By RoboForex Analytical Department

Brent crude oil prices have significantly decreased, reaching 71.46 USD per barrel on Tuesday. Prices fell nearly 6% earlier in the week, marking the most prominent daily drop in two years. The price reduction reflects the market’s reaction to developments in the Middle East, where the escalation of tensions has somewhat subsided.

Over the weekend, Israel’s measured response to Iran, which notably avoided impacting oil facilities and nuclear sites, substantially lowered the risk premium associated with potential disruptions in oil supplies from the region. Furthermore, Israeli officials expressed willingness to consider a temporary ceasefire in the Gaza Strip in exchange for the release of hostages, which has helped reduce some geopolitical risks that were previously inflating oil prices.

With the immediate threats in the Middle East receding, market focus has shifted back to the underlying weak economic data from China and the ongoing production levels from OPEC members. Additionally, upcoming US employment data will be closely monitored as it may provide further clues about the Federal Reserve’s forthcoming rate decisions. The prevailing expectation is two more rate cuts of 25 basis points each before the year ends, a scenario generally supportive of the energy sector. However, much of this has already been priced into the market.

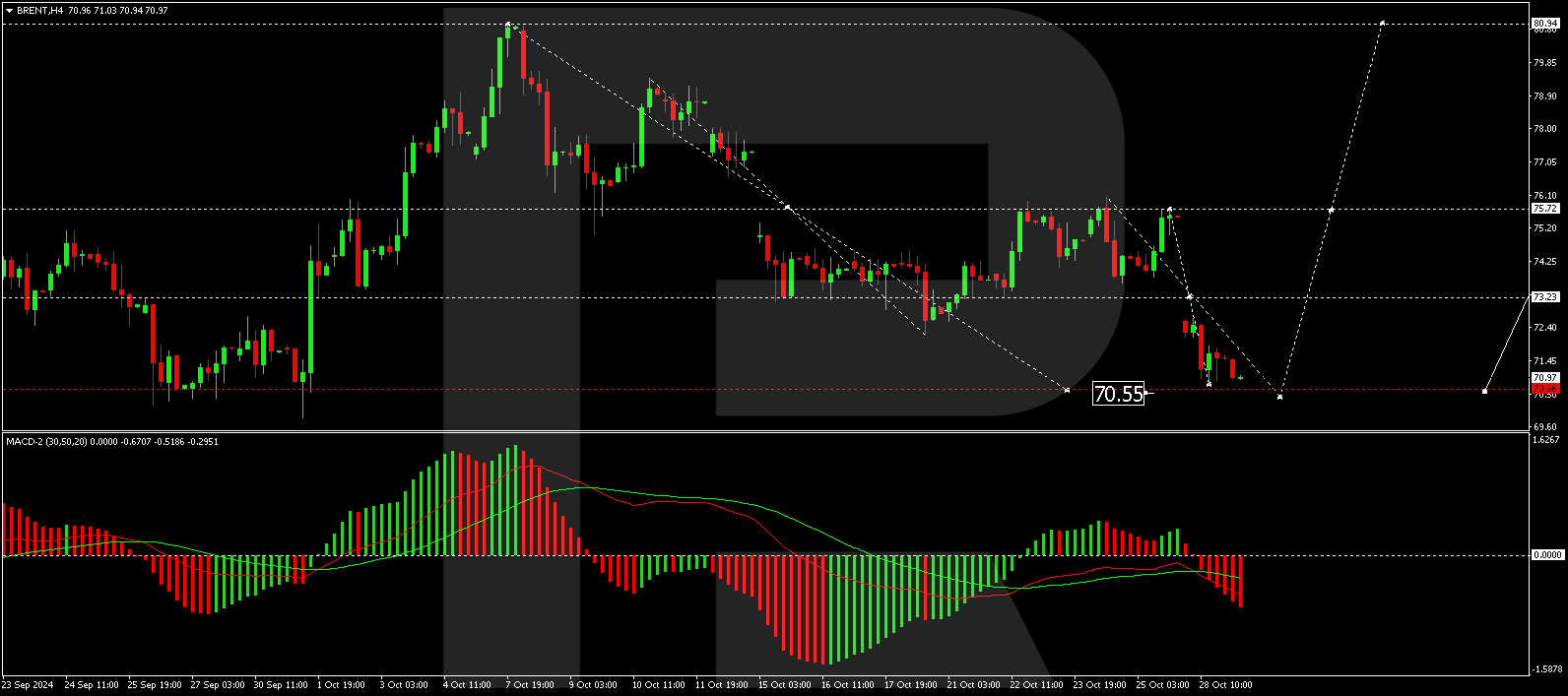

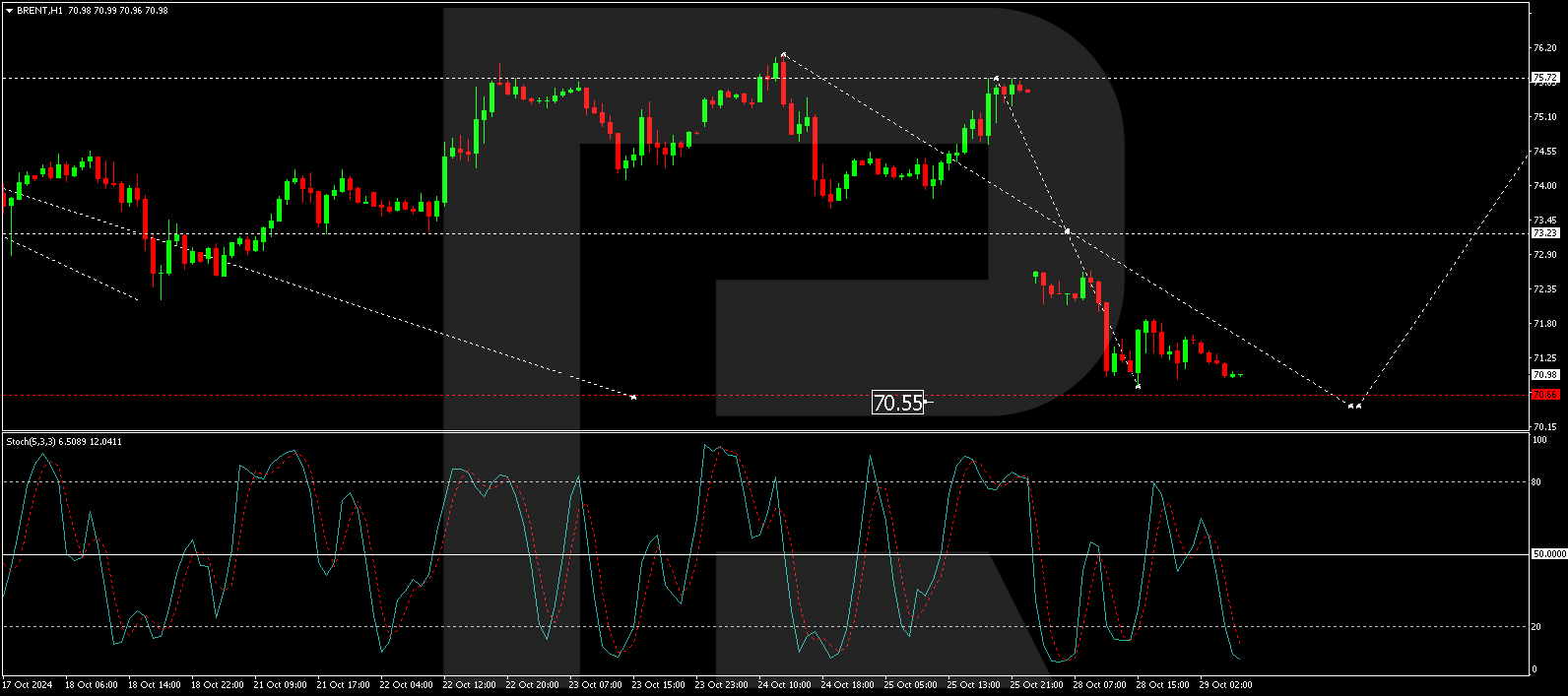

Technical analysis of Brent

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Brent crude is currently developing a corrective pattern targeting the 70.55 USD level. If this level is reached, the market may anticipate a rebound towards 75.75 USD. A breach above this could open up the possibility for a rally towards 80.90 USD, with further prospects to reach as high as 85.85 USD. The MACD indicator supports this bullish outlook, as its signal line is positioned below zero, indicating potential for an upward movement.

On the hourly chart, Brent is finalising a correction to 70.50 USD, currently forming the fifth wave of this corrective phase. Once the target of 70.50 USD is achieved, expectations shift towards a new growth wave, aiming for 73.23 USD as the initial target. This bullish Brent forecast is corroborated by the Stochastic oscillator, with its signal line poised below 20, suggesting a pending upward correction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026