Source: Michael Ballanger (7/8/24)

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of copper and gold and explains his positions in some stocks.

When I started writing a newsletter decades ago, I did so for two reasons. The first was to condense communication to one mailed letter rather than several hundred telephone conversations; the second was to clarify my own thoughts. By that, I mean taking the ideas I had been formulating on the “investment climate as I see it” and translating those thoughts into a concise, comprehensible, and simple format that all clients could grasp without a great deal of explanation.

What started as an experiment evolved into a ritual, which in later years became a business where subscribers pay to know what I am thinking on the “investment climate as I see it.” In doing so, I was inadvertently imparting learned behaviors (and largely successful ones) from a past era to an entirely new generation of traders and investors. This new generation of investors would hear their parents and grandparents talk about the stock market in whispered reverence of names like Robert Friedland (Diamondfields), Ron Netolitzsky (Eskay Creek), and Chuck Fipke (Dia Met) and, in later eras, names like Chris Smith (Great Bear’s Dixie Project) and Blair Way (Patriot Battery Metals) — names all associated with massive wealth creation.

However, outside of Friedland, very few have replicated their victories. Few except, of course, Friedland, who has parlayed a billion-dollar win with Diamondfields into multiples of that with his family-owned Ivanhoe Mines Ltd. (IVN:TSX; IVPAF:OTCQX), which is one of the top mining performers for 2024, up 45.68% on the strength of its partial ownership of the staggering Kamoa-Kakula Copper Complex in the DRC.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

I met Friedland in the early 1990s long before the mercurial Voisey’s Bay “Hustle” that turned a decent nickel find in Labrador into a larger-than-life, world-class, must-own asset for nickel giant Inco Limited wound up (thanks to Friedland’s masterful prompting) pay double what they should have for the resource. It is names like Bob Friedland that keep old-timers like me coming back to the junior resource casino, but the one thing that I neglected to recognize in my recent travels is that it is names like Michael Saylor (Bitcoin) and Elon Musk (Tesla, Space-X) and Jensen Huang (NVidia) that dominate the collective psyches of the youthful investing demographic.

The “kiddies” (as I love to call them) have little experience in multi-bagger mining stock windfalls, but they have plenty of them in technology and “meme” stocks.

So, when I entitle my weekend missive “BUY COPPER,” I fully expect to look out into the audience and see a multitude of glazed eyes and unresponsive stares. While the electrification movement won over the Millennial and Gen-X throng with emphasis on battery metals and storage (lithium) and the clean-energy revolution implied by a return to nuclear (uranium), they have been largely unimpressed with the stories being told by some of the world’s most experienced resource managers.

Even the senior gold stocks like Barrick Gold Corp.’s (ABX:TSX; GOLD:NYSE) CEO (and resolute gold bug, Mark Bristow) have shifted to a copper-bias and now aggressively seek out copper-gold porphyry deposits over straight gold deposits as part of their new strategy.

One has to ask one’s self why these heretofore trumpeting sound money advocates of yesteryear are now moving — charging — into the world of copper. One also has to admire the brilliance of the management vision of global copper leader Freeport-McMoRan Inc. (FCX:NYSE), whose portfolio of copper and gold operations has it superbly positioned to benefit from the rapidly accelerating structural shortage in the red metal. You have heard it and read it all before many times through eardrum-piercing screams and bold italicized capitals that waning global production brought on by hostile governments and declining grades has created a “too-little-too-late” conundrum verging upon crisis for copper consumers the world over.

I wrote about copper in 2023 at $3.40/lb. and urged ownership of FCX in the low $30’s when everyone was chastising me because I “obviously” did not “get it” because surely, with a recession about to ravage the U.S. (and the globe), my copper-bullish thesis was completely flawed. The big miners like Newmont and Barrick just kept acquiring copper-centric assets while the electrification crowd waving pompoms and blowing streamers about lithium as the new “Wonder-metal for the New Age” got their backsides handed to them in the wake of a 75% drop in lithium prices just as copper was quietly moving toward the $4.00/lb. then $5.00/lb. by early 2024.

I exited the copper market in mid-May at around $5.15/lb. only after scrolling down through Twitter and discovering that 90% of all the “kiddies” that were flag-waving over uranium and lithium juniors at the top in 2023 were now the newly-and-self-proclaimed experts in copper. Six-paragraph posts offering “The Ten Reasons Copper is headed to $10!” inundated the blogosphere, so seeing that I exited the copper ETFs and my beloved FCX (above $52), fully expecting a pullback in prices. Well, lo and behold, I got the 16.6% correction in copper, but alas, a testimonial to the incredible strength of their operations, the best (or worst) FCX could do was track back to just under $47 only to scream back to where it lies today at $51.68.

Agonizingly, I am forced to buy back my cherished Freeport a mere 50 cents under where I sold it. So be it.

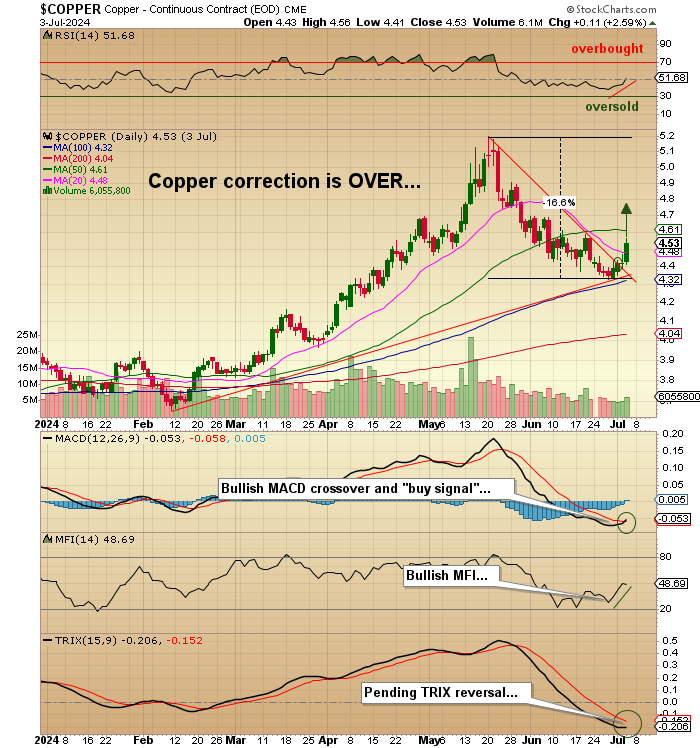

The technical picture for copper could not get any more bullish. You have a “neutral” RSI down from “overbought” while just entering a bullish MACD crossover and “buy signal” along with a bullish money flow indicator.

More importantly, the Twitterverse is now silent, absent the incessant cheerleading so characteristic of a top as sentiment has become subdued once again and conditions ripe for the turn.

Gold

Gold has completed its correction and now looks poised to test the highs of last May at $225.66. I have yet to lift my minuscule hedge positions, but I still have 42 days until expiry, so I will wait to see what next week brings.

SPDR Gold Shares ETF (GLD:NYSE) was poised to test the 100-dma at what was $202 originally when I first put on the hedges, but the action has been so positive for gold that the 100-dma is now $209.34 and rising. I will not put on any further trading positions until my usual mid-August shopping spree for “all things golden,” but with both copper and now gold kicking back into overdrive, it looks like my overweight positions in copper and copper-gold juniors (Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB),American Eagle Gold Corp. (AE:TSXV), and now Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE)) are going to be soon validated.

Let us all hope and pray that the blogosphere and the Twitterverse remain quiet until next year, some time allowing the two metal beasts to thrive and advance.

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc., Getchell Gold Corp., American Eagle Gold Corp., Vortex Metals Inc., and Barrick Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Ivanhoe Mines Ltd., Freeport-McMoRan Inc., Fitzroy Minerals Inc., Getchell Gold Corp.,American Eagle Gold Corp. , and Vortex Metals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026