By Dan Steinbock

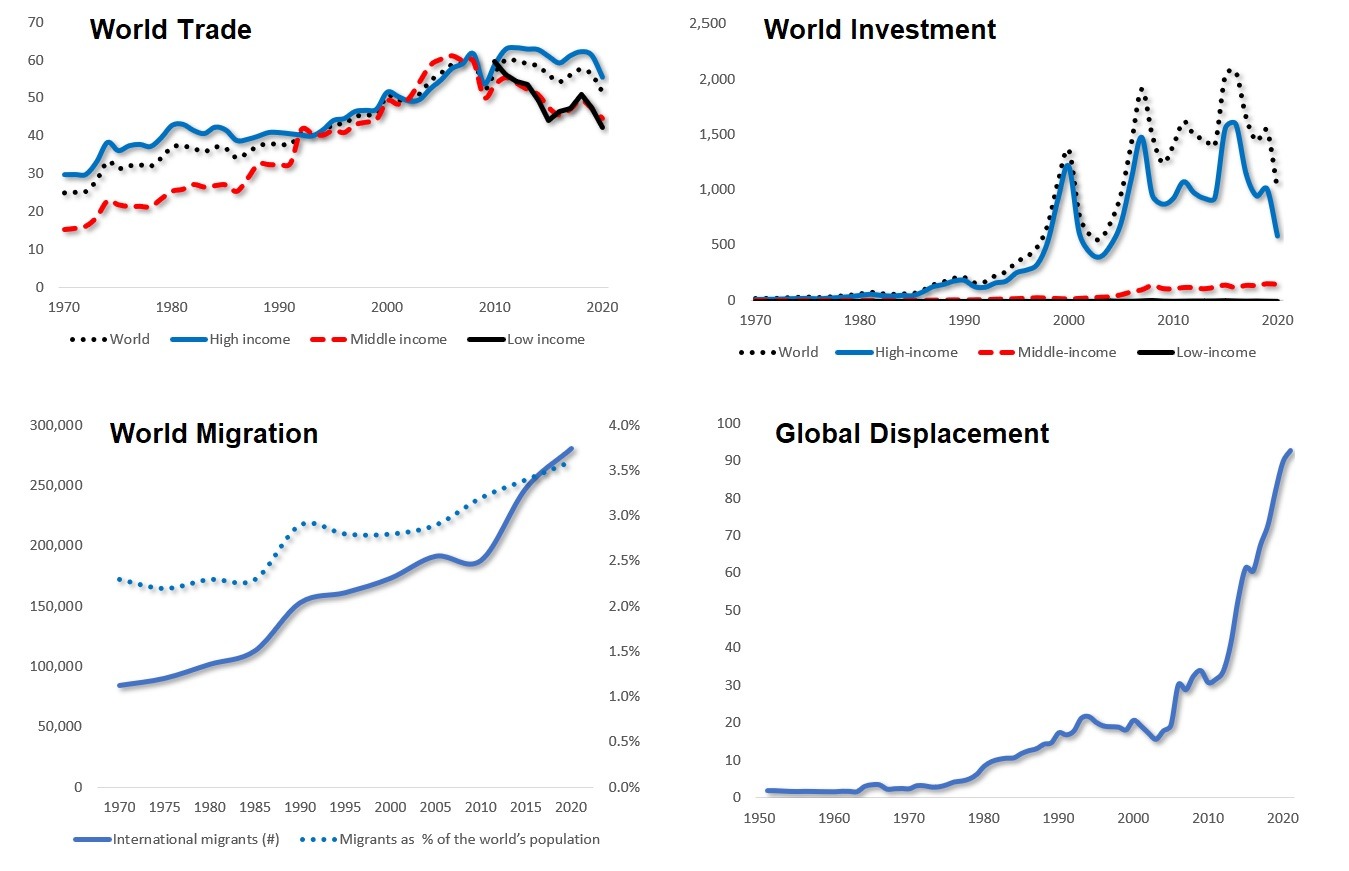

– Over the past decade, global economic prospects have been penalized by the fall of world trade, investment and migration, coupled with the unwarranted suffering of over 100 million globally displaced. It’s a prologue to an untenable future.

The postwar wave of globalization benefited mainly the advanced economies. It was only after 1980 that some large developing countries, particularly China, broke into world markets for manufactured goods and services, while also attracting foreign capital. This era of globalization eclipsed with the global recession in 2008.

As the G20 cooperation subsequently dimmed, so did global growth prospects, too.

Between November 2008 and 2016, global imbalances steadily worsened as a result of increasing trade discrimination. It was only in 2017 that there were some signs of trade recovery.

Yet, that historical opportunity was missed with the U.S. trade wars, followed by waves of COVID19 pandemic, the consequent global depression and nascent Cold Wars.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Global economic integration is often measured by world trade, investment and migration, although technology and finance could be added to the list.

The net effect of the past decade? Plunging trade and investment, slowing migration and explosion of global displacement.

Falling world trade

In particular, the fleeting gains of the U.S.-Sino trade truce were derailed by the global pandemic that caused both services and goods trade to contract by 30 percent in mid-2020. Subsequent gains have been penalized by new waves of pandemic variants and the worsening international economic landscape.

Last year, the World Trade Organization (WTO) anticipated global merchandise trade volume to grow by 10.8 percent, followed by a 4.7 percent rise in 2022. But these projections were unlikely to materialize even before the Ukrainian crisis.

Progress since the plunge of 2008 has been largely reversed. Trade as percentage of world GDP has fallen back to the level where it was over 15 years ago. Geopolitics derailed the potential for global recovery well before the pandemic, due to protectionism and new Cold Wars, compounded by the Russia sanctions.

Plunging world investment

Before the 2008 global crisis, world investment soared to almost $2 trillion. But the hoped-for rebound proved a pipe-dream, due to the tariff wars and the pandemic. High-income economies play a critical role in world inward investment flows. Yet, even before the Ukrainian crisis, world investment had plunged to a level which was first reached already in the late 1990s.

In 2020, global flows of FDI fell by one third to $1 trillion. That’s below the low of the 2008 crisis, and half of world investment in 2007. Decades of progress have been reversed in just few years.

Globalization undermined

Sources: Difference Group and a. Trade as average of exports and imports; and as % of GDP (World Bank/OECD; b. FDI Inward Flows in $ billions (UNCTADSTAT). c. UN/IOM, d. UNCHR

In the process, the poorest economies have been hurt the most. And that pain is only about to begin.

Slower migration

Over the last two decades, the number of international migrants has climbed to 281 million people. Yet, global migration has been slowing since 2008, particularly in advanced economies. Due to the pandemic, the stock of international migrants has increased only by 2 million; a fourth less than expected by mid-2020.

Let’s put these figures in historical context.

Between 1870 and 1914, some 10 percent of the world population migrated in search for a better life. While the absolute number of international migrants has over tripled in the past half a century, their relative share stayed below 2 percent until 2010 and is today 3.6 percent of world population; a third of what it was a century ago.

Explosion of global displacement

And as migration flows decelerate or are being blocked, the number of globally displaced has exploded, compounded by the post-9/11 wars and external interventions since the Arab Spring, which the West initially saw as the prelude to “democratization” in the Middle East, a bit like the devastated Ukraine today.

As a net effect, the number of forcibly displaced has more than doubled in the past decade. The Ukraine crisis alone is projected to internally displace up to 6.7 million people and 4 million displaced abroad.

Despite COVID-19 mobility restrictions, the total figure exceeded 92 million at the year-end of 2021 and has recently soared over 100 million.

In other words, the number of the globally displaced is soon over twice as high as it was after two world wars, the Holocaust, and Hiroshima and Nagasaki in 1945.

If that’s the outcome of “peacetime conditions,” one shudders with horror the effect of wartime conditions in the early 21st century.

A prelude to darker futures?

In the past half a decade, the costs of missed opportunities amount to trillions of dollars. Given continuing policy mistakes, worse looms ahead.

Growth scenarios that still seemed likely in early 2022 will not materialize because they were projected in fall 2021, when

- a truce subdued the U.S.-Sino trade war;

- Ukraine’s proxy conflict had not yet erupted;

- Sanctions targeting the world’s 11thlargest economy, the largest natural gas producer and third-largest oil producer, had not yet been launched.

- And the Federal Reserve had not initiated its aggressive rate hikes and quantitative tightening, which will cause lost years in the West and lost decades in the Global South.

As long as current policies remain in place in the West, sanctions will undermine U.S. growth, destabilize the Russian economy, penalize the fragile Euro area and slow Chinese growth – all of which will have an adverse impact on economic prospects in South and Southeast Asia.

The Global South will pay much of the bill; in economic costs and human lives.

The longer the unwarranted stagnation will prevail, the greater the likelihood that current Cold Wars will turn into Hot Wars, at the cost of future generations, even our planet.

That’s something that none of us may want. But it is the net effect of shortsighted policies in the prosperous West.

About the Author:

Dr. Dan Steinbock is an internationally recognized strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more, see https://www.differencegroup.net

Versions of this commentary have been published by multiple major dailies around the world. It is based on a report recently published by the Austrian National Bank (OeNB) and the Austrian Federal Economic Chamber (WKÖ). See also https://www.differencegroup.net

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026