By RoboForex Analytical Department

On Monday, the market major is neutral near 1.0800. The market has got all the info at hand: the decision of the Federal Reserve System to lift the interest rate by 25 base points and the confirmation of the ECB mood for it has lifted the rate by 50 base points.

The Fed will go on lifting the rate smoothly but is “mentally” preparing to put an end to the cycle. As for the ECB, it is decisive about lifting the rate until it gets inflation under control. As long as it lost quite a lot of time on monitoring the situation, things look quite logical.

The US employment market in January proved strong. The unemployment rate dropped to 3.4%, average wage grew by 0.3% m/m as expected. 517 thousand new workplaces were created by the NFP report, which is much more than forecast. The data taken together gave great support to the USD.

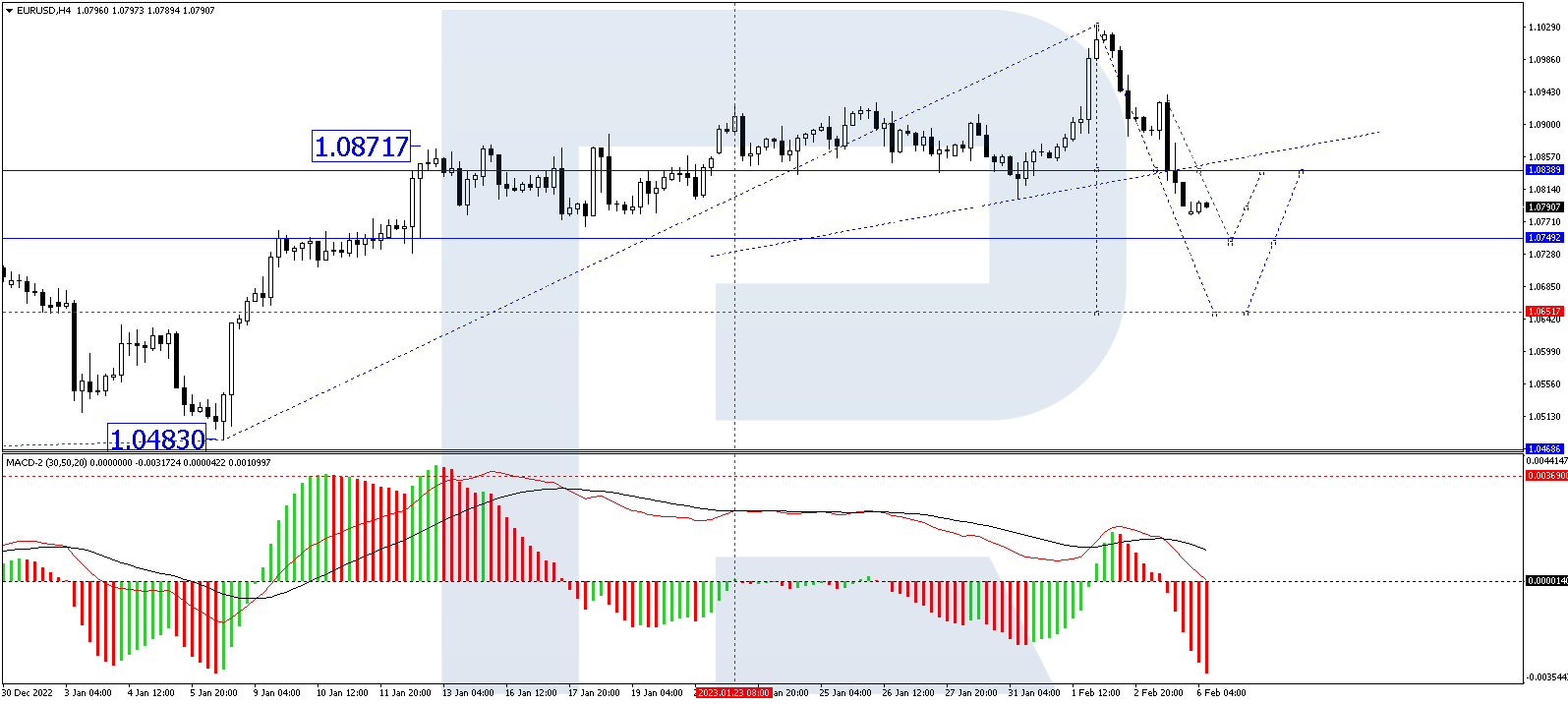

On H4, EURUSD has completed a wave of decline to 1.0840. Practically, this level has become a breakthrough for the ascending channel. At the moment, the market formed a consolidation range around this point, and with an escape downwards it opened a pathway for decline to 1.0750. After it is reached, a correction to 1.0840 should follow, and after that – a decline to 1.0650. Technically, this scenario is confirmed by the MACD. Its signal line is heading strictly downwards, getting ready to break through the zero level.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

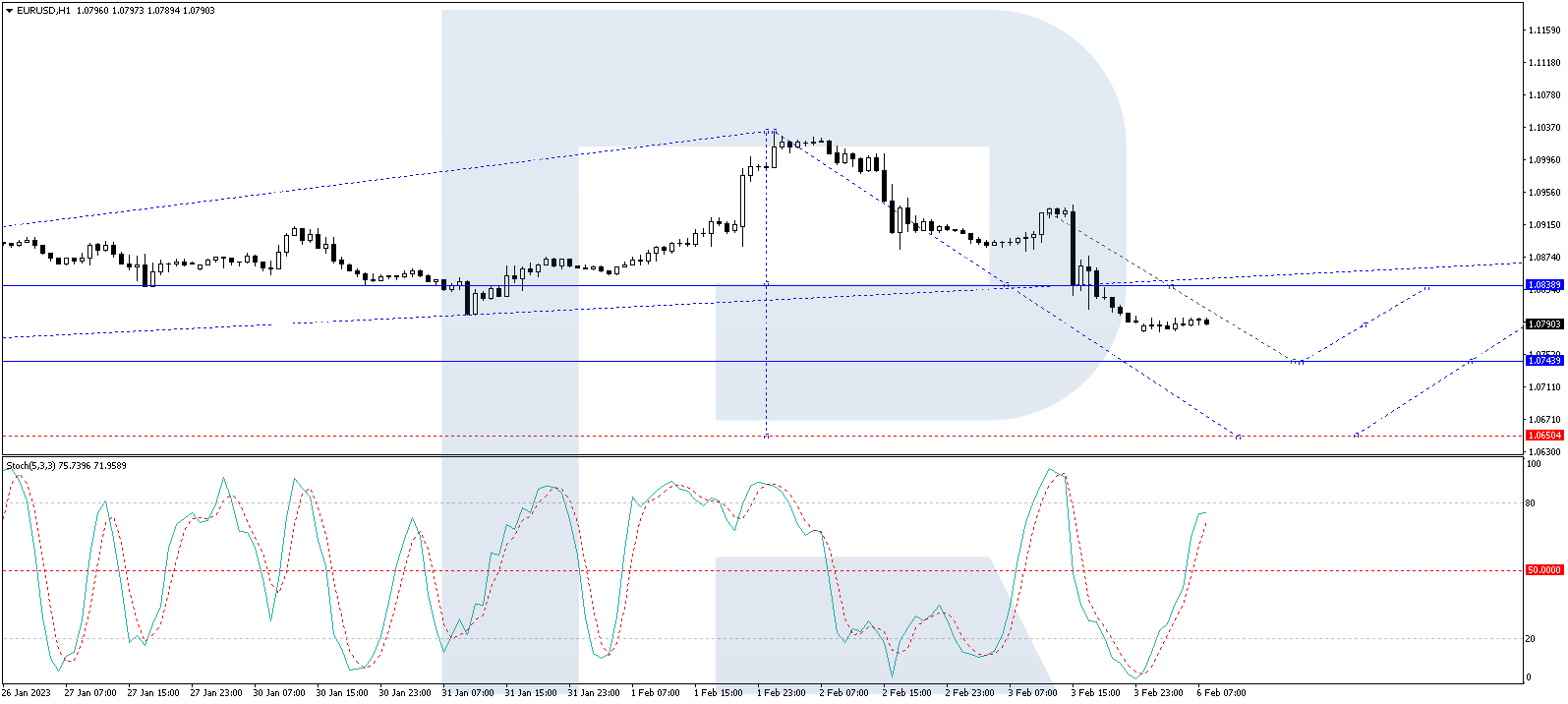

On H1, the pair has formed a structure of a consolidation range around 1.0840. With an escape downwards, a pathway for decline to 1.0750 will open. Then a correction up to 1.0840 and a decline to 1.0650 should follow. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above 50. A decline to 20 is expected.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026