Source: Ron Struthers (4/3/24)

Ron Struthers of Struthers Resource Stock Report compares six silver stocks to the SLV ETF, shares Pan American, a gold producer with many silver lines, and touches on Mag Silver, which he believes is not well known enough.

This chart compares the silver ETD ‘SLV’ to 5 well-known silver producers, Hecla, Coeur Mining, Majestic Silver, Mag Silver, and Pan American Silver. Also, non-producer Discovery Silver.

Like gold stocks, silver stocks are beaten up. SLV shows a 40% gain since the September/October 2022 bottom, while only Coeur Mining has outperformed, but that is because it is really a gold producer now. Hecla has almost caught SLV, and Pan American shows a small gain during the comparison period.

Coeur Mining Inc. (CDE:NYSE) might be remembered as a silver stock, but in 2023, 70% of its revenue came from gold. They do have about an equal value of reserves in silver compared to gold, so there is still leverage to silver. Couer stock has moved up lately, and that is related to the gold price increase.

First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) used to be one of my favorites, but I am not too happy with their performance of late. In 2023, production was 26.9 million silver equivalent (AgEq) ounces, consisting of 10.3 million silver ounces and 198,921 gold ounces. It gets about 60% of its revenue from silver.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Hecla Mining Co. (HL:NYSE) is an old well, well-known silver stock, and currently about 60% of revenues are from silver production. It should do well with rising silver prices.

Two silver stocks lagging on the chart that should do more than catch up are Pan American Silver and Mag Silver, so I am adding these two to our Selection list along with Discovery Silver as huge leverage to silver and a take-over target and also lagging silver on the chart.

Pan American Silver

Recent Price – $15.80

Dividend yield – 2.5%

Shares Outstanding – 364.7

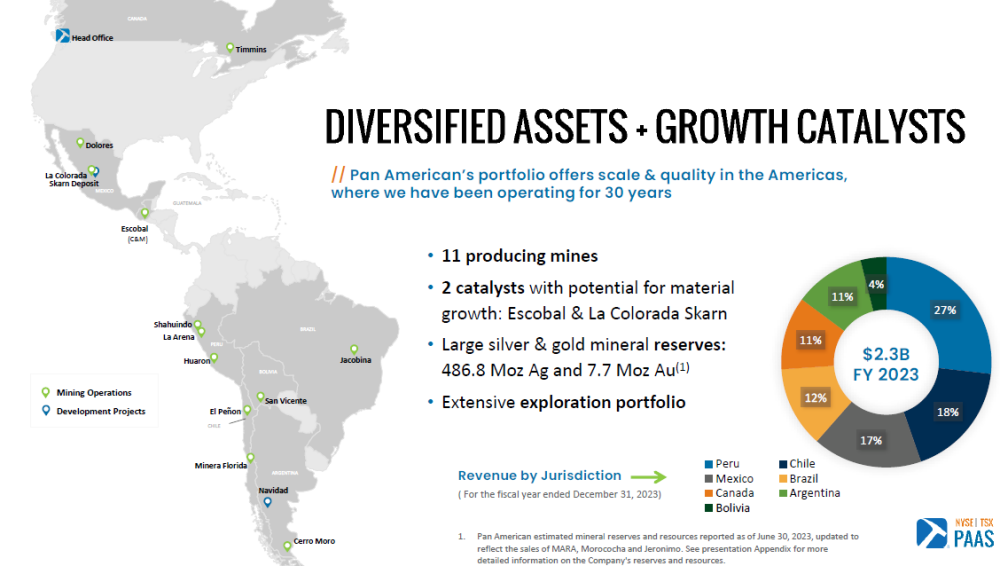

Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) trades like and is valued like a silver company, but it is really a gold company when it comes to production, so it is one of the gold stocks that has lagged recently.

However, Pan American has huge silver resources, over 1 billion ounces Measured and Indicated, so it is like a gold stock with several silver linings.

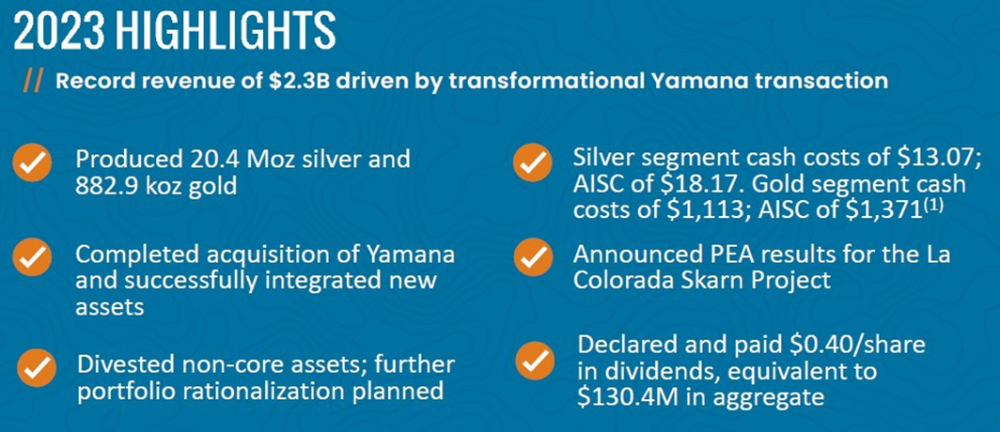

- For 2023, silver production was 4 million ounces, and gold production was 882,900 ounces.

- For silver, they realized a price of $22.94, so gross revenue was about $468 million.

- For gold, they realized a price of $1,951/oz, so gross revenue was $1.72 billion.

You can see that gold is over 70% of revenues, but the stock has not responded to the rising gold price, as well as many other gold stocks.

They have 1,033,800,000 M&I ounces of silver at $6/oz in the ground is about $6 billion value, and 16,083,600 M&I ozs gold at $150/oz in the ground is about $2.4 billion.

PAAS has a market cap of US$7.76 billion, less cash plus debt, for a value of $6.12 billion. You can look at the stock as either the silver is valued cheaply or the gold is valued cheaply. The current dividend gives about a 2.5% yield, and I expect this to rise as gold and silver go higher.

Pan American enters 2024 in a solid financial position with cash and short-term investments totaling $440.9 million and the full $750.0 million available under our undrawn credit facility. Total debt of $801.6 million was related to construction and other loans, leases, and two senior notes Pan American assumed through the acquisition of Yamana.

Pan American acquired Yamana Gold this year, which will drive growth in 2024. The company is very diversified, with 11 producing mines, so rather than get into each mine, this graphic from their presentation gives you a good idea of the diversity.

Conclusion

The company is well diversified and in strong financial shape. Their gold and silver ounces are valued cheaply like most miners now, but I don’t believe the stock has responded as well to the rising gold price as others. I see it catching up.

The company believes its stock is undervalued as well because it announced a normal course issuer bid to buy back up to 5% of the stock. They will have rising revenues and cash flow for 2024.

Its guidance for 2024 is 21 to 23 million ounces of silver at AISC of $16 to $18.50 per ounce. For gold, it is projecting 880,000 to 1 million ounces of production at AISC of $1,475 to $1,575. PAAS will have very good margins for 2024, and the higher gold and silver prices will add significantly to this.

Of note, and because New Pacific Metals -NUAG is on our list, Pan American owns an ~11.6% undiluted interest in New Pacific, which is advancing the Silver Sands exploration project in Bolivia.

Don’t be surprised if Pan American buys out New Pacific. The stock is way down from 2020/2021 highs, so it has lots of legroom to the upside. We need to see a close above $17 for a higher high and confirm the turnaround. I see that soon.

I believe the stock could easily break the $20 resistance and get back close to $30 or better this year.

That makes the Call Options attractive as well. I like the January 2025 $20 Call option for US$2.50.

Mag Silver

Recent Price – US$11.45

Share Outstanding – 103 Million

Mostly Institutional held – owning 70%

No debt and US$68.7 million cash on Dec 31, 2023

I have followed MAG Silver Corp. (MAG:TSX; MAG:NYSE American) for many years.

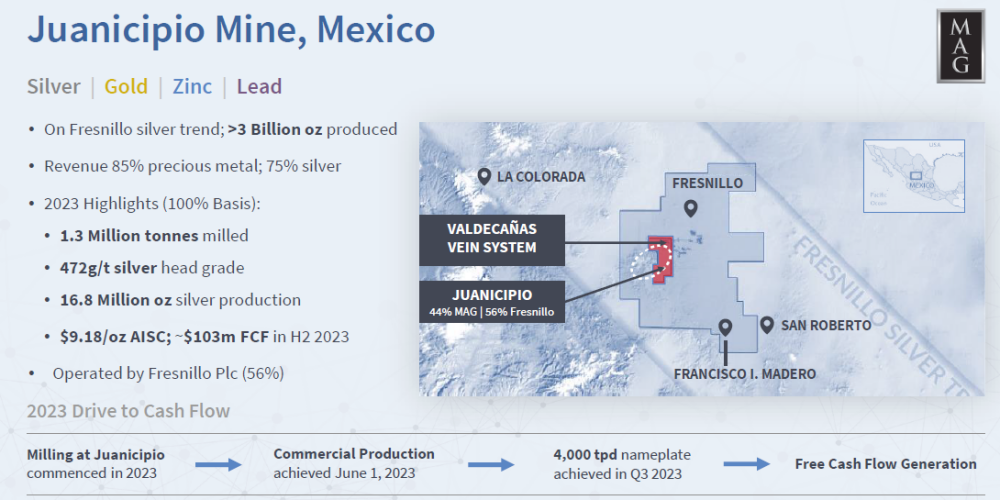

It is a relatively new producer because its mine just started production in 2023, so it is probably not known so much as a major silver producer. This principal asset is a 44% interest in the Juanicipio Mine located in Zacatecas, Mexico, which achieved commercial production at its 4,000 tonnes per day (“tpd”) processing facility on June 1, 2023.

MAG’s partner is Fresnillo Plc., a London-based company that debuted on the London Stock Exchange in 2008 following a successful, profitable, and decades-long track record as a Mexican mining company.

Due to its history as part of the Peñoles Group, Fresnillo can trace its origins back to the commencement of Peñoles’ mining operations in 1887 and smelting and refining operations at Torreon in 1901. The Juanicipio mine is high grade at 472 g/t silver and low cost at $9.18/oz AISC, so it will be a real cash cow for Mag Silver now that it is in production. A mine does not get much better than this one, and I don’t think the stock reflects this fact.

The silver recoveries are good at 88%, and in the last half of 2024, the mine generated a free cash flow of about $103 million, of which $33.4 million went to Mag Silver.

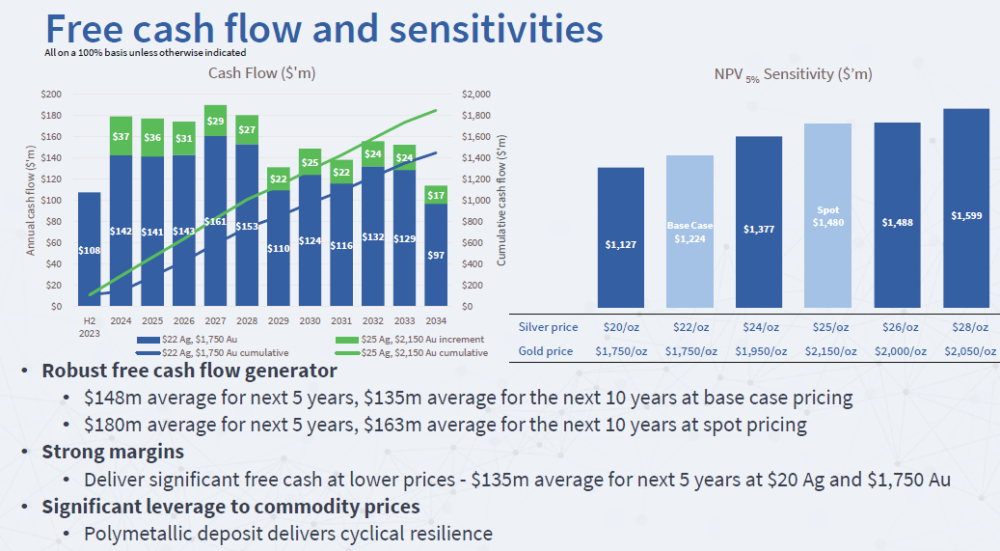

This is a great slide from their presentation that shows free cash flow at very conservative base case pricing and at spot prices.

Free cash flow of $180 M/year at current spot prices. If we get the prices I expect, hang on tight.

The mine has M&I resources of 406,277,000 AgEq ounces — Mag Silver 44% would be 178,740 ounces. The current valuation for MAG is about $6/oz silver, which is about the average of other companies, but this is an above-average mine.

There is tons of upside exploration potential here, so it will be a very long mine life, and the potential the mill rate could be expanded in a few years to increase production.

Conclusion

About 75% of revenue is from silver, so this is a pretty pure play on silver. Cash flow for the fourth quarter was around US$36 million, and with higher silver prices, we could easily see cash flow in 2024 for MAG around $160 million.

The stock is trading at around 11.5 times cash flow, according to MarketWatch. If it simply maintains that multiple, the stock should move to about $18.00 in 2024. On the chart, the long-term downtrend has been broken, and the stock is about to break out to a higher high and above the first resistance, around $12.00.

Discovery Silver

Recent Price – CA$0.85

Shares Outstanding – 395 million.

Eric Sprott owns 23% and Institutions 37%

Many of you will remember Discovery Silver Corp. (OTCMKTS:DSVSF) as it was on the Selection List for quite a while, but we got stopped out in 2022 at $1.55.

We can buy back much cheaper now. Discovery’s flagship project is its 100%-owned Cordero project, the world’s largest undeveloped silver deposit. The feasibility study completed in February 2024 demonstrates that Cordero has the potential to be developed into a large-scale, long-life project with low unit costs and attractive economic returns that offers the combination of margin, size, and scalability.

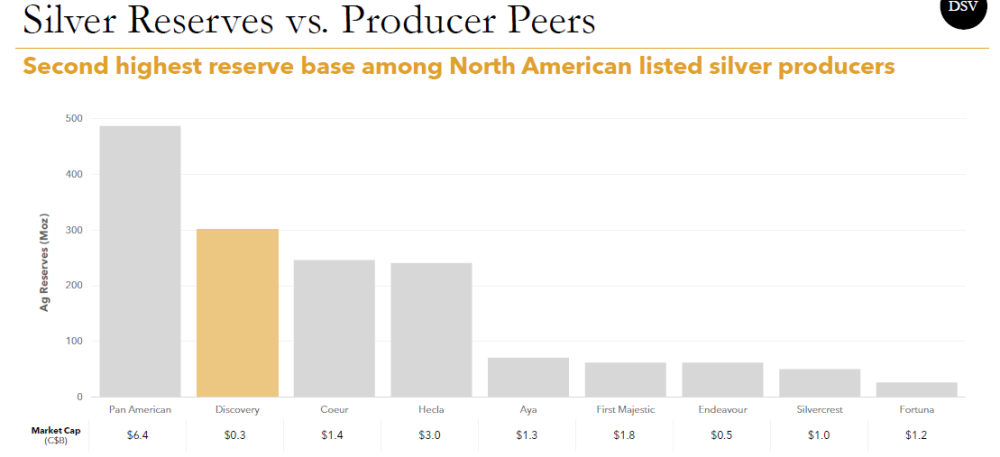

Cordero is located close to infrastructure in a prolific mining belt in Chihuahua state, Mexico. In the chart below, Mag Silver would fit between Ays and Hecla.

Summary of Cordero feasibility study results:

- Large-scale, long-life production: 19-year mine life with an average annual production of 37 million ounces silver equivalent in concentrate in year 1 to year 12 and 33 Moz AgEq in concentrate over the life of the mine;

- Highly profitable: low unit costs with all-in sustaining costs per AgEq ounce of under $12.50 (U.S.) in year one to year eight and under $13.50 (U.S.) over the LOM, placing Cordero in the bottom half of the cost curve;

- Tier 1 reserve base: reserves of silver: 302 Moz, gold: 840,000 oz, lead: 3.0 billion pounds, and zinc: 5.2 billion pounds, positioning Cordero as the largest undeveloped silver deposit globally;

- Clear upside potential: 240 million tonnes of measured and indicated resource sit outside of the feasibility study pit, highlighting the potential to materially extend the mine life at modestly higher silver prices;

- Low capital intensity: initial development capital expenditures of $606 million resulting in an attractive after-tax net present value to capital expenditure ratio of 2.0;

- Attractive economics: base-case after-tax net present value discounted at 5% of $1.2 billion (U.S.), growing to $2.2 billion (U.S.) in year 4, when the project reaches final completion to 51,000 tonnes per day.

Conclusion

On December 31, Discovery had a strong cash position of almost CA$59 million, so they have plenty enough to move this through permitting to the construction phase. DSV submitted an Environmental Impact Assessment (MIA) in August 2023; the review process is ongoing.

The deposit is massive. With the Feasibility and more drilling, the Measured & Indicated Resource grew by 70 Moz AgEq to 1,202 Moz AgEq within the pit outline.

Discovery has a market cap of US$255 million less cash, a value of about US$210 million. This puts a value per ounce of a measly US$0.17 cents. I expect a lower valuation with a lower grade deposit, but the average grade in the first few years of mine life is around 100 g/t silver, which is pretty decent for an open pit.

As you can see on the chart, this had a much higher valuation with fewer ounces and about the same silver price, but it is beaten down like every miner. The downtrend is broken, and the stock is close to breaking out to a higher high and resistance around $0.95. From here, it could soon get back to the $1.50 area.

As you have probably noticed from yesterday’s report, silver broke out today, currently at $26.77 on Comex.

I bought silver coins from my dealer yesterday, Colonial Acres. It is the most silver coin I have seen in stock there for years. I would not wait long; I expect this will soon get bought up.

Important Disclosures:

- Mag Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Pan American Silver Corp. and Discovery Silver. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026