John Newell of Golden Sky Minerals (AUEN.V) explains his view on where the copper market is going and shares one stock he believes is an attractive opportunity for forward-thinking investors.

In the heart of today’s technological and sustainable advancements lies an element whose significance has surged alongside our modern needs: copper. Copper’s role in energy transformation has increased attention in the news and social media within the last three years.

This versatile metal sometimes called the metal of electrification, plays a critical role in powering electric vehicles, enabling flights, advancing renewable energy sources like wind and solar, and facilitating essential communications through networks and systems. Its presence is ubiquitous, found in electrical wiring, appliances, motors, and computers, marking it as a cornerstone of innovation and daily life.

The Surge in Demand

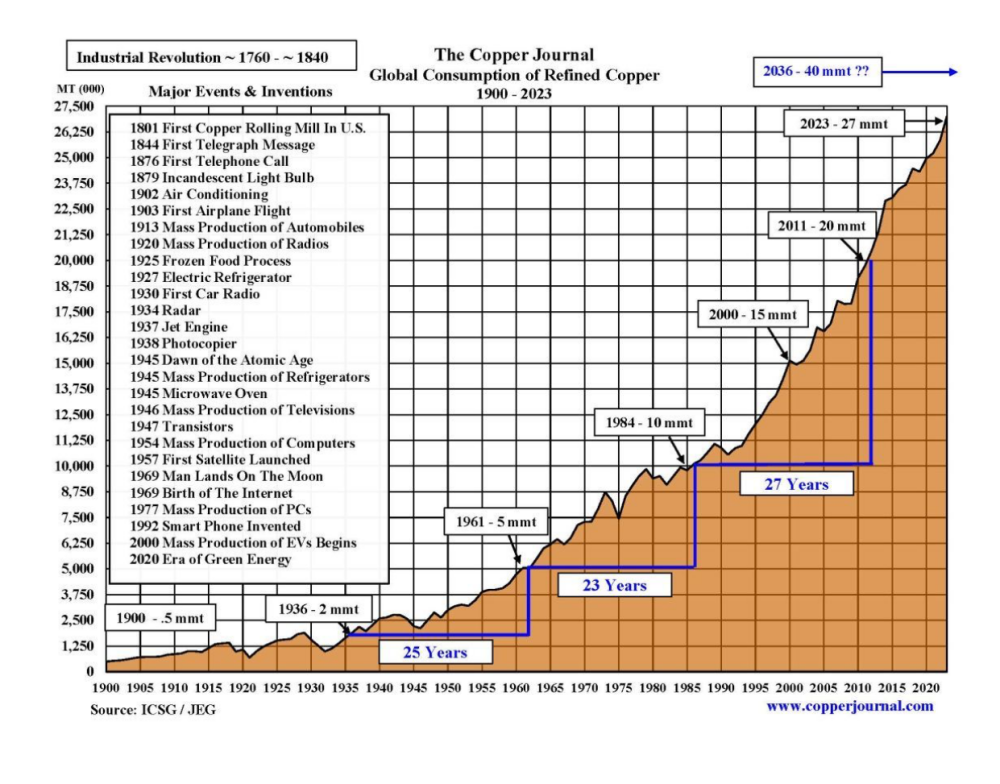

As we navigate through an unprecedented energy transition, copper’s demand is projected to approximately double by 2035. This looming increase highlights a stark reality about our mineral resources: they are the unsung heroes of power generation and usage across the globe.

By 2050, the anticipated annual demand for copper is expected to equal the cumulative usage from 1900 through 2022, illustrating a pivotal moment in its consumption history.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

As the graph below from John Gross’s Copper Journal suggests, the demand doubles every ~25 years, and by 2050, demand will likely be 53 MM tons, a jaw-dropping number with limited new supply being discovered or currently being brought to market. Electric Power vehicles and renewable power generation require 3x as much copper as traditional options.

Capital Expenditure Requirements

To meet this burgeoning demand, a substantial investment in capital expenditure (capex) is imperative.

An estimated $200 billion will be necessary over the next decade to bridge the forecasted 10 million tonne copper deficit by 2035. This figure not only underscores the financial commitment needed but also the urgency to act promptly to prevent a supply shortfall.

Global Supply and Future Potential

The future of copper production looks promising, with significant potential in countries such as Chile, Peru, the United States, Canada, Ecuador, Argentina, and the Pacific Rim.

Despite this potential, current production and sanctioned projects indicate a looming supply shortage in the second half of this decade. Compounded by the expected copper price forecast of $4.50 a pound from 2025 through 2027 and a long-term price of four dollars, there’s a clear need to incentivize new supply to meet future demands.

Some analysts are suggesting that copper prices are expected to rise by more than 75% over the next two years amid mining supply disruptions and higher demand for the metal fueled by the push for renewables and demand driven by green energy solutions, according to a report by BMI a Fitch Solutions research unit.

Challenges in Supply

Recent disruptions have already signaled a forthcoming copper deficit in 2024, exacerbated by operational shutdowns and downgrades in production forecasts. Events such as the closure of First Quantum’s Cobre Panama mine, operational disruptions in Chile and Peru due to El Niño, and logistical challenges in the DRC highlight the fragile equilibrium of copper supply.

These disruptions have set the stage for a significant, multi-year deficit, with forecasts predicting a rapid transition from a small surplus to a considerable deficit through 2025.

Innovations and Sustainability in Copper Mining

Amid these challenges, innovation and sustainability remain at the forefront of the copper mining industry. Eight world-class mines are leveraging renewable energy to produce low-carbon copper, showcasing initiatives like the Los Azules project by McEwen Mining and McEwen Copper.

These efforts are complemented by companies like Rio Tinto, which invests capital and technology in development-stage projects to enhance recovery and sustainability.

The Imperative of Copper

Copper’s role in our modern economy cannot be overstated. As demand continues to grow, the imperative to find and develop new sources of supply intensifies.

The wisdom of William Sulzer, a former governor of New York, echoes through time, reminding us of the fundamental importance of mining to human progress and civilization. His words from 1938, praising the miner and prospector, serve as a powerful testament to the enduring value of copper and the mineral resources that fuel our advancement and prosperity.

Excerpt from the Sulzer speech:

“Abandon mining and the value of every commodity would be insignificant, humanity would sink back to the barter-and-exchange age, and financial paralysis would lock in its vice-like grasp the industries of mankind.

It would be the greatest calamity that ever befell the human race, and in less than a century, civilization would revert to the barbarism of pre-history, when primitive man knew nothing about copper, gold, silver, iron, lead, zinc and the other mineral resources of Mother Earth.

Those who decry mining are ignorant of history. If they knew anything about metals, they would know that all business, all industry and all human progress depends on mines.

The wealth from mines, from the dawn of time, is the epic of human advancement of man’s heroic march along the path of progress. Show me a people without mines and I will show you a people deep in the mire of poverty and a thousand years behind the procession of civilization. It was the mines that made the greatness of the past, that made the ancient civilizations, that made Egypt great, that made Rome great and, in modern times, that hive made Spain, England and the U.S. rise beyond the dreams of avarice.

The greatest benefactor of the human race has been the prospector. The most beneficent men of all time are the far-seeing men whose brain and brawn developed the Earth’s mineral resources.

These are men who poured the golden streams of mineral wealth into the lap of civilization, into the channels of trade, into the avenues of commerce and into the homes of happiness.

All honor to the miner. All hail the prospector.”

– William Sulzer, a former governor of New York. from a speech delivered in 1938.

McEwen Mining

With all that said, there is one copper stock that may be worth looking into:

McEwen Mining Inc.’s (MUX:TSX; MUX:NYSE).

McEwen Mining owns 47% of McEwen Copper.

The investment case for McEwen Copper’s Los Azules Project in San Juan Province, Argentina, presents a compelling opportunity for investors looking to capitalize on the future burgeoning copper market.

This presentation dives into the strategic advantages, potential returns, and innovative approaches that make the Los Azules Project a standout investment in the copper exploration sector.

High Growth Potential

Copper’s role in electrification and renewable energy sectors underlines its growing demand. McEwen Copper, with its Los Azules Project, stands at the forefront of tapping into this demand, offering significant growth potential.

McEwen Copper is the eighth largest undeveloped copper project in the world. Copper demand in 2050 is expected to be 53 million metric tons, more than all the copper consumed from 1900-2022

Geopolitical and Economic Stability

The new Argentine government’s commitment to deregulation under President Javier Milei enhances the investment appeal of the country’s mining sector. This political shift, coupled with the strategic alliance between Argentina and the USA, offers a stable investment climate.

Innovation and Sustainability: McEwen Copper’s approach incorporates cutting-edge technologies and a commitment to environmental sustainability, positioning it as a leader in modern, responsible mining practices.

Robust Market Demand

The shift towards green technology, including renewable energy and electric vehicles, drives an unprecedented surge in copper demand.

This trend is set to continue, bolstering the market value of copper exploration and production companies.

Strategic Hedging

Investing in McEwen Copper offers a hedge against potential declines in the U.S. dollar, leveraging copper’s essential role in various industries and its historical price resilience if Los Azules copper resource is equivalent to ~70 million oz gold deposit, with an average annual production of 600,000 ounces at a cash cost of ~$600.00.

Early-Stage Involvement

Investors have the unique opportunity to engage in the early stages of the Los Azules Project, potentially yielding higher returns compared to investments in established mining operations.

Technological and Environmental Leadership

The Los Azules Project is pioneering in employing renewable energy solutions and carbon-neutral mining technologies, setting a new standard for the mining industry.

Supply Constraints

Key copper-producing regions like Panama and Peru are experiencing dwindling supplies, leading to a projected global deficit by 2024.

This scarcity is exacerbated by environmental and ESG concerns that restrict or make difficult new mining developments in jurisdictions like the U.S.

Price Projections

Analysts from BMI, BMO, Goldman Sachs, and Jefferies anticipate copper prices to spike significantly due to the burgeoning deficit, underscoring the lucrative potential of copper investments.

Clean Energy Transition

Copper is indispensable for the clean energy transition, with demand expected to reach 36.6 million metric tons by 2031.

This demand highlights the strategic importance of copper exploration and production.

A New Model for Mining Strategic Partnerships

McEwen Copper is in discussions to raise approximately $100 million for the Los Azules Project, engaging with notable stakeholders like Stellantis NV and Nuton (a Rio Tinto Group venture) to fund feasibility and engineering work.

Sustainable and Innovative Practices

The project is committed to being carbon-neutral, utilizing renewable energy and innovative leaching methods. It represents a significant step forward in environmentally sustainable mining.

Significant Copper Resource: Los Azules is one of the world’s largest undeveloped copper projects, with an estimated resource of 37.6 billion lbs of copper, positioning it to be a major player in the copper industry for decades to come.

Conclusion

The Los Azules Project by McEwen Copper Inc. is not just an investment in a mining operation; it’s an investment in the future of copper, a critical component of the global shift towards sustainable energy and technology.

With its innovative approach to mining, significant growth potential, and the strategic geopolitical context of Argentina, Los Azules represents a unique and attractive opportunity for forward-thinking investors.

I do not currently own McEwen Mining or any interest in McEwen Copper.

Important Disclosures:

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it’s advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026