Central banks are front and centre this week, as market participants eagerly await more policy cues amid these scheduled major economic events:

Monday, September 20

- CAD: Canada federal election

Tuesday, September 21

Wednesday, September 22

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

- CNH: China loan prime rate

- JPY: BoJ rate decision

- EUR: Eurozone September consumer confidence

- US crude: EIA crude oil inventory report

- USD: Fed rate decision

Thursday, September 23

- EUR: ECB publishes Economic Bulletin

- Markit manufacturing PMIs for Eurozone, UK, US

- GBP: BOE rate decision

- USD: US weekly initial jobless claims

Friday, September 24

- EUR: Germany IFO business climate

- USD: Fed speak – Fed Chair Jerome Powell, Fed Governor Michelle Bowman, Fed Vice-Chair Richard Clarida, Cleveland Fed President Loretta Mester, Kansas City Fed President Esther George

This will be a week where the spotlight is firmly focused on major central banks, with the US Federal Reserve and the Bank of England set to hold their respective policy meetings.

To be clear, neither the Fed nor the BOE are expected to adjust their policies this week. However, what either central bank conveys about its next move, and specifically the timing for any tapering or rate hike, could send markets into a frenzy.

As things stand, the BOE is thought to be much closer to a rate hike than the Fed:

- Markets are pricing in a 55% chance of a BOE rate hike in March, and 77% chance for a May hike.

- The Fed funds futures are forecasting an 82% chance of a US rate hike only by December 2022.

Generally, the closer a G10 central bank is to a rate hike, the more gains its currency has had. No surprise then that the Pound is the only G10 currency with a year-to-date gain against the US dollar, while also advancing against every single one of its G10 peers so far this year.

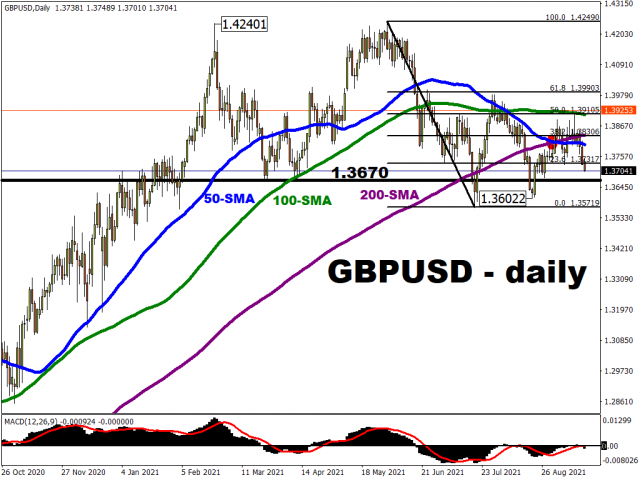

Hence, the policy gap between the Fed and the BOE is set to be manifested via GBPUSD’s performance this week.

The central bank that is perceived to be edging closer towards normalizing its policy settings could see its currency pushed higher by markets.

At the time of writing, GBPUSD is falling on broad dollar strength while concerns that an energy crisis could further stoke inflationary pressures that crimp the UK economic recovery. With the MACD pointing south, further declines could see this currency pair known as ‘cable’ testing the 1.367 region once more, which proved to be a reliable support back in March and early April.

Fed signaling tapering could spell declines for gold, stocks

Also recall how the debate about the Fed’s tapering has dominated market chatter for much of 2021, a discussion that has weighed across major asset classes. That debate is going to come into even sharper focus this week and as we count down the remaining months of the year. After all, Fed Chair Jerome Powell as well as other FOMC officials have already spoken about being open to tapering before year-end.

With that in mind, Friday’s slew of Fed speak could offer more clues to sharpen the central bank’s messaging after the FOMC concludes its mid-week meeting. Also, the Fed’s economic forecasts through 2024, to be delivered right after this week’s FOMC meeting, should be key to the US policy outlook.

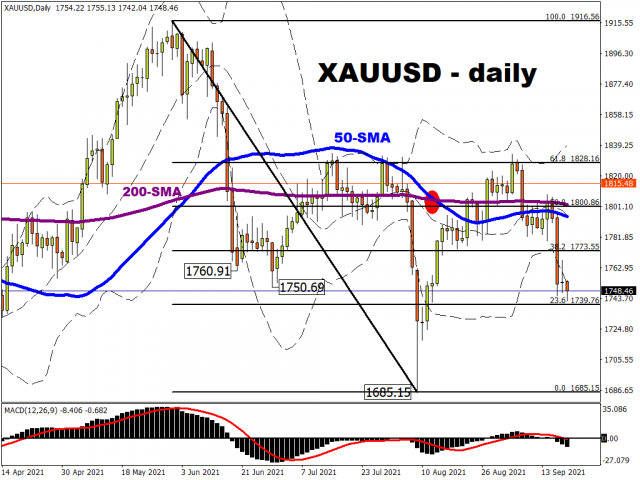

Should the Fed move closer to realizing its tapering of asset purchases before year-end, that could trigger another drop in gold prices, especially if Treasury yields rise further.

Immediate support should be found at the 23.6% Fib line from its June-August declines, which is around the $1740 mark.

A Fed that’s warming up to easing up on its support measures could also keep the S&P 500 subdued below its 50-day simple moving average, potentially losing a key support level that had done remarkably well for much of this year.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026