The hot US CPI print is still reverberating around markets. US bond markets were closed yesterday for Veteran’s Day. That means there will be some focus on treasury markets on the last trading of the week. Weekly closes are always important, especially after such a major data shock.

The dollar has continued its ascent, rising to 16-month highs and is poised for its best week in almost five months. This has seen oil prices dip as it grapples with a stronger dollar. Other commodities like copper are also lower. A stronger dollar makes greenback-priced metals more expensive to holders of other currencies.

Stock markets closed mixed on Wall Street, while Asian indices are also closing the week in a similar fashion. Evergrande concerns are weighing on Chinese markets, but the Nikkei has ended higher underpinned by tech stocks and brisk earnings. Japanese shares have lagged behind global market and their valuations are low compared with other countries.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

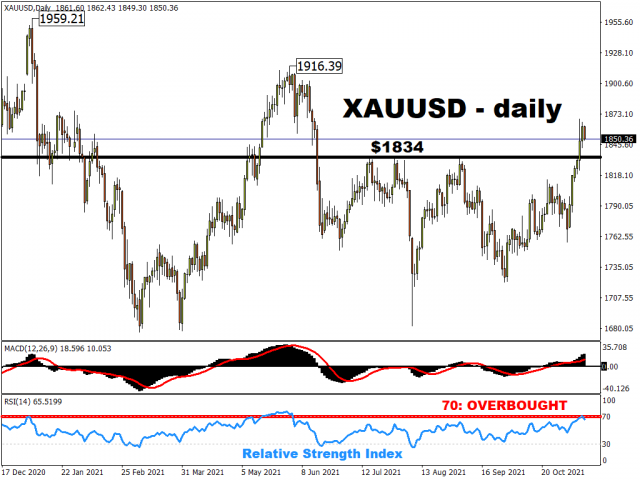

Gold bugs enjoying the limelight

After gold smashed through resistance at $1834, prices remain near the recent highs around $1860. Major support has come in the form of US 10-year real yields falling to record lows at minus 1.25%. Of course, the bumper US inflation has also seen the dollar surge, with traders raising US rate hike expectations for next year.

The precious metal has pull backed overnight. Momentum oscillators are nearing overbought territory so a healthy pause for breath should be constructive. The key upside target is the June high at $1916.

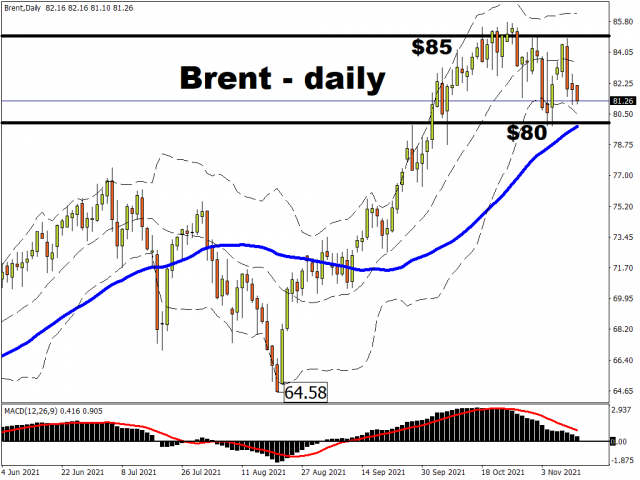

Crude oil falls again

After finding resistance near the recent highs, both WTI and Brent look like they are settling into a wide range. The latest weakness has been driven by President Biden’s statement that reversing inflation has become a top priority, especially in energy. Measures that could be introduced include the release of US Strategic Petroleum Reserves and even banning exports. Lower gas prices in Europe, as Russia finally increases supply, are also adding to downside pressures. This is likely to reduce gas-to-oil demand.

Lows around $80 should hold prices while the top of the recent range comes in at $85.77. OPEC released its latest monthly market report yesterday. This saw only marginal changes to supply and demand estimates for both this year and next. As a result, the report was fairly neutral for the market.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026