By RoboForex Analytical Department

On Monday, the market major has reached 1.0580. It must be realized, that this is not because the euro is strong but because the dollar is weak. Investors are undermining the USD, treading on statistics and upcoming decisions of the US Federal Reserve System.

The labour market in the US remains vigorous. In November, the unemployment rate remained at 3.7%, and the NFP grew by 263 thousand instead of 200 thousand forecast. Average hourly wage increased by 5.1% y/y upon growing by 4.6% in October.

All this makes the employment picture quite stable and gives us an idea that the US business withstands the growing expenses on crediting quite efficiently. The wage fund has expanded, which hinders the market idea about the interest rate growing by 50 base points in December.

With all this background, the USD is really unstable, which is obvious in the quotes.

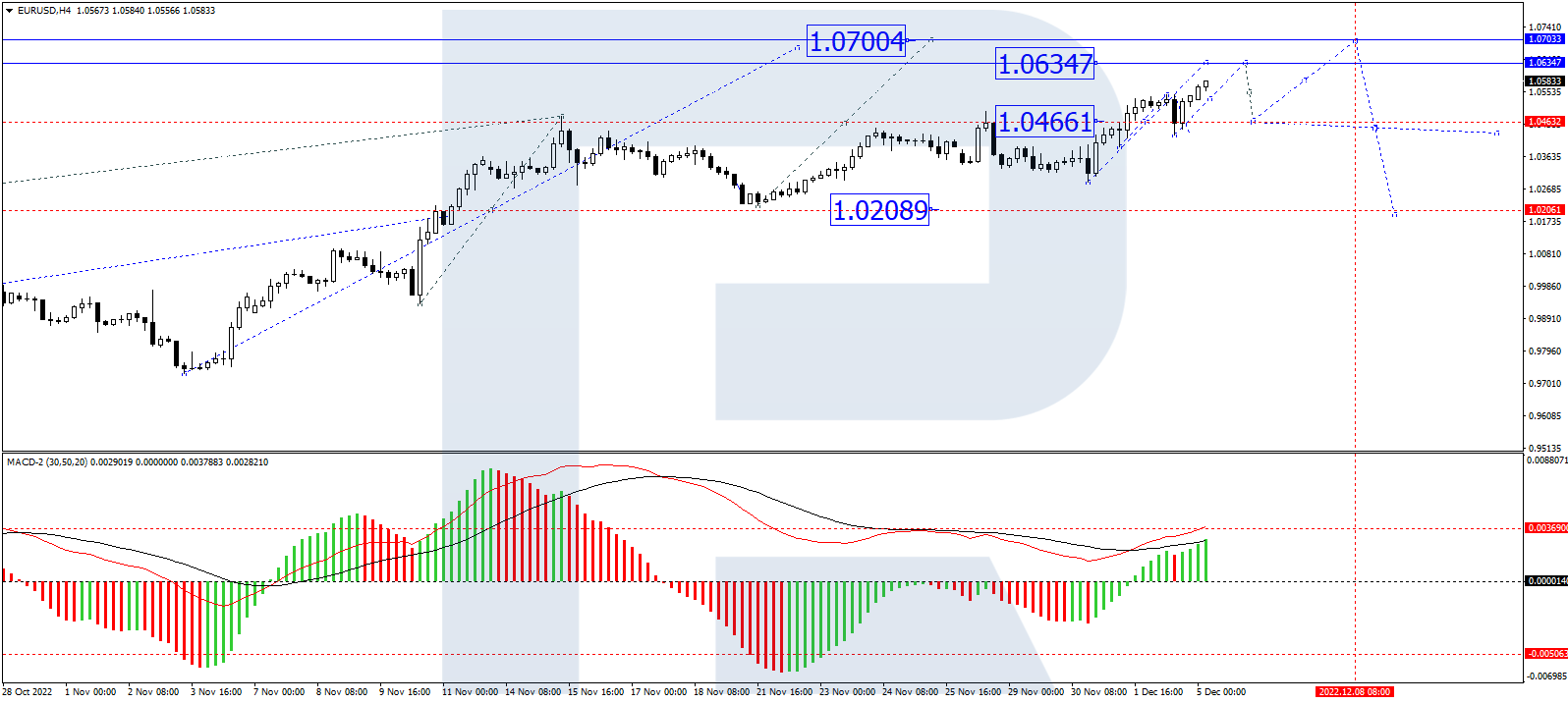

On H4, the currency pair has formed a consolidation range around 1.0466. Today the market is trying to break it upwards. The structure of growth is expected to extend to 1.0634, and after it is reached, a link of correction to 1.0464 is not excluded, followed by growth to 1.0703. Technically, this scenario is confirmed by the MACD: its line is directed strictly upwards, which suggests further growth.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

On H1, the pair has completed an impulse of growth to 1.0531. Today the market has formed a consolidation range around it, and with an escape upwards, it extends the structure of growth to 1.0634. Technically, the scenario is confirmed by the Stochastic oscillator. Its signal line is above 80 and shows no evidence of decline as yet.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026