By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday July 13 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

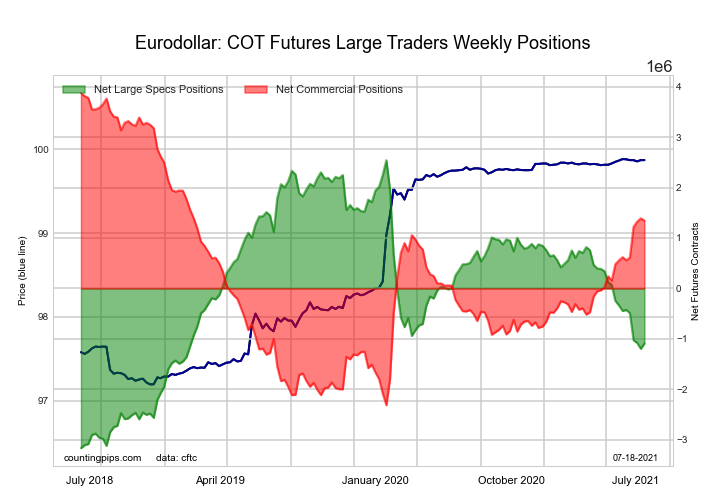

3-Month Eurodollars Futures:

The 3-Month Eurodollars large speculator standing this week equaled a net position of -1,092,200 contracts in the data reported through Tuesday. This was a weekly boost of 105,198 contracts from the previous week which had a total of -1,197,398 net contracts.

The 3-Month Eurodollars large speculator standing this week equaled a net position of -1,092,200 contracts in the data reported through Tuesday. This was a weekly boost of 105,198 contracts from the previous week which had a total of -1,197,398 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 36.4 percent. The commercials are Bullish with a score of 59.1 percent and the small traders (not shown in chart) are Bullish with a score of 69.9 percent.

| 3-Month Eurodollars Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 13.8 | 61.2 | 4.7 |

| – Percent of Open Interest Shorts: | 22.5 | 50.4 | 6.8 |

| – Net Position: | -1,092,200 | 1,345,510 | -253,310 |

| – Gross Longs: | 1,715,886 | 7,628,830 | 591,739 |

| – Gross Shorts: | 2,808,086 | 6,283,320 | 845,049 |

| – Long to Short Ratio: | 0.6 to 1 | 1.2 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 36.4 | 59.1 | 69.9 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.3 | 11.7 | -10.2 |

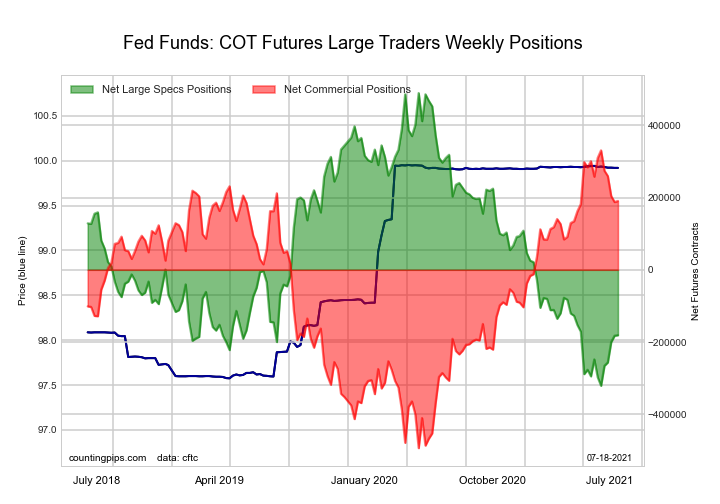

30-Day Federal Funds Futures:

The 30-Day Federal Funds large speculator standing this week equaled a net position of -180,992 contracts in the data reported through Tuesday. This was a weekly rise of 1,479 contracts from the previous week which had a total of -182,471 net contracts.

The 30-Day Federal Funds large speculator standing this week equaled a net position of -180,992 contracts in the data reported through Tuesday. This was a weekly rise of 1,479 contracts from the previous week which had a total of -182,471 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 17.3 percent. The commercials are Bullish-Extreme with a score of 83.0 percent and the small traders (not shown in chart) are Bullish with a score of 53.8 percent.

| 30-Day Federal Funds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 3.8 | 74.3 | 2.3 |

| – Percent of Open Interest Shorts: | 20.6 | 56.6 | 3.2 |

| – Net Position: | -180,992 | 190,473 | -9,481 |

| – Gross Longs: | 40,886 | 800,414 | 24,897 |

| – Gross Shorts: | 221,878 | 609,941 | 34,378 |

| – Long to Short Ratio: | 0.2 to 1 | 1.3 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 17.3 | 83.0 | 53.8 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 14.3 | -14.4 | 4.9 |

2-Year Treasury Note Futures:

The 2-Year Treasury Note large speculator standing this week equaled a net position of -131,440 contracts in the data reported through Tuesday. This was a weekly advance of 66,922 contracts from the previous week which had a total of -198,362 net contracts.

The 2-Year Treasury Note large speculator standing this week equaled a net position of -131,440 contracts in the data reported through Tuesday. This was a weekly advance of 66,922 contracts from the previous week which had a total of -198,362 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 74.3 percent. The commercials are Bearish with a score of 42.2 percent and the small traders (not shown in chart) are Bearish with a score of 36.2 percent.

| 2-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 18.5 | 71.8 | 7.0 |

| – Percent of Open Interest Shorts: | 25.0 | 65.4 | 6.8 |

| – Net Position: | -131,440 | 128,908 | 2,532 |

| – Gross Longs: | 370,853 | 1,440,250 | 139,891 |

| – Gross Shorts: | 502,293 | 1,311,342 | 137,359 |

| – Long to Short Ratio: | 0.7 to 1 | 1.1 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 74.3 | 42.2 | 36.2 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -12.6 | 16.3 | -19.2 |

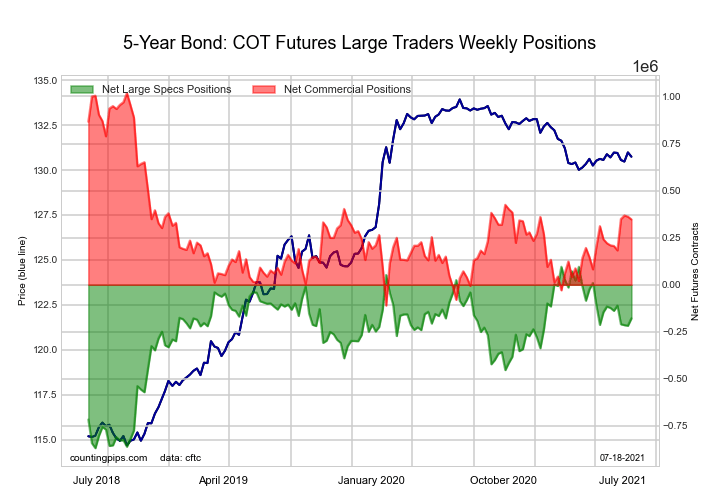

5-Year Treasury Note Futures:

The 5-Year Treasury Note large speculator standing this week equaled a net position of -178,076 contracts in the data reported through Tuesday. This was a weekly gain of 39,227 contracts from the previous week which had a total of -217,303 net contracts.

The 5-Year Treasury Note large speculator standing this week equaled a net position of -178,076 contracts in the data reported through Tuesday. This was a weekly gain of 39,227 contracts from the previous week which had a total of -217,303 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 71.6 percent. The commercials are Bearish with a score of 40.5 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 0.0 percent.

| 5-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 10.7 | 79.7 | 8.2 |

| – Percent of Open Interest Shorts: | 15.9 | 69.6 | 13.0 |

| – Net Position: | -178,076 | 346,911 | -168,835 |

| – Gross Longs: | 370,598 | 2,749,007 | 281,311 |

| – Gross Shorts: | 548,674 | 2,402,096 | 450,146 |

| – Long to Short Ratio: | 0.7 to 1 | 1.1 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 71.6 | 40.5 | 0.0 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.8 | 12.2 | -34.4 |

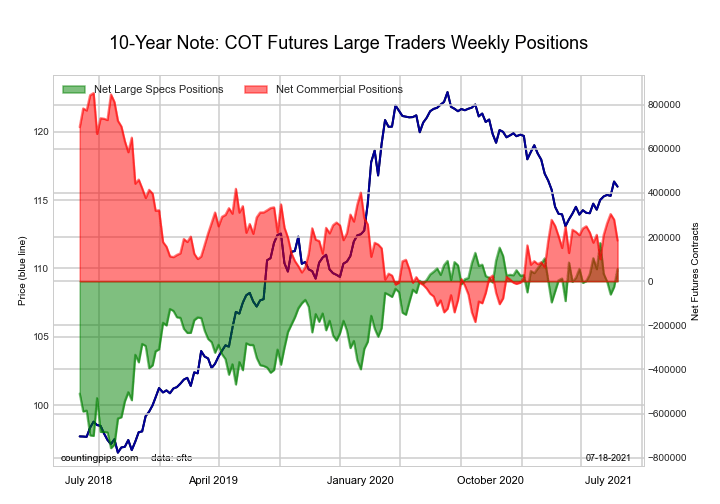

10-Year Treasury Note Futures:

The 10-Year Treasury Note large speculator standing this week equaled a net position of 55,987 contracts in the data reported through Tuesday. This was a weekly rise of 81,580 contracts from the previous week which had a total of -25,593 net contracts.

The 10-Year Treasury Note large speculator standing this week equaled a net position of 55,987 contracts in the data reported through Tuesday. This was a weekly rise of 81,580 contracts from the previous week which had a total of -25,593 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 87.4 percent. The commercials are Bearish with a score of 35.5 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 10.5 percent.

| 10-Year Treasury Note Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 22.6 | 67.7 | 7.9 |

| – Percent of Open Interest Shorts: | 21.2 | 63.3 | 13.7 |

| – Net Position: | 55,987 | 184,216 | -240,203 |

| – Gross Longs: | 937,802 | 2,814,625 | 329,488 |

| – Gross Shorts: | 881,815 | 2,630,409 | 569,691 |

| – Long to Short Ratio: | 1.1 to 1 | 1.1 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 87.4 | 35.5 | 10.5 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.1 | -2.5 | 6.7 |

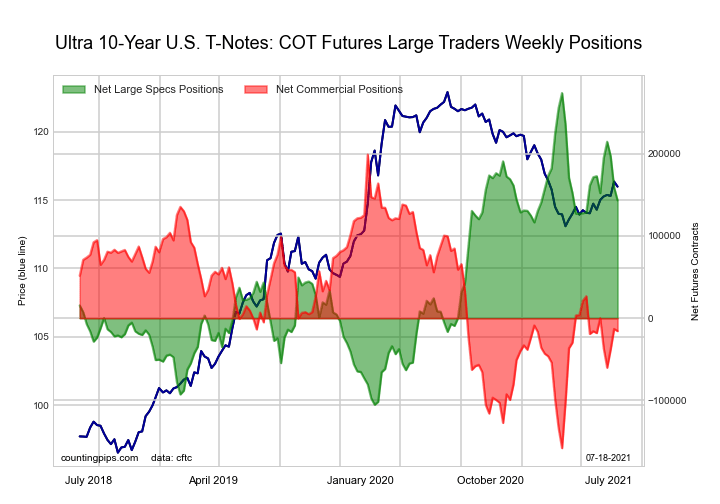

Ultra 10-Year Notes Futures:

The Ultra 10-Year Notes large speculator standing this week equaled a net position of 143,096 contracts in the data reported through Tuesday. This was a weekly decline of -15,817 contracts from the previous week which had a total of 158,913 net contracts.

The Ultra 10-Year Notes large speculator standing this week equaled a net position of 143,096 contracts in the data reported through Tuesday. This was a weekly decline of -15,817 contracts from the previous week which had a total of 158,913 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 65.5 percent. The commercials are Bearish with a score of 39.9 percent and the small traders (not shown in chart) are Bearish with a score of 23.6 percent.

| Ultra 10-Year Notes Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 16.6 | 74.6 | 8.6 |

| – Percent of Open Interest Shorts: | 7.3 | 75.6 | 16.9 |

| – Net Position: | 143,096 | -15,671 | -127,425 |

| – Gross Longs: | 255,501 | 1,147,004 | 131,996 |

| – Gross Shorts: | 112,405 | 1,162,675 | 259,421 |

| – Long to Short Ratio: | 2.3 to 1 | 1.0 to 1 | 0.5 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 65.5 | 39.9 | 23.6 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.8 | 0.7 | 20.3 |

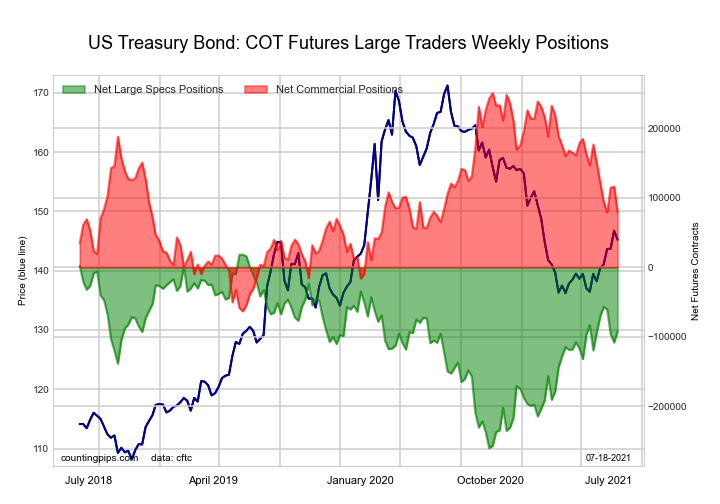

US Treasury Bonds Futures:

The US Treasury Bonds large speculator standing this week equaled a net position of -91,910 contracts in the data reported through Tuesday. This was a weekly gain of 16,001 contracts from the previous week which had a total of -107,911 net contracts.

The US Treasury Bonds large speculator standing this week equaled a net position of -91,910 contracts in the data reported through Tuesday. This was a weekly gain of 16,001 contracts from the previous week which had a total of -107,911 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 60.4 percent. The commercials are Bearish with a score of 45.5 percent and the small traders (not shown in chart) are Bullish with a score of 62.4 percent.

| US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.6 | 72.7 | 15.3 |

| – Percent of Open Interest Shorts: | 17.2 | 66.0 | 14.3 |

| – Net Position: | -91,910 | 79,595 | 12,315 |

| – Gross Longs: | 114,687 | 872,231 | 183,919 |

| – Gross Shorts: | 206,597 | 792,636 | 171,604 |

| – Long to Short Ratio: | 0.6 to 1 | 1.1 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 60.4 | 45.5 | 62.4 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.7 | -22.4 | 54.3 |

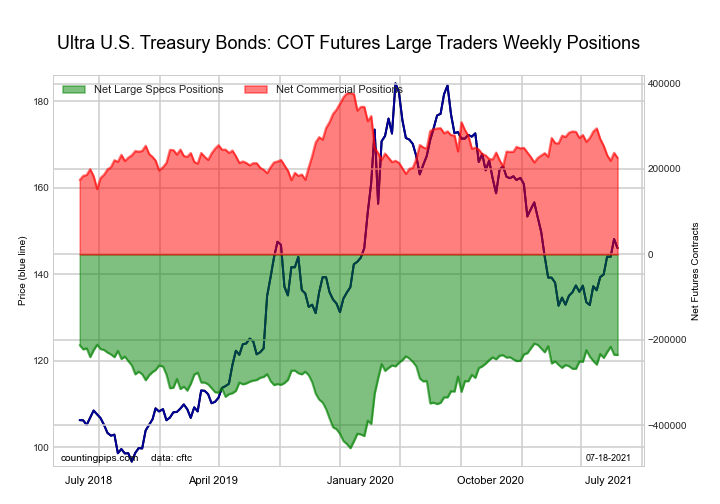

Ultra US Treasury Bonds Futures:

The Ultra US Treasury Bonds large speculator standing this week equaled a net position of -235,633 contracts in the data reported through Tuesday. This was a weekly decline of -566 contracts from the previous week which had a total of -235,067 net contracts.

The Ultra US Treasury Bonds large speculator standing this week equaled a net position of -235,633 contracts in the data reported through Tuesday. This was a weekly decline of -566 contracts from the previous week which had a total of -235,067 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 89.1 percent. The commercials are Bearish with a score of 32.4 percent and the small traders (not shown in chart) are Bearish with a score of 35.1 percent.

| Ultra US Treasury Bonds Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 9.3 | 78.3 | 12.1 |

| – Percent of Open Interest Shorts: | 28.8 | 59.6 | 11.3 |

| – Net Position: | -235,633 | 226,115 | 9,518 |

| – Gross Longs: | 112,383 | 946,864 | 146,304 |

| – Gross Shorts: | 348,016 | 720,749 | 136,786 |

| – Long to Short Ratio: | 0.3 to 1 | 1.3 to 1 | 1.1 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 89.1 | 32.4 | 35.1 |

| – COT Index Reading (3 Year Range): | Bullish-Extreme | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.2 | -30.8 | 33.4 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).