By Lukman Otunuga Research Analyst, ForexTime

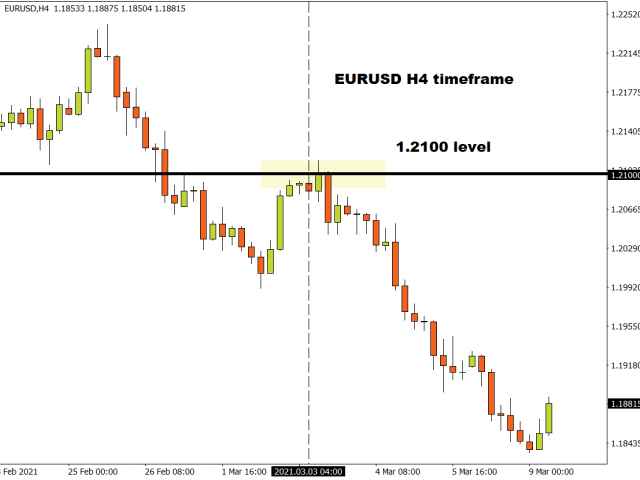

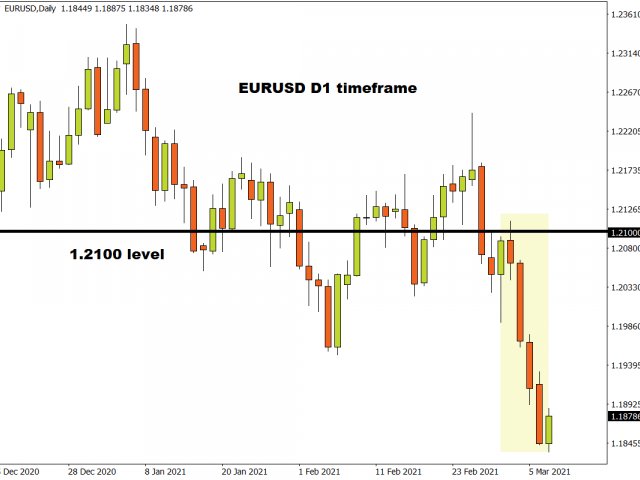

Can you believe that the EURUSD punched above 1.2100 last week?

Since then, the currency pair has dropped over 250 pips. It fell for a fourth consecutive session yesterday, sinking to levels not seen in four months under 1.1850 thanks to fundamental and technical factors.

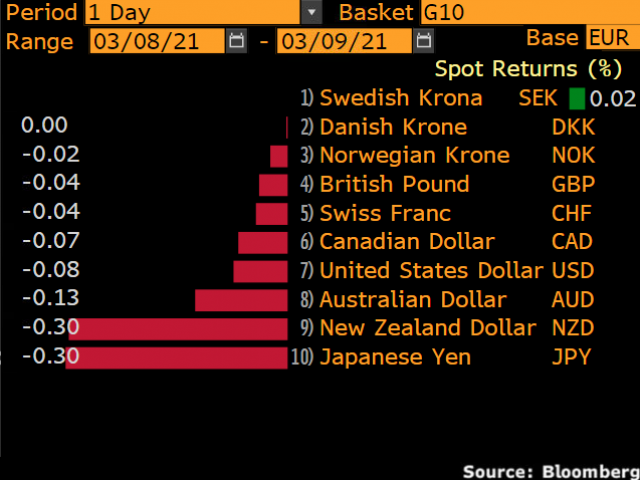

It looks like the Euro has woken up on the wrong side of the bed this morning, weakening against almost every single G10 currency.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Over the past few weeks, the outlook for the European economy has somewhat brightened thanks to vaccine rollouts and hopes over the government gradually lifting lockdown restrictions. While such encouraging developments continue to lend the Euro some support, the sharp rise in bond yields has thrown a wrench in the works for bulls.

Members of the European Central Bank’s policymaking Governing Council remain uneasy over the developments in the bond markets. This has fuelled speculation over the ECB potentially ramping up their bond purchases at the policy meeting this Thursday – a move that is negative for the Euro.

What other factors are impacting the Euro?

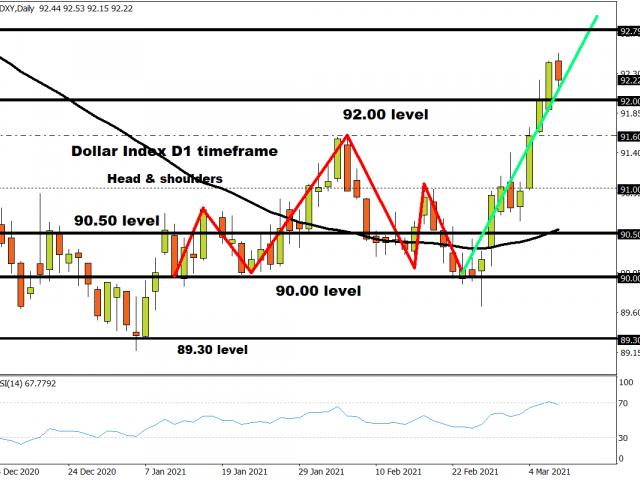

Just take a look at the mighty Dollar. It has roared back to life over the past few days, securing a solid daily close above the 92.00 resistance level. King Dollar continues to draw strength from rising yields and the prospects of higher interest rates in the face of accelerating inflation.

The technicals for the Dollar Index remain bullish with the 92.00 level acting as dynamic support to elevate prices higher. An intraday breakout back above 92.50 could open the doors towards 92.79.

Keep an eye out for GDP data

Later this morning, the Eurozone GDP (final reading) will be published. Markets are expecting final quarter GDP to contract 5% following a 4.3% contraction in the previous quarter. A report that meets or fails expectations bruise sentiment towards the European economy, resulting in a weaker Euro.

EURUSD: It’s a bear’s world

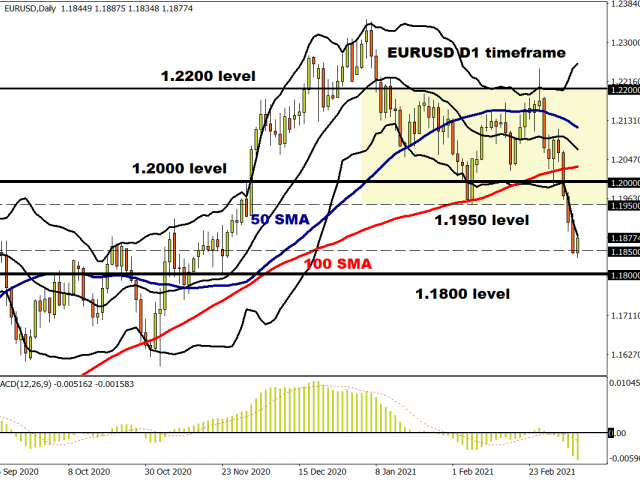

The EURUSD is heavily bearish on the daily charts. There have been consistently lower lows and lower highs while prices are trading below the 50 & 100 Simple Moving Average. On top of this, the candlesticks are hugging the outer skin of the Bollinger bands – further confirming the downtrend. Sustained weakness below the 1.1950 resistance level may encourage a move back towards 1.1850 and 1.1800.

Same story on the weekly charts

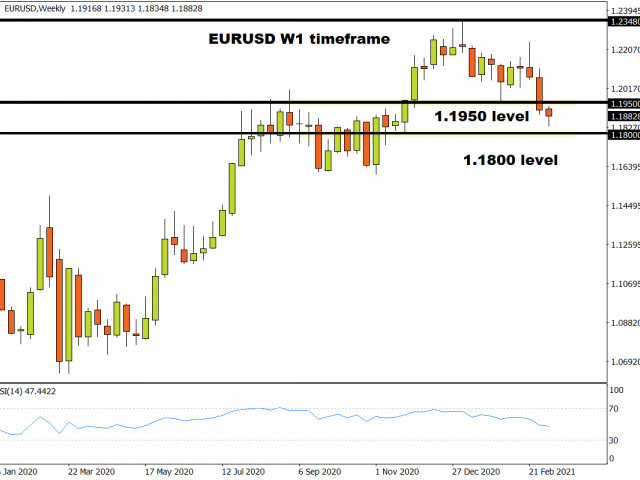

Nothing new here. There have been consistently lower lows and lower highs since February. A technical rebound back towards the 1.1950 regions could inspire bears to jump back into the game with 1.1800 acting as the first key point of interest.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024

- USD/JPY at a Three-Month Peak: No One Opposes the US Dollar Nov 13, 2024

- Can Chinese Tech earnings offer relief for Chinese stock indexes? Nov 13, 2024