By RoboForex Analytical Department

On Monday, the final trading day in October, the market major is declining, balancing near 0.9940.

Active growth of the instrument stopped right after the European Central Bank last week lifted the interest rate to 2.00% annual. This was just the decision know long before, so on facts investors just took the profit.

The main event of this week will be the meeting of the US Federal Reserve System. The is hardly any doubt that the interest rate will grow by 75 base points to 4.00% annual. Much depends on the comments of the Fed: investors need to understand whether the rate will keep growing at such speed.

EUR/USD volatility will grow on Wednesday.

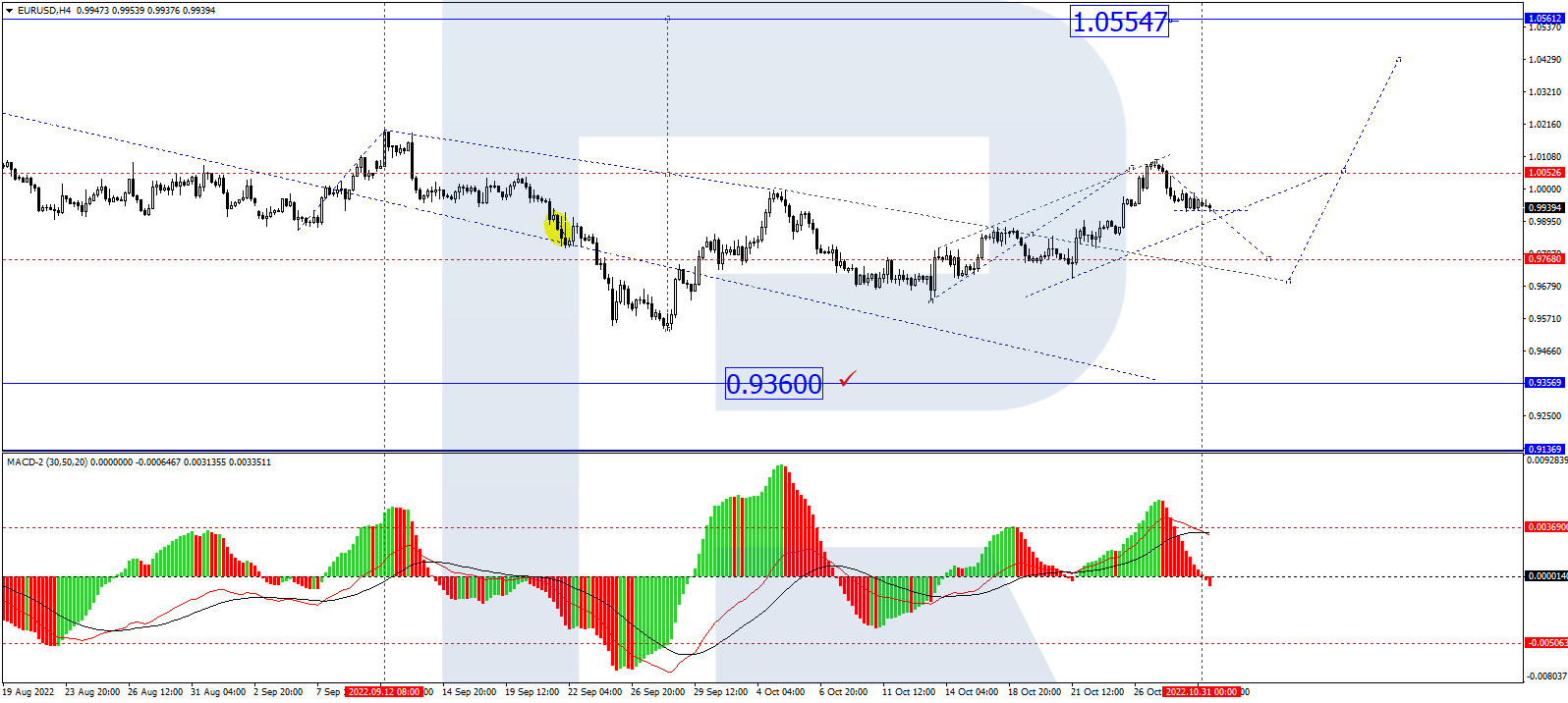

On H4, the market performed a wave of growth to 1.0090. Today the market continues developing a correction. The level of 0.770 is likely to be reached. Then a wave of growth may start for 0.9920. Practically, a consolidation range is likely to form between these two levels. With an escape upwards, another structure of growth is likely to develop to 1.0440. Technically, this scenario is confirmed by the MACD: its signal line is under zero and keeps going down to new lows.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

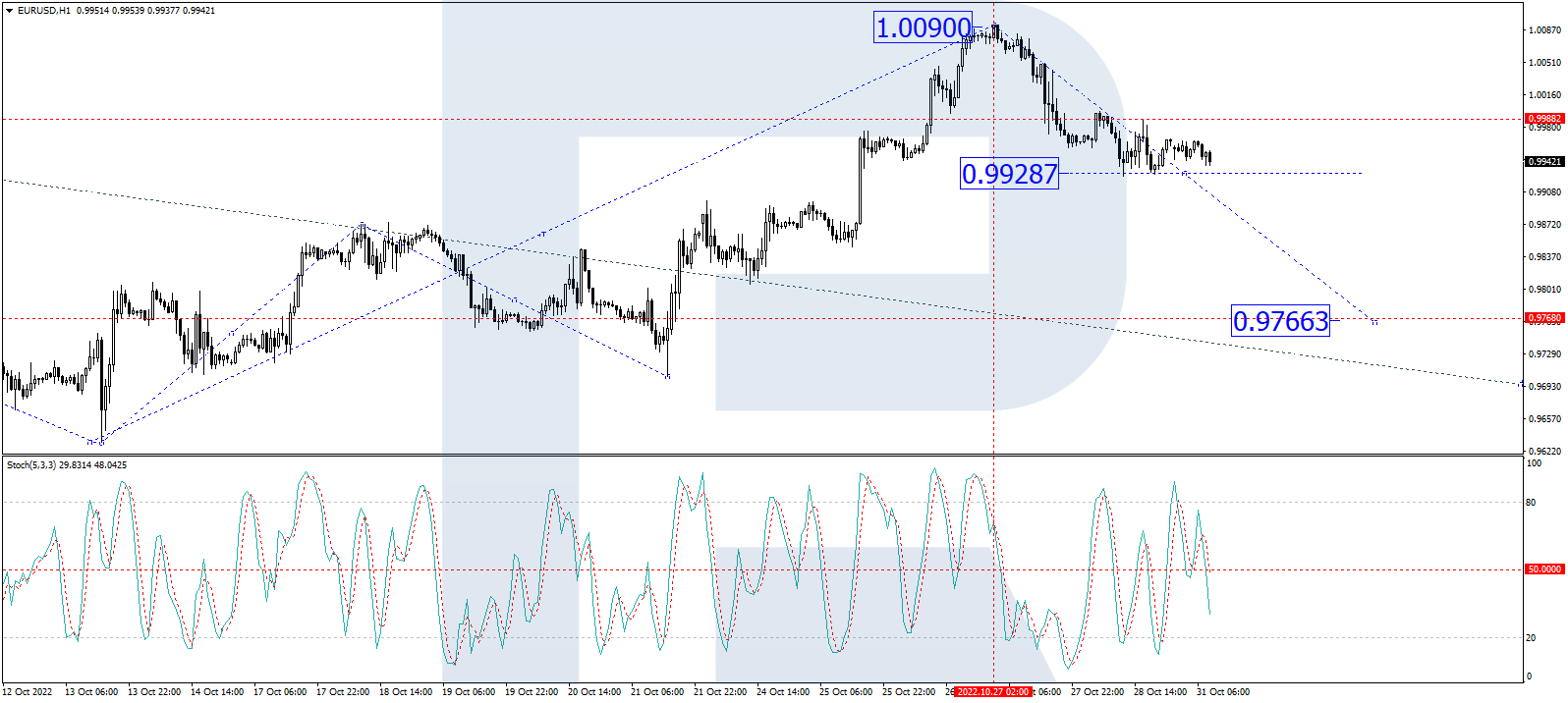

On H1, EUR/USD has completed a structure of a wave of decline to 0.9930. At the moment, the market has formed a consolidation area above it. We expect an escape downwards and a decline to 0.9766. After this level is reached, a link of growth might develop to 0.9930, from where the trend may continue to 1.0440. Technically, the scenario is confirmed by the Stochastic oscillator: its signal line is headed downwards, to 50. Upon breaking this away, the trend should continue to 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026