Currency markets exploded to life this week as global growth concerns, inflation worries, and geopolitical tensions rocked global risk sentiment.

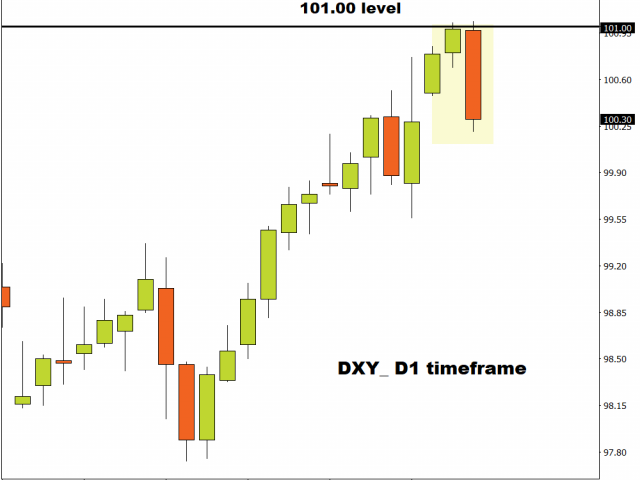

The mighty dollar jumped to a fresh two-year high yesterday only to tumble like a house of cards this morning.

There was no love for the Yen, which collapsed to a 20-year low below 129.00 before clawing back some losses. Even the Aussie made some noise by appreciating against most G10 currencies since the start of the trading week. With so much going on across the FX arena, this presents fresh opportunities and trading setups.

Our primary focus will be on yen crosses, complemented by other movers and shakers.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

As stated earlier, the past few days have not been kind to the yen…

It has weakened against every single G10 currency since the start of the week.

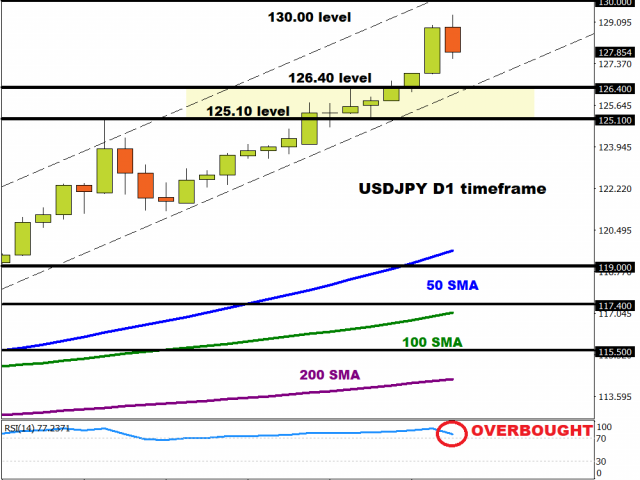

USDJPY closes in on 130…

In recent weeks, after prices broke to the upside above the March high at 125.10 who would have thought that the USDJPY would test 130.00? As the fundamentals drag the yen lower and lower, 130.00 could become reality this month. Looking at the technical picture, the currency pair is heavily bullish. According to the RSI, prices are extremely overbought and have been since mid-March. A technical throwback could be in the making before the USDJPY challenges 130.00.

It may be worth keeping a close eye on how prices behave around 126.40 and 125.10 over the next few days. Should these levels prove to be reliable support, this could encourage a rebound back towards 129.00 and 130.00 respectively. A breakdown below 125.10 may invite bears back into the scene.

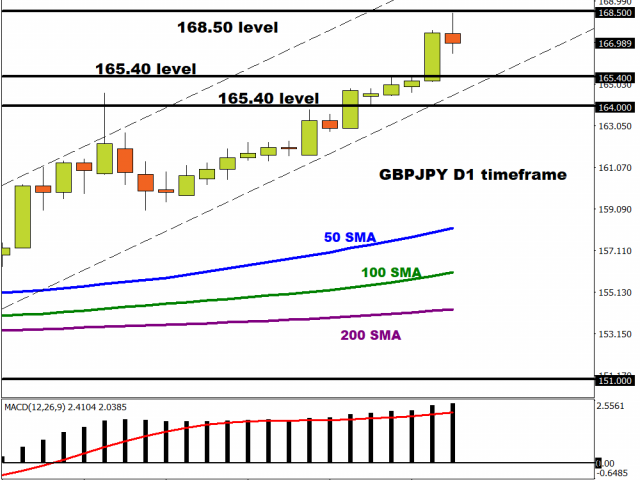

GBPJPY bulls take a breather

It looks like the GBPJPY could be experiencing a minor decline lower before bulls return to the scene.

Prices remain bullish on the daily charts as there have been consistently higher highs and higher lows. The MACD trades above zero while the 50, 100, and 200-day Simple Moving Averages have been left in the dust. Should 165.40 prove to be reliable support, a move back towards 168.50 could be on the cards. Alternatively, a decline below 165.40 could trigger a selloff to 165.40 and lower.

EURJPY remains bullish for now

A weakening yen continues to drive the EURJPY higher. Prices remain heavily bullish as there have been consistently higher highs and higher lows. A technical bounce from 138.00 could encourage a move towards 139.70 and 140.00. Should 138.00 prove to be unreliable support, prices could slip back towards 137.00. Weakness below 137.00 may drag the EURJPY back within the 250-pip range.

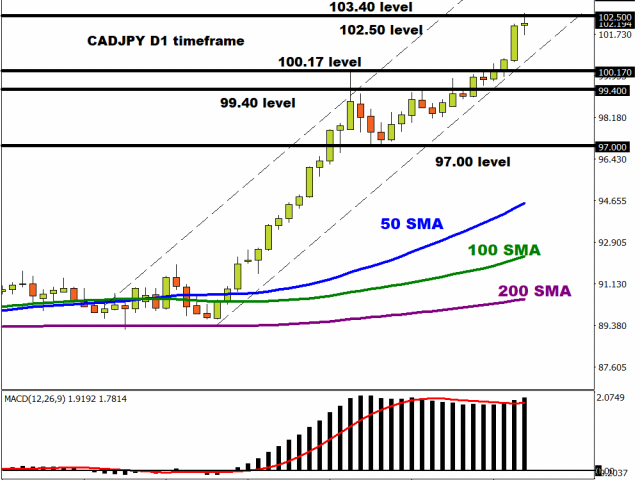

CADJPY touches 102.50

The trend is certainly a traders friend on the CADJPY. Prices are moving higher with bulls in the driving seat. A strong daily close above 102.50 could inspire an incline towards 103.40. Should 102.50 prove to be reliable resistance, a throwback towards 100.17 could be on the table before prices push higher. Weakness below 100.17 may trigger a selloff towards 99.40 and 97.00.

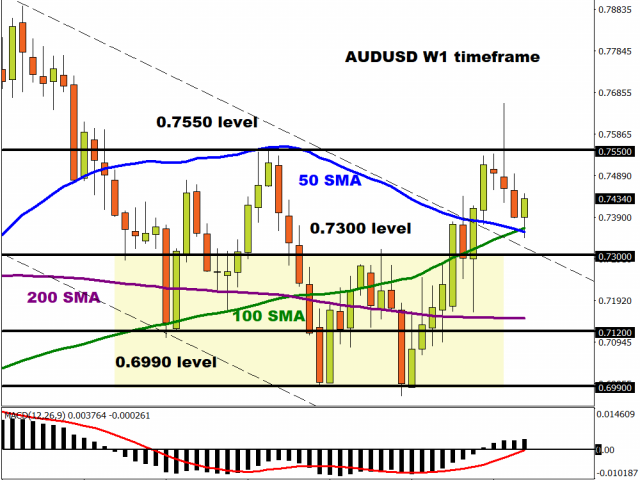

AUDUSD fights back

After experiencing three consecutive weeks of losses, the AUDUSD is attempting to stage a rebound. Prices are trading around 0.7430 as of writing while the MACD on the weekly timeframe trades above zero. A strong move above last week’s high of 0.7492 could signal an incline back towards the 0.7550 resistance level. If 0.7550 is conquered, this may open doors towards 0.7600 and beyond. Alternatively, weakness below 0.7300 may result in a selloff towards 0.7120.

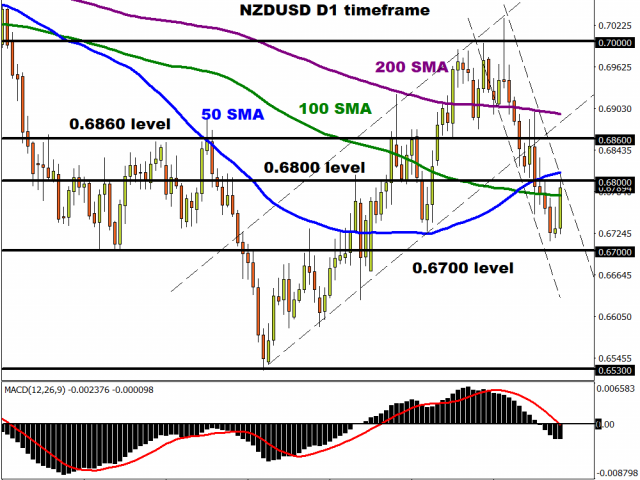

NZDUSD to resume downtrend?

The NZDUSD remains bearish on the daily charts. However, today’s rebound could throw the spanner in the works for bulls. If the 0.6800 level proves to be reliable resistance, a decline back towards 0.6700 is likely. Alternatively, a strong move and daily close above 0.6800 could trigger a move higher to 0.6860 and 0.7000.

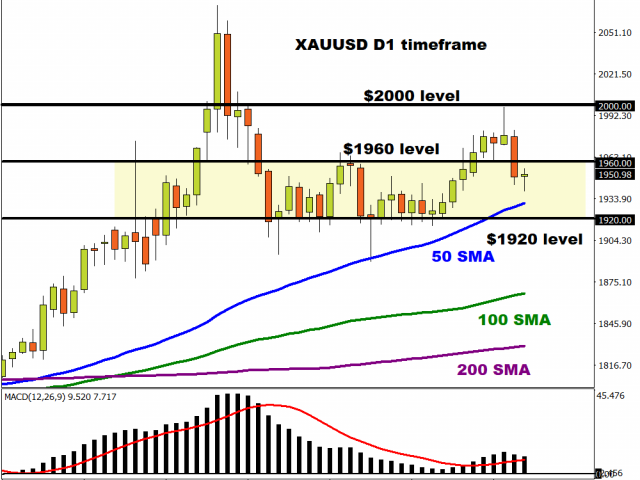

Gold back within a range?

After experiencing a heavy selloff yesterday, gold has found itself back within a range with support at $1920 and resistance at $1960. The precious metal may need a fresh fundamental spark to experience another breakout/down. In the meantime, it may be wise to sit back and enjoy the view.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026