The inflation outlook is set to return to centrestage amid these scheduled economic data releases and events for the week:

Sunday, November 7

- Daylight savings time ends in the US

Monday, November 8

- EUR: ECB Chief Economist Philip Lane speeches

- USD: Fed speak – Fed Vice Chair Richard Clarida

- Tencent Music Entertainment Q3 earnings

Tuesday, November 9

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

- USD: Fed speak – Fed Chair Jerome Powell, San Francisco Fed President Mary Daly, St. Louis Fed President James Bullard

- GBP: BOE Governor Andrew Bailey speaks

- CNH: PBOC Governor Yi Gang speaks

- EUR: Germany September trade, November ZEW survey expectations

- USD: US October PPI

- DoorDash Q3 earnings

- Coinbase Q3 earnings

Wednesday, November 10

- CNH: China October CPI, PPI, FDI

- USD: US October CPI

- USD: US weekly initial jobless claims

- US crude: EIA weekly US crude oil inventory report

- Disney Q3 earnings

- Tencent Q3 earnings

Thursday, November 11

- China’s Singles Day sales bonanza – watch Alibaba, JD.com

- JPY: Japan October PPI

- EUR: European Commission publishes updated economic forecasts

- GBP: UK 3Q GDP and external trade, September industrial production

- US bond markets closed for Veterans Day

Friday, November 12

- NZD: New Zealand October manufacturing PMI

- EUR: Eurozone September industrial production

- USD: US November consumer sentiment

Before we take a look at the week ahead, let’s recap how gold prices reacted to last Friday’s US jobs report

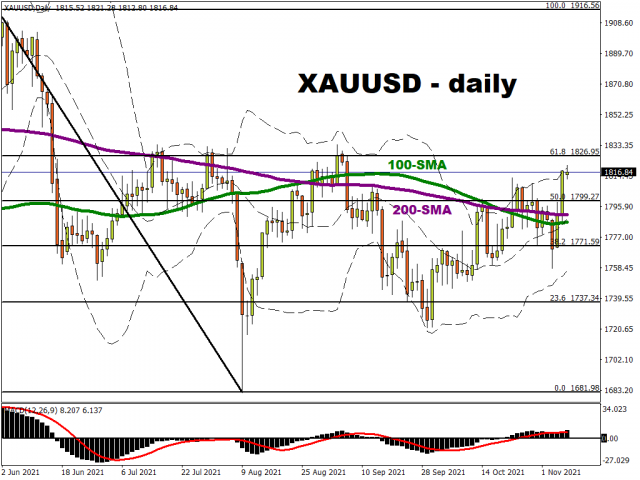

Interestingly, Treasury yields tumbled in the wake of that 531k NFP print which exceeded market estimates for 450k. The drop in yields encouraged zero-yielding bullion to soar past the psychologically-important $1800 mark and post its highest closing price since early-September on Friday. At the time of writing, spot gold is trying to hold on to most of its post-NFP gains.

The movements in bond markets suggest that, because of the solid jobs report, that could bring forward the first Fed rate hike since the pandemic. However, markets also think that the rates liftoff in the US might actually trigger the next recession. Hence the flight to safety towards Treasuries, which saw their yields fall, allowing gold bulls to capitalize.

With all that in mind, markets are set to focus on the incoming US inflation data.

The reason that markets expect the Fed rate hike to happen sooner is because, now that the labour market is showing enough resilience, the US central bank could feel bolder about raising interest rates to rein in stubbornly persistent inflationary pressures. Note that markets are forecasting a 5.9% year-on-year growth for the October US consumer price index – that would be its highest reading since 1990!

Typically, when US interest rates rise, Treasury prices fall and their yields rise, all of which combine to exert downward pressure on gold prices. This time however, as explained earlier, markets think that the Fed would be making a mistake in raising interest rates and potentially trigger a recession instead.

In short, if the US CPI figure continues to climb higher, that could in turn fuel more demand for the safe-haven gold for fear of a Fed-induced recession. Still, from a technical perspective, gold bulls have to conquer a major resistance level around $1830, which had thrice repelled prices back in Q3.

Still on the theme of inflation, China is also set to make a mid-week announcement of its own consumer price index. Add to that the producer prices out of the world’s three largest economies – the US, China, and Japan, all due this week – and investors worldwide could get more clues about how the global inflation outlook is shaping up. Of course, very importantly, how various major central banks react to the threat of stubbornly higher inflation is very crucial to how markets react.

Hence, pay attention to the central bankers’ commentary and the data on consumer and producer prices, all of which could influence greatly the performances of major currencies, bond markets, and ultimately gold as well.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026