By RoboForex Analytical Department

Brent crude is maintaining a steady position, trading close to $89.50 as the market endeavors to find a balance.

Middle Eastern tensions remain the central focus for traders, as the on-ground operations in the region have introduced multiple uncertainties that can sway prices.

Adding to the mix of factors influencing Brent crude this week is the expiration of December Brent futures. This expiration could lead to short-term volatility and impact prices accordingly.

Recent data from Baker Hughes indicates that the number of active oil rigs in the U.S. is on the rise. This week saw an increase of two units, bringing the total to 504 rigs. This growth marks the third week in a row of expansion.

Technical Analysis: Brent Crude

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

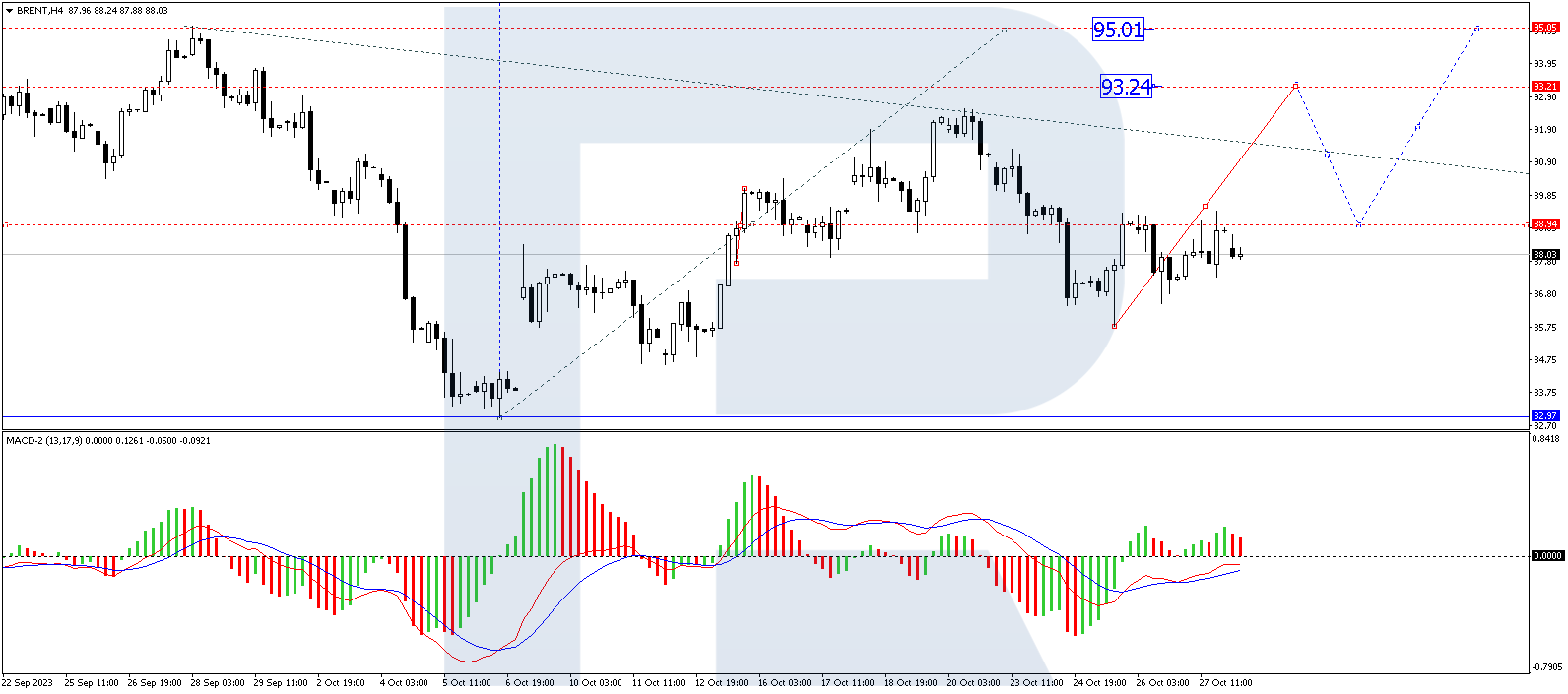

Brent has witnessed a corrective move to the $86.50 mark and is currently crafting an upward trajectory targeting $89.50. Should prices successfully surpass this resistance, we might witness a rally towards $93.20, and potentially even further to the $95.00 mark. The MACD on this timeframe solidifies this bullish sentiment. With its signal positioned below the zero line, it’s on an upward trajectory, hinting at possible future highs.

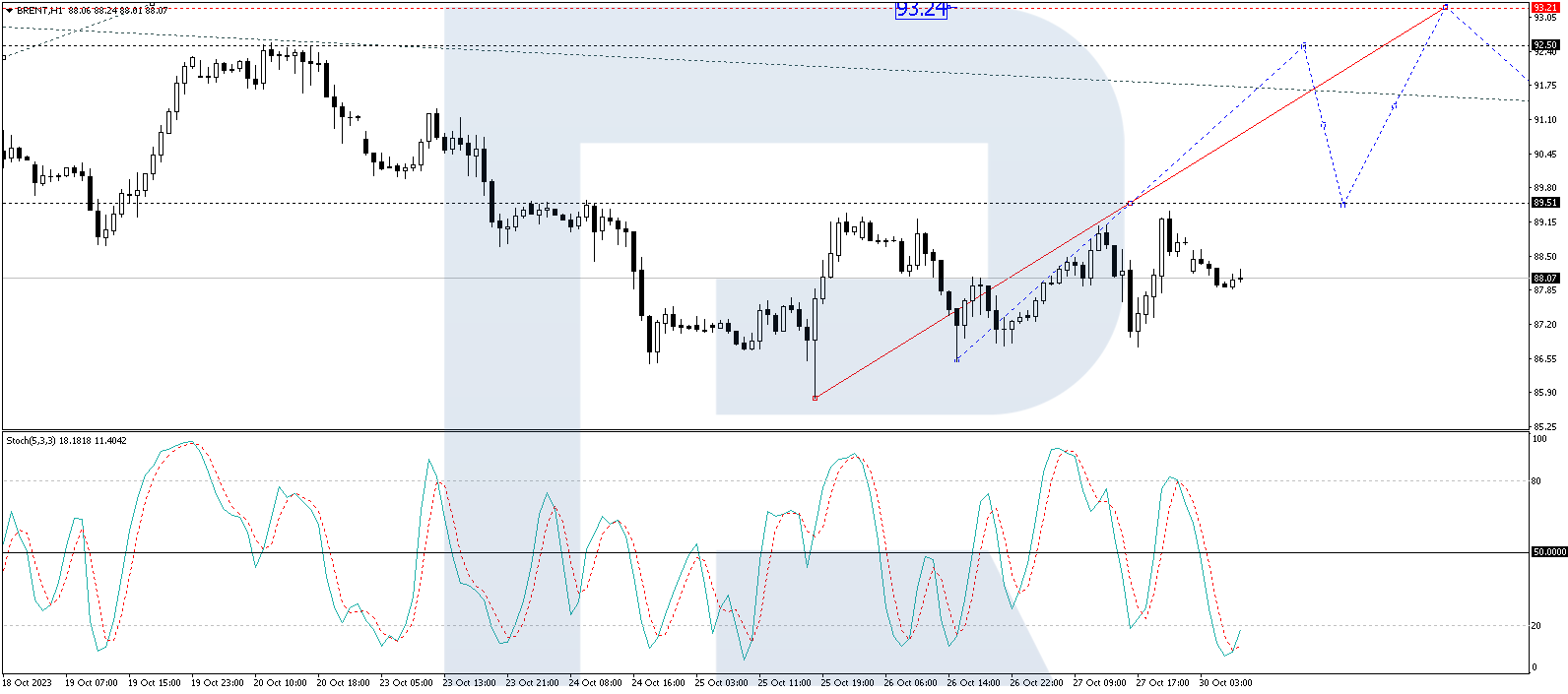

On the hourly frame, Brent has wrapped up a bullish wave reaching $89.36, succeeded by a minor pullback to $87.90 earlier today. The stage appears set for a subsequent bullish move, aiming for the $89.50 resistance. Breaking above this level could potentially unlock the door to $92.50. The Stochastic oscillator on this timeframe amplifies this bullish stance. Its signal, currently below the 20 mark, is pointed sharply upwards, suggesting a possible rally to the 80 level.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026

- Oil prices have seen their largest surge in 4 years amid the military conflict in the Persian Gulf. Mar 2, 2026

- EUR/USD Reacts to Geopolitics and Data: Week Opens Nervously Mar 2, 2026