By RoboForex Analytical Department

The commodity sector remains rather tense on Monday; Brent is trading at $102.75.

Global geopolitics is what investors are focused on right now. Any complications in this area muddy the water one way or another, and it’s bad news. Last weekend, the Kosovo situation escalated – a gas pipeline “Balkan Stream” is going through Serbia, which doesn’t recognise the independence of Kosovo. The pipeline delivers natural gas from “TurkStream” to Hungary.

Later this week, OPEC and OPECF+ will have meetings. The OPEC+ agreement is ending in August and the organisations are set to discuss options to increase oil production. First of all, it depends on Saudi Arabia, a country that still has the potential for oil extraction expansion. However, Saudis don’t seem to be interested in it.

The latest report from Baker Hughes showed that over the past week, the Oil Rig Count in the US gained 6 units, up to 605. In Canada, the indicator increased by 13 units, up to 137.

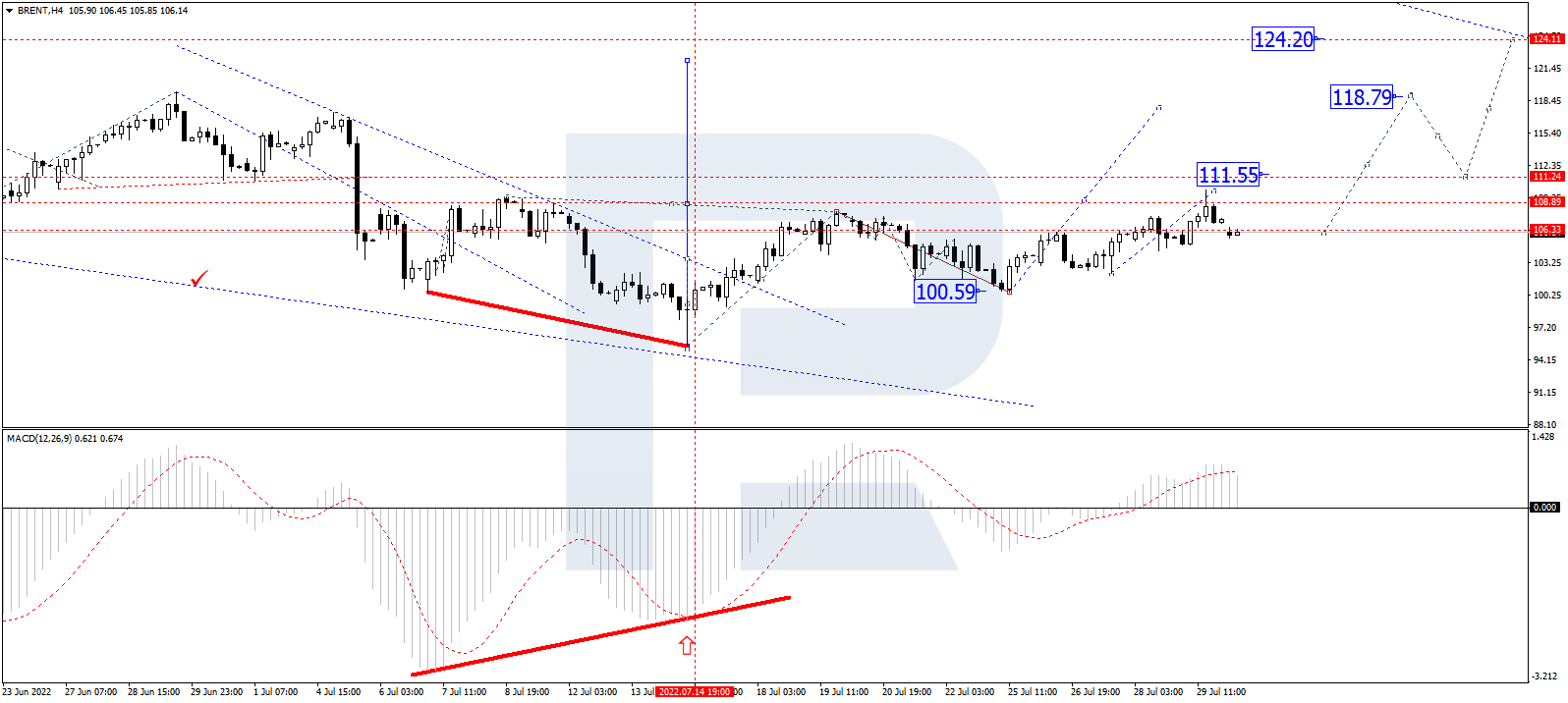

On the H4 chart, Brent is forming the third ascending wave with the target at 111.55 and may later correct down to 106.16. After that, the instrument may resume trading upwards with the short-term target at 118.80. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving above 0 inside the histogram area. Both the line and the price chart may yet continue to move upwards.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

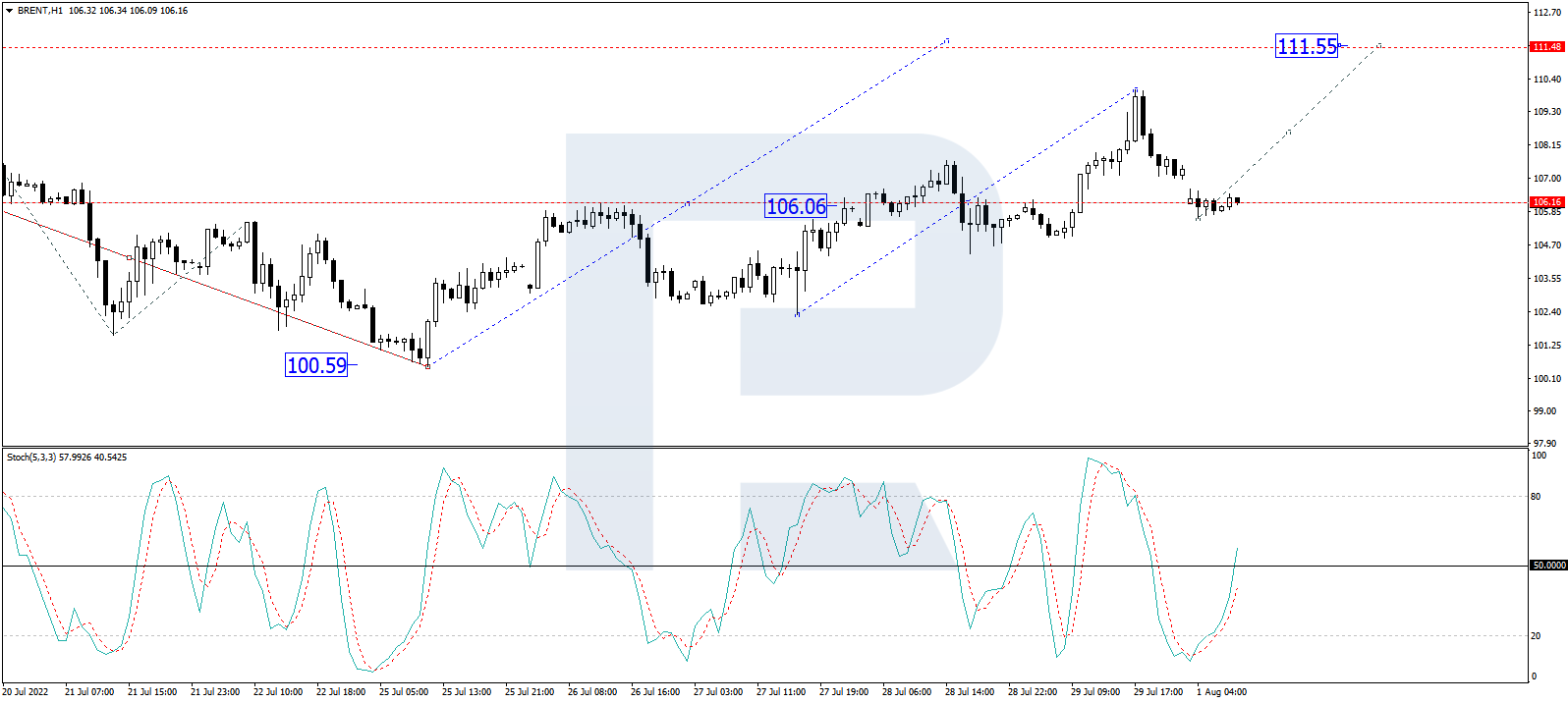

As we can see in the H1 chart, after finishing the descending correctional structure at 106.16, Brent is consolidating above this level. Possibly, the asset may break the range to the upside and start another growth with the target at 111.55, or even extends this structure up to 118.70. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: after breaking 20, its signal line is heading towards 50. Later, the line may break the latter level and continue growing to reach 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026