By RoboForex Analytical Department

The NZD/USD pair continues its downward trend, dropping to 0.6240 in its third consecutive session of declines. This ongoing sell-off in the New Zealand dollar is driven by market expectations of an upcoming interest rate cut by the Reserve Bank of New Zealand (RBNZ). New Zealand’s borrowing costs are currently at 5.25% per annum, with widespread anticipation of a 50-basis point reduction at the next RBNZ meeting.

The RBNZ is known for its proactive and flexible monetary policy, which swiftly adjusts to inflationary pressures and external economic indicators. This expected rate cut responds to such factors and aligns with the bank’s strategy to manage economic growth and inflation.

Moreover, the NZD has been under additional pressure from a strengthening US dollar, bolstered by unexpectedly robust US employment statistics for September, reported by ADP. Although the ADP report does not directly correlate with the Nonfarm Payrolls (NFP) due shortly, it still shapes market expectations and sentiment.

Global risk appetite has also waned significantly due to escalating geopolitical tensions in the Middle East, further dampening the prospects for growth-sensitive currencies like the NZD.

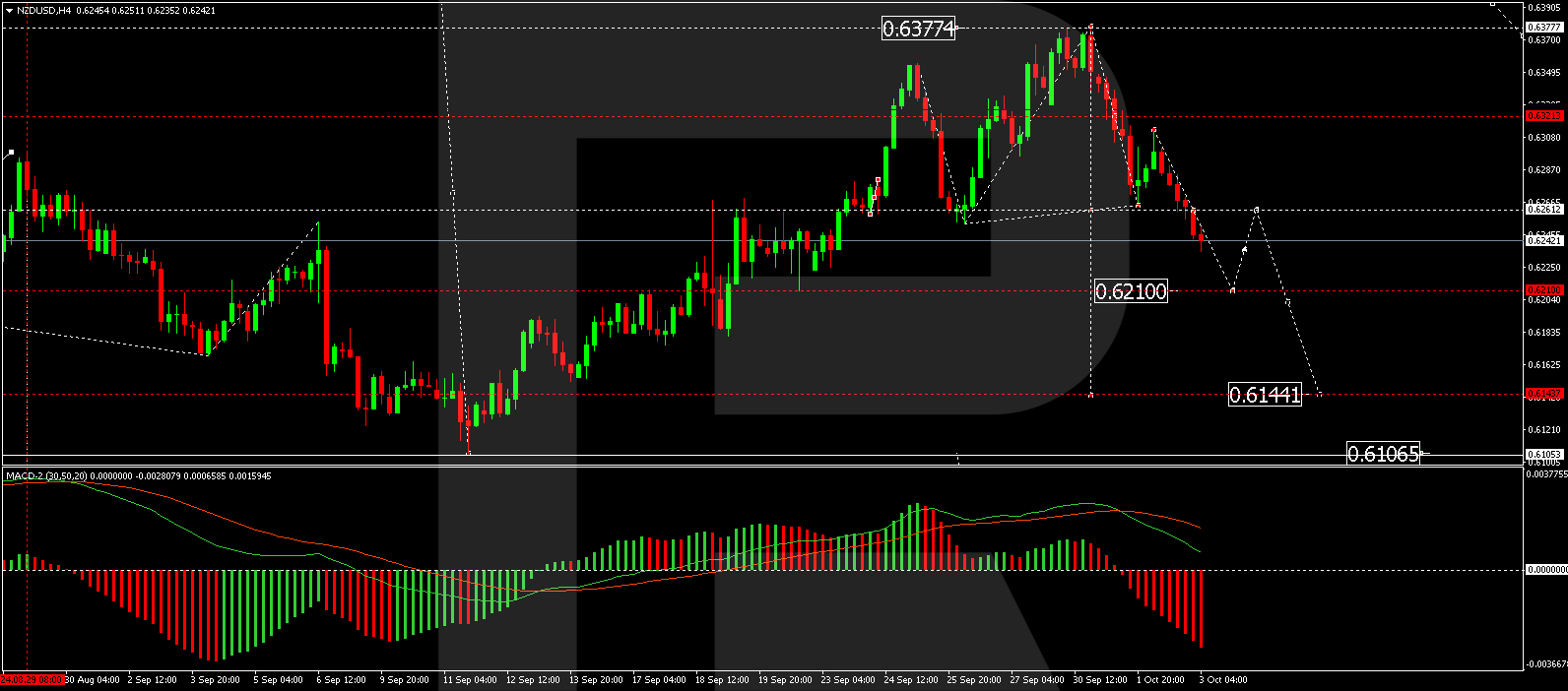

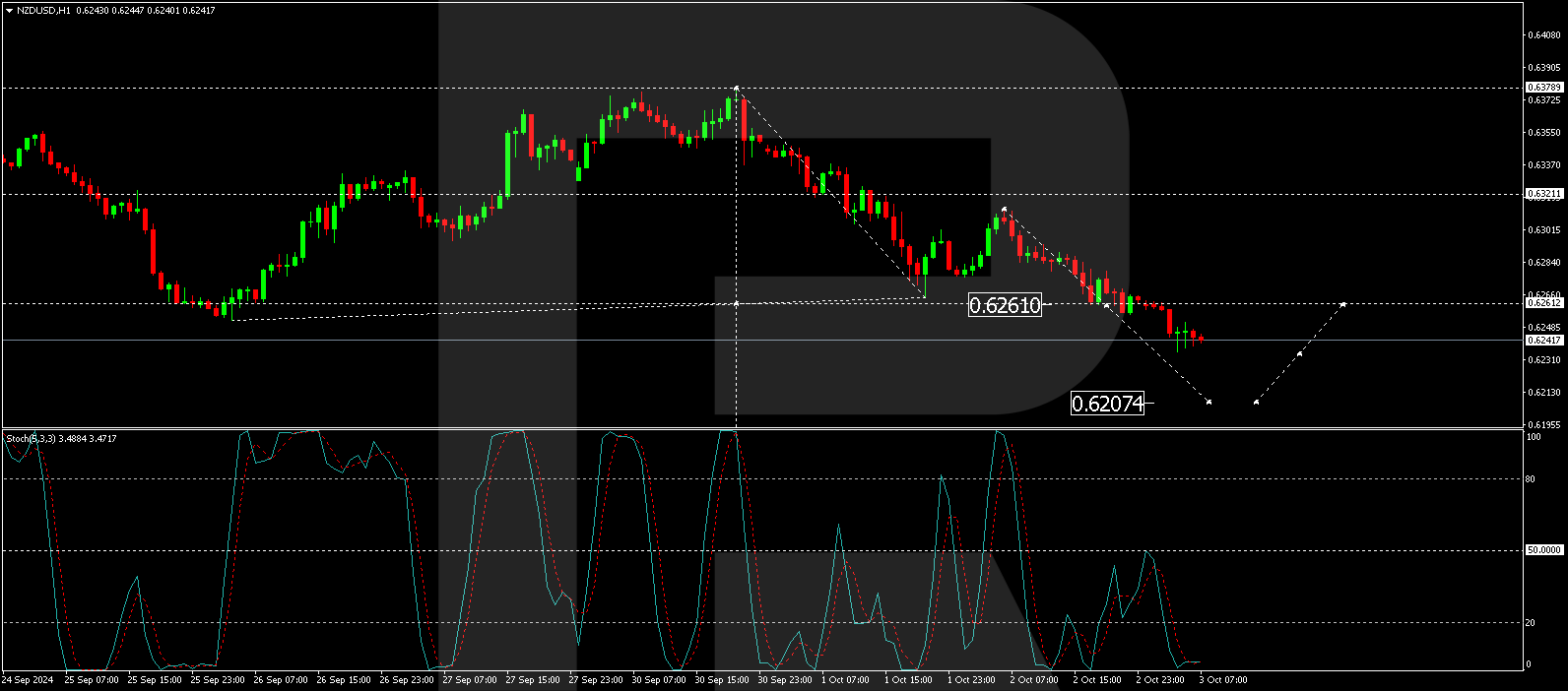

NZD/USD technical analysis

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The NZD/USD pair followed a bearish pattern, confirming a downward wave to 0.6265 and a corrective rise to 0.6313. The market is now forming a new decline towards 0.6210. Once this target is reached, a corrective move to retest 0.6265 from below may occur, potentially leading to further declines towards 0.6144. This bearish NZD/USD outlook is supported by the MACD indicator, which, despite being above zero, shows a strong downward trajectory.

On the hourly chart, the pair is developing the third wave of its decline towards 0.6210. Following this, a corrective fourth wave up to 0.6260 is anticipated. This forecast aligns with the Stochastic oscillator readings, which indicate the signal line is below 50 and heading towards 20, suggesting a continuation of the downward momentum after a brief correction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026