By RoboForex Analytical Department

Oil continues to fall at the start of another May week. A barrel of Brent crude fell to 73.70 USD.

The sell-off in the commodities market has been ongoing for several weeks. Investors tried to get a foothold above 78.00 USD, but their attempts failed. The OPEC report, which normally looks optimistic, did not give investors any reason to buy this time. The main trigger for selling remains fears that the high interest rates around the world will put pressure on global economic activity. This, in turn, will reduce the demand for energy commodities.

Data from Baker Hughes showed that US drilling activity declined. Gas rigs were primarily affected (-16) but oil rigs also declined (-2).

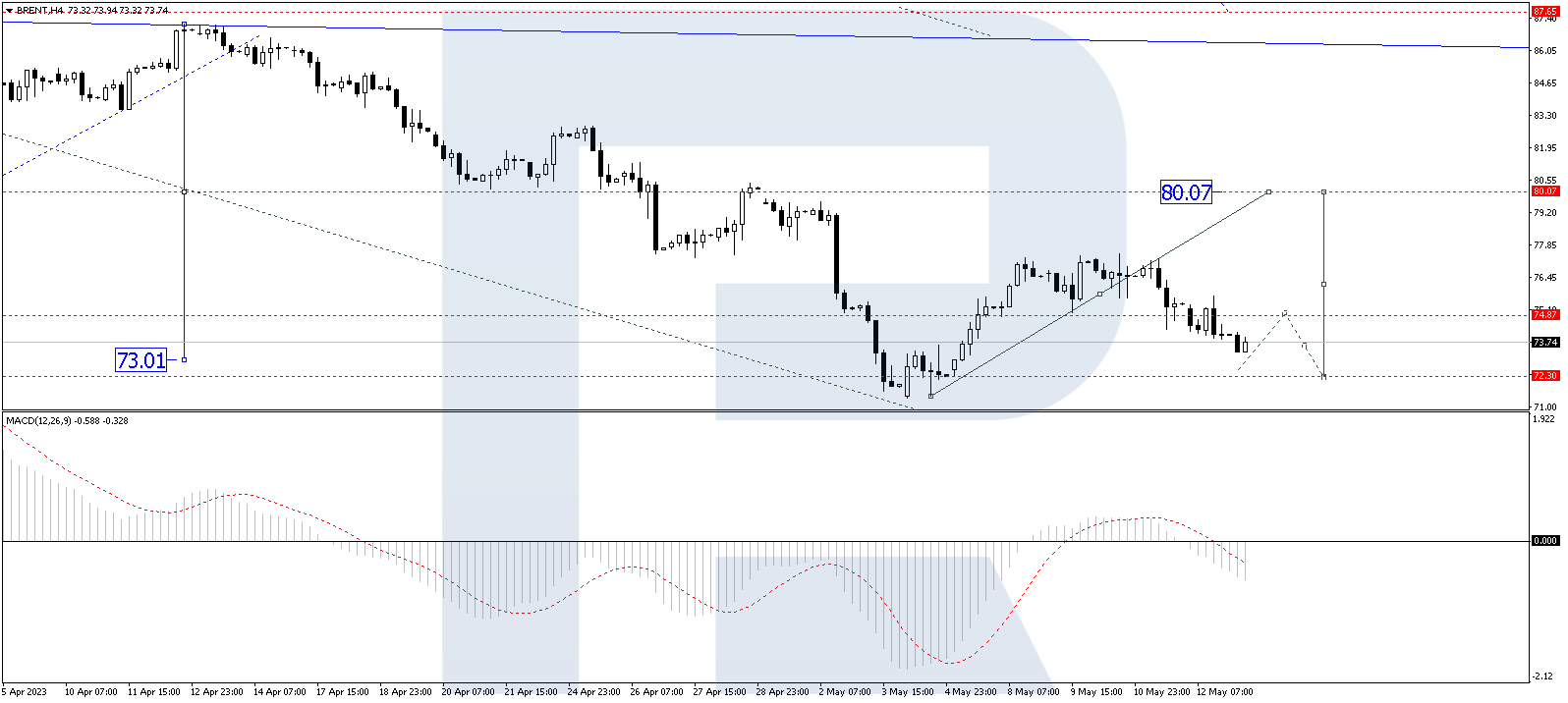

On H4, Brent has worked its way up to the 77.44 level. The market continues to develop a correction today. A decline to 72.33 is expected, followed by a new wave of growth to 80.07. After its breakdown, a new growth potential could open to the level of 87.77. The target is local. Technically, this scenario is confirmed by the MACD indicator: its signal line is below zero, with growth to new highs expected.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

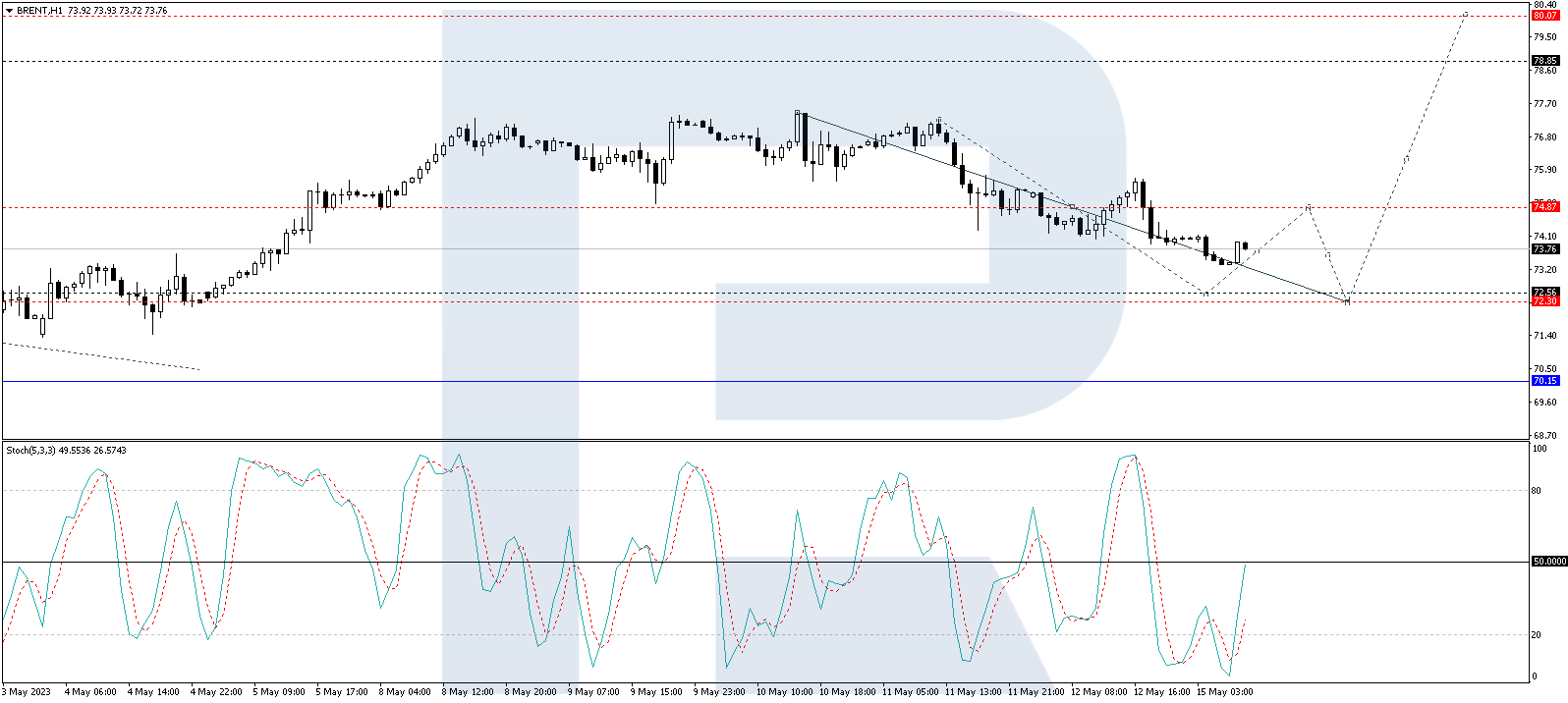

On H1, a consolidation range has formed around the 74.87 level. The market has escaped it downwards today. A decline to 72.56 is expected, followed by a rise to 74.87 and a decline to 72.33. After the price reaches this level, a wave of growth to 80.00 could begin. Technically, this scenario is confirmed by the Stochastic oscillator: Its signal line is breaking through the level of 20 upwards, aiming at 50. A rebound from this level is expected, followed by a new decline to 20. Next, growth to 80 could follow.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026