Article By RoboForex.com

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, it’s been quite easy for the asset to break through the post-correctional extension area between 138.2% and 161.8% fibo at 1.3790 and 1.3980 respectively, as well as the psychologically-crucial level of 1.40. At the moment, GBPUSD continues growing towards the next target, which is the long-term fractal high at 1.4376. After reaching this level, the price may start a new pullback towards 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.3973, 1.3726, 1.3525, and 1.3325 respectively.

The H1 chart shows a local divergence and the start of a new short-term correction to the downside, which is heading towards 23.6% at 1.4143 and may later continue towards 38.2% and 50.0% fibo at 1.4084 and 1.4035 respectively. The mid-term support is the low at 1.3830.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

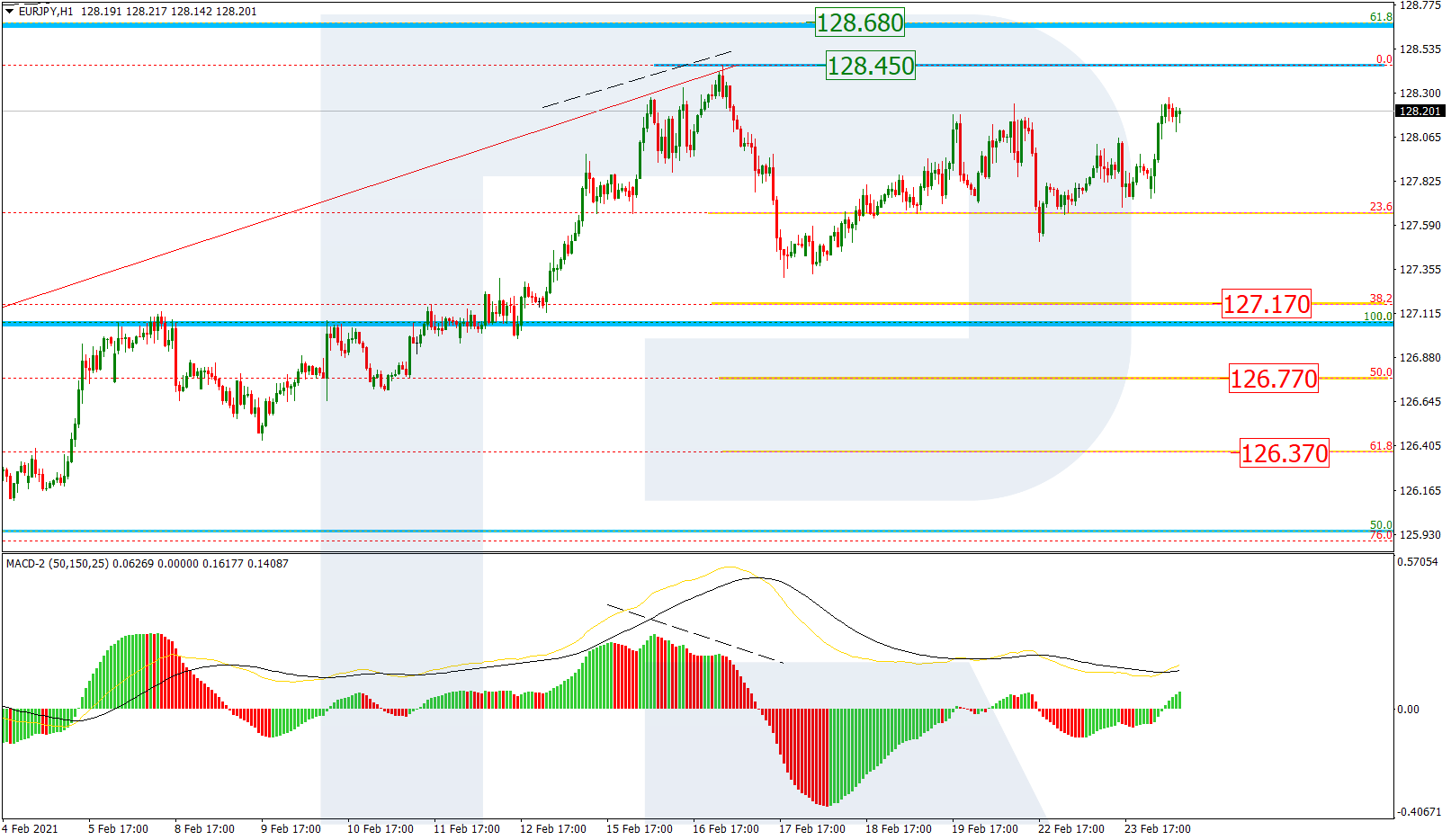

EURJPY, “Euro vs. Japanese Yen”

The H4 chart shows a stable uptrend. After breaking the high at 127.07 and fixing above it, EURJPY is approaching the long-term 61.8% fibo at 128.65, a breakout of which may lead to a further uptrend towards the post-correctional extension area between 138.2% and 161.8% fibo at 129.16 and 130.43 respectively.

As we can see in the H1 chart, a local divergence on MACD made the pair start a new short-term decline to reach 38.2% fibo at 127.17. However, the current rising impulse may break the high at 128.45 and continue the uptrend. Anyway, the pair may yet rebound from the high and resume falling towards 50.0% and 61.8% fibo at 126.77 and 126.37 respectively.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- The RBA will maintain a restrictive monetary policy until the end of the year. Nov 19, 2024

- Safe-haven assets rally on nuclear concerns Nov 19, 2024

- Gold Rebounds Amid USD Weakness and Geopolitical Uncertainties Nov 19, 2024

- RoboForex Receives Best Introducing Broker Programme Award Nov 18, 2024

- The hawkish attitude of FOMC representatives puts pressure on stock indices. Oil is growing amid escalation in Eastern Europe Nov 18, 2024

- AUD/USD Stabilises Amid RBA’s Hawkish Outlook Nov 18, 2024

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024