Source: Streetwise Reports (1/23/23)

An analyst says Defense Metals Corp. is well-positioned to benefit from demand for rare earth elements with its continued high-grade results in British Columbia.

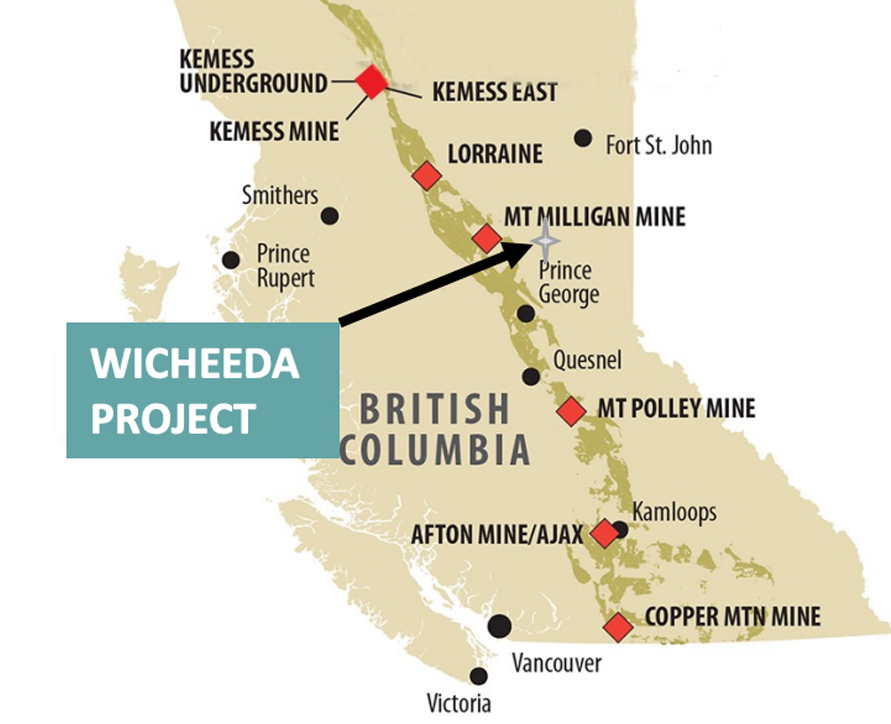

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) continues to release high-grade results from its Wicheeda rare earth element (REE) deposit in British Columbia.

This week it released drill results from eight core holes totaling 2,104 meters. One hole, WI22-73, returned the second longest REE-mineralized intercept of the 2021 and 2022 Wicheeda drilling campaigns, which totaled more than 10,000 meters in 47 core holes.

“We think Defense Metals is well positioned to benefit from growing demand for rare earths used in electric vehicle batteries, metal alloys, and advanced technology applications,” wrote analyst Mark Reichman in a note for Noble Capital Markets on Wednesday.

“Data from the 2021 and 2022 drilling programs will be incorporated into a preliminary feasibility study (PFS) which is expected to be completed by the fourth quarter of 2023,” Reichman wrote. “In addition to [the] significant potential to expand the resource and extend the mine life beyond 19 years, we expect grade enhancement and the meaningful conversion of inferred to indicated and potentially measured resources.”

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Reichman rated the stock Outperform with a target of CA$0.70. Its price on Thursday was CA$0.315.

The Catalyst: New Drill Results

The new results were from two explorations, three resource delineations, and three pit slope geotechnical core drill holes, the company said. Hole WI22-73 intercepted 1.42% total rare earth oxide (TREO) over 221.7 meters. Hole WI22-74 assayed 3.77% TREO over 30 meters and 2.52% TREO over 59 meters at mid-hole depths, the company said, with a broader zone average of 2.03% TREO over a 192-meter interval.

The 2022 drill program comprised of 18 core holes totaling 5,510 meters. Results have been announced for 16 holes. The results of the last two are expected shortly, Reichman wrote.

“We firmly believe Wicheeda is one of the best rare earths projects globally, and we eagerly look forward to advancing the project during 2023,” said Defense Metals Director Kristopher Raffle.

Three other holes, WI22-75, WI22-66, and WI22-65, all collared outside of the deposit, did not return significant REE mineralization.

Elements in High Demand

Defense Metals hopes to produce as much as 10% of the world’s light REEs to reduce reliance on China, which has about 85% of the world’s REE processing capacity. Political issues between the United States, China, and Taiwan put that vital supply at risk, as well as pressure from within China itself.

REEs are in high demand in the new green economy for purifying water, MRIs, fertilizers, weapons, research, wind turbines, computers, and permanent magnet motors for electric vehicles (EVs).

A preliminary economic assessment (PEA) for Wicheeda in 2021 showed an after-tax net present value of CA$512 million. Its 43-101 technical report showed a 5 million tonne indicated resource at 2.95% total rare earth oxides (TREO) and a 29.5 million tonne inferred resource averaging 1.83% TREO.

“DEFN is a best-of-breed North American REE developer that is well-positioned to its leverage growing global REE demand and government support to become part of a North American REE critical metals supply chain,” Gray wrote.

Wicheeda could help fill the resource gap with China, Reichman said. “The assay results released thus far have been outstanding,” he wrote last November.

Analyst Michael Gray of Agentis Capital recently initiated coverage on the company, saying Wicheeda was well-located with access to key infrastructure and “could become a globally significant producer” of REEs. He set a 12-month valuation of CA$3.50 for the stock.

“DEFN is a best-of-breed North American REE developer that is well-positioned to its leverage growing global REE demand and government support to become part of a North American REE critical metals supply chain,” Gray wrote.

The U.S. government in February announced a US$35 million grant to MP Materials Corp. to process REEs at its California facility. The company has agreed to invest US$700 million to create more than 350 jobs in the permanent magnet sector by 2024.

Gray said industries that use REEs are set to expand.

“The fundamentals for REE demand growth (are) very positive,” he wrote. “Demand is high, and forecasts suggest it will continue to grow, vis a vis the markets for EVs, wind turbines, and defense technologies.”

Reichman also noted the recent appointment of Len Clough, president and chief executive officer of Toro Pacific Management, to the board of directors to replace the departing Max Sali. Clough founded Toro, a capital markets advisory firm, in 2013, he said.

Ownership and Share Structure

Streetwise Ownership Overview*

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE)

| Retail: 90% | |

| Institutional: 5% | |

| Insider: 5% |

About 5% of the company’s stock is owned by institutional entities, and about 5% is owned by insiders. The rest, 90%, is retail.

Currently, the analysts covering Defense Metals Corp. include Reichman and Gray. Newsletter writers Clive Maund and Bob Moriarty also follow the stock. You can see all the analyst and newsletter coverage by clicking “See More Live Data” in the data box above.

Defense Metals has a market cap of CA$65.43 million with 207.7 million shares outstanding, 164.9 million of them free floating. It trades in a 52-week range of CA$0.365 and CA$0.16.

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Defense Metals Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026