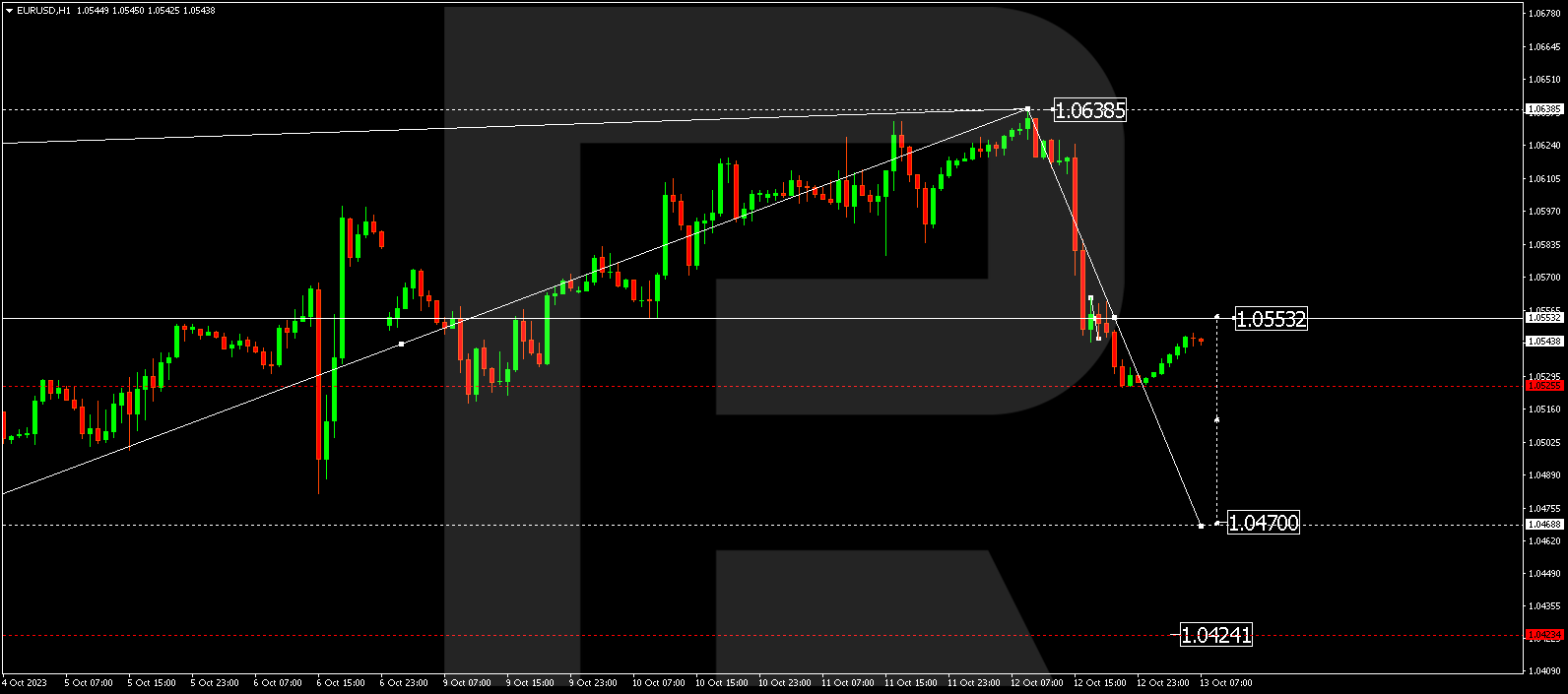

EURUSD, “Euro vs US Dollar”

EURUSD has completed a wave of growth to 1.0638. The market has formed a consolidation range under this level and, escaping it downwards, continues developing the declining wave to 1.0470. After the price hits this level, a link of growth to 1.0550 is not excluded (with a test from below), followed by a decline to 1.0424.

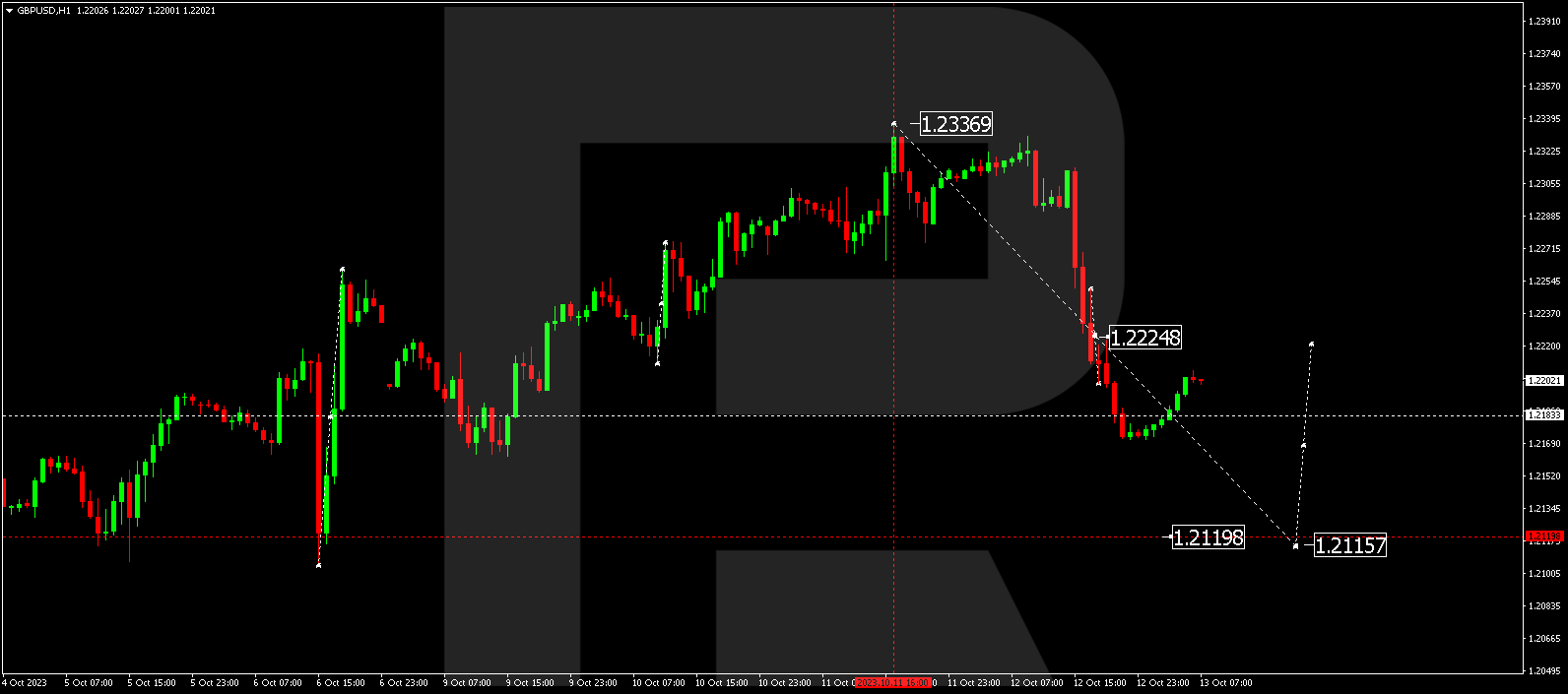

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed a wave of growth to 1.2337. By now, the market has formed a consolidation range under this level. Breaking the range downwards, the market completed a declining wave to 1.2171. A link of correction to 1.2222 is not excluded (with a test from below), followed by a decline to 1.2121. This is a local target.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

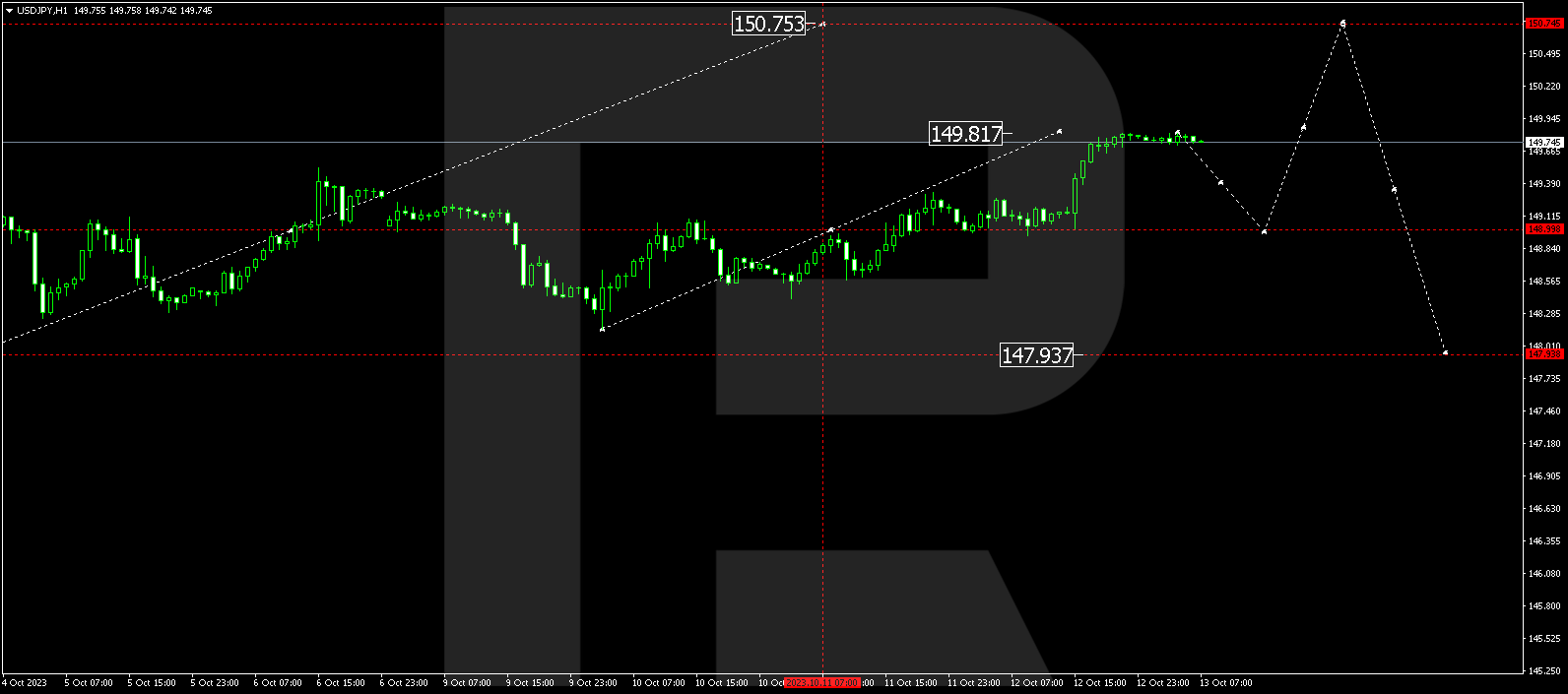

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a wave of growth to 149.81. A link of decline to 149.00 is expected (with a test from above). Next, a link of growth to 150.75 might follow.

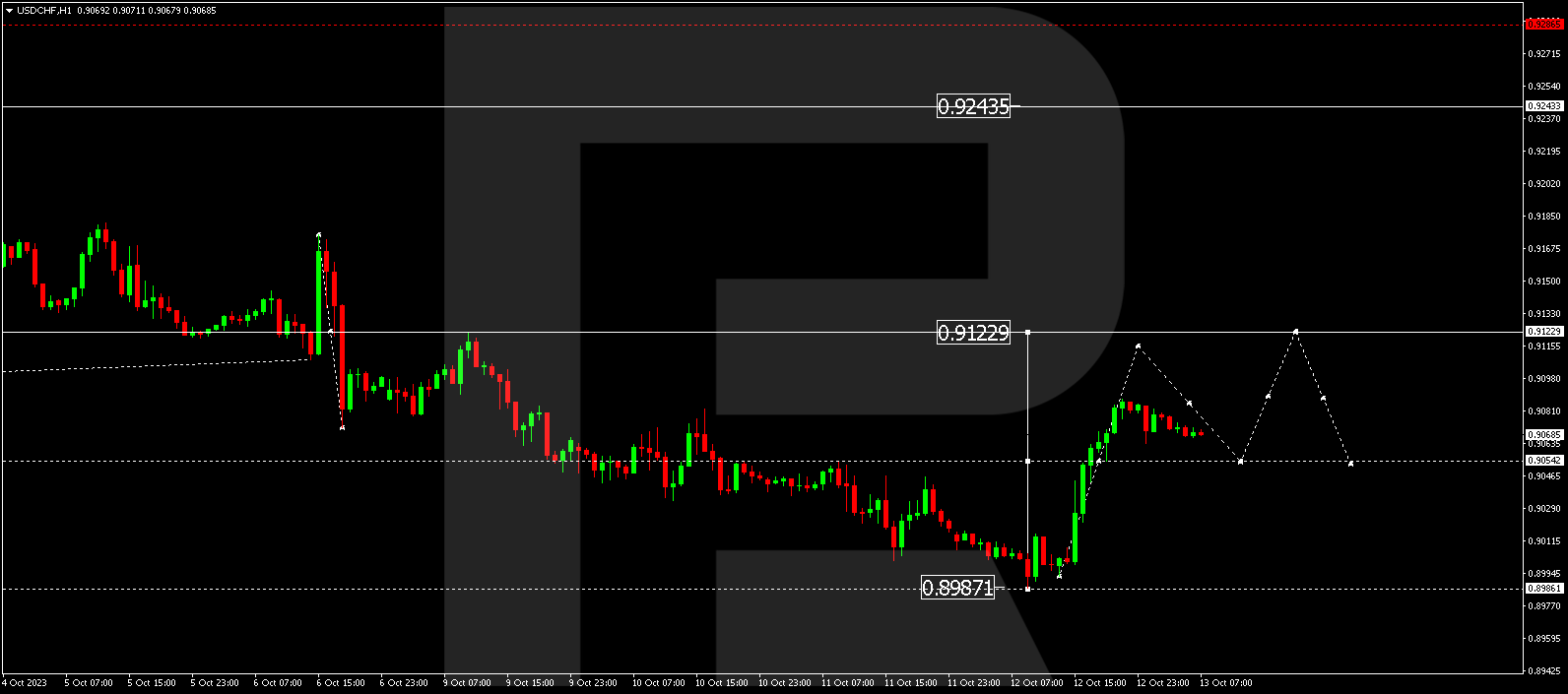

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has completed a wave of decline to 0.8989. By now, the market has formed a consolidation range above this level and is forming a growing impulse to 0.9122, escaping the range upwards. This is the first target.

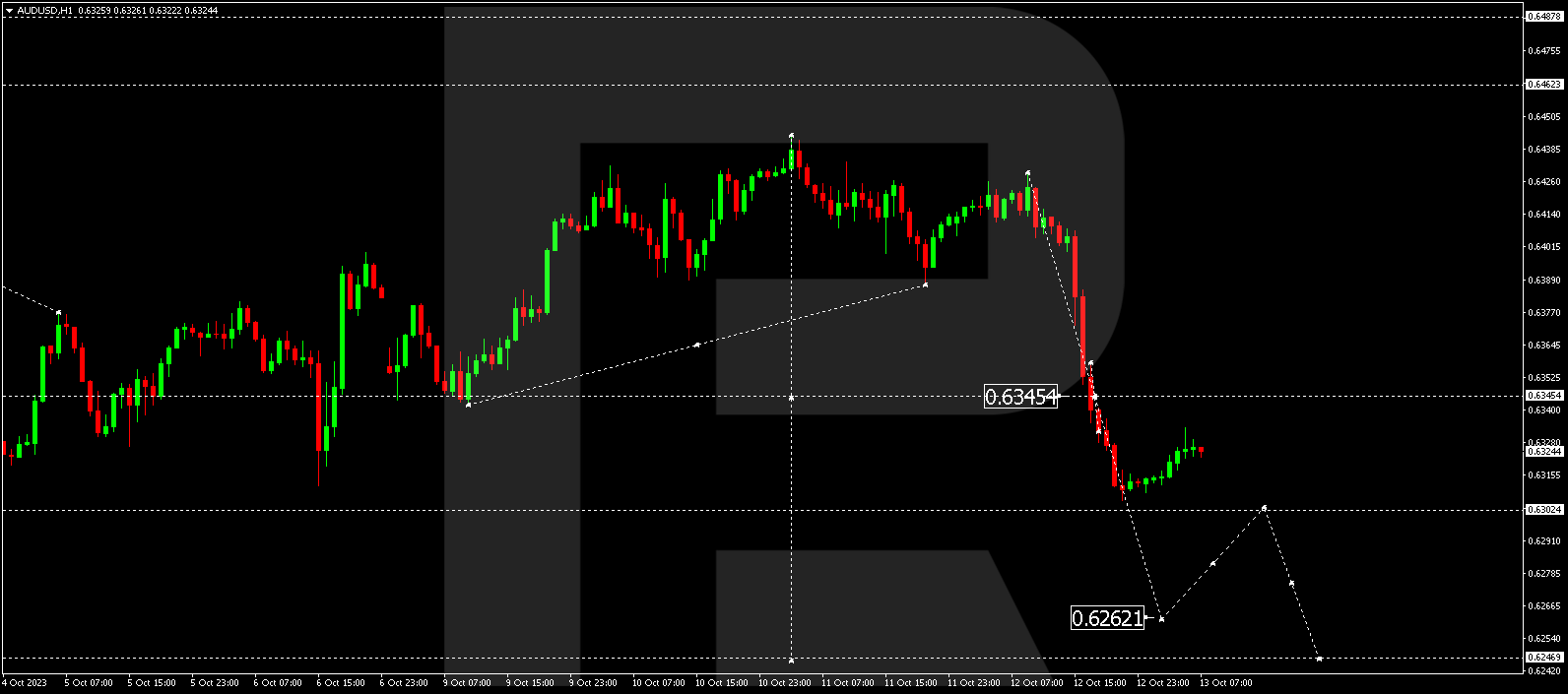

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD has completed a rising link to 0.6444. Practically, the market demonstrates the wave of growth as complete. By now, a consolidation range has formed under 0.6444 and, escaping it downwards, the market develops an impulse of decline to 0.6262. This is a local target.

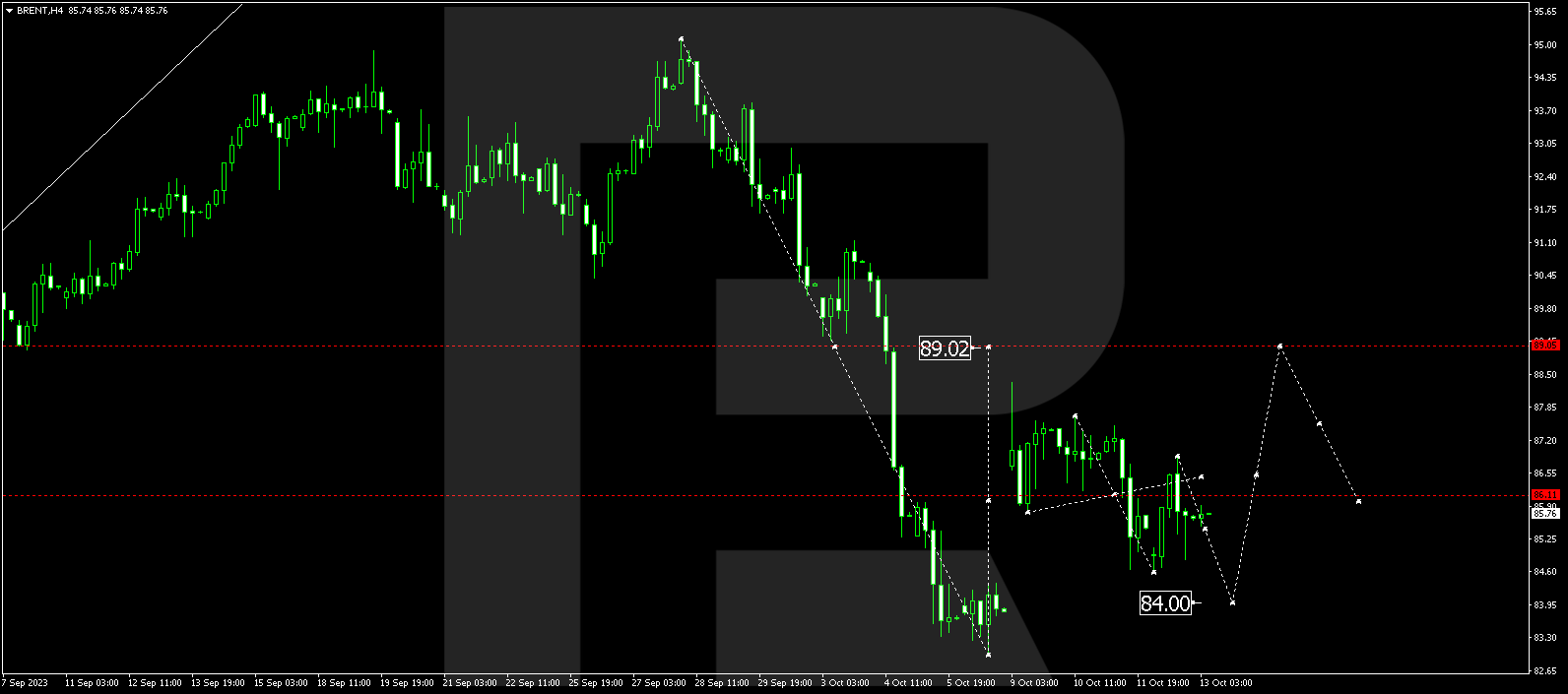

BRENT

Brent continues forming a consolidation range around 86.00. A link of decline to 84.00 is not excluded, followed by a rising link to 89.00. This is the first target.

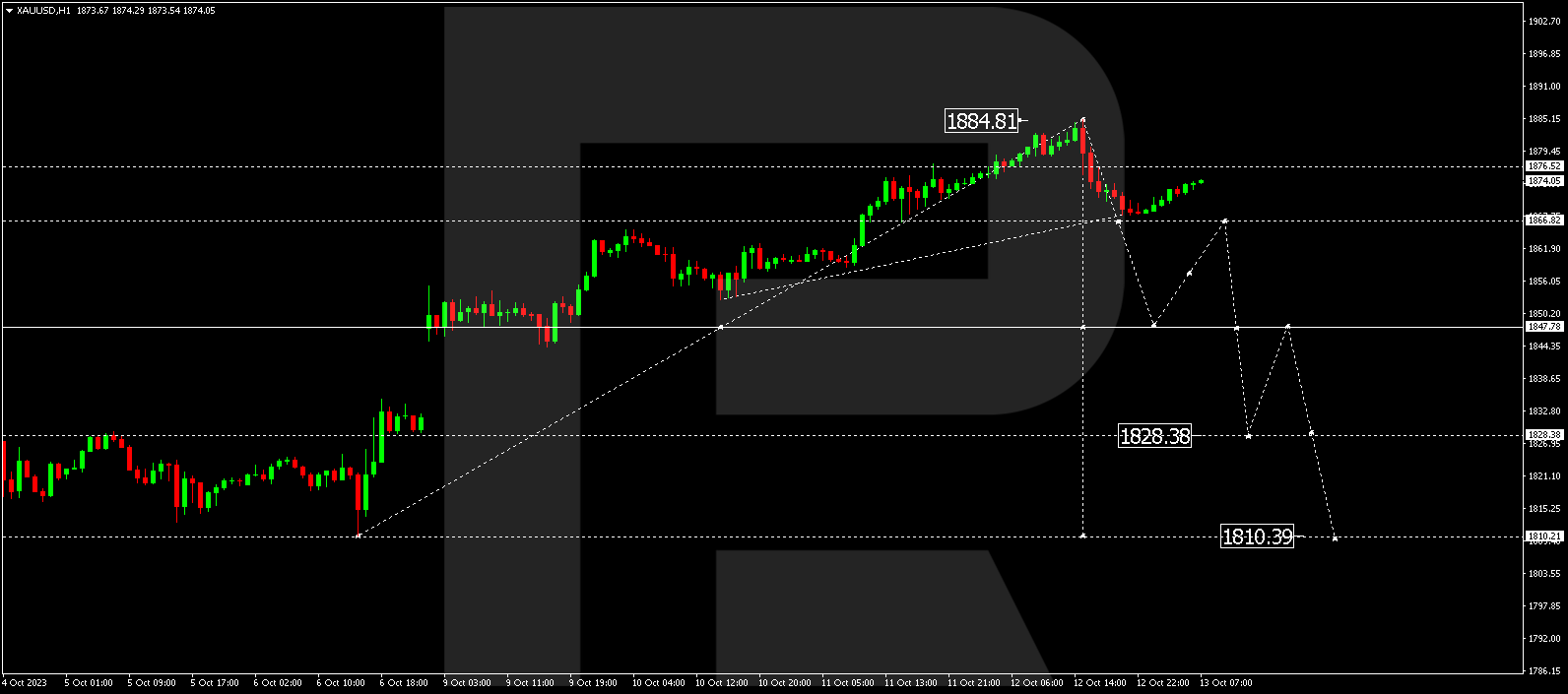

XAUUSD, “Gold vs US Dollar”

Gold has completed a wave of growth to 1884.80. Today the market has performed a declining impulse to 1867.00 and a rising link to 1876.55. Practically, a consolidation range has formed which the price might later break downwards to 1847.77. This is the first target.

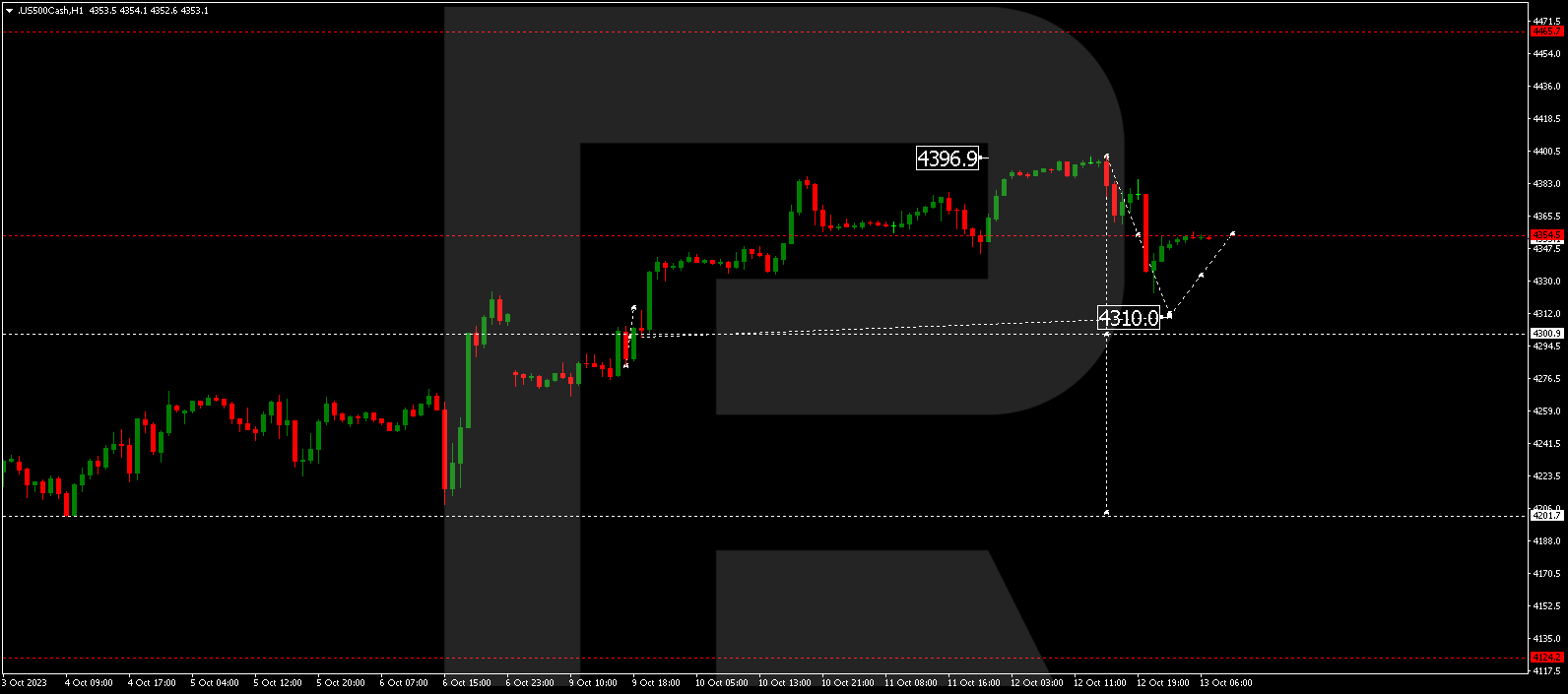

S&P 500

The stock index is forming a declining impulse to 4310.0. Next, the quotes might rise to 4355.0 (with a test from below). Next, a new wave of decline to 4200.0 might begin. This is a local target.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026