By CountingPips.com COT Home | Data Tables | Data Downloads | Newsletter

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday August 17 2021 and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

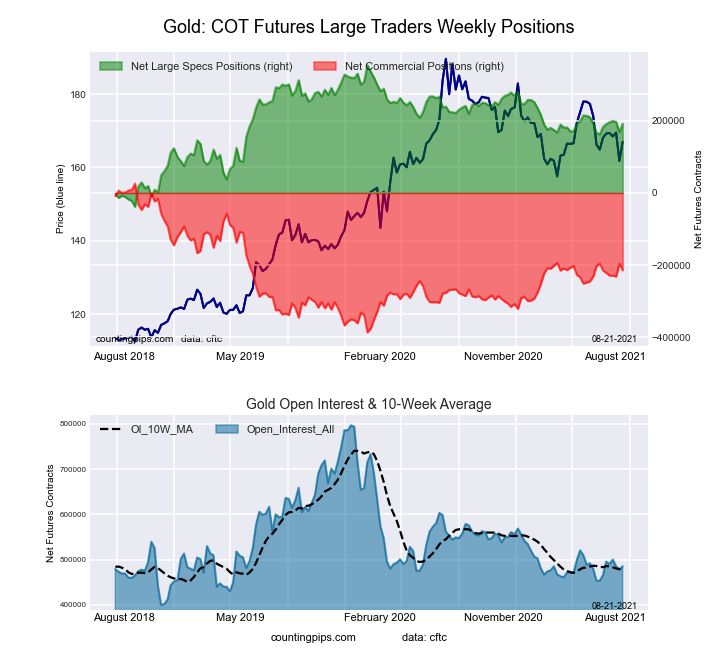

Gold Comex Futures:

The Gold Comex Futures large speculator standing this week resulted in a net position of 191,542 contracts in the data reported through Tuesday. This was a weekly increase of 23,136 contracts from the previous week which had a total of 168,406 net contracts.

The Gold Comex Futures large speculator standing this week resulted in a net position of 191,542 contracts in the data reported through Tuesday. This was a weekly increase of 23,136 contracts from the previous week which had a total of 168,406 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 58.6 percent. The commercials are Bearish with a score of 41.7 percent and the small traders (not shown in chart) are Bearish with a score of 37.9 percent.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 58.6 | 25.4 | 9.1 |

| – Percent of Open Interest Shorts: | 19.1 | 69.5 | 4.5 |

| – Net Position: | 191,542 | -214,000 | 22,458 |

| – Gross Longs: | 284,437 | 123,301 | 44,315 |

| – Gross Shorts: | 92,895 | 337,301 | 21,857 |

| – Long to Short Ratio: | 3.1 to 1 | 0.4 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 58.6 | 41.7 | 37.9 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 2.2 | 0.2 | -23.1 |

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

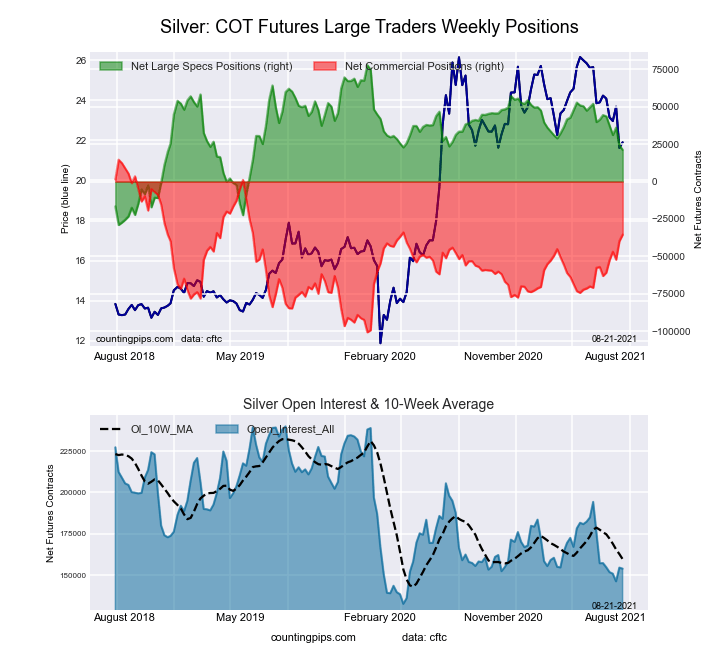

Silver Comex Futures:

The Silver Comex Futures large speculator standing this week resulted in a net position of 21,220 contracts in the data reported through Tuesday. This was a weekly reduction of -3,254 contracts from the previous week which had a total of 24,474 net contracts.

The Silver Comex Futures large speculator standing this week resulted in a net position of 21,220 contracts in the data reported through Tuesday. This was a weekly reduction of -3,254 contracts from the previous week which had a total of 24,474 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 47.0 percent. The commercials are Bullish with a score of 56.6 percent and the small traders (not shown in chart) are Bearish with a score of 23.2 percent.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 41.2 | 36.3 | 17.3 |

| – Percent of Open Interest Shorts: | 27.4 | 59.4 | 8.0 |

| – Net Position: | 21,220 | -35,490 | 14,270 |

| – Gross Longs: | 63,390 | 55,831 | 26,597 |

| – Gross Shorts: | 42,170 | 91,321 | 12,327 |

| – Long to Short Ratio: | 1.5 to 1 | 0.6 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 47.0 | 56.6 | 23.2 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -21.8 | 23.9 | -26.2 |

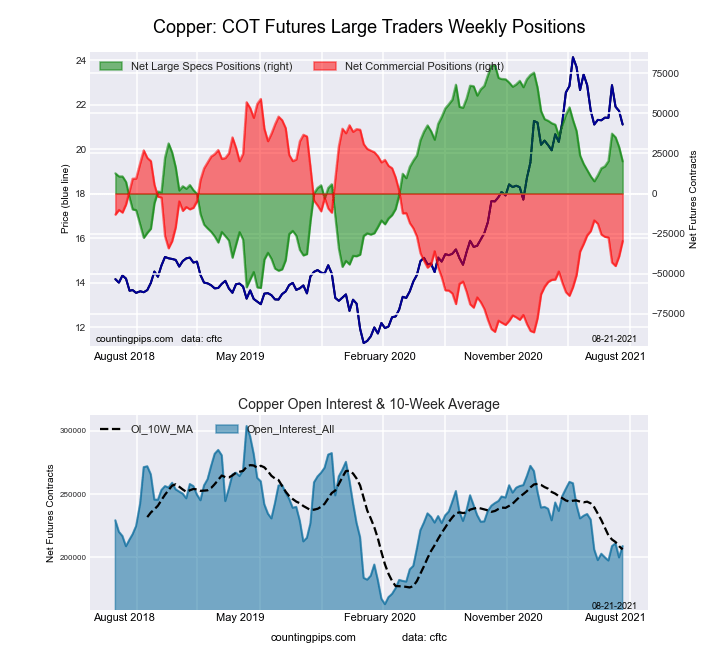

Copper Grade #1 Futures:

The Copper Grade #1 Futures large speculator standing this week resulted in a net position of 20,080 contracts in the data reported through Tuesday. This was a weekly decrease of -8,951 contracts from the previous week which had a total of 29,031 net contracts.

The Copper Grade #1 Futures large speculator standing this week resulted in a net position of 20,080 contracts in the data reported through Tuesday. This was a weekly decrease of -8,951 contracts from the previous week which had a total of 29,031 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.8 percent. The commercials are Bearish with a score of 39.1 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 80.7 percent.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 41.1 | 39.0 | 9.8 |

| – Percent of Open Interest Shorts: | 31.5 | 53.2 | 5.2 |

| – Net Position: | 20,080 | -29,655 | 9,575 |

| – Gross Longs: | 85,953 | 81,424 | 20,453 |

| – Gross Shorts: | 65,873 | 111,079 | 10,878 |

| – Long to Short Ratio: | 1.3 to 1 | 0.7 to 1 | 1.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 56.8 | 39.1 | 80.7 |

| – COT Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.1 | -2.8 | -1.4 |

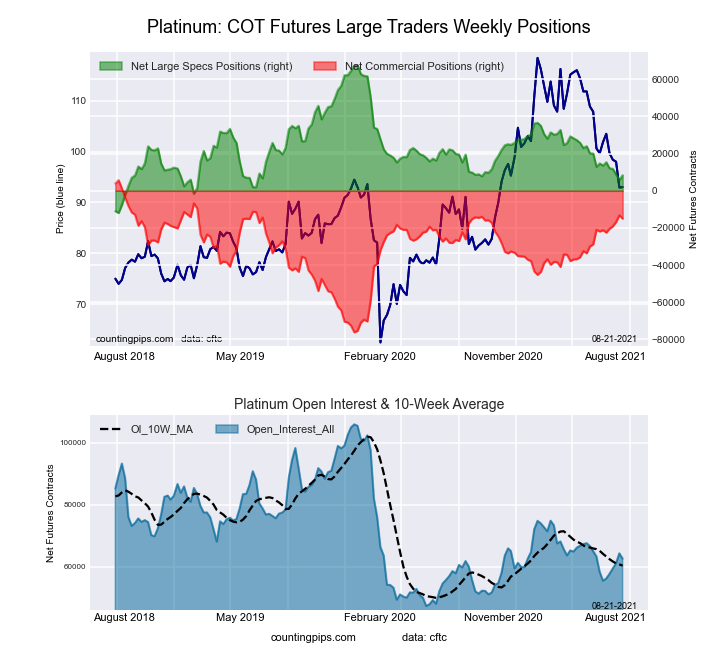

Platinum Futures:

The Platinum Futures large speculator standing this week resulted in a net position of 8,358 contracts in the data reported through Tuesday. This was a weekly increase of 2,539 contracts from the previous week which had a total of 5,819 net contracts.

The Platinum Futures large speculator standing this week resulted in a net position of 8,358 contracts in the data reported through Tuesday. This was a weekly increase of 2,539 contracts from the previous week which had a total of 5,819 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 25.5 percent. The commercials are Bullish with a score of 74.7 percent and the small traders (not shown in chart) are Bullish with a score of 54.6 percent.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 51.3 | 30.3 | 16.1 |

| – Percent of Open Interest Shorts: | 38.0 | 54.3 | 5.5 |

| – Net Position: | 8,358 | -14,997 | 6,639 |

| – Gross Longs: | 32,124 | 18,984 | 10,103 |

| – Gross Shorts: | 23,766 | 33,981 | 3,464 |

| – Long to Short Ratio: | 1.4 to 1 | 0.6 to 1 | 2.9 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 25.5 | 74.7 | 54.6 |

| – COT Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -6.6 | 7.6 | -13.5 |

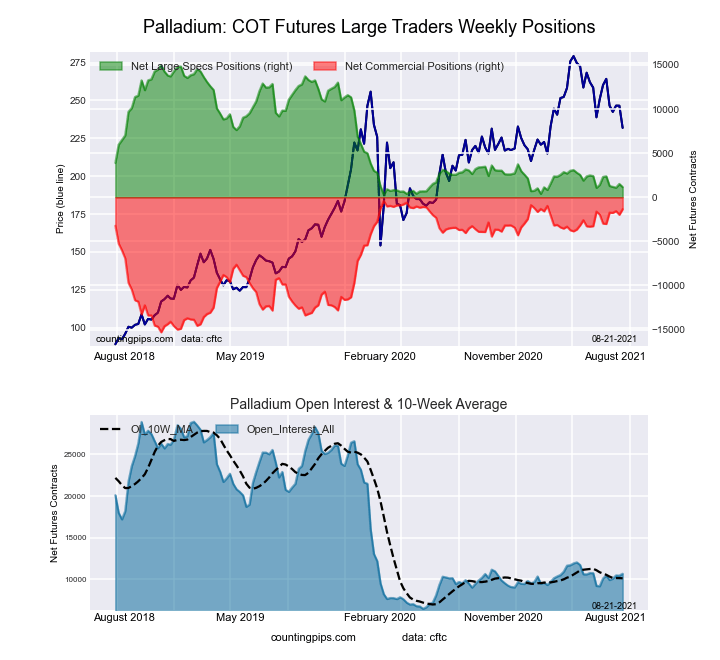

Palladium Futures:

The Palladium Futures large speculator standing this week resulted in a net position of 1,151 contracts in the data reported through Tuesday. This was a weekly reduction of -357 contracts from the previous week which had a total of 1,508 net contracts.

The Palladium Futures large speculator standing this week resulted in a net position of 1,151 contracts in the data reported through Tuesday. This was a weekly reduction of -357 contracts from the previous week which had a total of 1,508 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 5.9 percent. The commercials are Bullish-Extreme with a score of 93.7 percent and the small traders (not shown in chart) are Bullish with a score of 56.2 percent.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 44.0 | 34.7 | 13.4 |

| – Percent of Open Interest Shorts: | 33.2 | 47.3 | 11.6 |

| – Net Position: | 1,151 | -1,347 | 196 |

| – Gross Longs: | 4,697 | 3,706 | 1,436 |

| – Gross Shorts: | 3,546 | 5,053 | 1,240 |

| – Long to Short Ratio: | 1.3 to 1 | 0.7 to 1 | 1.2 to 1 |

| NET POSITION TREND: | |||

| – COT Index Score (3 Year Range Pct): | 5.9 | 93.7 | 56.2 |

| – COT Index Reading (3 Year Range): | Bearish-Extreme | Bullish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.8 | 10.9 | -28.1 |

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026