By Han Tan Market Analyst, ForexTime

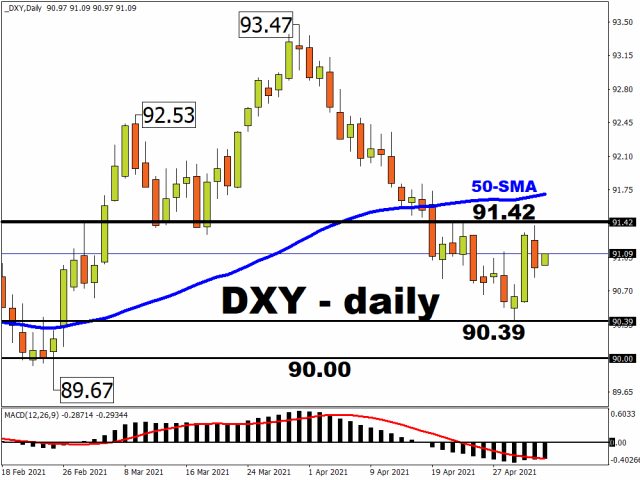

The dollar index (DXY) yesterday pared some of Friday’s gains, dipping below the psychological 91 mark before resurfacing.

The dollar’s declines come as Fed Chair Jerome Powell reminded markets that the US economic recovery needs to be more equitable, with almost 1 out of every 5 of the lowest-paid workers in America still unemployed since the pandemic broke out over a year ago. Powell’s comments prompted some segments of the markets to walk back expectations that the Fed could start removing its support for financial markets sooner than expected. The benchmark 10-year Treasury yields moderated back below the psychologically-important 1.60% mark on Monday, which in turn prompted a softening of the dollar.

Monday’s lower-than-expected readings for the final Markit US manufacturing PMI and the ISM manufacturing print, which registered 60.5 and 60.7 respectively, also underwhelmed dollar bulls. Compare the US data points against the latest economic indicators out of Europe on Monday. Germany’s March retail sales far exceeded market expectations, while the Markit Eurozone manufacturing PMI posted a record high.

Noting that the euro accounts for 57.6% of the DXY, the euro’s gains against the dollar heaped downward pressure on the dollar index. EURUSD is currently testing its 100-day moving average for support.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Meanwhile, despite the Pound’s climb yesterday, GBPUSD remains very much rangebound, with the 1.40 psychological level proving a tough nut to crack. With markets expecting a 60.7 print for the UK’s Markit manufacturing PMI announcement later today, a positive surprise could help lift Sterling higher. The Pound accounts for 11.9% of the DXY, hence Sterling gains tend to exert downward pressure on the DXY.

The buck has clearly started off the new month on the back foot against its G10 peers, and could continue being weighed down by dovish Fed commentary.

The slate of speeches by Fed officials over the coming days could force further moves in the greenback:

Tuesday, May 4

- San Fran. Fed President Mary Daly

- Minneapolis Fed President Neel Kashkari

Wednesday, May 5

- Chicago Fed President Charles Evans

- Cleveland Fed President Loretta Mester

Thursday, May 6

- Dallas Fed President Robert Kaplan

- Cleveland Fed President Loretta Mester

The far-reaching impact of the Fed’s next policy move extends beyond major currencies. US stocks have also been swaying to such shifts in market expectations.

On Monday, the reflation trade made its presence known, with the Dow Jones Industrial Average gaining 0.7% while the Nasdaq 100 fell by about 0.5%.

Investors bought up stocks in sectors that stand to benefit from the US economic reopening, such as energy, materials and industrials. Meanwhile, the S&P 500’s consumer discretionary sector was weighed down by the likes of Amazon and Tesla, as investors shy away from these pandemic-era darlings.

As long as market participants continue pinning their hopes on the global vaccination drive that is set to bring the world out of the pandemic, and worry less about the nagging concerns in the likes of India and Southeast Asia, that could ensure more legs for the reflation trade. As such, the tech-heavy Nasdaq 100 could underperform in the interim, with the index still trying to shed its tag of having too-rich valuations.

At the time of writing, the futures contracts for all 3 major US benchmark indices are in the red, suggesting declines at Tuesday’s market open, should this trend persist until then.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026