Of course, global financial markets will continue monitoring the latest developments surrounding the Russia-Ukraine war, and whether Putin or the Western allies will escalate this crisis and darken the global economic outlook.

Amidst all that raging uncertainty, at least we’ll know this much – here are some of the major scheduled economic events and data releases due in the coming week:

Sunday, March 27

- CNH: China February industrial profits

- UK, European daylight savings time begins

Tuesday, March 29

- JPY: Japan February jobless rate

- AUD: Australia February retail sales and weekly consumer confidence

- USD: US March consumer confidence, Philadelphia Fed President Patrick Harker speech

Wednesday, March 30

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

- EUR: Eurozone March economic and consumer confidence

- USD: US 4Q GDP (third estimate)

- US crude: EIA weekly US crude inventories

Thursday, March 31

- JPY: Japan February industrial production

- CNH: China March PMIs

- GBP: UK 4Q GDP (final)

- EUR: Eurozone February unemployment rate

- USD: US February personal income and spending; PCE deflator; weekly jobless claims; New York Fed President John Williams speech

- Brent: OPEC+ meeting

Friday, April 1

- CNH: China March Caixin manufacturing PMI

- EUR: Eurozone March CPI (preliminary)

- USD: US March nonfarm payrolls, ISM manufacturing

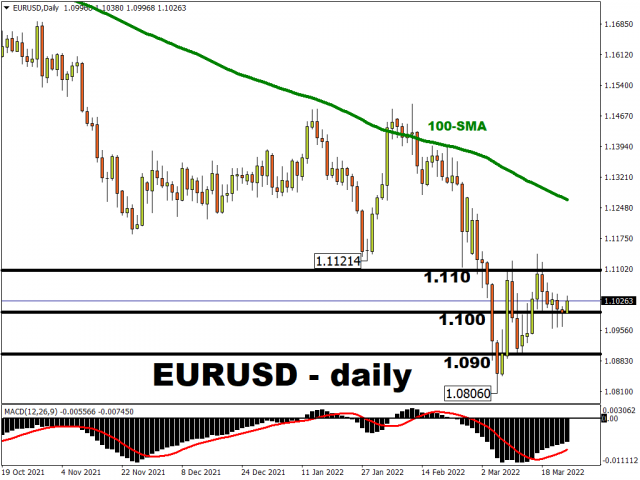

Euro bulls have done well in recent weeks to push EURUSD off the 1.08 floor from earlier this month, which were the lowest levels for the world’s most popularly traded currency pair since the onset of the pandemic.

Despite a series of higher lows since, EURUSD still needs to register a daily close above 1.110 to further embolden euro bulls.

For those focused on EURUSD’s fundamental picture, the first day of April could kick off with a bang:

- 9:00AM GMT: The EU’s March consumer price index is forecasted to have surged to a fresh record high of 6.4%.

- 12:30PM GMT: The March US nonfarm payrolls report is estimated to print a headline figure of 450k, marking a 15th straight month of job gains, while the unemployment rate is forecasted to tick lower to 3.7% – its lowest since the pandemic.

READ MORE: What are nonfarm payrolls and why do markets care?

We note that both the European Central Bank and the US Federal Reserve are pressing ahead with wanting to raise interest rates despite the uncertainties stemming from the Ukraine crisis.

Both central banks have one shared aim: to rein in red-hot inflation. The risk to such hawkish intentions however is that it could drag down economic growth, or worse, trigger a recession.

The Fed continues to paint a ‘goldilocks’ scenario, insisting that the US economy is strong enough to withstand higher interest rates. Fed Chair Jerome Powell also recently said that the US labour market has reached “unhealthy” levels, potentially justifying a larger-than-usual 50 basis point hike in May.

Meanwhile, ECB President Christine Lagarde also earlier this week seemingly pooh-poohed the idea of the Euro-area facing a stagflation, despite commodity prices staying stubbornly elevated and a war raging at its doorstep to the east.

Still, markets will be eyeing which data point, be it Europe’s inflation print or the US jobs report, that could give either central bank the bigger excuse to rush interest rates hikes.

Whichever side of the Atlantic throws up the more hawkish data, that could lift that currency higher, potentially shifting EURUSD closer to either 1.12 or 1.08.

However, it must be said that the euro’s upside appears significantly capped as long as it continues wrangling with its worst security crisis since World War 2. Meanwhile, the US dollar finds itself in a supportive environment due to the heightened demand for the greenback as a safe haven asset.

Such factors should translate into limited upside for EURUSD, with the world’s most-traded currency pair likely to maintain a downside bias as long as the conflict between Russia and the West persists.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026