By Lukman Otunuga, Research Analyst, ForexTime

Anyone else feeling sorry for the British Pound?

It was treated without mercy by G10 currencies today, falling more than 1% against the Dollar as deadlocked Brexit talks left investors empty-handed. As negotiations over the future trading relationship between the UK and EU remain on a knife-edge, fears are set to mount over a no-deal Brexit becoming reality.

UK Prime Minister Boris Johnson is expected to call EU President Ursula von der Leyen this evening after initially threatening to walk away from negotiations! While a successful outcome to the call could soothe tensions and open the doors to further talks, this all sounds too familiar. It must be kept in mind that the three outstanding topics of fisheries, level playing field rules, and governance remain unsolved. With both sides refusing to budge from their stand, the next few days promises to be filled with more drama and uncertainty.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Much attention will be directed towards the European Union summit on Thursday the 10th of December. For those who are banking on a potential breakthrough at the “eleventh-hour”, the two-day summit could present such an improbable opportunity. One of the greatest lessons from the Brexit saga is to always expect the unexpected – and this could hold as the series slowly comes to an end.

Outside of Brexit, the weather in the United Kingdom remains gloomy as usual – accompanied by a winter chill. The same can be said for the macroeconomic landscape. Although the UK has moved into its new tiered system of restrictions, early data suggests that a double-dip recession could be around the corner.

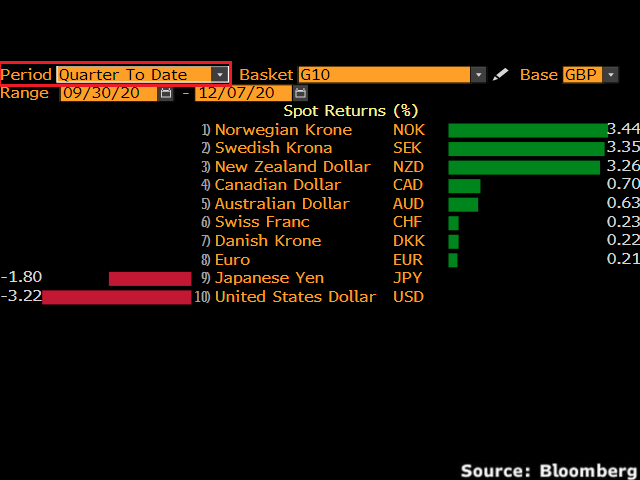

You might be wondering what this all means for the Pound which has surprisingly gained over 3% against the dollar this quarter?

Although the Pound has appreciated against the Dollar, it has weakened against practically every other G10 currency since the start of October. This confirms that the Pound’s upside has nothing to do with a change of sentiment towards the currency or UK economy but Dollar weakness.

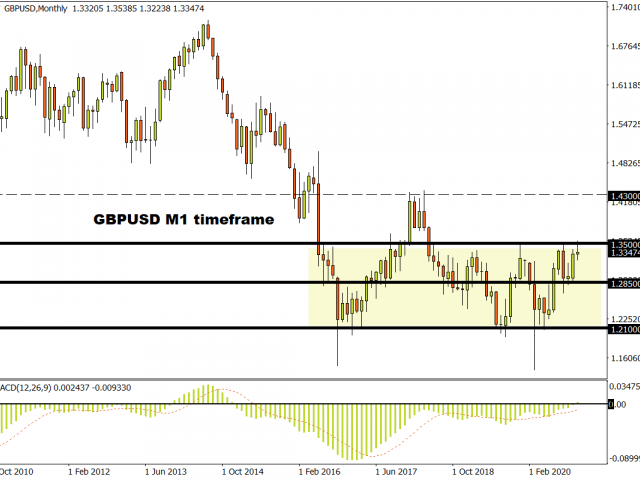

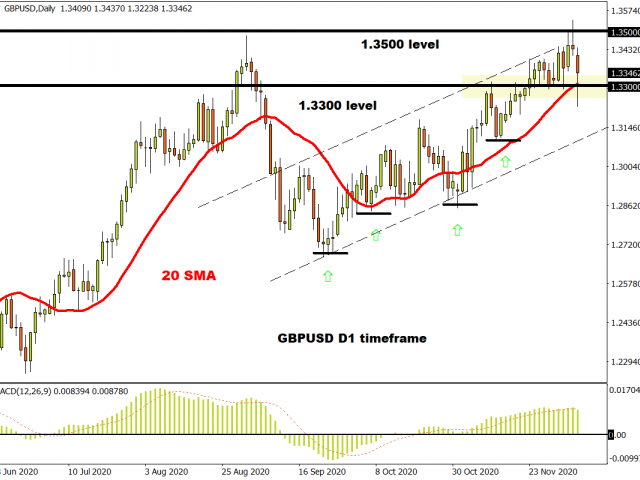

Looking at the technicals, the GBPUSD remains bullish on the weekly charts. Prices have the potential to test 1.3482 if 1.3300 proves to be reliable support. A solid breakout above 1.3482 could open the doors towards 1.3500 and 1.3600.

On the daily charts, there is still hope for Pound bulls despite the currency pair experiencing its biggest one day drop in three months! It’s all about where the GBPUSD closes today. A solid daily close above 1.3300 could inject bulls with some confidence to send prices back towards 1.3482. However, a daily close under 1.3300 is likely to signal further downside with the next key level of interest around 1.3100.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The hawkish attitude of FOMC representatives puts pressure on stock indices. Oil is growing amid escalation in Eastern Europe Nov 18, 2024

- AUD/USD Stabilises Amid RBA’s Hawkish Outlook Nov 18, 2024

- COT Metals Charts: Speculator Changes led lower by Gold & Platinum Nov 17, 2024

- COT Bonds Charts: Large Speculator bets led by 2-Year & Ultra Treasury Bonds Nov 17, 2024

- COT Soft Commodities Charts: Large Speculator bets led by Corn & Soybean Oil Nov 16, 2024

- COT Stock Market Charts: Speculator Bets led by MSCI EAFE & VIX Nov 16, 2024

- The Dollar Index strengthened on Powell’s comments. The Bank of Mexico cut the rate to 10.25% Nov 15, 2024

- EURUSD Faces Decline as Fed Signals Firm Stance Nov 15, 2024

- Gold Falls for the Fifth Consecutive Trading Session Nov 14, 2024

- Profit-taking is observed on stock indices. The data on wages in Australia haven’t met expectations Nov 13, 2024