By Orbex

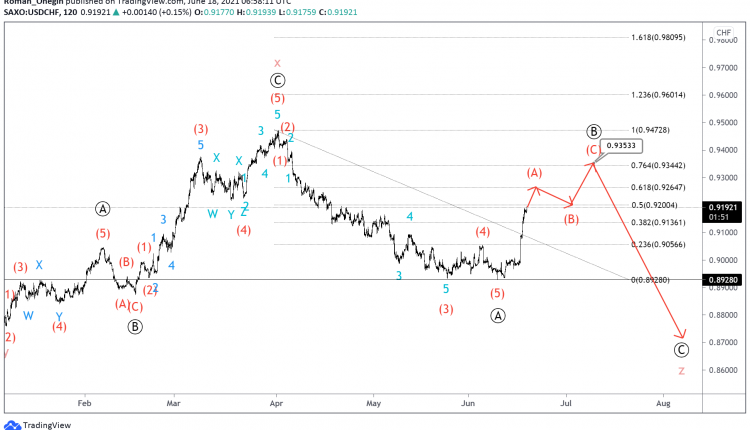

The current USDCHF formation suggests that the bullish intervening wave x of a cycle degree has completed. Then the market began to move in a downward direction within the cycle actionary wave z.

Most likely, wave z will be simple in shape and will have an Ⓐ-Ⓑ-Ⓒ zigzag structure. The impulse wave Ⓐ has already fully completed and the construction of the ascending primary correction Ⓑ has begun.

It is assumed that the intermediate sub-waves (A)-(B)-(C) will complete the zigzag correction Ⓑ near 0.935. At that level, wave Ⓑ will be at 76.4% of impulse Ⓐ.

In the future, after the correction of prices in the wave Ⓑ, the bulls could fall in the impulse Ⓒ below 0.892.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Let’s consider an alternative scenario, in which the formation of the primary correction Ⓑ has ended.

It is possible that it is an intermediate double (W)-(X)-(Y) zigzag, which can end near 0.926. At that level, wave Ⓑ will be at 61.8% of impulse wave Ⓐ.

If confirmed, the pair could devalue in wave Ⓒ to the 0.872 area.

At that level, primary impulse waves Ⓐ and Ⓒ will tend to be equal.

By Orbex

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026