It’s a new trading quarter people!

Another three months of fresh and exciting opportunities across financial markets.

Today, it’s all about using technical analysis to identify existing/potential trends in the FX space.

EURUSD eyes 1.0850

The EURUSD remains under pressure on the daily charts. Bears remain in control below 1.1000 with the next key level of interest found at 1.0850. A solid break under this point could trigger a decline towards 1.078. If bulls manage to propel prices back above 1.1000, a move towards 1.1120 could be on the cards.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

GBPUSD gearing for a steeper decline

If you are looking for a strong trend, then check out the GBPUSD on the weekly timeframe.

There have been consistently lower lows and lower highs while the MACD trades below zero. A major breakdown could be on the horizon but this will depend on whether bears can conquer the 1.3000 support level. A weekly close under this point may open the doors towards 1.2750. Should 1.3000 prove to be a tough nut to crack, a rebound back towards 1.3300 is likely to happen.

USDJPY approaches yearly high

Things are looking good for USDJPY bulls as prices steadily approach the 2022 high at 125.10.

A strong breakout and daily close above 123.90 could aid the upside and provide a fresh foundation for bulls to retest 125.10. Beyond this point is 125.85 – a level not seen since mid-2015.

Should 123.90 act as resistance, prices could decline back towards 122.50.

AUDUSD breaches 0.7550 resistance level

Things are starting to get interesting for the AUDUSD.

Over the past few months, the currency was stuck within a very wide range with support at 0.6990 and resistance at 0.7550. Earlier this week, prices punched well above 0.7550 for the first time since July 2021. This is certainly a bullish move but a weekly close above this point needs to be achieved for further upside. If this resistance proves too tough for bulls to handle, this could signal a possible selloff next week with 0.7300 acting as a key level of interest.

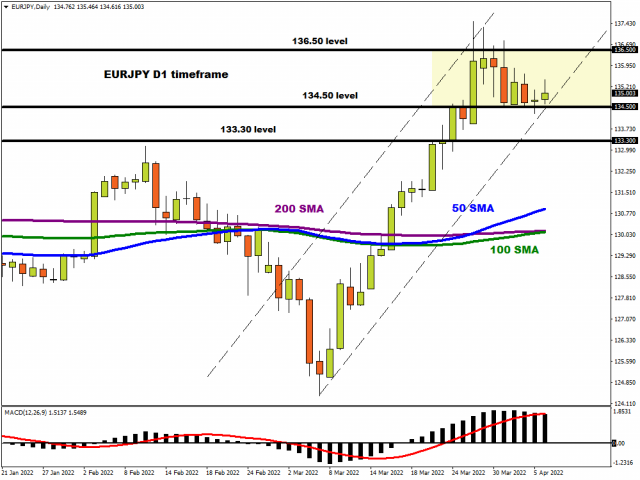

EURJPY balance above 134.50

The EURJPY remains in a bullish trend on the daily charts as there have been consistently higher highs and higher lows. Prices are trading above the 50, 100, and 200 Simple Day Moving Average while the MACD trades above zero. The EURJPY has the potential to rebound towards 136.50 if 134.50 proves to be a reliable support. A decline below this level may open a path back towards 133.30.

EURGBP drops back below 50 SMA

There is a lot going on with the EURGBP. Prices remain as choppy as ever on the daily timeframe, trading around 0.8340 as of writing. The currency pair is trading below the 50, 100, and 200 Simple Moving Average but the MACD trades above zero. If prices break below 0.8300, then a decline towards 0.8250 could be a possibility. A rebound that sees prices back above 0.8380 could encourage an incline towards 0.8420.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026