By CountingPips.com – Receive our weekly COT Reports by Email

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday March 09 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

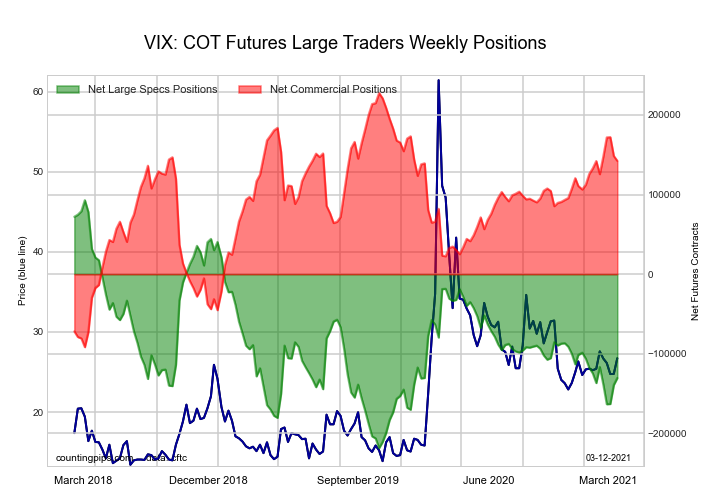

VIX Volatility Futures:

| VIX Volatility Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 12.3 | 63.6 | 4.8 |

| – Percent of Open Interest Shorts: | 45.2 | 27.6 | 7.8 |

| – Net Position: | -130,389 | 142,309 | -11,920 |

| – Gross Longs: | 48,589 | 251,573 | 19,048 |

| – Gross Shorts: | 178,978 | 109,264 | 30,968 |

| – Long to Short Ratio: | 0.3 to 1 | 2.3 to 1 | 0.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 28.3 | 73.3 | 11.2 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 2.0 | 0.1 | -24.8 |

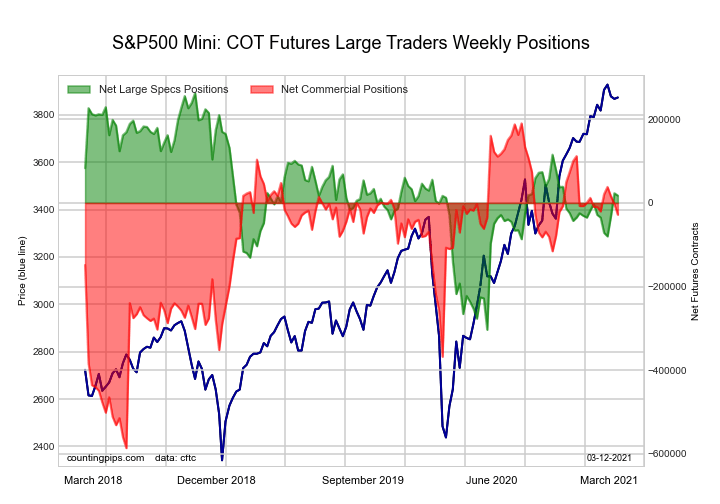

S&P500 Mini Futures:

| S&P500 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.4 | 73.0 | 9.9 |

| – Percent of Open Interest Shorts: | 13.7 | 74.0 | 9.5 |

| – Net Position: | 17,791 | -28,002 | 10,211 |

| – Gross Longs: | 399,052 | 2,029,232 | 274,048 |

| – Gross Shorts: | 381,261 | 2,057,234 | 263,837 |

| – Long to Short Ratio: | 1.0 to 1 | 1.0 to 1 | 1.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 56.7 | 71.9 | 25.0 |

| – COT Index Reading (3 Year Range): | Bullish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 8.2 | -2.4 | -5.1 |

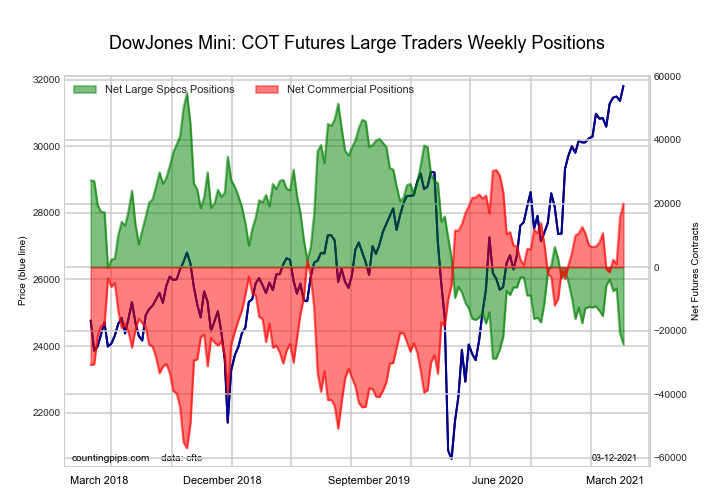

Dow Jones Mini Futures:

| Dow Jones Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 17.5 | 62.5 | 18.5 |

| – Percent of Open Interest Shorts: | 43.7 | 41.0 | 13.8 |

| – Net Position: | -24,301 | 19,950 | 4,351 |

| – Gross Longs: | 16,265 | 57,993 | 17,189 |

| – Gross Shorts: | 40,566 | 38,043 | 12,838 |

| – Long to Short Ratio: | 0.4 to 1 | 1.5 to 1 | 1.3 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 5.3 | 87.8 | 71.3 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -10.8 | 10.6 | -1.7 |

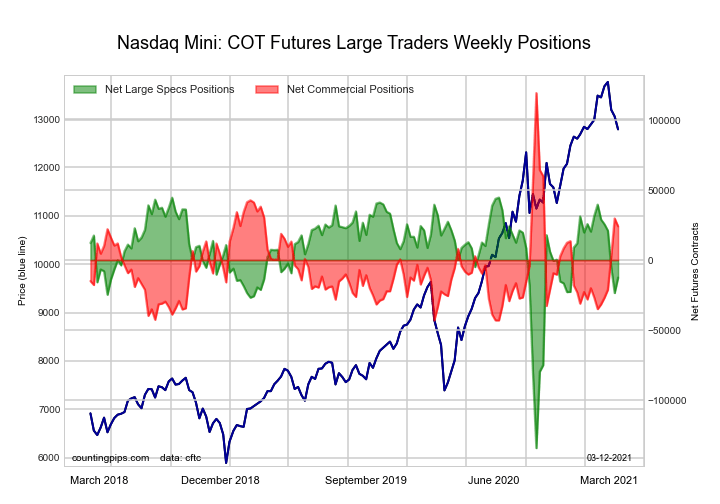

Nasdaq Mini Futures:

| Nasdaq Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 24.6 | 58.9 | 13.9 |

| – Percent of Open Interest Shorts: | 29.6 | 49.4 | 18.5 |

| – Net Position: | -12,494 | 24,175 | -11,681 |

| – Gross Longs: | 62,457 | 149,443 | 35,185 |

| – Gross Shorts: | 74,951 | 125,268 | 46,866 |

| – Long to Short Ratio: | 0.8 to 1 | 1.2 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 68.1 | 41.4 | 17.8 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -29.1 | 36.4 | -15.6 |

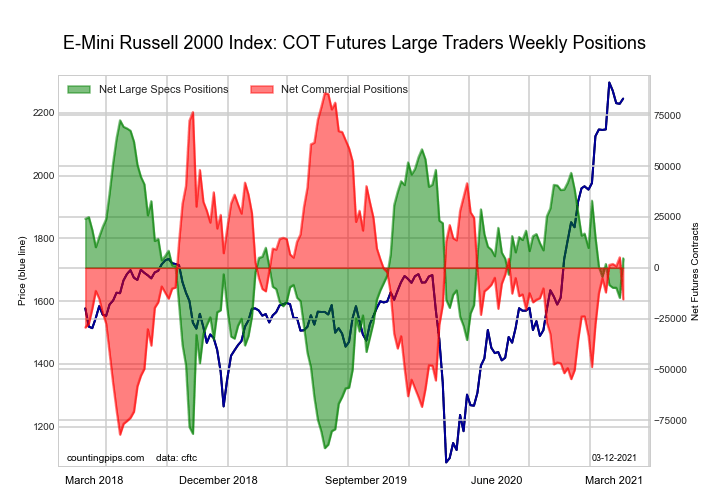

Russell 2000 Mini Futures:

| Russell 2000 Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 16.2 | 77.9 | 5.3 |

| – Percent of Open Interest Shorts: | 15.4 | 80.7 | 3.3 |

| – Net Position: | 4,690 | -15,502 | 10,812 |

| – Gross Longs: | 89,204 | 428,827 | 28,983 |

| – Gross Shorts: | 84,514 | 444,329 | 18,171 |

| – Long to Short Ratio: | 1.1 to 1 | 1.0 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 57.9 | 39.6 | 63.6 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 5.7 | -6.2 | 3.4 |

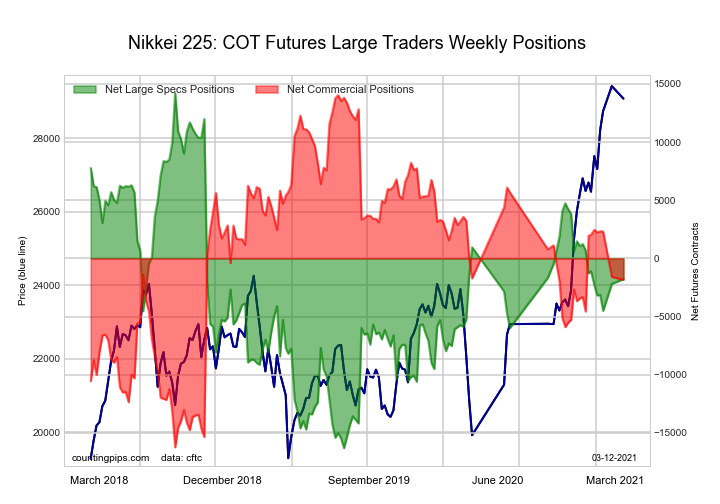

Nikkei Stock Average Futures (USD):

| Nikkei Stock Average Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 10.5 | 43.4 | 37.9 |

| – Percent of Open Interest Shorts: | 18.3 | 51.5 | 21.9 |

| – Net Position: | -1,770 | -1,832 | 3,602 |

| – Gross Longs: | 2,366 | 9,779 | 8,551 |

| – Gross Shorts: | 4,136 | 11,611 | 4,949 |

| – Long to Short Ratio: | 0.6 to 1 | 0.8 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 47.6 | 47.6 | 61.1 |

| – COT Index Reading (3 Year Range): | Bearish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -2.2 | -12.8 | 53.7 |

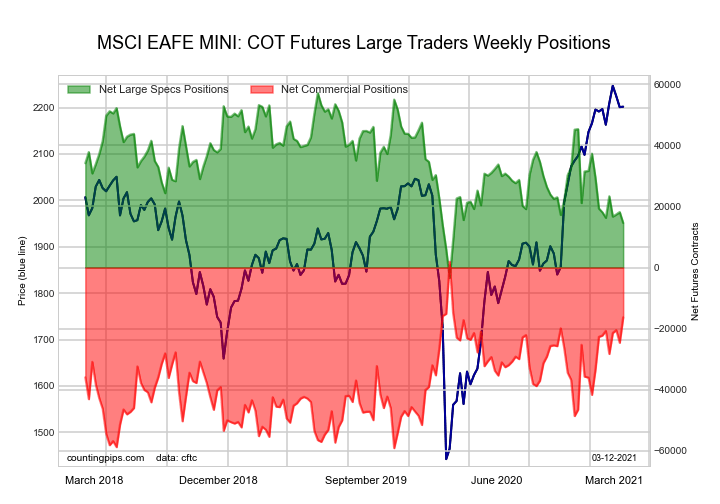

MSCI EAFE Mini Futures:

| MSCI EAFE Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 8.3 | 89.1 | 2.2 |

| – Percent of Open Interest Shorts: | 4.9 | 92.9 | 1.8 |

| – Net Position: | 14,605 | -16,316 | 1,711 |

| – Gross Longs: | 35,698 | 383,424 | 9,314 |

| – Gross Shorts: | 21,093 | 399,740 | 7,603 |

| – Long to Short Ratio: | 1.7 to 1 | 1.0 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 29.7 | 70.2 | 31.3 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -5.8 | 9.8 | -22.4 |

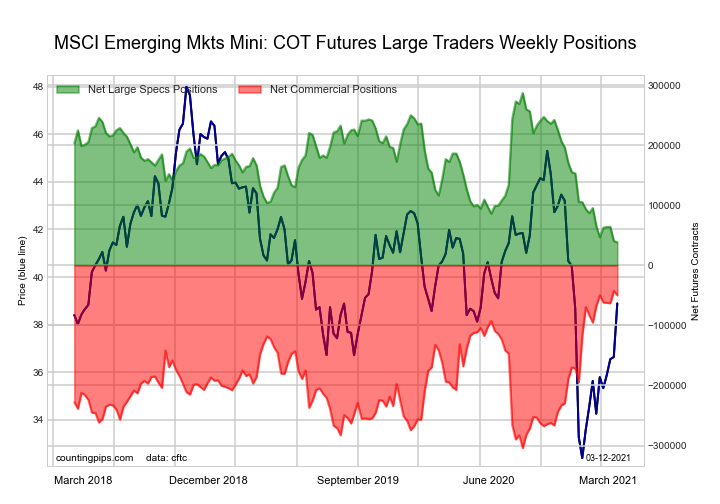

MSCI Emerging Mkts Mini Futures:

| MSCI Emerging Mkts Mini Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 14.3 | 82.2 | 2.4 |

| – Percent of Open Interest Shorts: | 11.0 | 86.5 | 1.3 |

| – Net Position: | 38,211 | -49,886 | 11,675 |

| – Gross Longs: | 165,150 | 950,685 | 27,250 |

| – Gross Shorts: | 126,939 | 1,000,571 | 15,575 |

| – Long to Short Ratio: | 1.3 to 1 | 1.0 to 1 | 1.7 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 0.0 | 97.2 | 40.4 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -11.0 | 6.8 | 7.3 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).