Article By RoboForex.com

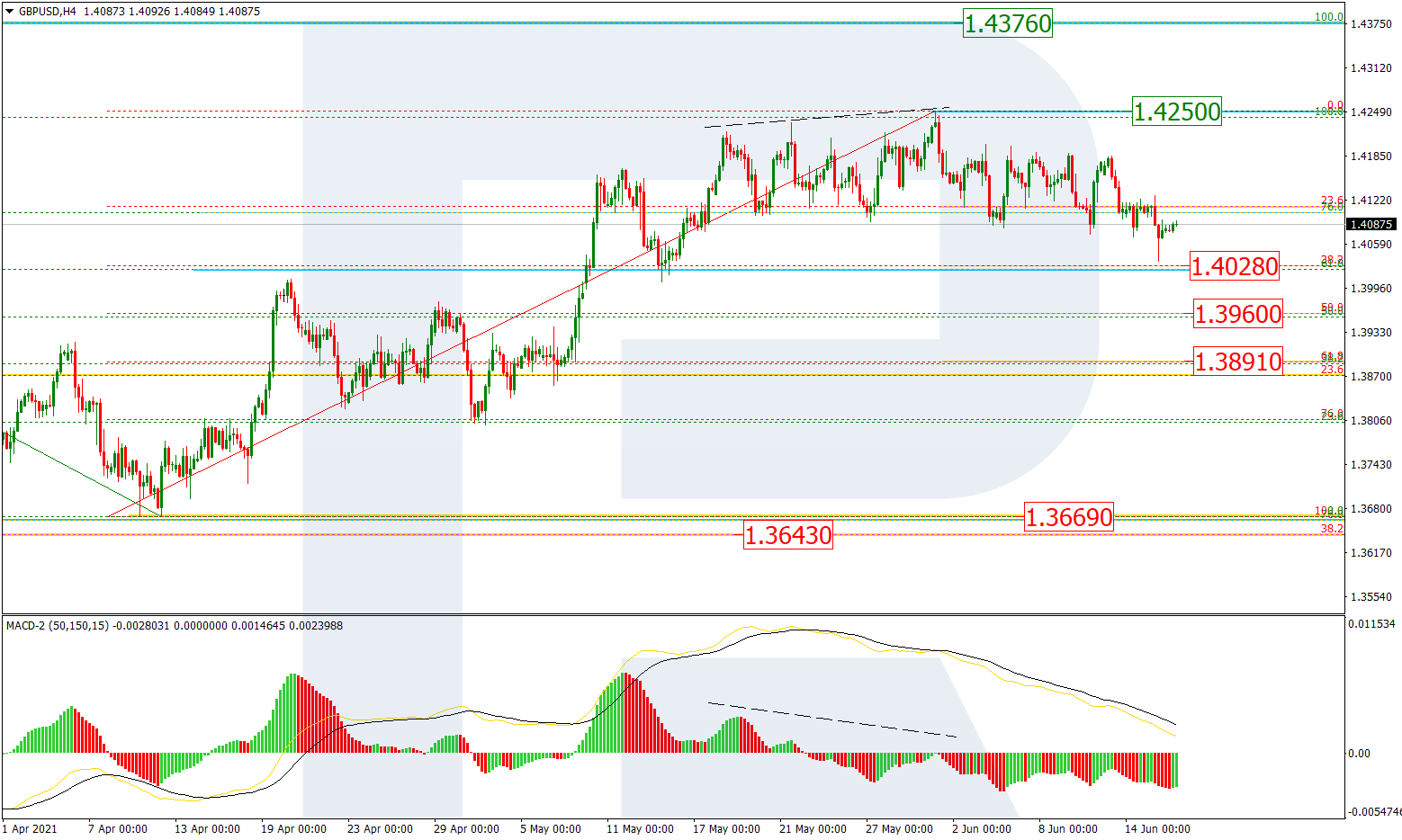

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, the asset is finishing the correctional decline at 38.2% fibo (1.4028) and may later start a new growth towards the local high at 1.4250, a breakout of which may lead to a further uptrend towards the long-term high at 1.4376. However, as long as the pair is moving below the high, there might be another scenario, which implies one more descending impulse to reach 50.0% and 61.8% fibo at 1.3960 and 1.3891 respectively.

In the H1 chart, GBPUSD is growing after a convergence on MACD and has already reached 23.6% fibo. Later, the price may continue moving upwards to reach 38.2%, 50.0%, 61.8%, and 76.0% fibo at 1.4116, 1.4142. 1.4167. and 1.4198 respectively. However, the key upside target is the high at 1.4250, a breakout of which may lead to a further uptrend towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.4332 and 1.4384 respectively. The support is the local low at 1.4034.

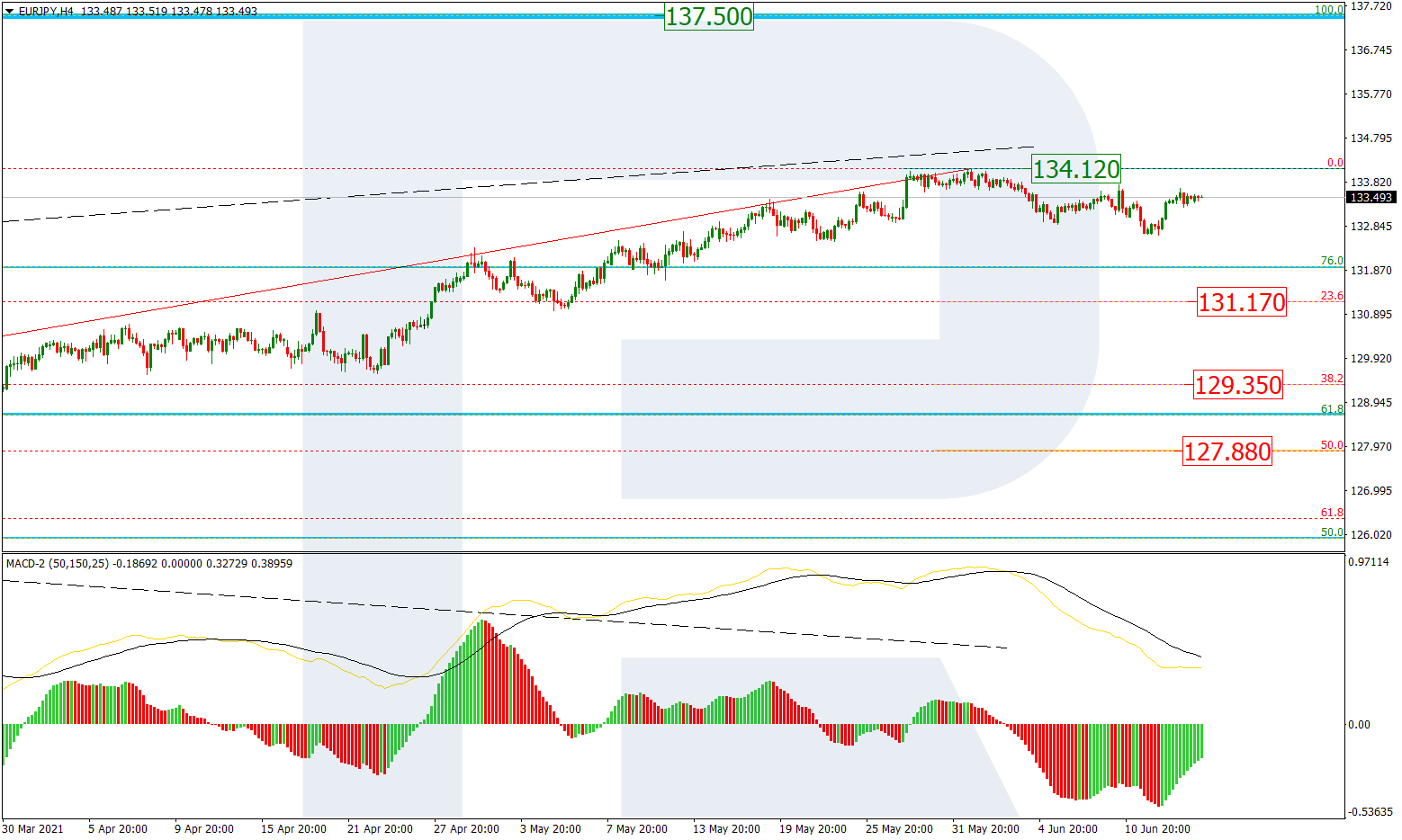

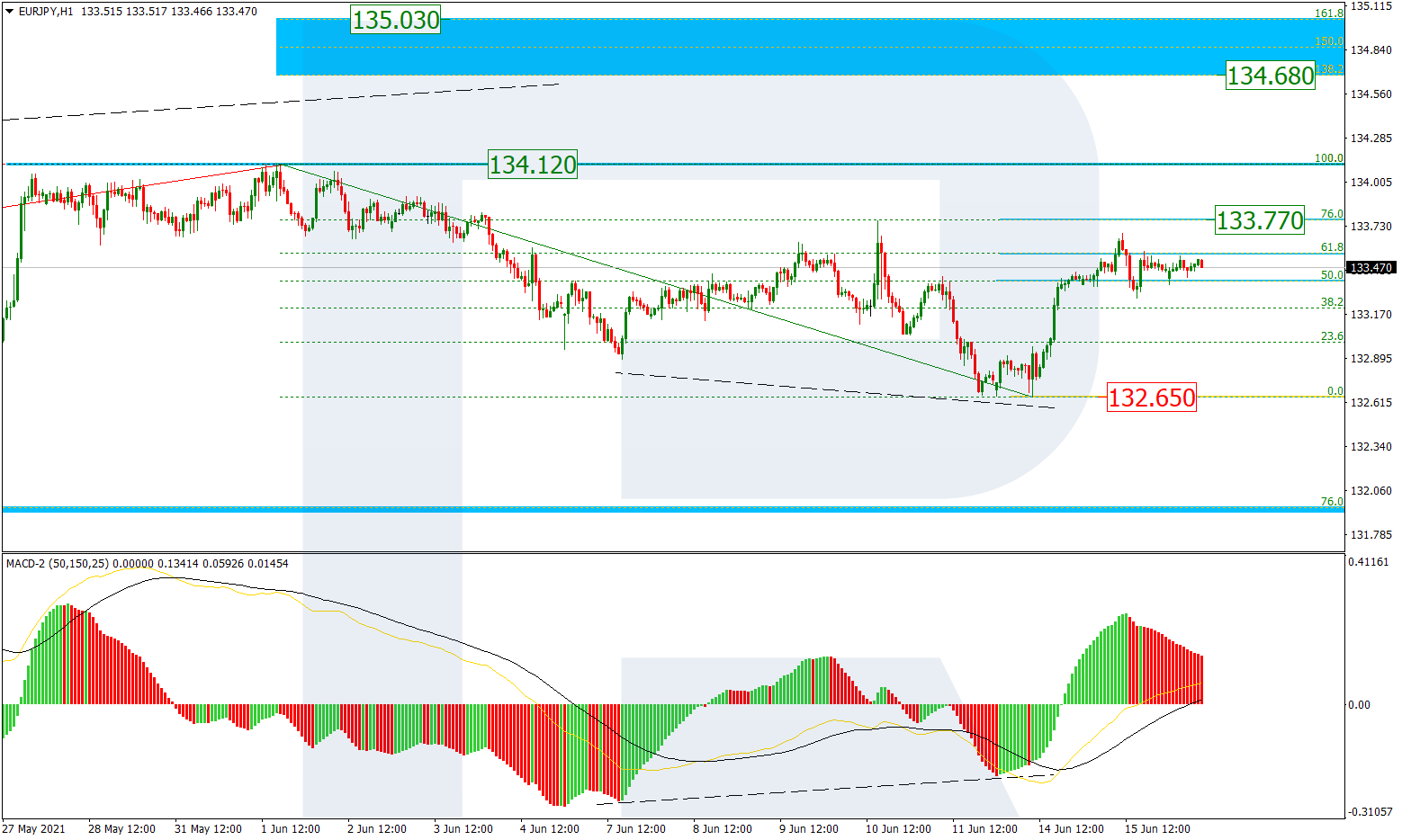

EURJPY, “Euro vs. Japanese Yen”

In the H4 chart, the situation hasn’t changed much; however, the decline was rather weak and couldn’t even reach 23.6% fibo at 131.17. Still, as long as the price is moving below the high, there might be another scenario, which implies a new descending wave towards 38.2% and 50.0% fibo at 129.35 and 127.88 respectively. At the same time, a breakout of the current high at 134.12 will complete the correction and lead to a further uptrend towards the key high at 137.50.

As we can see in the H1 chart, the asset is trading upwards after a convergence on MACD. It has already reached 61.8% fibo and may later continue growing towards 76.0% fibo and the high at 133.77 and 134.12 respectively, a breakout of which will lead to a further uptrend to reach the post-correctional extension area between 138.2% and 161.8% fibo at 134.68 and 135.03 respectively. The support is the low at 132.65.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.