Article By RoboForex.com

AUDUSD, “Australian Dollar vs US Dollar”

In the daily chart, the asset is forming a quick descending wave inside the downtrend. After testing 23.6% fibo from below, AUDUSD is approaching 38.2% at 0.7052 and may later continue trading towards 50.0% and 61.8% fibo at 0.6758 and 0.6464 respectively. The key resistance is the high at 0.8007.

The H1 chart of AUDUSD shows divergence on MACD, which may indicate a potential correctional rebound after the price 38.2% fibo at 0.7052. the correctional targets may be 23,6%, 38.2%, and 50.0% at 0.7141, 0.7195, and 0.7239 respectively.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

USDCAD, “US Dollar vs Canadian Dollar”

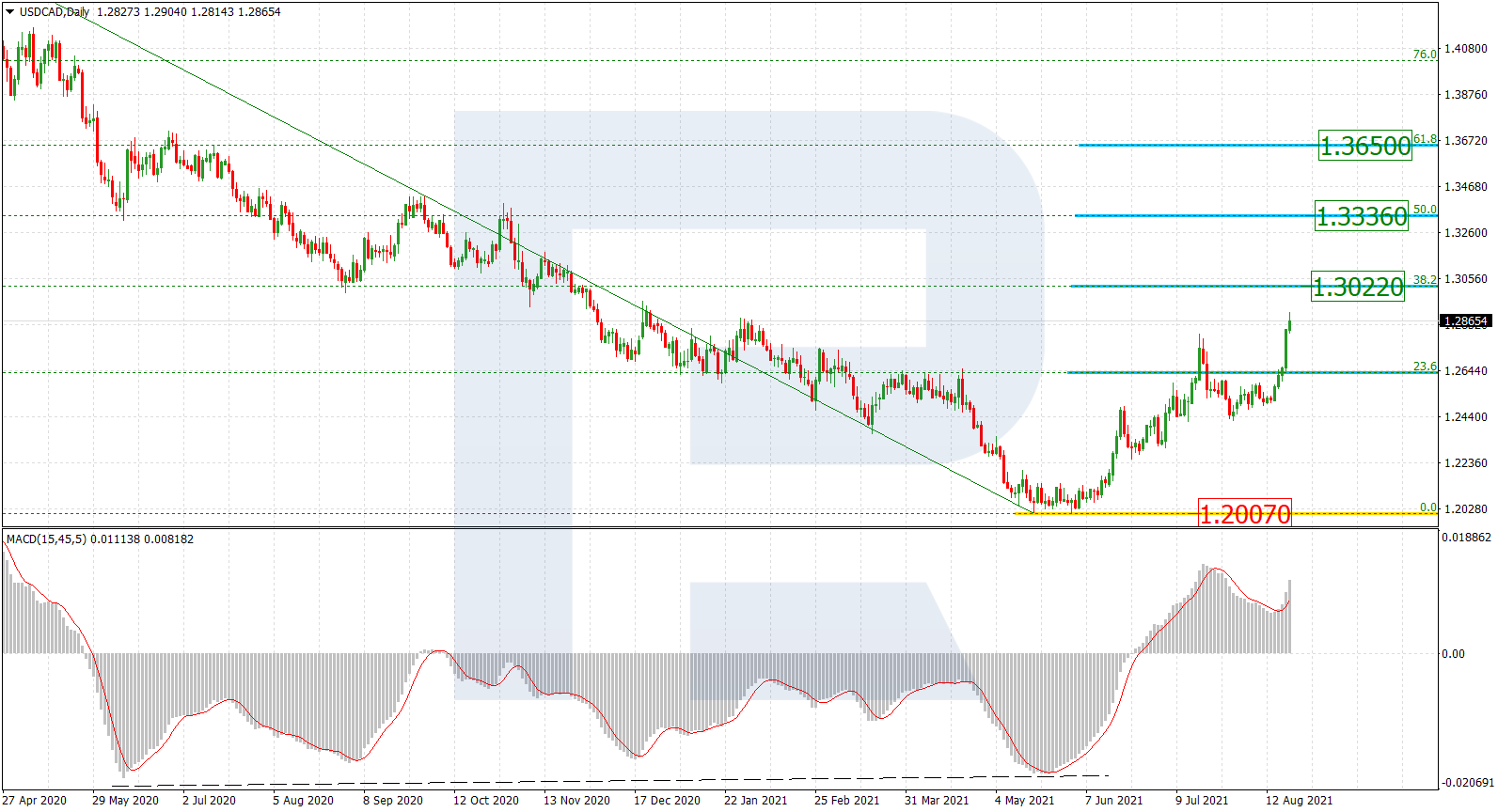

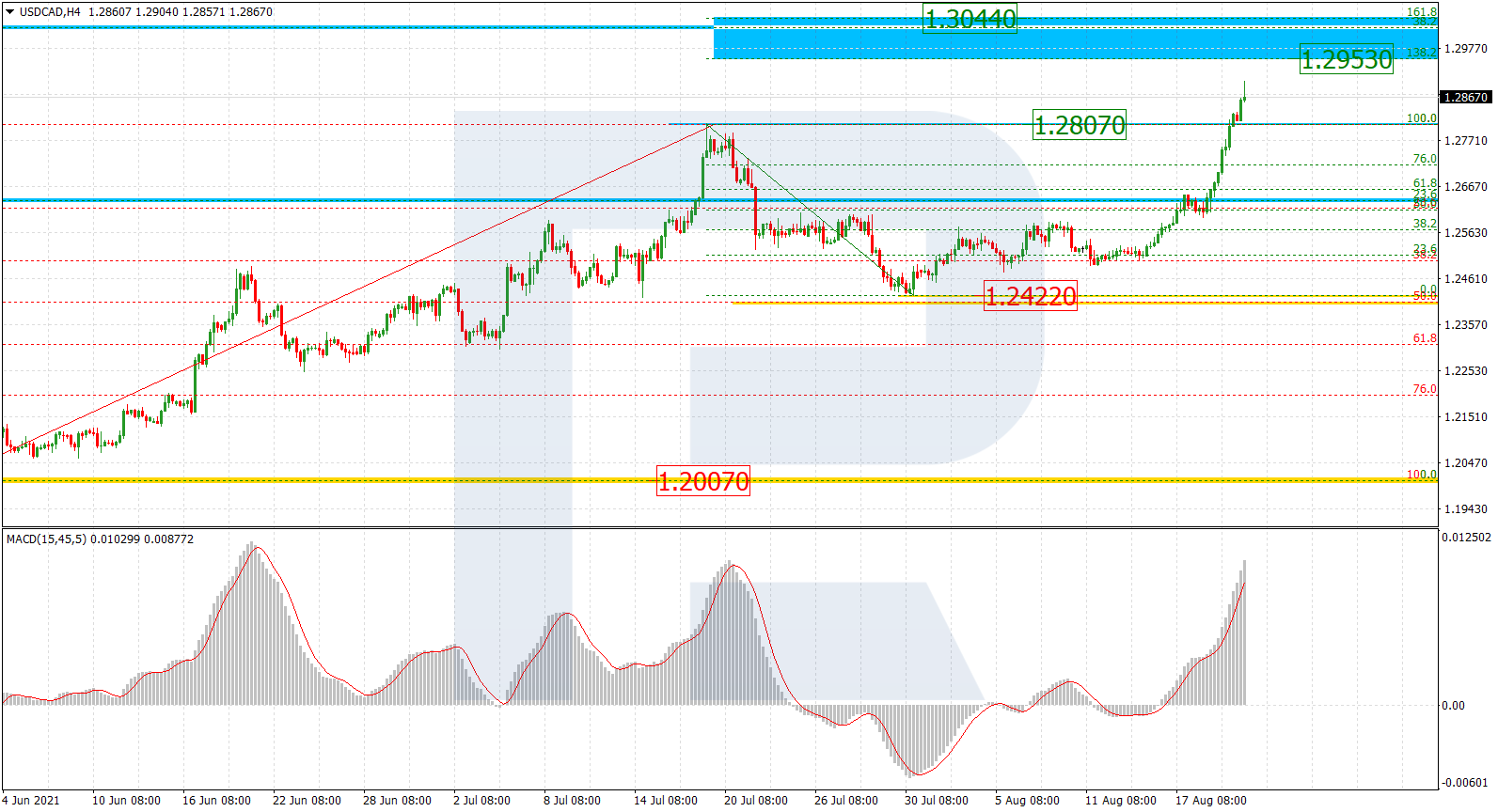

As we can see in the daily chart, the pair is moving upwards, thus forming a new wave to the upside with the targets at 38.2%, 50.0%, and 61.8% fibo at 1.3022, 1.3336, and 1.3650 respectively. The key support remains at the low at 1.2007.

In the H4 chart, after completing the descending correction at 50.0% fibo, the asset has broken its previous high. At the moment, the pair is trading towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.2953 and 1.3044 respectively. The support is the fractal low at 1.2422.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026