By ForexTime

– Global sentiment brightened on Wednesday with equities rebounding after a rally in technology companies helped reverse most of the losses on Wall Street overnight.

We already knew this would be an explosively volatile week for financial markets thanks to speeches from numerous Fed officials, ongoing geopolitical risks, and anticipation ahead of the US inflation report. Since Monday, there have been some significant movements with the dollar rallying to levels not seen in 20 years! Oil prices closed over 6% lower on Monday while gold secured a daily close under the $1855 support! There was some action in the FX space, with commodity currencies like the Australian Dollar and New Zealand dollar depreciating across the board.

With just less than one hour until the latest US CPI report is published, here and some technical setups we have our eyes on.

Dollar Index hovers near 20 year high

King Dollar marched into the week on a high note, reaching levels not seen in 20 years on Monday as U.S Treasury yields climbed on Fed rate hike expectations. Although prices have slightly retreated, the risk-off sentiment stemming from geopolitical risks should keep the DXY buoyed. Dollar volatility could remain a key theme, especially if the pending US CPI report exceeds expectations. Bulls may shift into higher gear on hawkish comments from Fed officials.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Looking at the technical picture, a strong daily close above 104.00 could open a path towards 104.50 and beyond. Sustained weakness below 104.21 could encourage a decline back towards 103.20.

Equally weighted USD bullish

The subtitle says it all.

Prices are heavily bullish on the daily charts. There have been consistently higher highs and higher lows while prices are trading above the 50,100 and 200-day Simple Moving Average. A strong daily close above 1.1835 could encourage a move towards 1.1955. If bulls run out of steam below 1.1835, this could result in a technical throwback that sees prices trade back towards 1.1660 – 1.1600 before bulls return to the scene.

If prices sink back towards 1.1470, the equally-weighted USD index may decline back towards 1. 1300.

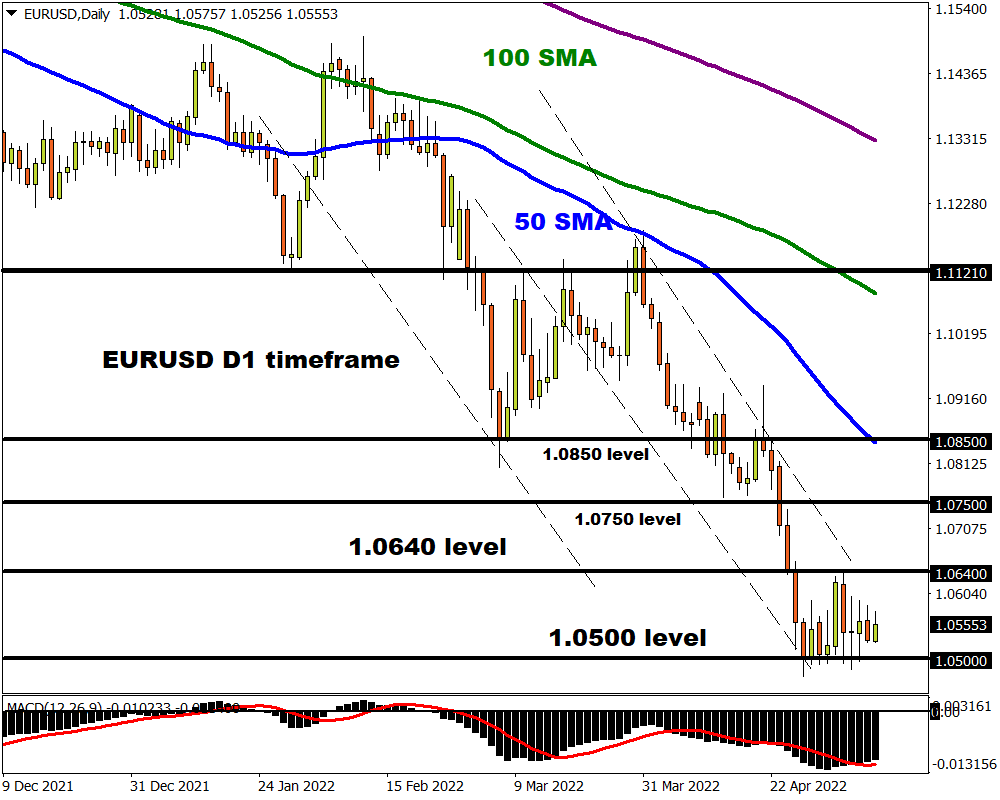

EURUSD on standby…

Where the EURUSD concludes this week may be heavily influenced by the US inflation data. The key levels of interest can be found at 1.0640 and 1.0500. A strong dollar could drag the currency pair well below 1.0500, opening the doors towards 1.0350. Should 1.0500 prove to be reliable support, this could trigger a rebound back to 1.0640.

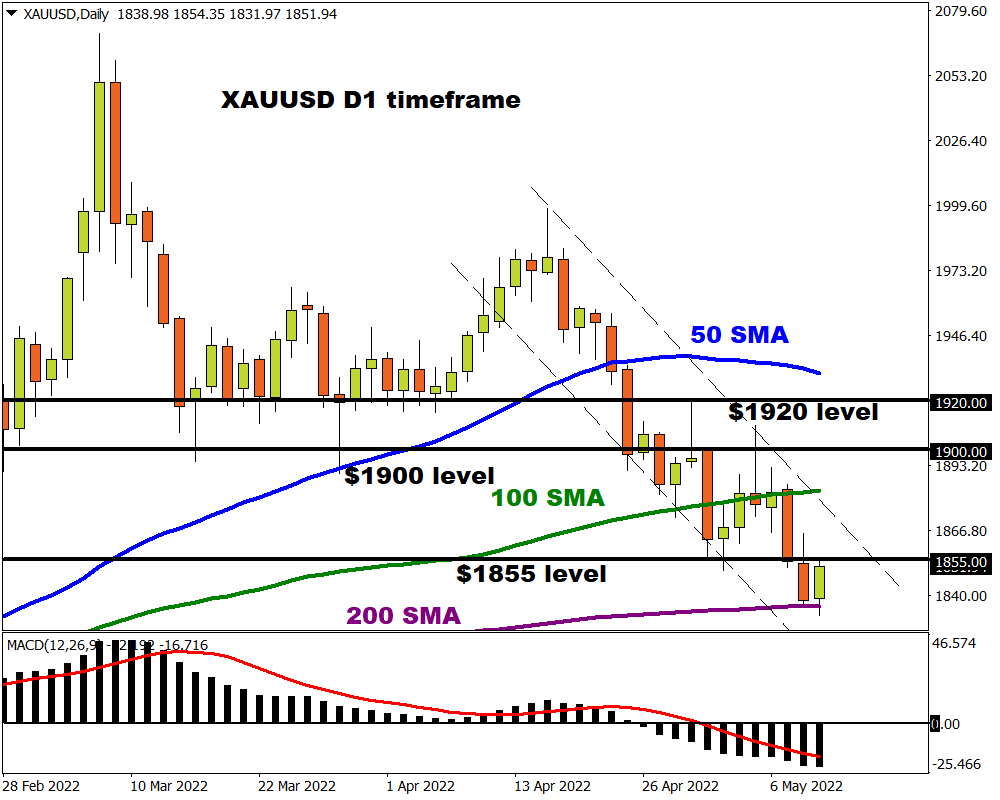

Bonus: Gold glitters ahead of CPI data

A softer dollar has injected gold bugs with renewed confidence ahead of the US inflation. Prices have staged a rebound from the daily 200-day Simple Moving Average but are still below the $1855 support level. Regardless of the recent rebound, the precious metal may face headwinds in the form of rising treasury yields and expectations over the Fed maintaining an aggressive approach towards monetary policy. On the technical front, prices are bearish on the daily charts with support found at $1855. It will be interesting to see whether bulls can defend this level of bear’s drag prices even lower. Whatever the outcome, volatility is certainly on the cards.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026