By Han Tan Market Analyst, ForexTime

US stock futures are little changed at the onset of the new trading week while Asian equities are a mixed bag at the time of writing. US stocks saw a boost from this past Friday’s lower-than-expected US nonfarm payrolls data, pushing the S&P 500 the within 0.06% of its record high from 7 May.

‘Markets Extra’ Podcast: Jobs, jobs, jobs! Why the US nonfarm payrolls are such a big deal

Markets appeared primarily to have latched on to the headline NFP figure of 559,000, which was below the forecasted figure of 675,000.

That jobs report alleviated some of the concerns that the Fed may have to move up its timeline for its eventual tapering of its asset purchases.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

That slight respite in the ongoing inflation debate allowed the Nasdaq 100 to claim its biggest single-day gain in two weeks, while the Dollar unwound much of its pre-NFP gains.

Still, there were signs of underlying cost pressures from Friday’s jobs report.

The average hourly earnings of American workers climb by more than expected in May, while the unemployment rate also fell to 5.8% last month, compared to April’s 6.1%.

Although markets were able to ignore such inflation cues for now, focusing instead on the fact that some 7.6 million Americans remain out of work compared to pre-pandemic levels, it does not mean that the inflation debate has disappeared from market chatter.

In fact, this coming Thursday’s US consumer price index announcement could set tongues wagging once more, amidst all the other potential market-moving events lined up over the coming days:

Monday, June 7

- Germany factory orders

Tuesday, June 8

- Eurozone Q1 GDP (final)

- Germany industrial production

- Japan Q1 GDP (final), trade balance

Wednesday, June 9

- Bank of Canada rate decision

- EIA crude oil inventories

- China CPI, PPI

Thursday, June 10

- European Central Bank rate decision

- US-Iran nuclear talks resume

- OPEC’s monthly Oil Market Report

- US inflation, initial jobless claims

Friday, June 11

- G7 summit begins

- UK industrial production

- US consumer sentiment

Considering all the inflation markers due mid-week out of the world’s two largest economies (US and China), the ECB meeting is likely to fade into the background.

The European Central Bank is widely expected to leave its bond purchases program unchanged this month.

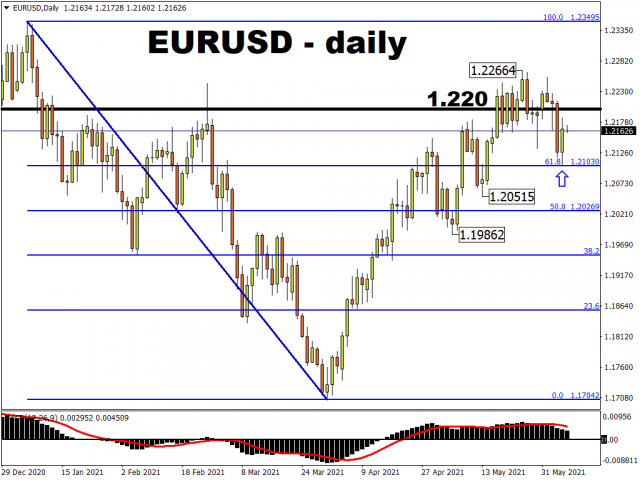

That sets up the euro to be more reactive to Dollar-events, with EURUSD attempting to take advantage of the dollar’s disappointment following the NFP miss. The world’s most-traded currency pair is trying to reclaim the 1.22 mark, having recently found support at the 1.21 Fibonacci line.

Should the US May consumer price index register a lower month-on-month reading than the forecasted 0.4%, that could prompt investors into thinking that the Fed would be less inclined to adjust their support measures for financial markets. Such a narrative could lead to more weakness in the greenback, which in turn should translate into gains for the rest of the FX universe.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026