By Ino.com

This week we have a stock market forecast for the week of 10/17/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

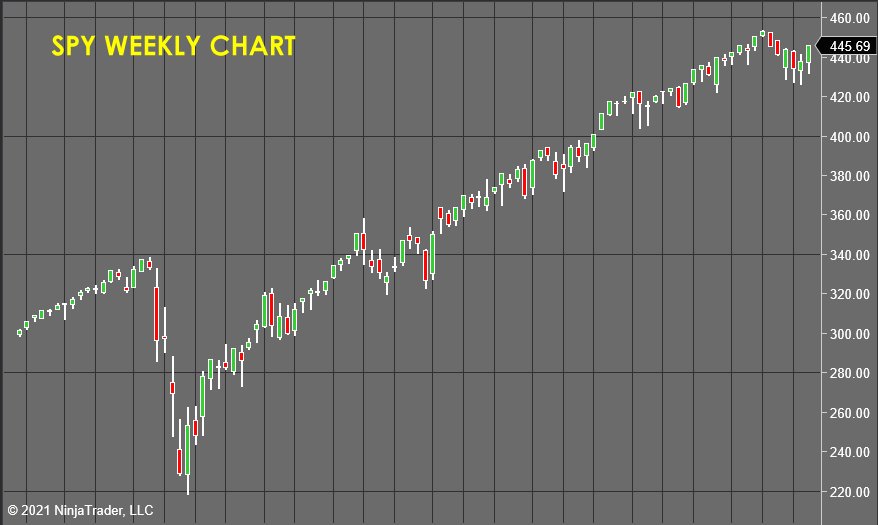

The S&P 500 (SPY)

This week’s rally conforms to my forecast nicely from last week.

Nothing has really changed; I still have a lot of bearish readings for the S&P 500, which conflict with the surge of bullish interest that is currently being absorbed.

I still expect the SPY to rally up to retest the all-time highs and break out to the upside. Unfortunately, that breakout would likely be on low momentum, and the odds are high; it will turn into a false breakout. This would set up a classic “Trap trade,” as the breakout players all react emotionally to the failed breakout.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

I’ll be focused on the long side intraday early next week, then once the breakout gets rejected will flip to the bear side and try to surf the emotional selling down for some nice short intraday trades.

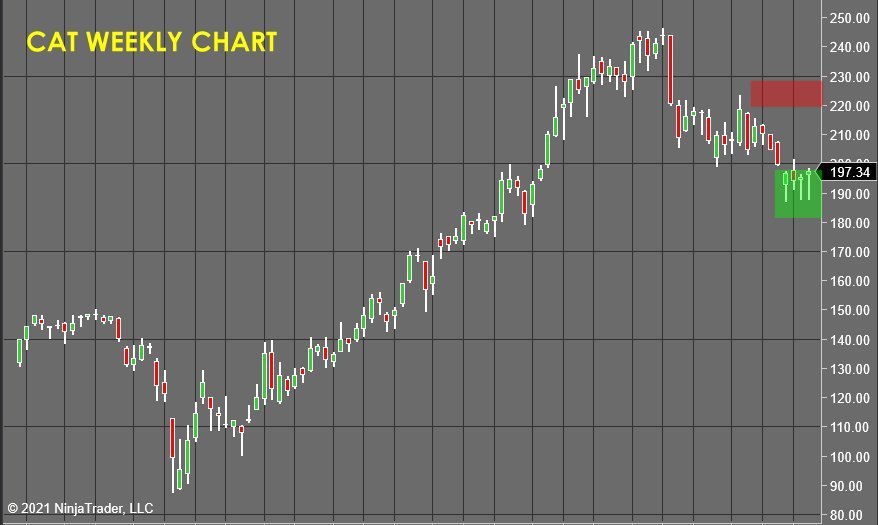

Caterpillar Inc. (CAT)

CAT looked really awful as it retested the lows this week, and then the bulls came back HARD to close out this week’s candle as yet another bottoming tail.

Any time you see the level of uncertainty rise like that, it increases emotional tension, and if that tension gets released in the “right” direction… It can really add fuel and trend your trade in a nice way.

This week, there was plenty of time to get a good fill anywhere in the green zone, with a profit expectation above the $220 per share area.

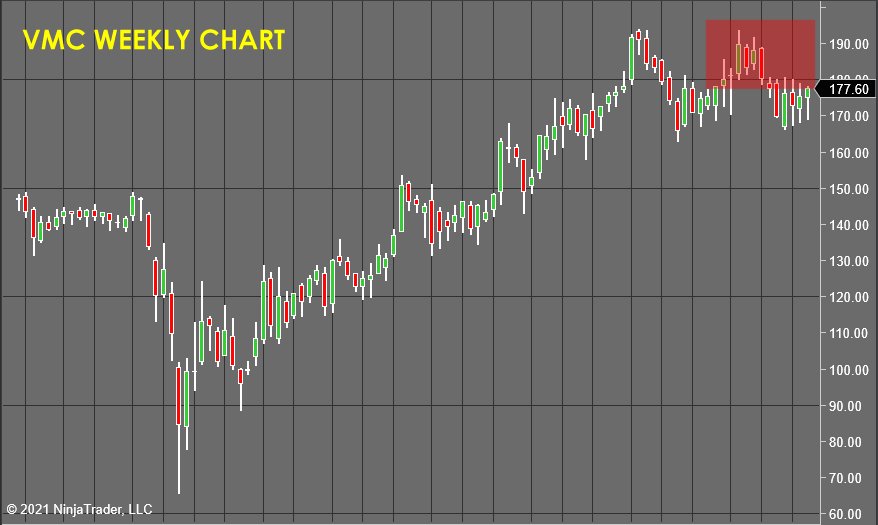

Vulcan Materials Company (VMC)

VMC continues to go nowhere, so I’m happy to have scratched it for an insignificant profit this week. It just never had the “juice” it needed to trend for me.

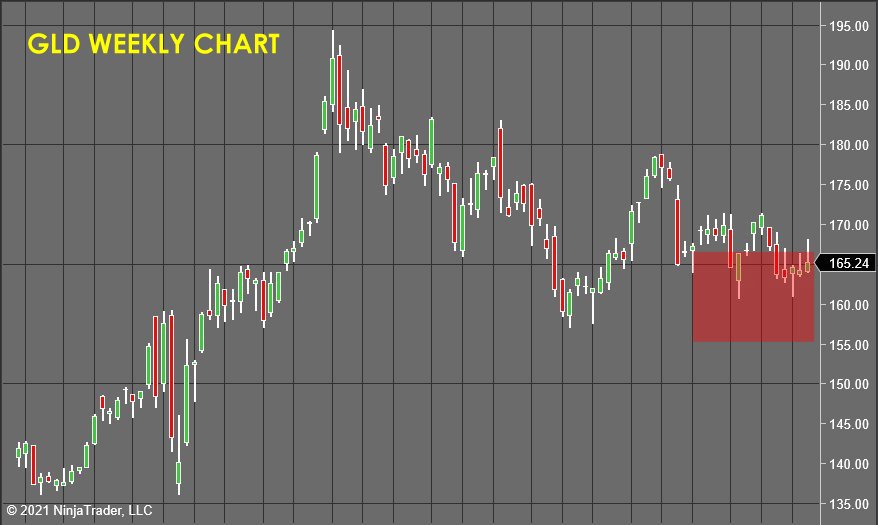

SPDR Gold Shares (GLD)

GLD is still experiencing “the battle of the candles” as it followed last week’s bearish candle with ANOTHER bearish rejection candlestick. The bulls need to show up this week, or I would expect we will wash down to take out the stops under the $160 area.

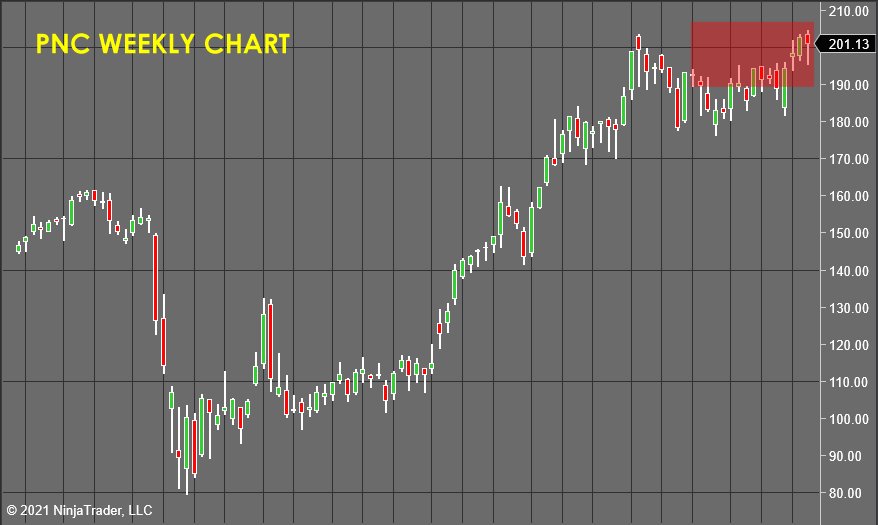

The PNC Financial Services Group, Inc. (PNC)

I’m actually surprised that PNC survived this week! We might be able to pull this one out yet.

We really need the bears to take charge this week if this trade is to ever pay off. I’ll consider a scratch next week if it continues to waffle.

My next major focal point will be if/when the market reverses this week or next.

I want to keep my powder dry until we see that reversal form with some clarity. Then I think it’s time to get aggressive and try to capture a significant correction.

Stay frosty out there; things should get interesting as I still believe there are “October Surprises” lurking out there, which should offer some nice moves for intraday traders.

To Learn How To Accurately and Consistently Forecast Market Prices Just Like Me, Using Market Vulnerability Analysis™, visit Market Forecasting Academy for the Free 5 Day Market Forecasting Primer.

Check back to see my next post!

Bo Yoder

Market Forecasting Academy

About Bo Yoder:

Beginning his full-time trading career in 1997, Bo is a professional trader, partner at Market Forecasting Academy, developer of The Myalolipsis Technique, two-time author, and consultant to the financial industry on matters of market analysis and edge optimization.

Bo has been a featured speaker internationally for decades and has developed a reputation for trading live in front of an audience as a real-time example of what it is like to trade for a living.

In addition to his two books for McGraw-Hill, Mastering Futures Trading and Optimize Your Trading Edge (translated into German and Japanese), Bo has written articles published in top publications such as TheStreet.com, Technical Analysis of Stocks & Commodities, Trader’s, Active Trader Magazine and Forbes to name a few.

Bo currently spends his time with his wife and son in the great state of Maine, where he trades, researches behavioral economics & neuropsychology, and is an enthusiastic sailboat racer.

He has an MBA from The Boston University School of Management.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.

By Ino.com – See our Trader Blog, INO TV Free & Market Analysis Alerts

Source: Weekly Stock Market Forecast

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026