By InvestMacro.com | #stocks #XLU #utilities

Utilities Select Sector SPDR Fund End of Day Update: October 06 2022

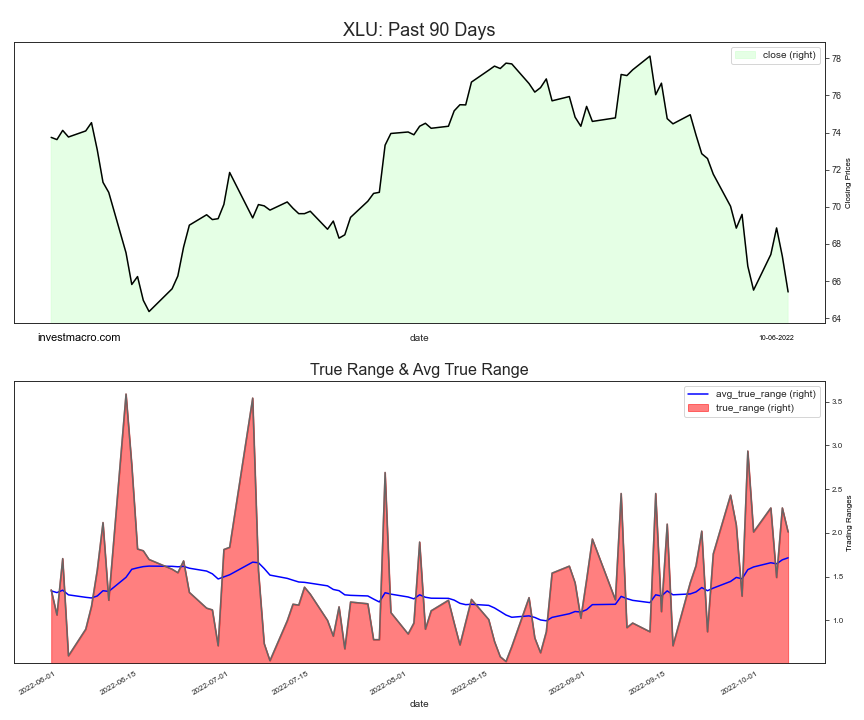

The Utilities Select Sector SPDR Fund (XLU) ETF finished the day with a fall of -2.85 percent and closed the day not too far off the lows of the day near the 65.41 price level, according to unofficial data at the New York close.

The XLU, an ETF that tracks the SP500 Utilities Select Sector Index, opened the day trading at 67.04 with the high of the day being 67.15 and the low of the day at 65.32.

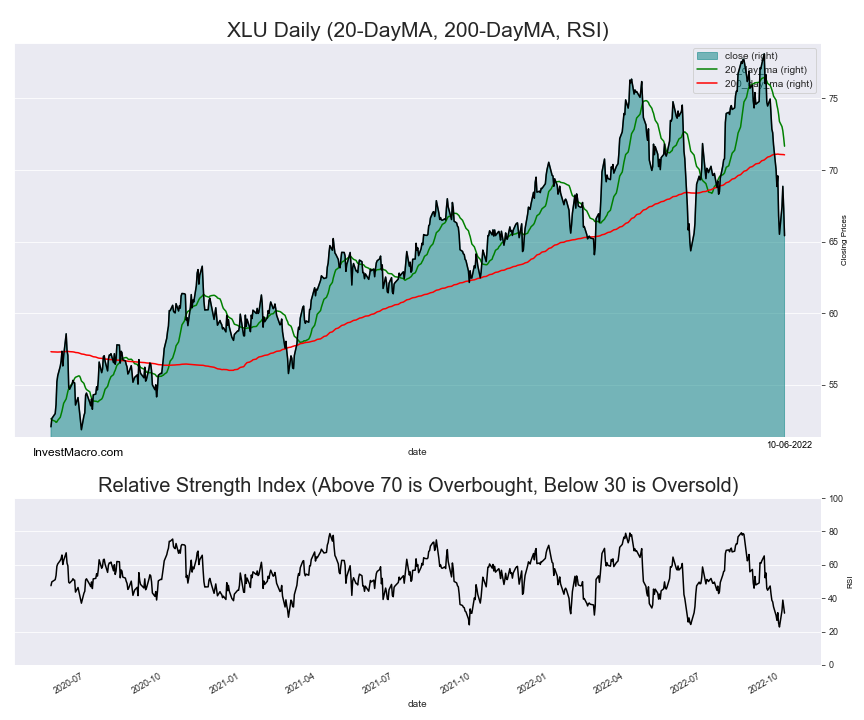

XLU has recently fallen below the 200-day moving average and has seen a deep descend after hitting a recent high over $78.00 in the middle of September.

The XLU RSI level is Bearish

The Relative Strength Index, an indicator that can indicate overbought (above 70) and oversold levels (below 30), shows that the current RSI score is at 31.0 for a Bearish reading on the daily time-frame.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

XLU Price Trends

The XLU has fallen by -9.90 percent over the past 10 days while seeing a decrease by -14.41 over the past 30 days. The 90-day change is -12.52 while the 180-day return and the 365-day return are -3.64 and 3.40, respectively.

By investmacro.com

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026