Source: Michael Ballanger (3/13/23)

In light of the Silicon Valley Bank collapse, Michael Ballanger of GGM Advisory Inc. reviews what he believes the Fed will do and what the unintended consequences of that might be.

Since I suspect that every newsletter writer, blogger, financial journalist, and armchair strategist will be writing about the major story for the capital markets for 2023, I figured that I might as well too.

The story involves the sudden and shocking vaporization of a forty-year-old bank out of the West Coast, Silicon Valley Bank, that had acted as the bagman for the bulk of the Silicon Valley start-ups and was ranked as the eighteenth largest bank in the United States with over US$212 billion in assets.

It was announced mid-week that they had been experiencing “difficulties” and were trying to complete a capital raise in order to shore up losses in their fixed income portfolio, but by Friday afternoon, it was learned that not only had they experienced losses due to declines in U.S. treasury prices, they were also experiencing a classic bank “run” where some US$42 billion was withdrawn by Thursday afternoon.

The Great Financial Bailout of 2008

What was left was a negative equity position of almost a billion dollars, and THAT, my friends, is exactly where the major Wall Street banks were in 2008 before Congress flinched embarrassingly and bailed out the sorry lot.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

The intrigue grows when one peels back the layers of this grotesque onion to find out that none other than the Master of Financial Shenanigans — JP Morgan Chase — the most-prosecuted and most-fined financial institution in the history of the world – was instrumental in inciting many SVB clients to remove their funds in favor of “the Jamie bank.”

Prominent venture capitalists advised their tech startups to withdraw money from Silicon Valley Bank, while mega institutions such as JP Morgan Chase & Co. sought to convince some SVB customers to move their funds Thursday by touting the safety of their assets. (Zerohedge — March 10th).

Needless to say, the impact of this major bank failure is going to be seen by many (but not me) as the event which will force the Fed to finally engage and that highly-coveted “pivot,” but it came to a tad late as stocks took it on the chin again on Friday with the S&P closing below that all-important “convergence zone” containing the three moving averages (200,100 and 50-day) as well as the uptrend line drawn off the Oct-Dec lows.

SVB’s demise is not going to cause one ripple in the Fed’s monetary policy despite the friendlier average hourly wages number and slightly-higher unemployment rate from Friday’s jobs report.

I emailed subscribers with a “Crash Alert” and tweeted out that yesterday felt a lot like Friday, October 16th, 1987, when many of the junior stock salesmen with whom I worked sat mesmerized by a tape that lost 103 Dow points in the final hour of trading.

While I have no idea what will happen when stocks re-open on Monday, the problems that led to the demise of Silicon Valley Bank can be found solidly embedded in the halls of the Marriner S. Eccles Building, which is located at the intersection of 20th St. and Constitution Avenue in Washington, D.C.

In case you are wondering, that is the workplace of the Chairman of the U.S. Federal Reserve Board, the Right Honorable Jerome Powell, whose anti-inflation monetary policy has been responsible for the largest and fastest interest rate increase in world history.

After the Great Financial Bailout of 2008, legislators brought in laws designed to force the banks to hold only “risk-free assets” with the assumption that U.S. Treasuries fit that bill admirably. Banks like (but not confined only to) Silicon Valley Bank were/are forced to hold treasury bonds of varying duration under law, but anyone that has ever owned leveraged bonds knows that when you own a 30-year bond and interest rates move against you (higher), the price of the bond declines.

Value at Risk

Whether it is the U.S. government or Toys R Us bond, it is the coupon (rate of interest), the duration (time until maturity), and the debit balance (leverage) that can torpedo you; it is not the credit quality of the issuer.

What It smells like to me is that someone at SVB forgot those courses he/she was supposed to take at the Harvard Business School on “hedging” because there is no bank or insurance company of which I know that runs a bond portfolio absent risk management tools such as “hedging” which involves the use of derivatives and which is absolutely critical, especially since Chairman Powell warned the Wall Street banks (for whom he toils) multiple times that he was going to start increasing rates and waited for what seemed like an eternity before he actually began the levitation process.

Whoever was responsible for keeping an eye on the “VAR” (“value at risk”) at SVB was obviously asleep at the switch unless what appeared to be acceptable prior to the bank run was suddenly and ruthlessly removed once the US$42 billion in withdrawals took hold.

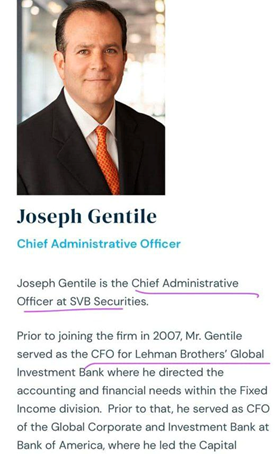

Now, I do not wish to be “unfair,” but the graphic to the left shows the pleased countenance of one Joseph Gentile, Chief Administrative Officer at SVB Securities, and whether it should be classified as “bad luck” or “poor timing” or “serendipitous savagery,” he also held the title of Chief Financial Officer for Lehman Brothers, the only big U.S. bank that did not receive a bailout back in 2008 and proceeded to collapse in bankruptcy.

Perhaps the staffers at SVB thought that the chances of a Joseph Gentile being involved in two gargantuan financial collapses in one career would be analogous to receiving two shark bites on the same day that you get hit by lightning.

It might happen but probably not.

There exists little need to tear away any more layers of this topical onion in today’s missive other than to explain why it is markedly different than the events back in late September when the Bank of England was forced to reverse their QT decision in favor of a US$5 billion QE bailout for the British pension funds.

As you all recall, I had been pounding the table as a card-carrying bear looking for new lows in October when that seminal event was announced.

That weekend, I reversed course and proceeded to cover all shorts, liquidate all put options, and began to look at a long position in the S&P 500.

Thirteen days later, stocks began what amounted to a 20% pop terminating the move in very early February against ear-splitting protests from the entire hedge fund community, all of whom were positioned for an October CRASH but instead were taken out behind the financial woodshed and thrashed to within inches of their lives.

SVB’s demise is not going to cause one ripple in the Fed’s monetary policy despite the friendlier average hourly wages number and slightly-higher unemployment rate from Friday’s jobs report, and the reason is that a bank run instigated by a competitor bank resulting in a “technical default” will not be deemed as a “systemic risk” event and since the only occurrence that could alter the Fed’s monetary policy is just that, the Fed will take no action.

However, what MAY happen is that the events of last week may prompt a more pervasive rout of the regional banks, and if there is one thing upon which one may bank (forgive the bad pun), it is that just as there is never “only one cockroach,” those bond losses at SVB are present right across the global financial system and are NOT ring-fenced to one insignificant venture capital financial institution in California.

If stocks take out the December lows at SPX 3,764, the buy signal from the formerly-bullish January Barometer becomes impotent, sending traders limping to the safety of cash.

The trade was in acting late last week to “get defensive” in a hurry which we did, and we are now able to ride the move down to the test of those all-critical December lows.

Gold

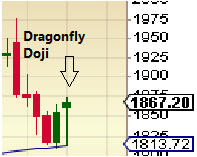

Gold was all over the map last week but went out with a weekly “dragonfly doji” a powerful buy signal where you have a wide range of values but which ended with a strong rally that closes on the highs for the session — in this case, for the week.

I prefer to stay with gold because whereas early in the session, silver was vastly outperforming gold; it would wind up the day ahead only 2.18% versus gold up 2.08%. I see a test of the US$1,900 range by the end of the month, but if, in fact, I see further turmoil in the regional banks that spreads to the money-center banks and abroad, gold could catch a “fear trade” bid as traders move rapidly for the safety of non-paper assets.

Another positive was that the mining stocks (HUI) shrugged off the weakness in the broader market and had a decent day, up 1.36%, which, I should add, was what used to happen with bankable regularity back in the day when trading involved rules and where rules could not be broken.

Gold was always used as a hedge against volatility, and it worked beautifully until the walking carbon units (humans) were replaced by robots in the trading pits.

What I need to see next week is a gold market that divorces itself from the broad markets and has both silver and gold miners outperforming. The weekly COT report came in with yet another positive as Commercials continue to cover shorts as Large Specs liquidate, which will continue to happen as long as the net shorts for the bullion bank behemoths stays above 100k.

At the lows in December 2015, that number actually went positive (net long) very briefly, but it has not happened since.

I will be finding great amusement in reading the tweets and watching the blogs of the big power players on Wall Street, like Bill Ackman, who has a habit of whining at or near major turning points.

He has already launched one tweet begging “the government” to reverse the SVB event “before the opening on Monday” lest it turns into “look out below.”

This is classic lobbying by the same Wall Street carpetbaggers that wound up being rescued back in March 2020 and September 2008 instead of being monkey-hammered by margin calls like the rest of the world. I expect that the Jamie Dimons of the world will be calling for “regulatory action,” including a Fed pivot, in order to avoid stock market Armageddon and quarter-end bonus enhancements because their prop desk suddenly went south.

What was it that Santayana said about “the more things change?”

Good luck in 2023.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: My company, Bonaventure Explorations Ltd., has a consulting relationship with: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026