By RoboForex Analytical Department

EUR/USD is steadily rising and has already reached 1.0138. After testing 1.0000 for several trading sessions, the pair reversed upwards after all.

Investors are now switching their attention to the ECB rate decision. There is no doubt that the rate will be raised by at least 25 basis points in July, but there are opinions and expectations that the regulator might be more aggressive and announce a 50-point rate hike in September. These factors are strongly in favour of bulls. Well, even July’s hike will be the first one since 2011.

However, this decision might not be enough to reverse the pair and push it upwards, because the US Fed is also acting very aggressively and many investors are using the “greenback” as a “safe haven” asset. The decline of the European currency does cause a problem for the ECB and might boost inflation, which is already high above its target level. The moves to strengthen the Euro are now considered highly doubtful; that’s why the current movement is probably just a correction before the major currency pair resumes the downtrend. The overall downside target might be at 0.9000.

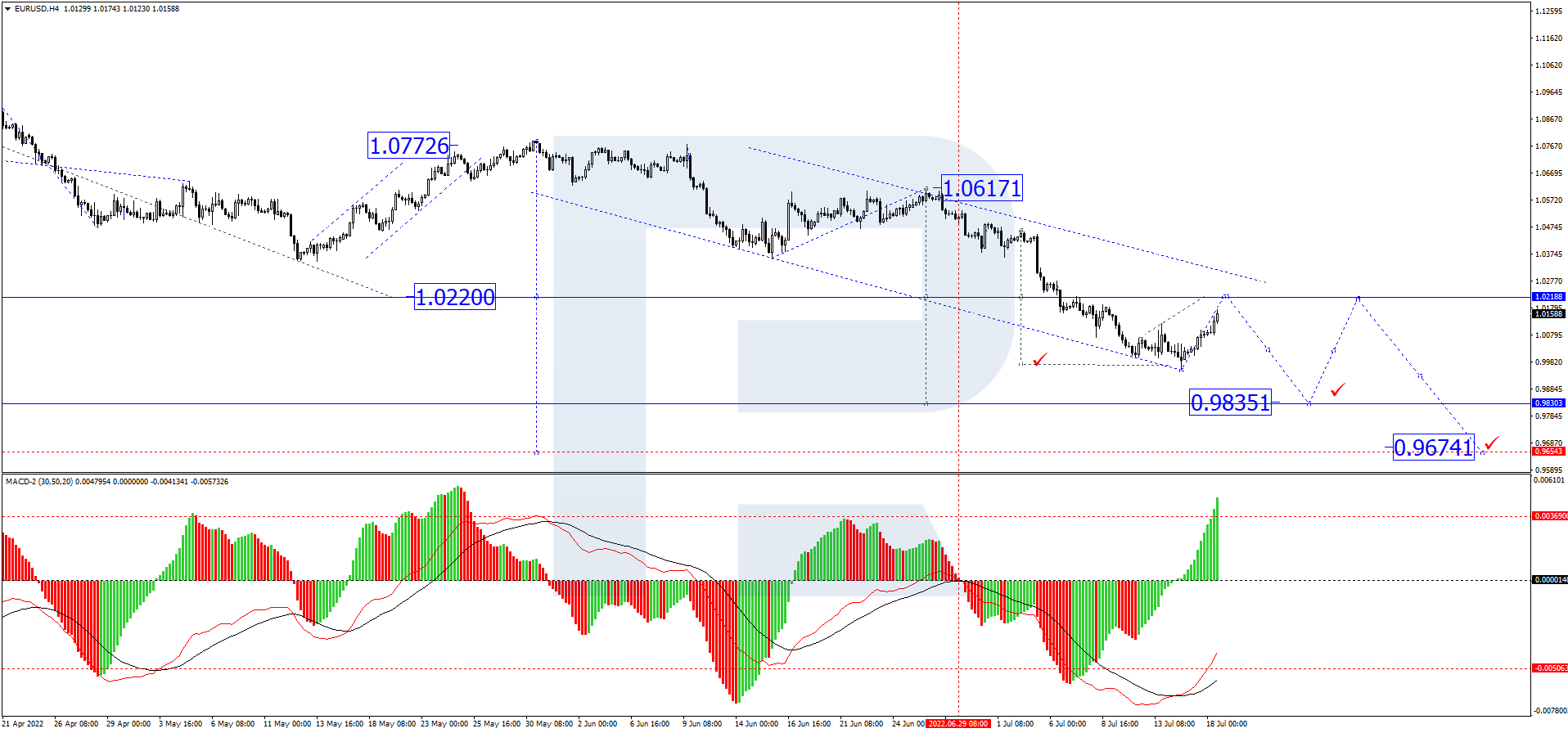

On the H4 chart, after completing the third descending wave at 0.9955, EUR/USD is correcting upwards to test 1.0220 from below. Later, the pair is expected to resume trading downwards with the target at 0.9835. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is growing towards 0. In the future, it may rebound from this level and resume falling to update the lows.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

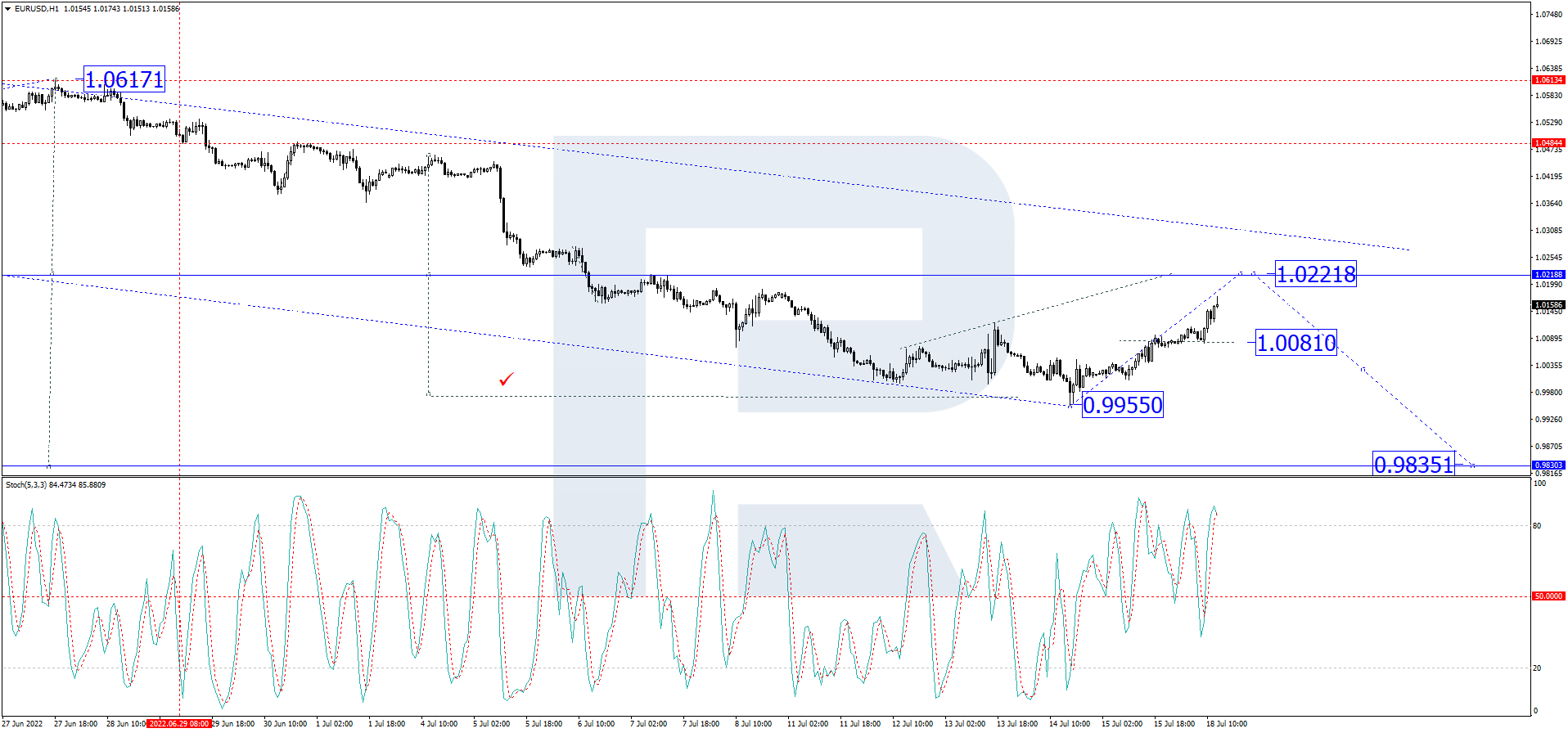

As we can see in the H1 chart, having finished the descending wave at 0.9855, forming a new consolidation range above this level, and then breaking it to the upside, EUR/USD has reached 1.0081; right now, it is forming another consolidation range around the latter level and may later break it upwards to extend this structure up to 1.0220. After that, the instrument may resume trading downwards. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: after breaking 50 upwards, its signal line is moving above 80. In the future, the line may fall to rebound from 50 and resume growing to return to 80.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026