Oil markets will be closely monitoring these events on this final day of March:

- OPEC+ meeting

This alliance of 23 oil-producing nations are set to decide how much more oil to pump out and export to the world for May 2022.

OPEC+ had been gradually raising output by an additional 400,000 barrels per day each month. They’re widely expected to decide the same today for May’s output levels.

And today’s meeting could be another quickie. Their previous meeting held online earlier this month lasted just 13 minutes. So blink and you could miss it.

- US President Joe Biden may announce the release of 180 million barrels (or 1 million barrels a day) of oil from US strategic reserves.

Such a move is intended to bring down gasoline prices in the US.

A release of 180 million barrels, spread out over the coming months, would be significantly larger than the previous two releases from US strategic reserves (30 million announced in March 2022, and 50 million in November 2021).

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Those two previous announcements had little impact on oil markets given their relatively small size.

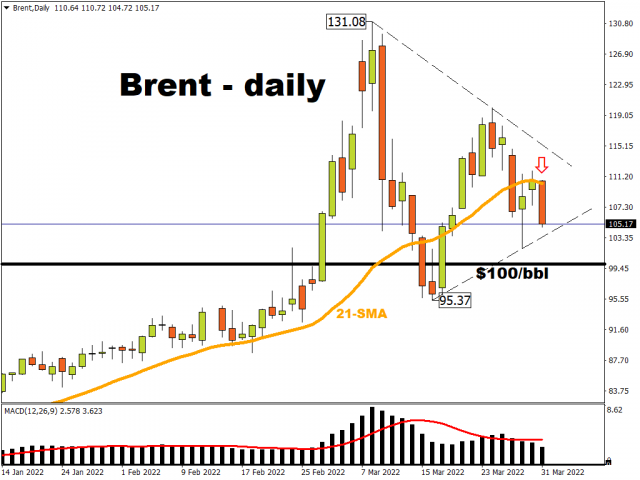

Both US crude and Brent oil prices are pulling back by over 5% today at the mere suggestion that more US oil could flood the markets.

Let’s go back to some basic economics to understand to better understand why oil prices are reacting this way today and why these events matter for markets.

Here’s how supply and demand impacts prices:

- When supply falls short of demand (scarcity), prices tend to rise.

- When there’s an oversupply (supply exceeds demand), prices tend to fall.

Why have oil prices been surging?

The main reason why oil prices have been skyrocketing in recent months is because there is not enough supply to meet the world’s demand for oil.

The world is clamouring for more oil as the global economy continues recovering from the pandemic (more people are jetting off on vacations abroad, daily commutes to work/school runs/social gatherings are ramping up, more of the world’s factories are coming back online, etc.)

According to the IEA, global demand for oil is just a couple million barrels short of pre-pandemic levels of around 100 million bpd.

But oil has been hard to find, due to:

- Russian oil being sanctioned by the US and the UK.

Although the EU has refrained from such a drastic move for the time being, such a risk could resurface the longer the Ukraine invasion continues. As things stand, Russian oil is already struggling to find buyers around the world, as countries fear the potential repercussions of sanctions.

- Lack of spare capacity at OPEC+ members.

Years of underinvestment as well as political instability have led to a severe lack of spare capacity for oil-production in countries such as Nigeria, Angola and Libya. Only the likes of Saudi Arabia, the UAE, and Iraq have sizeable spare capacity of a combined 3 million barrels per day or so.

- But OPEC+ may not be able to pump out more even if they wanted to due to political sensitivities.

Given Russia’s status as an influential member within OPEC+, the alliance may not want to invoke Russia’s wrath by pumping out more oil. Raising the collective OPEC+ output would be seen as bowing to pressure from the US administration. After all, President Biden had attempted (unsuccessfully) since last year to encourage OPEC+ to pump more oil to bring prices down.

How would this reported US strategic reserves release impact prices?

If White House unleashes 180 million barrels into the US economy, that means there is more incoming supply to meet demand.

This brings prices into more of an equilibrium and helps prices moderate (as we’re witnessing now).

Of course, the exact details have yet to be announced. But given the markets’ forward-looking nature, traders tend to react first based on assumptions.

And whether prices can stay at these levels very much depends on the details released by the White House.

- If the headline figure is significantly LESS than 180 million barrels, then oil prices could swiftly rebound (less incoming supply than expected, meaning demand still exceeds supply)

- If the headline figure is significantly MORE than 180 million barrels (after all, the US has about 568 million barrels of oil in its strategic reserves), then prices could fall even further!

- Markets will also want to see whether the White House intends to replenish its strategic reserves.

If markets discover that the US government will be forced later to buy back what oil it had already unleashed from its strategic reserves, then that might only have a fleeting impact on prices.

In other words, if markets get the sense that this extra supply is only a temporary band-aid, and not a lasting solution, then Brent and US crude prices could look past today’s announcement (again, forward-looking) and may not stay down for long.

Also, note that such a move by the White House may also put the pressure on other US allies around the world, such as the UK, Japan, and South Korea to release oil from their respective strategic reserves as well.

Although these non-US amounts will likely be a lot smaller, such a coordinated move could offer more relief to a world that’s desperate for more oil, while helping prices moderate lower.

But a massive release from the US strategic reserves could in turn trigger a response from OPEC+.

To be clear, OPEC+ today is widely expected to stick with its “gradual” approach to restoring oil output (400k bpd hike per month).

Still, the alliance has built a penchant for making shock announcements since the pandemic.

A shock OPEC+ announcement today, or at the next meeting, to halt its pans to raise output could see prices recovering sharply upwards (less supply to meet global demand).

Overall, we still find ourselves in a world where there still isn’t enough oil to meet global demand.

And that should keep oil prices supported around $100, barring a major shocker today.

However, if either the OPEC+ decision or the White House announcement today upends that global supply-demand calculation, that could inject even more volatility into oil prices as we enter the second quarter of what has already been an eventful 2022.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026