By Han Tan Market Analyst, ForexTime

Subdued trading yesterday should give way to something more exciting today as UK and US traders are back at their desk eagerly hunting for more opportunities in a very busy week for economic data releases and potential risk events.

The dollar sold off yesterday and is moving lower again this morning as US equity futures are in the green, while Asian stocks are generally better bid.

Asian manufacturing figures out earlier today largely decelerated but remain above the key 50 threshold. The China Caixin PMI increased slightly to 52.0 in May, but firms continue to struggle with increasing raw material costs with the input costs index in China reaching the highest level since 2016.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Euro inflation rising

The eurozone CPI figures have just been released, with the May flash estimate registering a slightly better-than-expected 2% year-on-year growth for the first time since November 2018. Much of the increase is still driven by energy base effects, though core inflation came in at 0.9% year-on-year, right in line with market expectations. While the European Central Bank has oft repeated that it’s still premature to consider easing up its support measures, that stance may have to be massaged should consumer prices continue hitting or even exceeding the central bank’s medium-term target.

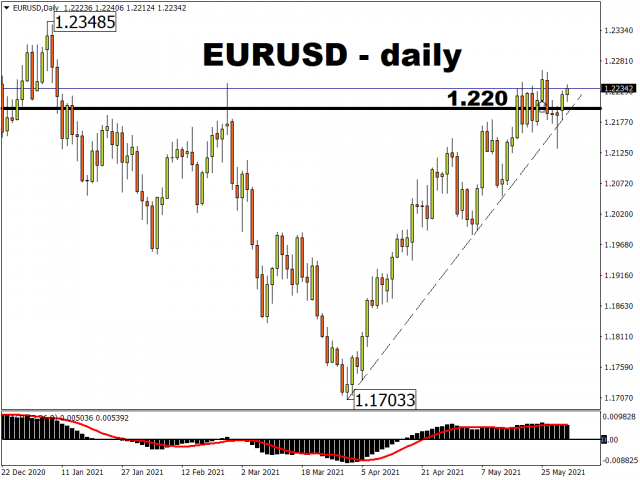

With next week’s ECB meeting looming, EURUSD has struggled to firm above 1.22 convincingly, with two attempts last week failing to hold. However, Friday’s price action was more constructive with lower prices being snapped up by buyers and printing a bullish hammer candlestick. The ISM manufacturing report out of the US is also released later, which is set to rise a bit from an already high level.

RBA opts not to rock the boat

Meanwhile overnight the RBA did very little and pointed to their July meeting as the next point where they reassess their quantitative easing (QE) and yield curve control (YCC) stimulus programmes. They did use slightly more positive labour market language by saying that progress in reducing unemployment has been faster than expected. On the flip side, they mentioned the ongoing uncertainty of further virus outbreaks though the hope here is that vaccinations will overcome this concern in time.

AUDUSD initially popped higher above 0.7760 but has since given back these gains.

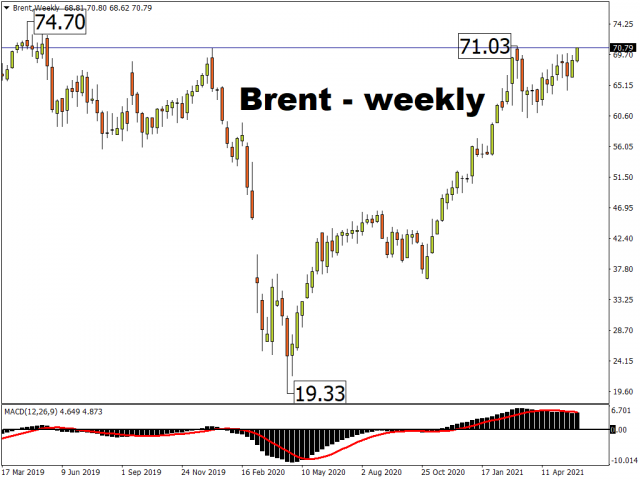

Oil breaking higher

The US Memorial holiday traditionally starts the summer driving season stateside, which obviously has big implications for demand. But all eyes are on the OPEC+ meeting today with the possibility of hiking oil output again as the global recovery is widely expected to gather more pace in the coming months and stockpiles to be drawn down.

Any signs that the group hold output steady for now would likely provide more support to oil and oil-sensitive currencies like the CAD.

The year-to-date March high for Brent at $71.03 is firmly in view and then the spike high in April 2019 at $74.70, if bulls can hold prices up here and we get helpful news from the cartel.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024