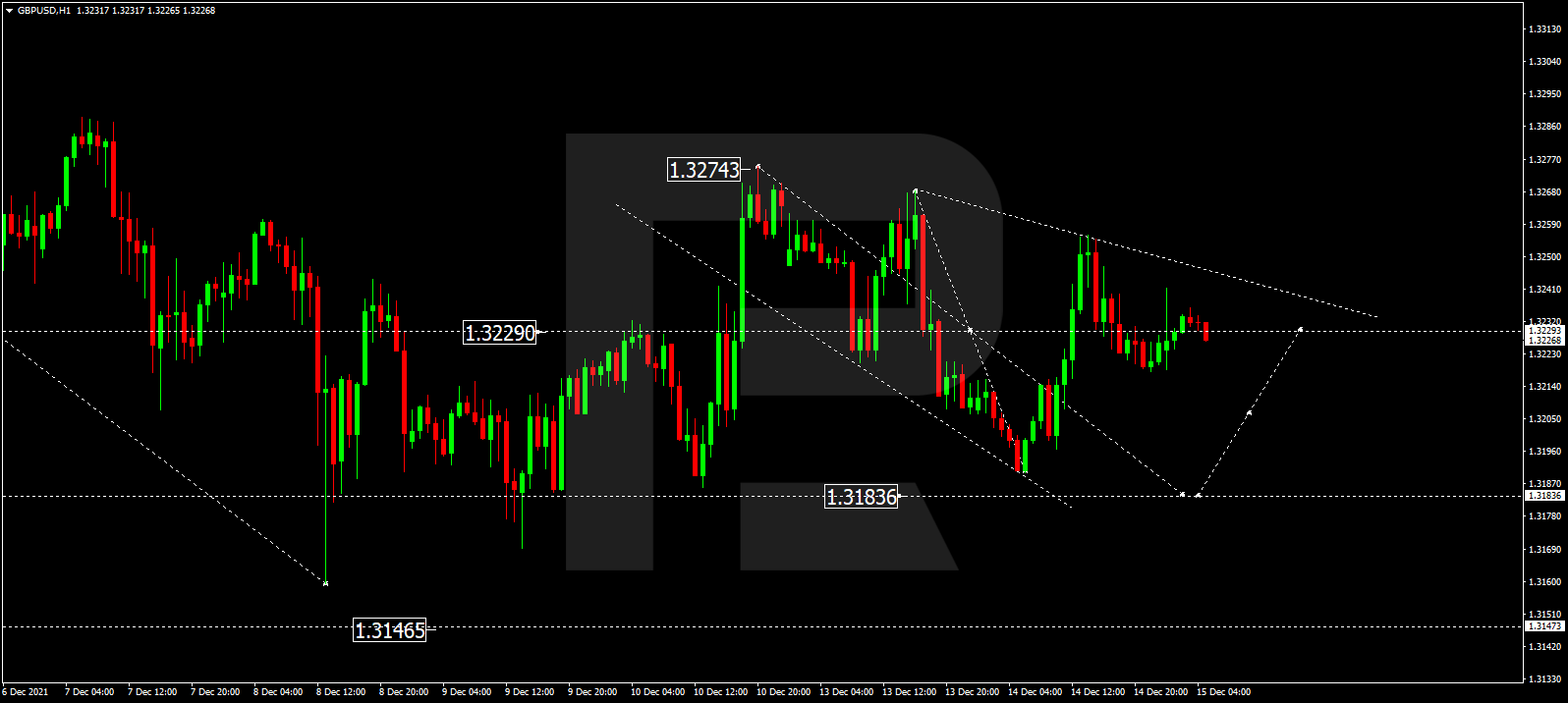

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is forming a new consolidation range around 1.3230. Today, the pair may resume falling towards 1.3183. Later, the market may correct to return to 1.3230 and then resume trading downwards with the target at 1.3146.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

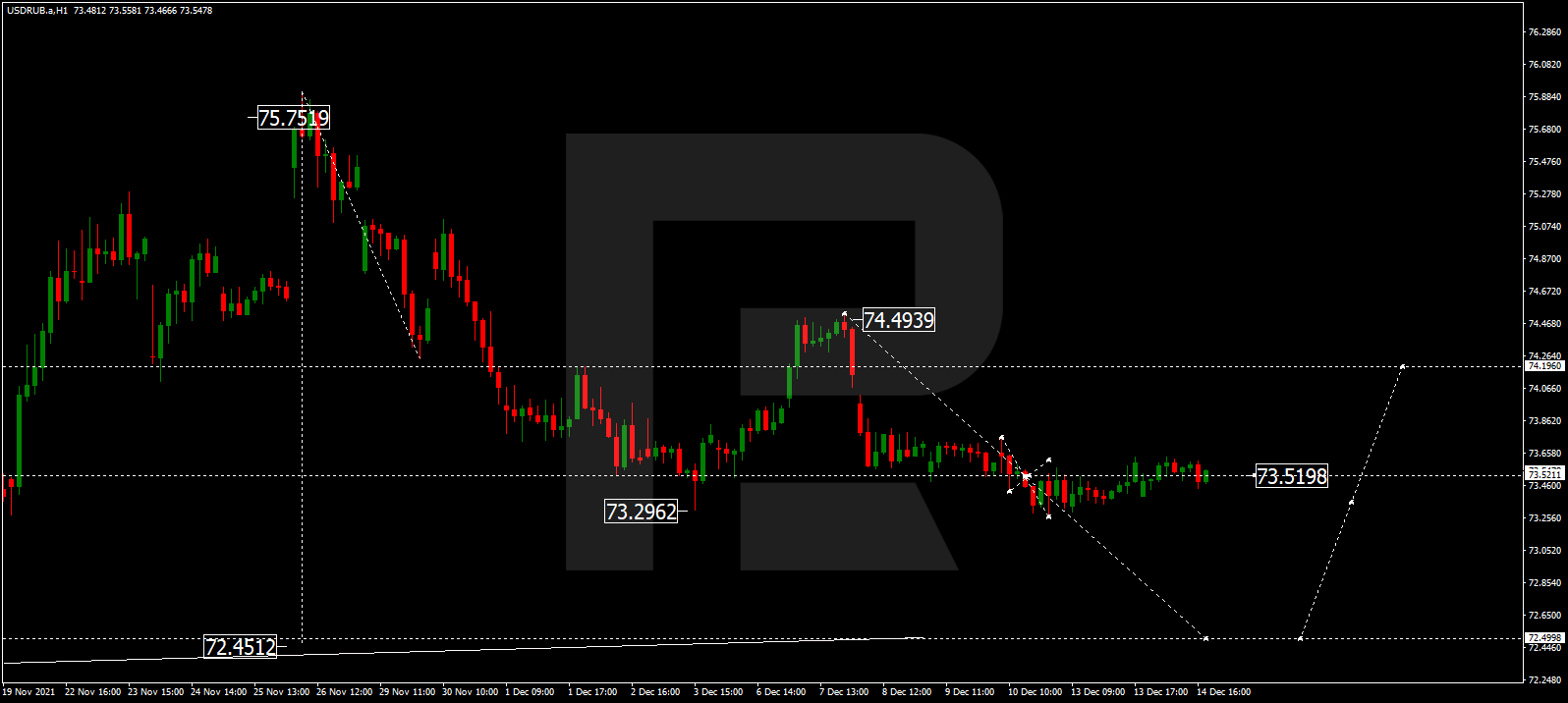

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is still consolidating around 73.50 without any specific direction. Possibly, the pair may break the range to the downside and resume falling with the first target at 72.50. Later, the instrument may start a new correction towards 74.20.

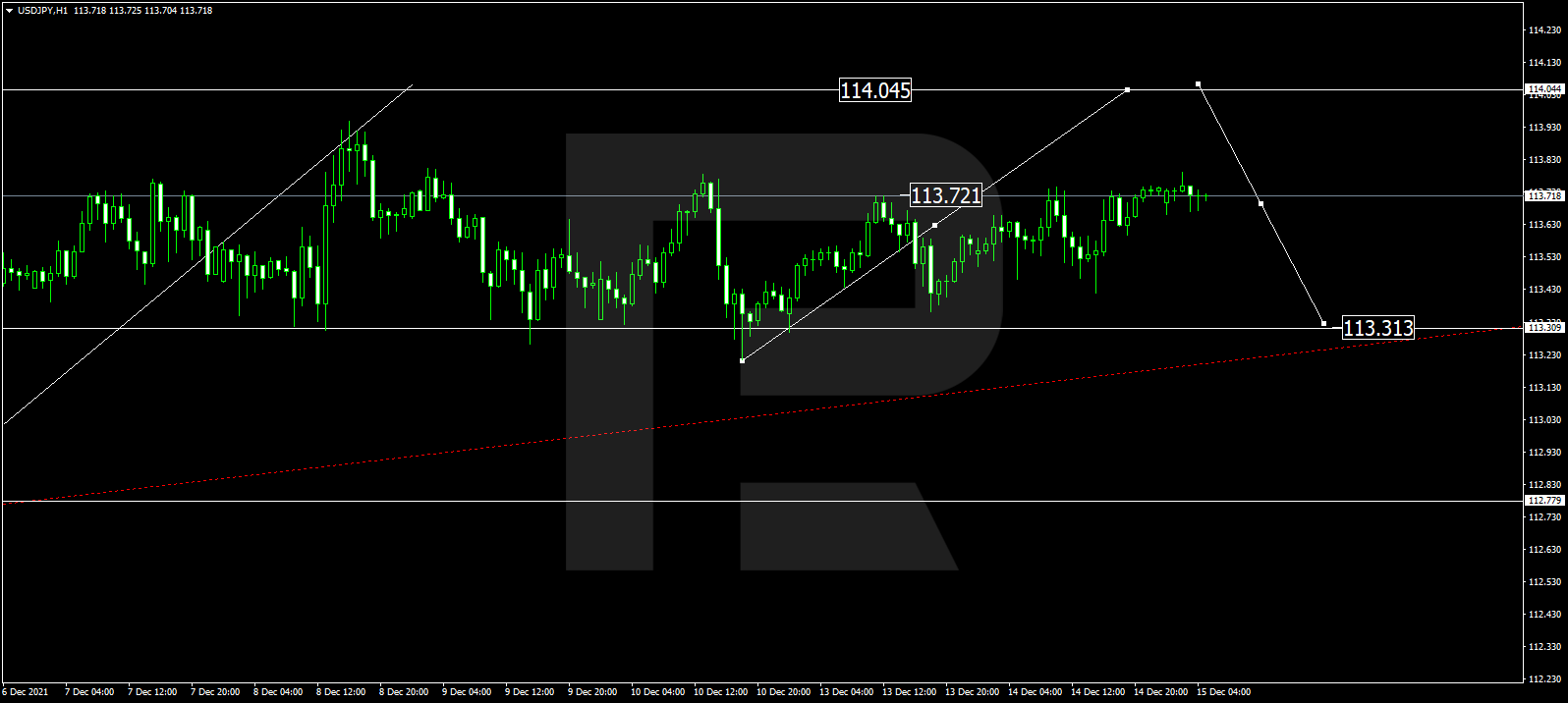

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is forming a narrow consolidation range around 113.55. Possibly, today the pair may break the range to the upside and reach 114.05. Later, the market may start a new correction towards 113.30 and then resume trading upwards with the target at 114.55.

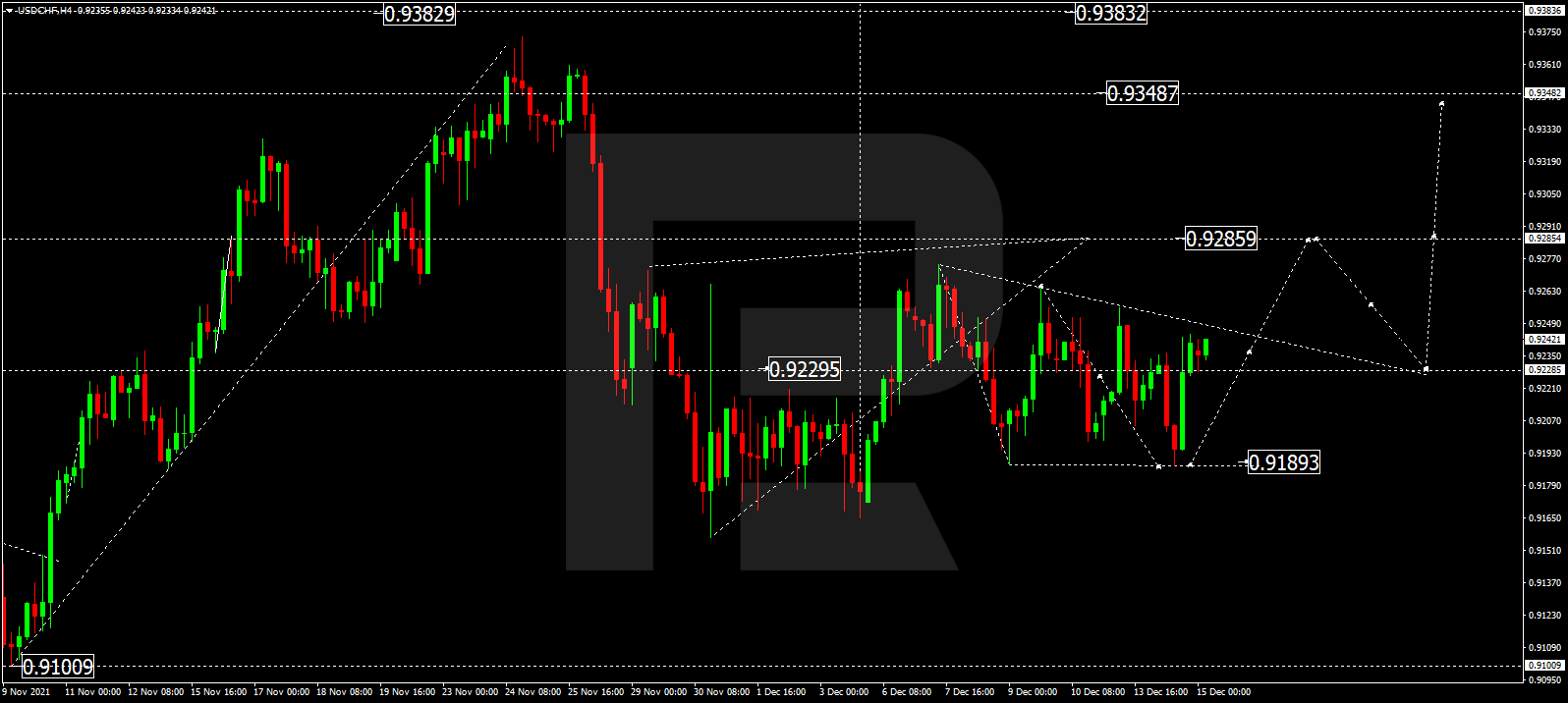

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is consolidating around 0.9229 without any particular direction. Possibly, the pair may break this range to the upside and resume growing towards 0.9286. Later, the market may correct to reach 0.9233 and then form one more ascending structure with the target at 0.9350.

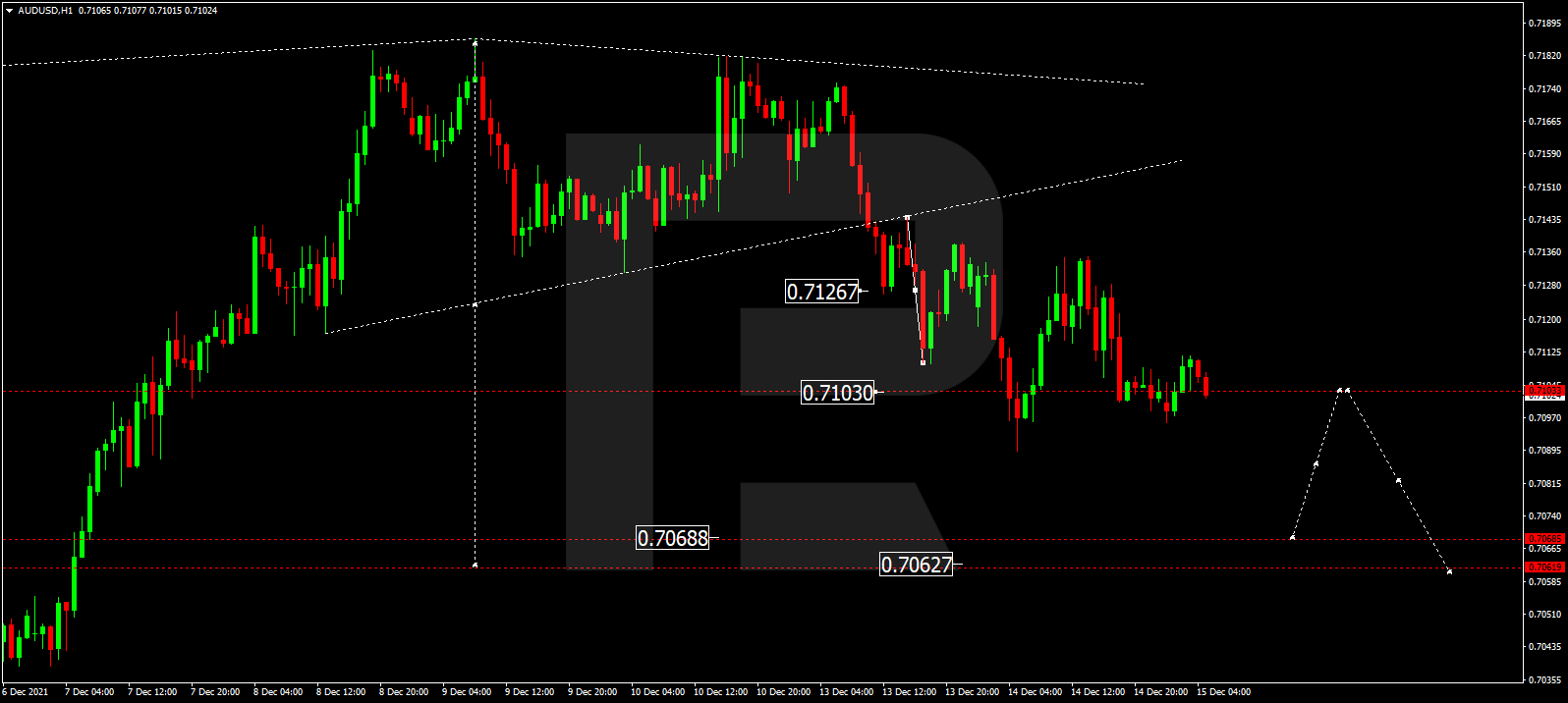

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has broken 0.7125; right now, it is still falling towards 0.7070. Later, the market may correct to return to 0.7125 and then resume trading downwards with the target at 0.7060.

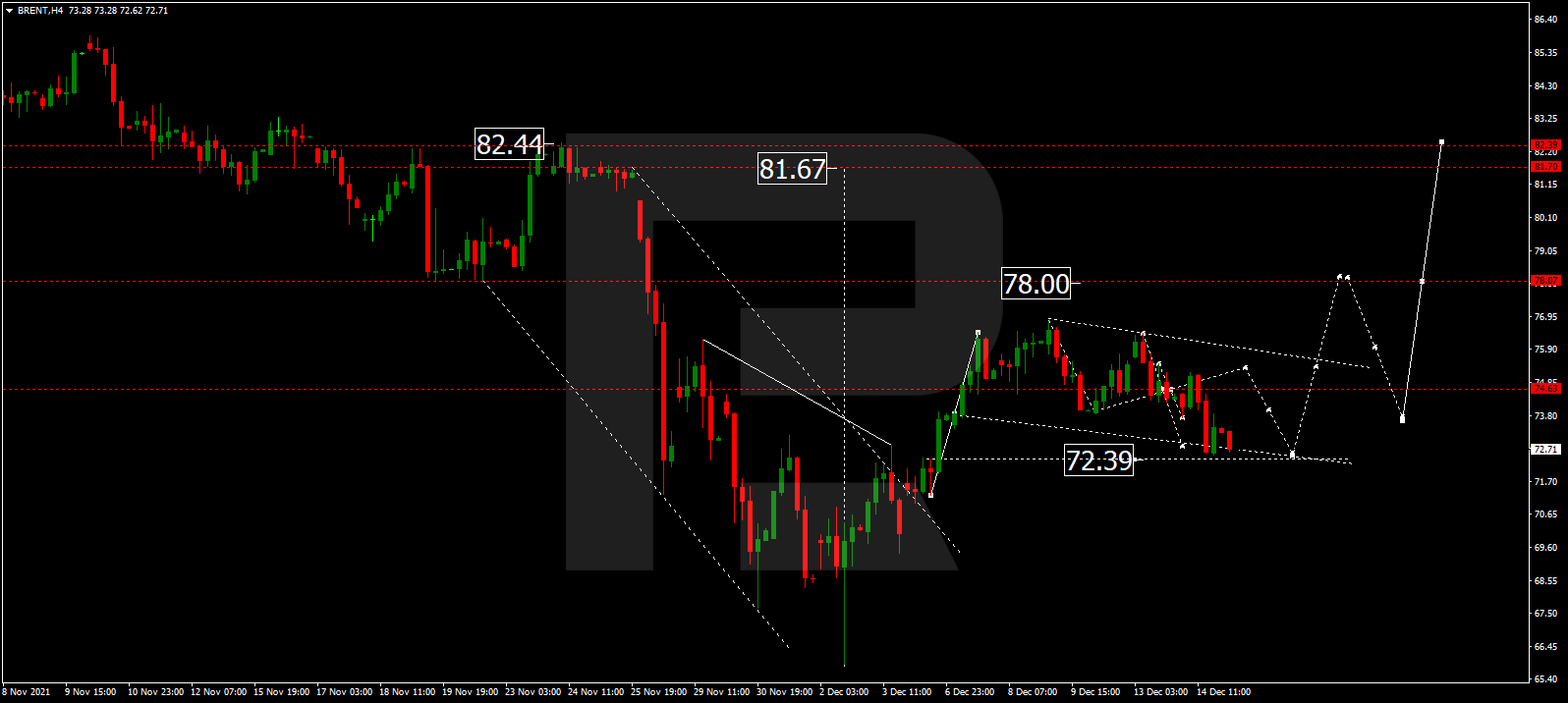

BRENT

Brent is still correcting; it has already reached 72.70. Possibly, today the asset may grow towards 75.25. Later, the market may start a new decline to reach 72.00 and then form one more ascending structure with the short-term target at 78.00.

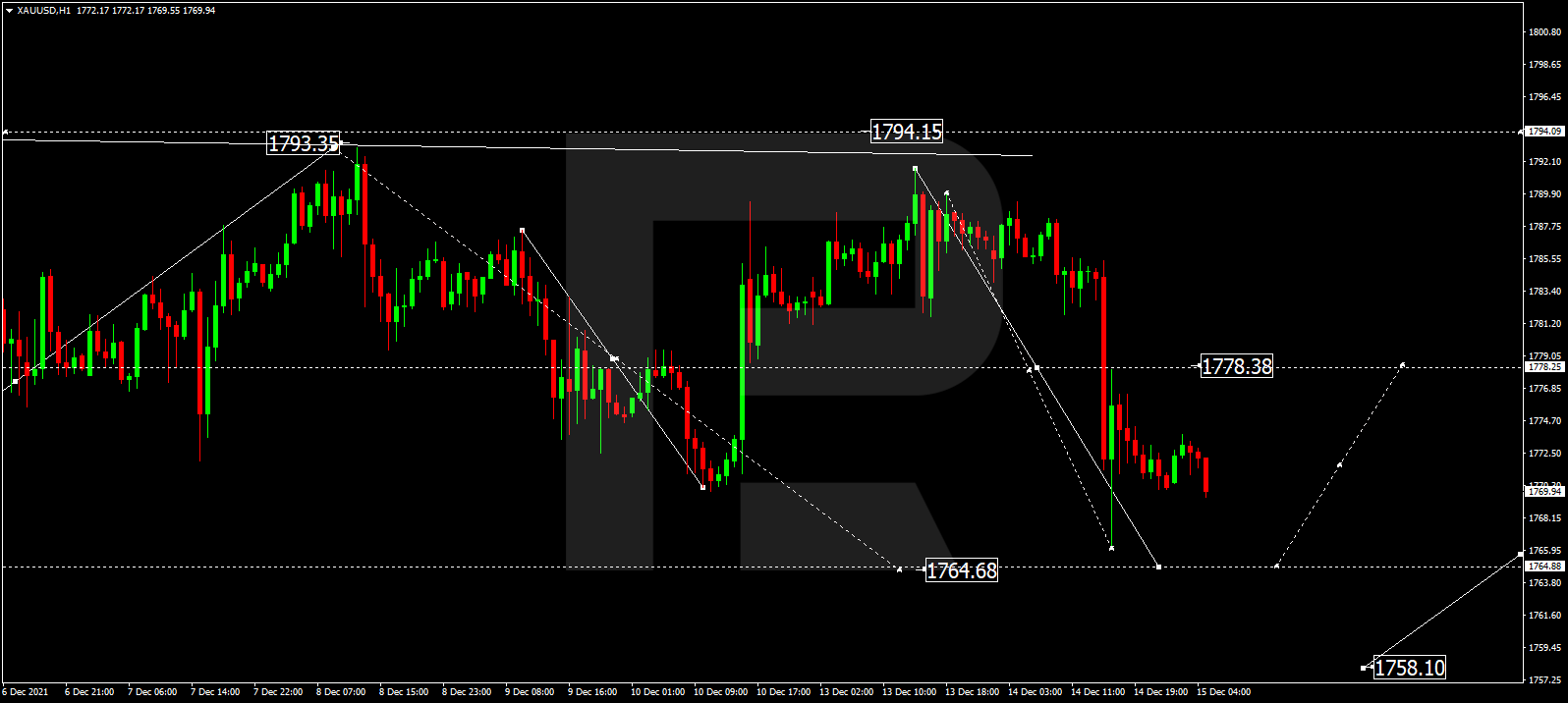

XAUUSD, “Gold vs US Dollar”

Gold has broken 1778.40 to the downside. Possibly, the metal may form one more correctional structure towards 1764.50. After that, the instrument may start another growth to break 1780.00 and then continue trading upwards with the target at 1800.00.

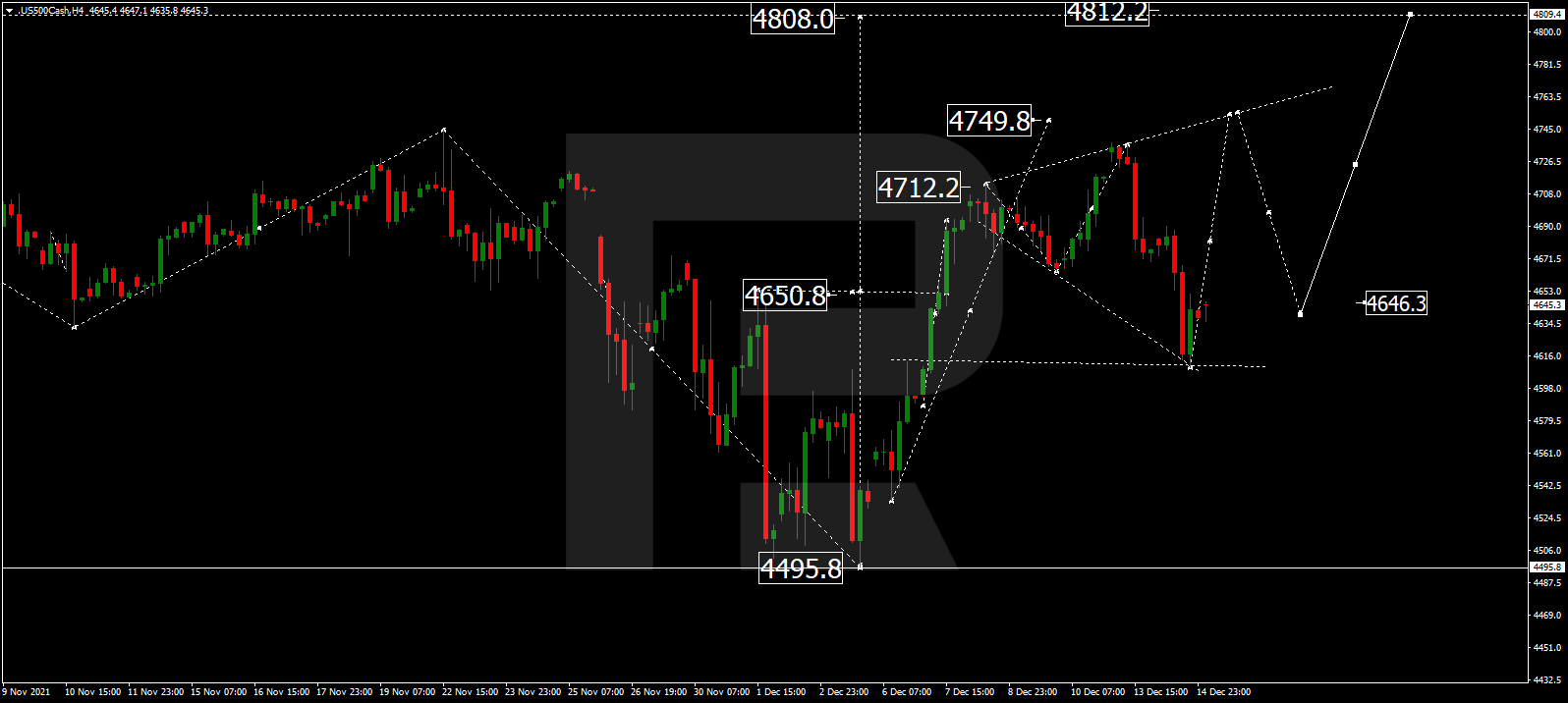

S&P 500

After breaking 4660.0 and then reaching 4610.0, the S&P index is expected to grow and return to 4660.0. Later, the market may break this level and form one more ascending wave with the target at 4750.0.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- RoboForex Receives Best Introducing Broker Programme Award Nov 18, 2024

- The hawkish attitude of FOMC representatives puts pressure on stock indices. Oil is growing amid escalation in Eastern Europe Nov 18, 2024

- AUD/USD Stabilises Amid RBA’s Hawkish Outlook Nov 18, 2024

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024