Source: Streetwise Reports (1/13/23)

In conjunction with the release of its third-quarter report, Largo Inc. reported record high-purity vanadium production. Read more to hear what analysts are saying about this stock and the multiple catalysts the company has set for the future.

This November, Largo Inc. (TSX:LGO;NASDAQ:LGO) announced that it produced record high-purity vanadium production and completed battery stack manufacturing for its 6.1 MWh VCHARGE VRFB Deployment in Spain. However, despite impacts incurred during the quarter, the company continues to make moves with exciting growth plans throughout 2025.

Largo Inc. is a dual-listed vanadium producer and supplier that produces 7% of the world’s vanadium supply.

The company does everything to further its mission to provide the world with low-carbon solutions and create value through its unique vertical integration. This is done through the company’s two-pillar strategy based on 1.) vanadium production from one of the highest grade and lowest cost vanadium production facilities in Brazil and 2.) its energy storage business in the U.S. with one of the world’s most advanced VRFB technologies.

H.C. Wainwright analyst Heiko F. Ihle gave the company a Buy rating and a CA$19 target price and said, “In our view, some of this value is likely to surface in the near-term since market interest for clean energy investments remains quite high.”

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Vanadium is a rare metal discovered in Mexico in 1801. It is a key transition metal suitable for use in energy storage and high-quality alloy applications. Approximately 90% of vanadium is currently used as a steel additive. It is used in the hardening of space vehicles, nuclear reactors, and airplanes.

However, more excitingly, it is also used in producing vanadium electrolyte, which is used in Vanadium redox batteries. These batteries store significant amounts of renewable energy from solar and wind power. According to an article in the Journal of Vacuum Science & Technology B, Vanadium redox batteries are “the most successful Redox flow batteries (RFB) for large-scale applications,” which may explain their recent increase in demand, particularly in China.

On December 13, Pangang Group Vanadium & Titanium Resources Co., Ltd. announced that the company’s wholly-owned subsidiary, Pangang Group Chengdu Vanadium & Titanium Resources Development Co., Ltd. and Dalian Rongke Power Group Co., Ltd. recently signed the “2023 Annual Framework Agreement on Vanadium Battery Energy Storage Material Cooperation” in Chengdu, Sichuan.

According to the agreement, both parties shall adopt the cooperative mode of purchasing and selling ammonium polyvanadate raw materials, with an estimated total quantity (converting to vanadium pentoxide) of 8,000 tons in 2023. If the agreements signed are all successfully executed, the total transaction amount is expected to be about RMB$1 billion (US$144 million) based on the current market prices of vanadium products.

This represents approximately 4% of 2022’s annualized global vanadium supply. Dalian Rongke Power operates the world’s largest vanadium battery with a capacity of 100 MW/400 MWh and plans to further increase its capacity to 200 MW/800 MWh following a second phase of expansion.

Vanadium Demand Rising

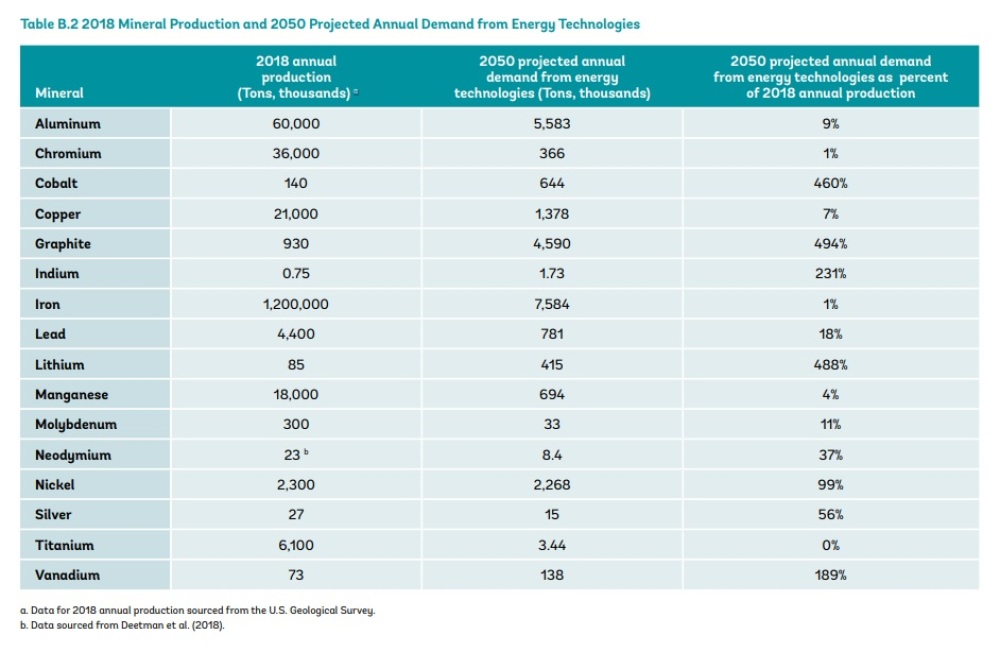

Demand for low-carbon technology has been growing worldwide. The World Bank Group report, “The Mineral Intensity of the Clean Energy Transition,” projected that demand for vanadium will rise by 189% by 2050. And it has caught the attention of experts throughout the past year.

In an April post, Shovel Stocks said, ” Investors, therefore, should look for vanadium projects with deposits which are either huge, non-TVM, or both.”

The metal is also desirable from an ESG standpoint as it includes non-degrading, fully recyclable electrolyte and carbon-reducing steel alloying applications. Yet, there is a deficit between current supply and demand.

Vanadium price spiked in 2018 to US$30 per pound, caused by a deficit of 8-10 tonnes. Last year, Roskill said it expects “structural deficit and elevated prices to remain for some time, which should incentive a handful of new projects into production over the next decade. ” This isn’t just because of unexpected demand, but projects can take up to five years to start production.

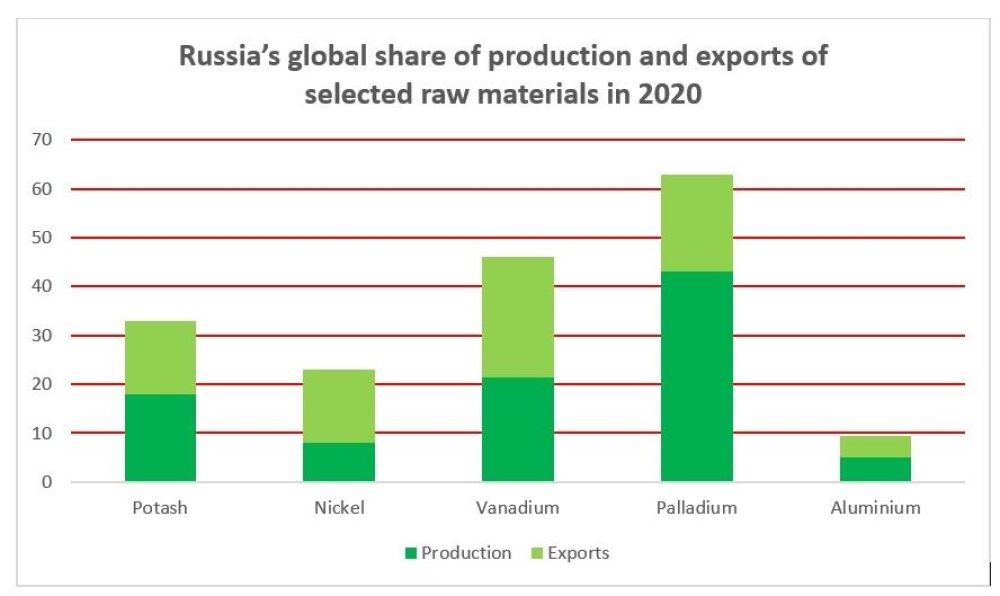

This strain is exacerbated by the war in Ukraine, as 70% of the world’s vanadium supply is currently with Russia and China.

Largo is the Largest, Highest-Grade Primary Producer

While Largo only produces 7% of the world’s vanadium, it is the largest, highest-grade primary producer globally and is one of only two producers that supply HP to the aerospace industry.

According to the company, it generates a healthy operating margin with cash operating costs of US$4.30 per pound (US$4.30/lb) in 2022 guidance and rising vanadium prices. In late December, the price of vanadium was US$8.95/lb. This has now risen almost 10%, with the price at US$9.83/lb.

High-purity sales can also add US$1-2 more per pound for Largo’s HP vanadium.

The company runs on two strategic pillars.

- Vanadium pillar: future vanadium operation expansions, ilmenite plant, titanium plant

- Clean energy pillar: delivery of inaugural VRFB for Enel, exploring government subsidies, non-binding MOU to potentially form a JV with Ansaldo Energia

CIBC Equity Research noted that they “view successful execution of Largo’scapital construction projects, as well as [the] advancement of the clean energy business through further customer updates to be potential catalysts in the year ahead.”

Largo also plans to produce ilmenite and titanium pigment from the same mining stream it does vanadium, which is expected to aid in lowering the vanadium cash costs as a co-product.

The company has also signed a non-binding MOU to negotiate the formation of a joint venture with Ansaldo Green Tech to manufacture and deploy VRFBs in the European, African, and Middle East power generation markets.

In a November 11, 2022 note, H.C. Wainwright analyst Heiko F. Ihle gave the company a Buy rating and a CA$19 target price and said, “In our view, some of this value is likely to surface in the near-term since market interest for clean energy investments remains quite high.”

Gordon Lawson et al. at Paradigm Capital also echoed this with its own Buy rating on Largo and a CA$20 target.

Q3/22 Highlights

While important for its unique placement as one of the world’s largest primary vanadium producers, Largo has been making moves these past few months. In September of last year, Largo’s new venture Largo Physical Vanadium began trading on the TSX Venture Exchange under the ticker “VAND.” This venture provides investors with the opportunity to own physical vanadium themselves, which could increase demand within the vanadium market and aid in Largo’s clean energy strategy. You can learn more about how vanadium will aid in a greener future here.

At the time of the listing, Largo President and CEO Paulo Misk said, “With this enhanced visibility on the TSXV, LPV will do its part to raise the profile of vanadium — a key green transition metal central to clean energy storage and greener steel.”

Then in October, the company released reports for its third quarter of 2022. Highlights of the third quarter included:

- V2O5 production of 2,906 tonnes (6.4 million lbs) versus 3,260 tonnes produced in Q3 2021; Lower quarterly production due to a planned kiln and cooler refractory refurbishment and a change of mining contractor, but was in line with the company’s revised production guidance.

- Record high purity V2O5 equivalent production of 962 tonnes, representing 33% of the company’s Q3 2022 production.

- V2O5 equivalent sales of 2,796 tonnes (inclusive of 351 tonnes of purchased material) versus 2,685 tonnes sold in Q3 2021; Largo completed the first high-purity V2O3 sale in Europe in Q3 2022.

- Average benchmark price per pound of V2O5 in Europe of US$8.23, a 12% decrease from the average of US$9.40 in Q3 2021; High purity vanadium demand has increased following ongoing recovery from 2020 COVID-19 impacts, which was partially offset by a softening of steel demand in Q3 2022.

- The company advanced construction of its ilmenite concentration plant, including receiving all required metallic flotation structures and building of desliming, flotation, filtration, warehouse, and pipe rack structures; It expects commissioning to be completed in Q2 2023.

- Largo Clean Energy (“LCE”) progressed with the delivery of its Enel Green Power España (“EGPE”) VCHARGE vanadium redox flow battery (“VRFB”), including the manufacturing of all high-power battery stacks required for the system; The company has begun shipping battery stacks and electrolyte to the deployment site in Mallorca, Spain.

- Largo Physical Vanadium Corp. (“LPV”) commenced trading on the TSX Venture Exchange on September 27, 2022, under the symbol “VAND” and launched a new website www.lpvanadium.com.

- Published inaugural Climate Report aligned with the Taskforce on Climate-Related Financial Disclosures (TCFD), providing additional transparency on the company’s approach to climate change.

Multiple Catalysts

Experts expect vanadium to have a bullish market in 2023, and Largo plans to take full advantage of this as the company is highly leveraged to increase vanadium prices. It also has an ilmenite plant that is expected to come online in Q3 2023, and the company expects this new revenue stream to arrive in 2024.

In a November 10, 2022, report, CIBC Equity Research noted that they “view successful execution of Largo’s capital construction projects, as well as [the] advancement of the clean energy business through further customer updates to be potential catalysts in the year ahead.”

The company also plans to iron out its titanium production strategy in three phases over the next six years. The official commencement of this plan is expected in 2025. Largo believes this will give them a US$2.0 billion After-Tax NPV7% and US$4.2 billion After-Tax Life of Mine Cash Flow (using US$8/lb vanadium price).

Last but not least, Largo’s inaugural VRFB installation for Enel Green Power in Spain is anticipated for quarter two of 2023.

Ownership and Share Structure

| VC/PE Firms: 28,039,020 shares | |

| Retail: 19,400,253 shares | |

| Institutions: 16,137,220 shares | |

| Management: 428,507 shares |

According to Reuters, around 70% of the shares are tightly held. 25.21% of the shares are held with institutions. VC/PE Firms hold the most, with 43.81%. Arias Resources Capital Management LP has the most shares at 43.81%, with 28 million shares. West Family Investments is at 8.71%, with a little over 5 million shares, and Grantham Mayo Van Otterloo & Co. LLC is at 7.66%, with 4.9 million. BNY Asset Management has 1.84%, with a little over a million shares, and Baker Steel Capital Managers LLP has 1.27%, with 800,000 shares.

Other notable institutions and firms include Dolefin SA, Legal & General Investment Management Ltd., Konwave AG, Go ETF Solutions LLP, Rezco Investment Council, Blackrock Inc. ETFS Management, Russell Investment Management LLC, Mid-Continent Capital LLC, and BTG Pactual Asset Management SA.

0.67% of stocks are with management and insiders, and 30.31% are in retail. Of Management, President, CEO, and Director, Paulo Misk has the most shares at 0.19%, with 122,510.

As of September 30, 2022, the company has US$62.7 million in the bank.

Largo has a market cap of CA$478.75 million with 64 million shares outstanding. It trades in the 52-week range between CA$6.34 and CA$18.20.

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Largo Inc. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously publishLargo Inc, a company mentioned in this article.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026